The Middle East’s time to lead is now

Value in motion

Trillions of dollars are in motion as AI, climate and trade reshape global growth – setting the stage for a bold new economic future.

Transformation accelerates as Middle East businesses reinvent for the decade ahead

Three-quarters of sectors in the Middle East are already under intense pressure to reinvent as the energy transition, climate risks, AI and trade disruptions blur traditional sector boundaries – with up to US$300bn in regional value reshaped in 2025 alone. Will your organisation be on the winning side, or is it at risk of being left behind?

The Middle East is entering a defining decade. Around the world, trillions of dollars in value are already in motion as global systems are reshaped by geopolitical uncertainty, trade disruptions, polarised AI power dynamics and the accelerating impact of climate change.

Driven by the magnitude of the forces at work, traditional industries are converging, transforming how we move, build, fuel, care and connect.

Against this backdrop, the Middle East holds a distinct advantage: access to the world’s lowest-cost renewable energy, a competitive AI infrastructure and bold government initiatives that strengthen future-focused sectors. To lead in this new era and capture the value in motion, the region must act decisively – turning its strategic assets into long-term, sustainable growth.

Value in motion

The decade ahead

Value in motion for the Middle East

$4.57trn

The total projected Middle East GDP in 2035, about US$1trn larger than it is today.

$232bn

Equivalent to the entire GDP of Qatar – is the additional value the region stands to gain by 2035 if it leverages AI-driven productivity gains and manages the economic impacts of climate change.

8.3%

The potential AI boost to Middle East GDP over the next decade, if adoption is widespread, responsible and focused on productivity gains.

13.9%

The estimated loss for Middle East GDP from physical climate risks by 2035.

Foreword

The world is entering a disruptive new era shaped by geoeconomic fragmentation, climate urgency and the accelerating influence of Artificial Intelligence (AI). Traditional alliances are shifting and trade instability is on the rise, as global politics reshape economies. At the same time, industries once considered distinct are converging – driven by digitsation, decarbonisation and supply-chain realignment – to create entirely new ‘domains of growth’.

Against this backdrop, countries with diversified partnerships, energy independence and strong AI infrastructure are best positioned to weather uncertainty. Here the Middle East holds a strategic advantage. With its bold climate commitments, low-cost renewable energy and advanced artificial intelligence (AI) capabilities, the region is driving the next wave of sustainable, tech-enabled progress. The recent flurry of multi-billion-dollar announcements by major AI firms reaffirm the region's accelerating AI ambitions.

The relationship between AI and climate impact is deeply interconnected and will play a pivotal role in shaping how businesses create and capture value in the future.

In this context, our report underscores the opportunity to harness AI-driven productivity gains to leapfrog in priority sectors, while offsetting the economic risks of climate change. By taking this path, the region can position itself as a global leader in climate solutions and emerge as a hub for green manufacturing.

Our research also maps how the broader economic dynamics will evolve under three profoundly different future scenarios, and where value will flow over the next decade.

Looking ahead, we will continue to collaborate with leaders across business, governments and the wider society in our region to navigate this defining era together, seizing opportunities for sustained resilience and growth.

Hani Ashkar,

Middle East Senior Partner, PwC Middle East

“Energy is not just the engine of progress... It is a cornerstone of peace, stability and ensuring prosperity. The race for AI is not just about code... it’s about gigawatts... Meeting this demand is not just a technical challenge, but a ‘once-in-a-generation’ opportunity”

Dr. Sultan Al Jaber, UAE Minister of Industry and Advanced Technology at the opening of the 2025 Global Energy Forum, hosted by the Atlantic Council’s Global Energy Centre

The Middle East in 2035

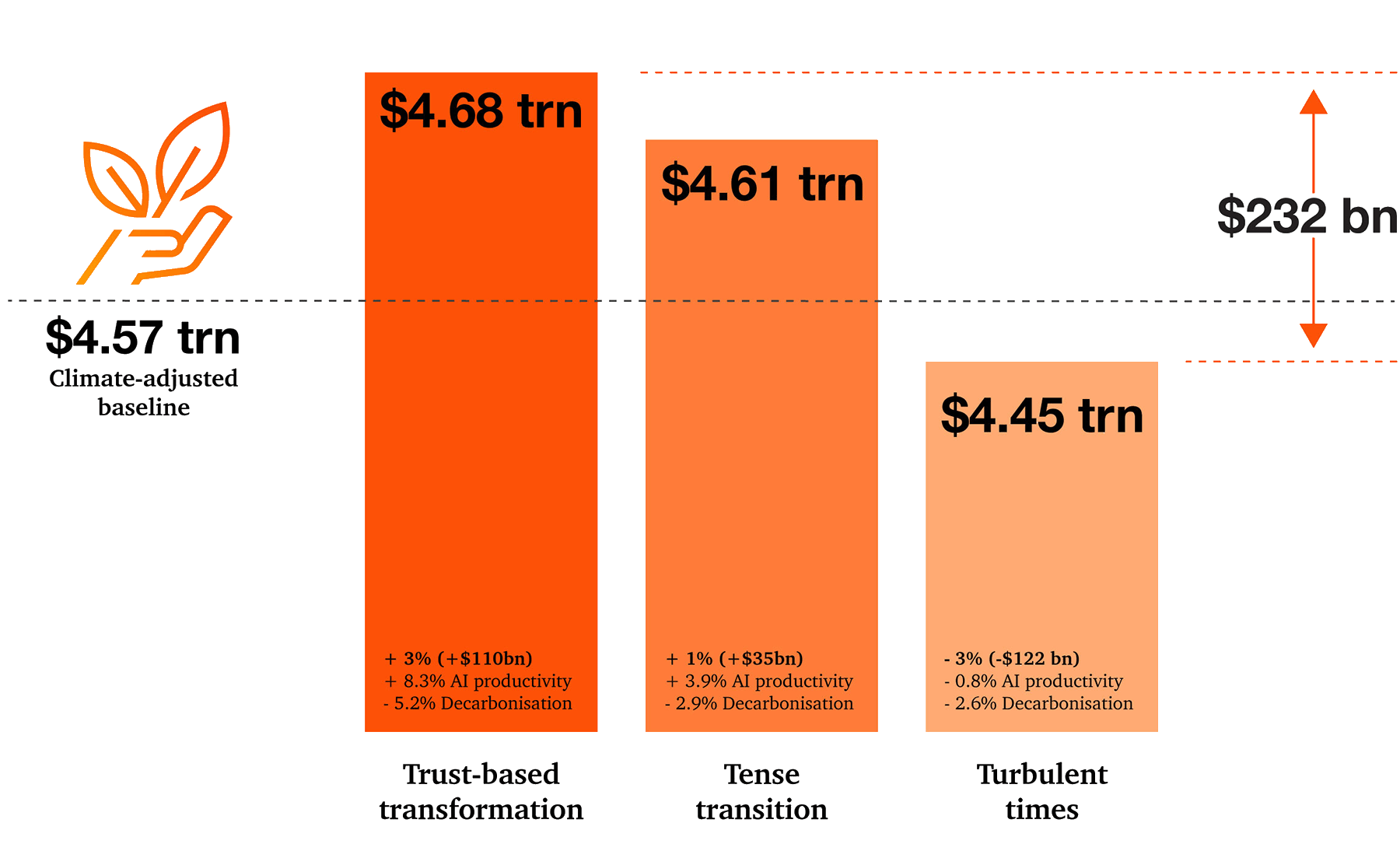

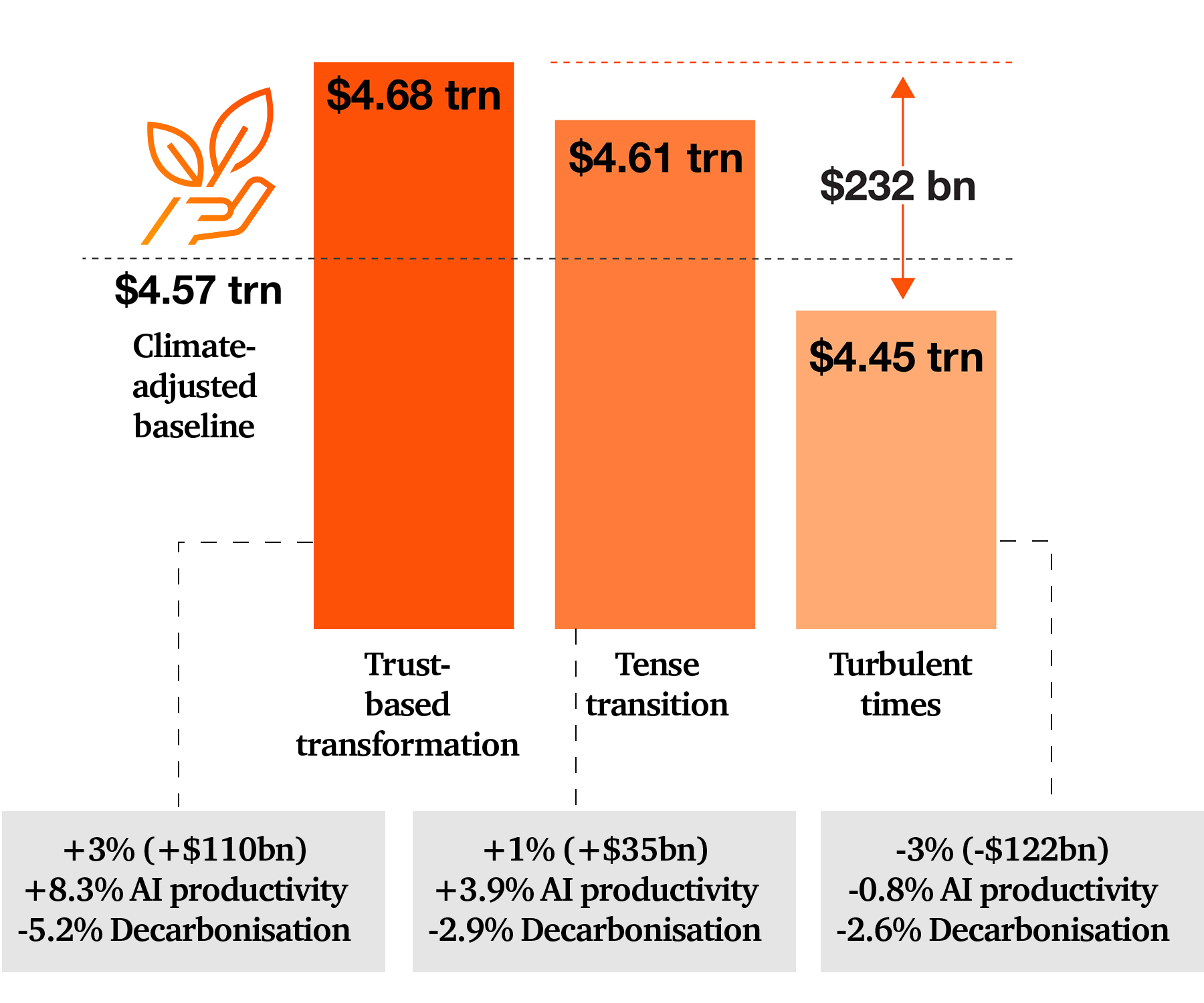

Three divergent futures and their GDP projections

There is a US$232 billion gap between the best and worst-case scenarios for the Middle East; a powerful reminder of what’s at stake in the decade ahead.

While much of the world grapples with high levels of geopolitical and macroeconomic uncertainty – economic resilience and stability will hinge on strategic partnerships, investment in technology and access to an affordable clean energy supply. In this context, the Middle East is charting a confident path forward: one defined by a bold vision for the future, innovation and agility. The region is not only strengthening its economic foundations but also emerging as a global leader in climate action, AI innovation and technological transformation. And if it continues to accelerate AI adoption and lead the energy transition, its real GDP could reach up to US$4.68tn in the next decade.

The path to that future will depend on how the region’s economies respond to the interplay between AI, climate change and other emerging technologies – amid fracturing geopolitics and megatrends like demographic shifts and social instability.

To understand how these forces could reshape the region over the next decade and what the impact on GDP growth might be, diverse subject matter experts at PwC have envisioned three distinct economic scenarios. Each is built on a different set of assumptions about geopolitical shifts, AI adoption and trust, and climate uncertainties. These scenarios are designed to spark imagination and will help business leaders anticipate how these forces can drive innovation – will they create greater prosperity or deepen existing challenges?

The Middle East in 2035

Between now and 2035, PwC's modelling for the Middle East projects that under a ‘business-as-usual' scenario1 the regional economy is set to grow by 41.8% in real terms. However, when physical climate risks – such as extreme heat and water stress, drought and flooding – are factored into our economic modelling, they alter some of our baseline assumptions about economic growth, reducing projected GDP growth by 13.9 percentage points.

So, with climate factored in, the Middle East economy is forecast to grow by 27.9%, reaching a GDP at US$4.57 trillion in 2035. This serves as the baseline for assessing these three distinct future scenarios for the region.

Welcome to three divergent futures for the region in 2035

“A critical factor will be the interplay between the cost and scalability of AI and the availability and affordability of clean energy needed to power it, especially as AI adoption accelerates in the region at an unprecedented pace. Striking the right balance between these priorities will be essential.”

Dr Yahya Anouti, Partner, Strategy&, Middle East Sustainability Platform Leader

Beyond industries

The new domains of growth

The total projected Middle East GDP in 2035 would be US$4.57 trillion, with traditional sectors reconfiguring into new ‘domains of growth’.

The same transformative forces driving our scenarios above are also dissolving traditional sector boundaries, blurring the lines between processes and applications, geographies and platforms, and even between humans and machines.

Over the next decade, these traditional sectors will reconfigure to meet human needs – such as how we move, feed, build, fuel and care for ourselves – in entirely new ways, leading to the formation of economic domains.4

These domains will also redefine how we connect and compute, fund and insure, and govern and serve our societies to enable the transformation ahead. Organisations will diversify to engage in new ways to meet these human needs, reinventing their approaches to target new client bases, form cross-sector alliances and innovate their service and operating models.

PwC economists estimate that the real GDP of the Middle East will be about US$1 trillion larger in 2035 than it is today – offering a significant upside for those ready to move quickly and decisively and capture the next wave of value.

The urgency to reinvent among organisations in the region was strongly indicated in PwC’s 28th Annual CEO Survey: Middle East findings, with 60% of regional CEOs stating their businesses wouldn’t remain viable in 10 years or less without adaptation. This heightened concern not only surpasses last year’s levels but also far exceeds the current global average of 41%.

Not surprisingly, more than half said they have innovated with products and services within the last five years and 40% have begun competing in new industries or sectors to grow market reach.

Several leading regional players are already exemplifying this momentum and moving beyond their traditional boundaries. In the UAE, Careem has become a ‘super-app’, expanding from ride-hailing into food delivery, digital payments, remittances and more. Abu Dhabi’s G42 Healthcare merged with Mubadala Health to form M42, combining AI-driven genomics with world-class patient care. In Saudi Arabia, Aramco’s partnership with EV maker BYD is accelerating the region’s clean-transport shift. These moves show how mobility, healthcare and energy leaders are converging to forge entirely new value chains.

Ahmad video

This graphic maps the traditional economic sectors today (on the left side of the chart) to the domains that focus on core human needs (on the right), scaled up to 2035. It shows how much value will be in motion amid the large-scale reconfiguration underway. The domains on the right bring together a wide range of economic sectors – as a result they are larger than the traditional sectors and are hence called domains of growth.

Middle East spotlight

Industry reconfiguration is already underway

Organisations across the globe and the Middle East are rapidly evolving – breaking down industry boundaries and reinventing business models to unlock new growth. In the process, they are reshaping how fundamental human needs are met.

Below, you can find real-world examples of organisations reconfiguring into domain players.

How we Build

- A regional construction conglomerate has refocussed on sustainable infrastructure in water, energy, social infrastructure and transport and logistics, including a collaboration to build a 10GW onshore wind farm.

- A regional clean energy pioneer has strategically expanded into urban development and smart infrastructure through the creation of a purpose-built urban community designed to be a global model for sustainable living and smart city innovation. It integrates renewable energy, green building standards, IoT-enabled infrastructure, and autonomous transportation systems to reduce environmental impact and enhance urban efficiency. This transformation illustrates how a company rooted in energy infrastructure can evolve into a cross-sector ecosystem builder.

How we Care

- A regional healthcare and technology player has undertaken a bold transformation, partnering with a sovereign investor to merge advanced medical technologies with a world-class clinical care network to create a fully integrated, AI-driven healthcare ecosystem that places the patient at the centre of a tech-enabled, data-driven model.

- Another regional healthcare provider has expanded beyond traditional clinical services into academia, establishing medical education programmes, residency training and research initiatives.

How we Feed

A regional ride-hailing app has moved into a rapid delivery service, including food and grocery delivery to a personal item courier and laundry services, in a bid to become a future-proofed “everything app”.

A regional food company recently announced plans to build a large-scale biotech production hub that will use precision fermentation to create alternative proteins and functional ingredients, positioning the UAE as a regional leader in food innovation.

How we Fuel

- A traditional regional utilities operator has transformed into a global renewable energy and green hydrogen leader.

- A regional automotive company has partnered on AI-related climate tech megadeals to bring domestic EV manufacturing to the region, supporting national visions and targets on scaling electric and hybrid vehicle use.

How we Make

- A regional mall and retail developer has harnessed AI and expanded into other industries such a leisure, entertainment and home delivery services to become a data-driven phygital lifestyle brand.

How we Move

- A regional logistics provider has scaled with advanced AI and IoT capabilities to support green initiatives and address complex cargo and multimodal transformation through cross-border e-commerce partnerships.

- A regional fuel delivery start-up has become a comprehensive mobility solutions provider, including EV charging solutions, vehicle maintenance services and partnerships for marine fuel delivery.

How we Connect and Compute

A regional telecoms company has expanded their AI infrastructure and cloud services to tap into the growing demand for accelerated computing power and processing across the region.

How we Fund and Insure

- A regional ride-hailing app now offers digital wallets and peer to peer transfer services in the UAE, enabling users to send, request and receive money transfers via phone number, QR code or payment link.

- A regional utility bill payment platform has reinvented itself to provide broader financial inclusion through fintech, with over 90% of its region’s banks in its network.

How we Govern and Serve

- The government of Qatar has made significant strides in digital transformation, reflected in its rapid advancement in the UN’s E-Government Development Index. The focus has been on digitising manual processes and improving access to public services through platforms like the official Hukoomi portal.

- The government of Saudi Arabia has built a pioneering model in providing digital services centred around the citizen raising the quality of services provided in line with the Kingdom's ambitious vision 2030. The Digital Government Authority paves the way for raising the value of the national economy to achieve beneficiary satisfaction.

- The UAE Centre for Government Digital Excellence aims to accelerate the UAE government’s digital transformation by leveraging global best practices and cutting-edge technologies. The centre drives the development of digital government systems and services, enhance digital readiness, and strengthen collaboration with leading tech providers to fast-track progress.

Powering the shift

AI, climate, trade and the Middle East advantage

Amidst the disruptions of technological transformation and climate pressure, the region holds two powerful strategic advantages: a leadership in climate action with bold national visions driving ambitious sustainability goals, and its status as an emerging global force in artificial intelligence, with forward thinking governments spearheading a more resilient, tech-enabled future.

This foundation gives the region an edge – an ability to easily navigate the powerful forces that also are reconfiguring the global economy, creating the conditions for a trust-based scenario in the future – one where AI adoption accelerates, climate action scales and regional influence grows.

Trust in having AI embedded into key processes is particularly high, with half of GCC CEOs trusting it to a ‘large’ or ‘very large’ extent.

Powering the shift

Reinvent to stay relevant

What organisations must do now

The decade ahead will challenge the region’s imagination and capabilities, reshaping an economic model long anchored in hydrocarbons. As the Middle East transitions to a greener economy, government leaders, businesses and academia must reinvent core business, operating, and energy models to stay competitive.

Our research takes a ten-year view – recognising that while today’s seismic geopolitical shifts are largely destabilising, they may ultimately force the pendulum in the opposite direction, prompting deeper global cooperation. Over time, our research indicates that there is a potential for these disruptions to strengthen the momentum towards a more trust-based economic transition.

To thrive in this next defining decade, strategic first movers will turn uncertainty into opportunity – laying the foundation for long-term growth and impact.

Hawazen video

The stakes for the region have never been higher – or more exciting. The combined evolution of AI innovation and clean energy adoption represents a timely convergence that bolsters the region’s sustainable growth and economic resilience.

With world-beating renewable energy costs, bold national visions, strategic investment in digital infrastructure and a growing cohort of future-focused businesses, the Middle East is not just adapting to disruption – it’s poised to shape what comes next in this defining decade.

But the path forward will require coordinated action between business, government and society to reimagine industries, accelerate localisation, scale innovation, and build resilience into the foundations of the economy. The value to be gained is in motion.

Now is the time to act.

1 This assumes moderate progress in economic, population and technological areas, and no significant external shocks or policy interventions. ↩︎︎

2 AI productivity gains: AI productivity gains refer to the improvements in efficiency, output, or performance achieved by using responsible artificial intelligence technologies in various tasks, processes, or workflows. Such gains would depend on the fundamental rewiring of functions and tasks in organisations, which will come about only if the AI really works, it’s responsibly deployed, and it’s therefore deeply trusted.

Our research shows that the global economy could be nearly 15% bigger than expected in 2035 if AI delivers a jolt to productivity comparable to the productivity booms ignited in the past by foundational technologies like electricity. The AI growth dividend also depends in part on the global economy replacing the tasks AI takes over with new ones for people to perform. ↩︎︎

3 Stranded assets: Stranded assets are investments or resources that have lost economic value or become obsolete before the end of their expected useful life, often due to external changes such as market shifts, regulatory actions, or technological advancements. As the world moves towards decarbonisation, stranded assets will be replaced by lower-carbon alternatives, resulting in sector-level shifts in investment, consumption, and output across different scenarios. ↩︎︎

4 Emerging economic zones that transcend traditional industries, shaped by megatrends such as AI, climate change, and evolving consumer demands. They are collections of ecosystems aligned with Customer/human needs. ↩︎︎

5 US President Donald Trump’s recent visit to the Middle East resulted in almost US$700 billion in investment pledes across the region, including major commitments spanning energy, defense, and technology. Such investments reinforce the value in motion across the global economy. The AI sector gained the most – with one third of the deals made targeting AI and digital infrastructure. Some of the stand-out projects announced include: the preliminary agreement for the UAE to import 500k Nvidia’s advanced AI chips annually; Open AI establishing a hyperscale data center in Abu Dhabi; AWS’s partnership with HUMAIN to develop and ”AI Zone” in Saudi; AMD investing up to US$10 billion in AI infrastructure in Saudi; and Data Volt announcing a US$20 billion investment in AI data centers and energy infrastructure in the US. ↩︎︎

Connected momentum

Turning the Middle East’s reinvention potential into lasting impact

Economies across the Middle East are being rewritten in real time. Intelligent devices, data and analytics are transforming healthcare; cities are evolving into living ecosystems; telecom operators are emerging as key enablers of the region’s digital future and retailers are reinventing their business models through digital and supply chain innovation

mona vim

Authors

Chief Strategy & Technology Officer, PwC Middle East

Dr Yahya Anouti

Partner, Sustainability Platform Leader, Strategy& Middle East

Jing Teow

Moussa Beidas

Partner, Ideation Lead, PwC Middle East

Ahmad Abu Hantash

Partner, Digital and Cyber Leader, PwC Middle East

Editorial

Carolyne Allmark, Sustainability Platform Strategy and Regional Content Lead , PwC Middle East

Esha Nag, Lead Editor, Thought Leadership and content , PwC Middle East

Louise Coyle, Industry Marketing , PwC Middle East

Explore further

To further explore our value in motion data, and understand more about what it means for your sector and different territories worldwide, visit our global research site.

Discover more

Viewpoint

The region is transforming & the world is watching

The Middle East has a once-in-a-generation opportunity to lead the technology transformation, not just respond to it

Learn more

Viewpoint

Is it the right time to reinvent your business?

Businesses around the world are navigating an increasingly complex environment - reshaped by geopolitical uncertainties

Learn more

Viewpoint

نموذج الحوكمة في السعودية: خدمة الوطن وتحقيق القيمة

تعمل السعودية على بناء مستقبل يقوم على التكنولوجيا والابتكار والكوادر المؤهلة، معلنة بذلك توجهها نحو حقبة جديدة تتضافر فيها عوامل تنويع الموارد الاقتصادية والتحول الرقمي والاستدامة

Learn more

Viewpoint

هل حان الوقت لإعادة ابتكار أعمالك؟

تتعامل الشركات حول العالم حالياً مع بيئة اقتصادية تتزايد فيها التعقيدات يوماً بعد يوم، ويُعاد تشكيلها من جديد بفعل التغيرات الجيوسياسية

Learn more