Global, regional and local trends in virtual assets

Global trends

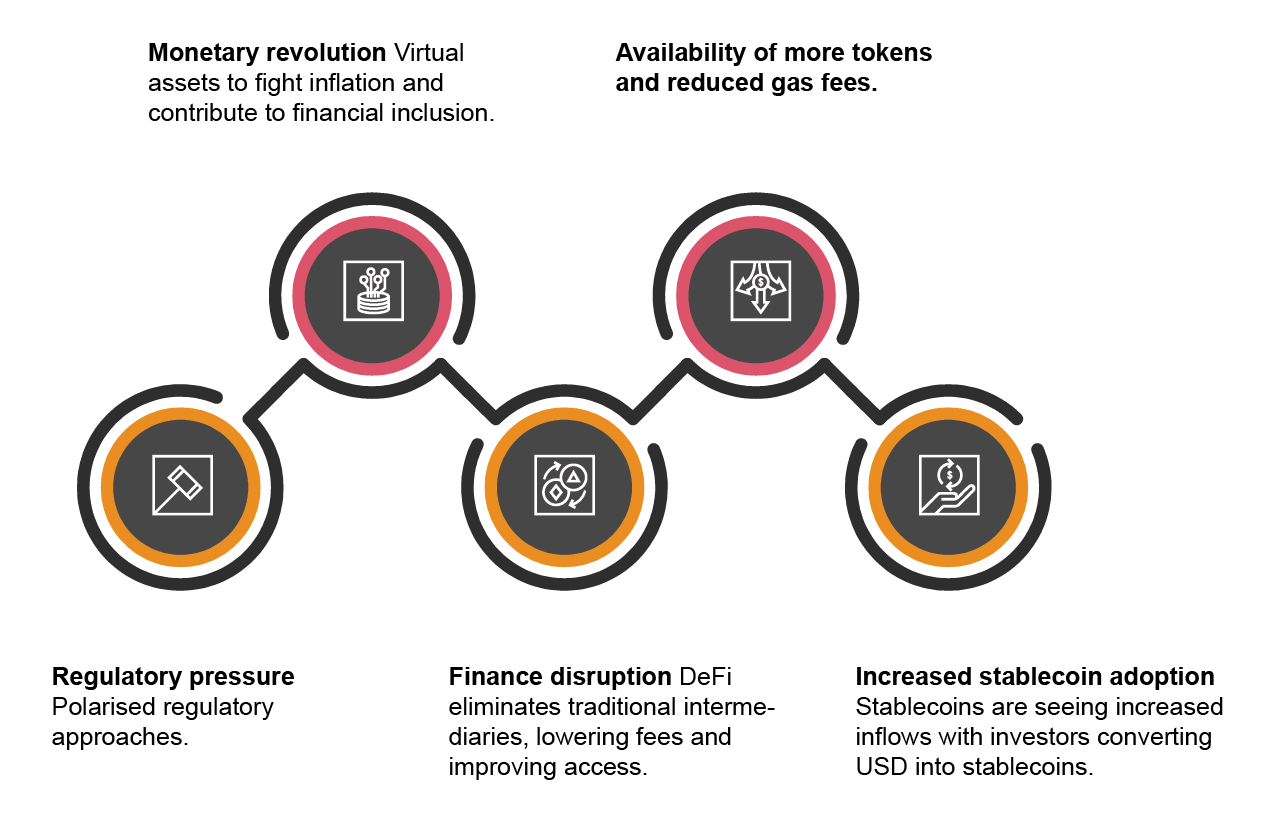

In spite of recent market turbulence and regulatory pressure, virtual asset adoption is moving from the fringes of finance to the largest institutions in the world, driven by macro factors:

Regional trends

A subset of regional factors are creating the ‘pull’ for adoption of virtual assets and associated business models.

Expansive virtual assets ecosystem

- Government investments, clear strategies, ease of doing business and favourable tax regimes, have attracted more than

1,400 virtual assets and Web3 companies to the UAE.

Regulatory clarity

- The UAE has a comparatively clear regulatory regime and welcoming stance. Companies from hostile jurisdictions are migrating here to establish regional/global headquarters.

Institutional investors and FIs entering the market

- Traditional financial institutions and banks are exploring opportunities to enter the virtual assets space with multiple services, such as accounts opening for VASPs, brokerage and custody services.

Currency devaluation in some MENA countries

- Currency devaluation in Turkey and Egypt has strengthened the appeal of virtual assets (stablecoins) to preserve savings.

Local market trends

While the global market prepares for its cyclical resurgence, the local virtual assets market is strategically positioned to capitalise on growth. The crypto asset market has historically exhibited a four-year cyclical pattern – one year of a bear market, followed by three years of market recovery and growth – fuelled by technological and regulatory developments and accelerated by halving events.

Local trends signal that the UAE is strategically positioned to capture market growth

The UAE continues to lead in terms of regulatory clarity surrounding virtual assets service provision.

1,400+ VASPs are setting up local operations in the UAE.

(Source: CryptoOasis)

Local banks now look to commence virtual assets service provision in the UAE

While Virtual Asset Service Providers in the GCC are supported by a vibrant ecosystem, they also face challenges in operating and growing

Challenges

Virtual Asset Service Providers performing regulated activities will need to be licensed and comply with regulatory requirements.

Due to the high-risk profile of virtual assets activities, institutions and financial institutions are concerned about the potential risks of partnering with Virtual Asset Service Providers .

Virtual Asset Service Providers with inadequate controls are perceived as high risk and are far less likely to have their product applications accepted.

Virtual Asset Service Providers, like many other start-ups and tech companies, continue to face challenges in raising capital.

PwC offers a uniquely integrated team of cross-functional virtual assets specialists to support Virtual Assets Service Providers in entering the market, meeting compliance requirements and achieving growth targets

Virtual Asset Service Providers (VASPs):

Navigating the Future of Fintech

Meet the Virtual Assets team

Hafedh Ajmi

Regulatory and Financial Crime Compliance, Partner, PwC Middle East

Serena Sebastiani

Virtual Assets Financial Services Consulting Lead, PwC Middle East

Oliver Sykes

Partner, Blockchain, Technology, Cybersecurity, PwC Middle East

Sashi Sekhar

Regulatory and Financial Crime Compliance, Director, PwC Middle East