Series 2 - Episode 3: Transfer Pricing & the rise and rise of digital banking

04 April, 2022

Digital banking - a 'new normal' for the industry

Digitisation has taken the world by storm, with technology and advanced analytics penetrating every industry including the banking industry, both in the Middle East and across the globe. Technology has rendered traditional banking systems obsolete, as BigTech and Fintech companies close in on the banking industry faster than ever. Banks are left with no option but to adopt digital banking in a major way if they hope to compete, with mass digitisation no longer a choice but an inevitability.

As such, the banking industry's business models are shifting, and as a result there are various Transfer Pricing matters that need to be considered as banks’ operating models continue to evolve. In this article, we look to cover some of the major considerations for banks that are undergoing the digital banking transformation journey from a Transfer Pricing perspective.

The global pandemic has played a pivotal role in expediting the adoption of digital banking - a ‘new normal’ as users across the board adopt more and more technology and continue to look for a seamless experience. With reduced face-to-face interactions and an aversion to paper based currency, digital banking offers a contactless alternative to traditional banking which customers continue to embrace. PwC US has recently conducted a digital banking consumer survey which highlights the growing importance of digital banking to the consumers, with 64% of the Gen Z respondents saying that they have financial accounts with nontraditional financial institutions. In addition, PwC Middle East recently conducted a general consumer survey which reflected that 67% of consumers in the Middle East believe that they have become more digital. Both the surveys demonstrate that consumers are becoming more and more digital and therefore, to meet consumer expectations, the banking sector has embraced digitisation at an unprecedented level.

However, digital banking is not a new phenomenon. Following the global financial crisis, the banking industry was faced with a number of threats, namely low interest rates, increased regulation, and a damaged reputation. Consequently, since 2015, there has been an unwavering rise in the number of digital banks around the world. Consumers are now looking for efficiency and accessibility, which are the key value drivers of digital banks.

Middle East market perspective - Digital transformation front and center for banks

The Middle East is one of the world's fastest growing markets in the banking and capital markets sector. The region's financial services sector is in the midst of a significant overhaul. With populations getting younger, better educated and more demanding; increasing diversity in financial products and services; and growing regulatory requirements for better monitoring of processes and developing secure financial systems, banks and financial institutions across the region are investing heavily to match or outstrip their international peers.

The Middle East consumer is no different to the rest of the world and with rising customer demand for digital services and the apparent success of the digital banking operation model in the West, banks in the Middle East region are highly focused on digitalising their banking services in an expedited manner.

Most traditional banks in the Middle East offer online banking services and proprietary mobile applications to their customers, making everyday banking a seamless and increasingly digitised experience for consumers. However, digital banking in the Middle Eastern region remains relatively new, and multiple traditional banks are just beginning to offer digital banking platforms, in an attempt to capitalise on the shifting market demands.

Middle East Transfer Pricing environment - A fast evolving environment

Transfer Pricing describes all aspects of inter-company pricing arrangements between members of a multinational group, including transfers of tangible goods; services; intellectual property; and loans as well as other financial transactions.

Transfer Pricing is a major topic globally and in the Middle East recently. With the OECD’s initial Base Erosion and Profit Shifting (BEPS) Action Plan back in 2015 proposing Transfer Pricing related guidance, various countries in the Middle East region have either introduced detailed Transfer Pricing legislation and guidance (e.g. KSA, Jordan, Qatar) or revisited their existing Transfer Pricing legislation and guidance (e.g. Egypt). Accordingly, given the nascent nature of the legislation in most countries in the Middle East region, Transfer Pricing is a key point of consideration for all types of organizations, including banks.

The importance of Transfer Pricing is further highlighted by the very recent developments in relation to the OECD’s two pillar proposal on global taxation and the potential impact of such developments on the domestic fiscal policy agendas across various Middle East countries.

Given the fast evolving tax policy environment in the Middle East, based on our recent experience, Transfer Pricing continues to be a critical point of discussion for the region’s C-suite and boards within banks.

Aligning Transfer Pricing with the business models

Development Strategy

The starting point for banks looking to launch digital banks is to determine the strategy around the development of the digital bank. Some of the potential options include inorganic approach (M&A), build in-house, or enter a strategic partnership, amongst others. The choice amongst the options available depends on several considerations, including tax / transfer pricing related ones.

Target Operating Model

Once a development strategy has been determined, the next step is around the determination of a Target Operating Model (TOM). Different banks have approached the TOM in different ways depending on multiple considerations such as in-house personnel capabilities, the overlap with existing infrastructure, etc.

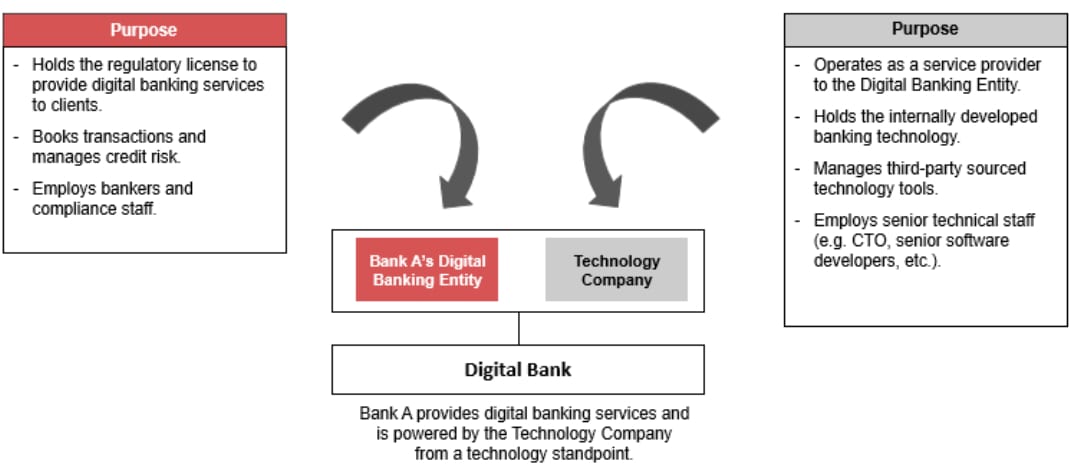

For example, a traditional bank may decide to utilise its existing regulatory banking license (as well as any additional regulatory approvals that may be required) and separately establish a digital banking technology entity (“Technology Company”) to provide intra-group services and develop technology tools / systems to enable the licensed entity to provide digital banking services. The figure below summarises this example with additional illustrative pointers.

Illustration 1: Digital Banking Model Example

Value chain overview of a digital bank

1. Regulatory license and core functions

The banking industry is amongst the most regulated in the region and accordingly, the regulatory license a bank holds is a key driver for a business. Thus, the ability to provide digital banking services through the regulatory license is of critical importance and has a direct impact on the revenue booking model of the financial institution. Specifically, the entity within a MNE holding the banking license will be responsible for booking the revenue, managing the risks, and employing the relevant banking professionals to house the key functions. In addition, the regulated entity will have substantial compliance requirements to adhere to.

2. Technology

Technology has always been a critical enabler for financial institutions with substantial investment made in, and operating expenditures incurred by financial institutions in this regard. Having said that, digital banking raises the bar in terms of the type of technological platform needed, with the evolution of technology requiring banks to continuously invest in their technological capabilities and infrastructure.

3. Support services

Support services such as back-office and head office services constitute the backbone for banking operations and represent a very important element that enables banking operations to run in a smooth and consistent manner.

Transfer Pricing guidance for digital banks

The fundamentals of a Transfer Pricing analysis are embedded in the arm’s length principle and the functions performed, assets employed and risks assumed by the various intra-group entities (i.e. the Transfer Pricing matching principle). In addition, for banks, capital and risk are equally important elements for the purpose of a Transfer Pricing analysis. Therefore, it is critical for banks looking to launch a digital bank to clearly delineate the functions, assets and risks and how these are distributed across the institution’s entities and branches with respect to the digital banking segment. A Transfer Pricing analysis goes to the heart of an organisation’s value chain and therefore, it is critical that Transfer Pricing is amongst the key considerations during the strategy and TOM stage of the discussion in order to ensure Transfer Pricing outcomes are aligned with the value creation strategy and TOM.

In light of the above, an implementation of digital banking services and/or products will potentially lead to a change / alteration in the standard allocation of functions performed, assets employed and risks assumed by the entities and branches that are part of a financial institution.

Banking-specific guidance

When it comes to Transfer Pricing for financial institutions, the OECD has provided banking industry-specific direction in the Authorised OECD Approach (“AOA”) to facilitate the identification and analysis of the functions and risks which are considered to be economically significant to banking value chains. Accordingly, the guidance provided by the OECD through the AOA can be used as a starting point and basis for extrapolating the key considerations for digital banks and overlaying these with additional elements that are specific to digital banking.

Utilising the AOA guidance on the banking industry, traditionally, several functions have been deemed as critical and high-value adding, which are referred to in Transfer Pricing parlance as Significant People Functions (SPFs). Likewise, several types of risks are considered as being critical for a bank. This is of substantial importance as the entities within a bank performing the SPFs and taking on the significant risks are entitled to the commensurate level of return or the residual profits (i.e. profits over and above a limited risk return).

With respect to banking, the creation of financial assets through the sales / trading function and the subsequent management of the financial assets through the risk management function are considered to be the SPFs, as these are the functions that create or allow for the management of the economically significant risks for a bank. Thus, the economic ownership of the financial asset (along with the income and expenses associated with holding that asset, lending it out, or selling it to third parties) is a critical consideration for Transfer Pricing purposes.

Digital banking overlay

In addition to the core banking-specific SPFs listed above, digital banking in particular requires valuable technology and systems to be utilised. Certain banks develop in-house technology to operate a digital bank thereby creating valuable intellectual property (IP). On the other hand, certain technology modules are obtained from third party sources (e.g. KYC / AML checking, CRM, etc.). For the latter, the decision to choose a technology solution / vendor is a critical one and the continuous monitoring of third party technology systems / solutions is equally important to ensure a smooth and successful operation. Accordingly, Transfer Pricing practitioners will need to evaluate the technology function with a new lens for digital banks given the enhanced importance of technology in the value chain of such banks. This analysis is further impacted by the recent work by the OECD focused on the digital economy which has led to proposals to overhaul the global tax system arising largely in response to the digitisation occurring across all sectors of the economy, including financial services.1

1) Although regulated financial services have been excluded from the OECD’s Pillar 1 guidance, technology continues to play a major role in the financial services sector and accordingly, the value of technology needs to be assessed carefully in the context of digital banking Transfer Pricing analysis.

Selecting the approriate Transfer Pricing model - Example

Selecting the appropriate Transfer Pricing model will depend on the underlying functions, assets and risks with respect to the digital banking operations of a bank / financial institution. Using illustration 1 as an example where there is a Digital Banking Entity and a ‘Technology Company’ powering the Digital Banking Entity, the split of the SPFs and risks between the regulated Digital Banking Entity and the role of the Technology Company in powering the Digital Banking Entity will determine the most appropriate Transfer Pricing model. Below we have highlighted two potential scenarios that may play out depending on the functional profile of the Digital Banking Entity vis-a-vis a ‘Technology Company’.

Scenario 1 - ‘Technology Company’ as a pure limited risk service provider to the Digital Banking Entity

In this scenario, the Digital Banking Entity will provide the Technology Company with detailed specification based on its know-how and intellectual property and the Technology Company will be simply acting as a service provider operating under strict guidance of the Digital Banking Entity. Furthermore, the Technology Company will be insulated from the financial outcome of the Digital Banking Entity and will not be entitled to extraordinary profits.

In this context, the Technology Company will bear limited risks and hold routine assets and can be qualified as a limited risk service provider as the Digital Banking Entity will be responsible for all the risks associated with the digital banking activity and hold all the needed assets1. Accordingly, the remuneration to be earned by the Technology Company, as a limited risk entity, may be that of a routine entity (for example through a fixed return on the cost-base) and will not earn any residual / super profits.

Scenario 2 - ‘Technology Company’ and Digital Banking Entity as co-entrepreneurs

In this scenario, both Digital Banking Entity and Technology Company operate as co-entrepreneurs. Given the importance of the technology, the Technology Company may be developing critical intellectual property core to the operation of the digital bank. The main difference between scenario 1 and scenario 2 would be the control the Technology Company will have over the intellectual property and the risks it would bear with respect to the operations of the digital bank.

On the other hand, the Digital Banking Entity will continue to provide the services to the consumers and book transactions and undertake the associated risk management. However, the Digital Banking Entity will be supported by the Technology Company which would be responsible for the development, enhancement, maintenance, protection and exploitation (DEMPE) of the intellectual property needed to allow the Digital Banking Entity to provide its services to its customers. Accordingly, both entities in this scenario will perform key functions, assume key risks and hold key assets. As such, both entities may be entitled to non-routine returns under the Transfer Pricing model.

In our experience with various banks, a RASCI3 analysis serves as a highly beneficial analysis tool, often a cornerstone of a detailed Transfer Pricing analysis, which can help outline the split of the key functions, value drivers and relative contribution (in this example between the Technology Company and the Digital Banking Entity). A RASCI matrix helps delineate the functions in a precise manner and can act as a robust analysis tool for selecting a fit-for-purpose Transfer Pricing and remuneration model.

2) The term ‘Assets’ in this context is used from a Transfer Pricing perspective and not financial assets. All financial bookings would automatically be undertaken by the licensed banking entity.

3) RASCI matrix is a method used to assign and display responsibilities of individuals or jobs in a task in an organization. It is an acronym derived from the five key criteria most typically used: Responsible, Accountable, Supporting, Consulted and Informed.

Marrying the Transfer Pricing policy with commercial considerations

In addition to the factors mentioned above, there are certain commercial considerations that may significantly impact the Transfer Pricing policy, implementation and documentation for digital banks as further discussed below.

Startup losses

One of the major issues that needs attention is the possibility of startup losses incurred by the digital bank while its new technology is being developed / implemented. The Transfer Pricing model selected will have to take into account the expected financial outcome from the digital banking operations. For example, where a limited risk entity model is selected for the ‘Technology Company’, it will be insulated from any losses and be entitled to a target return. However, if an alternative option is selected, the Transfer Pricing model may need to be adjusted to account for a phased approach / implementation due to the startup losses or other commercial considerations.

Documentation

A certain level of documentation should be maintained to support the Transfer Pricing model.

As a first step, the Transfer Pricing policy would need to be reflected in the agreements and the invoices between the related parties / units. Hard documents such as invoices and agreements are a critical starting point for tax authorities when assessing the policy for taxpayers. Accordingly, ensuring that the Transfer Pricing policy is accurately articulated in the agreements, whilst taking into account any potential commercial nuances, is absolutely critical.

In addition, Transfer Pricing documentation (Local Files/Master File) needs to be prepared following the local regulations. The Master File is an overarching document (i.e., blueprint) which contains high level information about the global business operations and the Transfer Pricing policies while the Local File is a document specifically related to an entity.

Negotiation related to Transfer Pricing

It may be the case that due to the Transfer Pricing model selected, and in particular around how the profits are to be split in a digital banking context, the parties involved have to go through additional negotiations over and above the commercial negotiations to agree on the Transfer Pricing model and underlying profit allocation mechanism.

Dynamic regulatory and tax environment

The tax landscape in the Middle East (and globally) is rapidly and constantly changing. Regulatory requirements are increasing, business and finance transformation is commonplace, and tax authorities and boards are demanding that tax risks are effectively managed.

In view of this, we are expecting increasing challenges for companies arising from this rapid evolution. The tax authorities in this region have committed to implementing the OECD’s two pillar solution, which was initially launched with the main objective of addressing the tax challenges of ever increasing digitalisation. This is particularly relevant for digital service offerings, where customers may be located in different countries, connected through a digital platform located in one jurisdiction only, where the entire income may be currently booked.

In addition, transparency requirements have increased under initiatives such as country-by-country reporting which may now be shared via automatic exchange of information agreements between tax authorities in different jurisdictions. This has led to an abundance of information being made available to tax authorities worldwide, contributing to an upward trend in Transfer Pricing disputes.

Ensuring that the Transfer Pricing policies are flexible and adaptive to these rapidly changing regulatory and tax requirements is the key, otherwise the policies can quickly become redundant, requiring significant efforts to update.

Conclusion

Banks around the world are embracing the power of digital transformation. As banks embark on their digital banking journeys, Transfer Pricing is one critical area of focus to ensure that the Transfer Pricing outcomes are aligned with value creation and that a fit-for-purpose Transfer Pricing model is developed and implemented in a dynamic regulatory and tax environment.