The Energy and Resources (E&R) sector in the Middle East and elsewhere in the world has been affected by significant developments and challenges, always at the center of economic development.

Since the Middle East E&R sector represents regional governments' primary source of revenue, the fall and volatility of global oil prices, has led to budget constraints in the Middle East, with governments turning to tax revenues to make up for the shortfall in overall country revenues.

As a result, a number of tax authorities in the region have introduced transfer pricing (TP) regulations making it a crucial time for businesses operating in the region with an expected increase in tax audits and enquiries.

In this article we will look at the E&R business segments and the related value chain, how to best deal with the sector’s TP considerations as well as recommendations for businesses operating in this space.

"As the Middle East region continues to transform, you need to see the risks and identify the opportunities ahead, plan for change and create efficiencies that allow your transfer pricing function to be a competitive advantage."

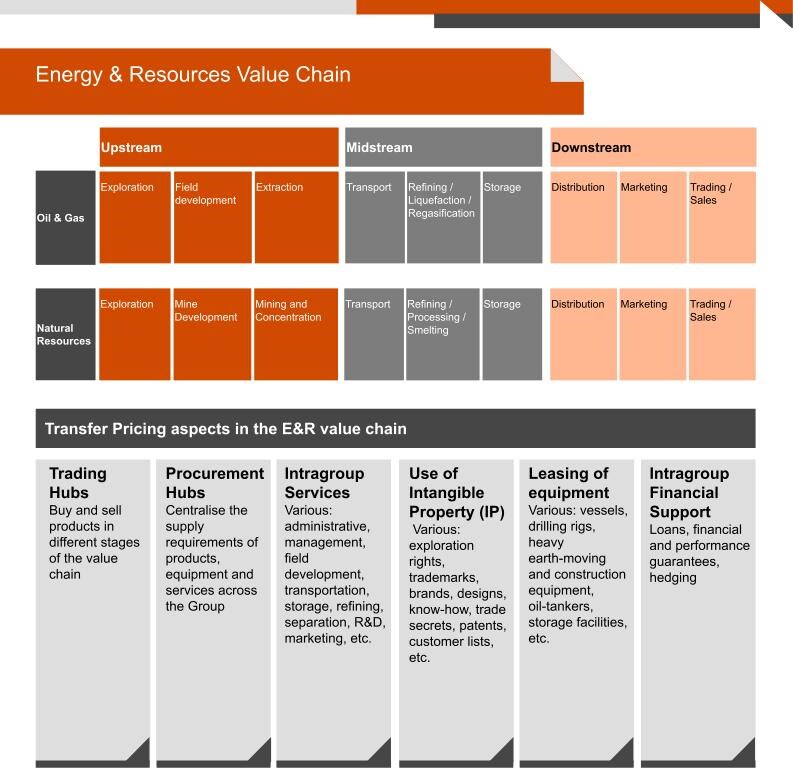

The upstream, midstream and downstream phases of the value chain

Most companies in the E&R sector operate complex multi-jurisdictional value chains, which comprise a large number of processes through their upstream, midstream and downstream operations. The processes, may be performed by different entities within the same corporate group, creating a web of related party transactions and corresponding transfer pricing issues.

Each segment of the E&R sector has its own specificities, but generally their value chain can be structured in three key phases: Upstream, Midstream and Downstream. Each phase includes key activities, which present different challenges to the tax departments of multinationals operating in this sector from a transfer pricing perspective.

Transfer Pricing aspects in the E&R value chain

TP considerations in the E&R sector

Trading hubs

Now more than ever, in the current BEPS environment, the key TP aspect to consider when it comes to trading hubs, is ensuring alignment between the location of key decision makers that i) control the underlying business risks and ii) have the financial capacity to assume those risks in case they materialise; and the location where the residual profit generated by the trading activities is booked.

Another aspect to consider is whether universally accepted pricing indexes exist that serve as a reference for trading particular commodities, and whether these have been considered in pricing the intercompany sales, with any necessary adjustments required for differences in quality/blend, location, storage, insurance, volumes, etc.

Centralised procurement hubs

Within the E&R sector, the use of centralised procurement hubs is common practice (i.e. through a procurement principal structure) which typically source products or commodities from suppliers/manufacturers, taking full title for onward sales to related parties. Similar to trading hubs, in order to ensure the robustness of the procurement principal structure, it is critical to ensure that it has appropriate economic substance.

Intra-group services

Intra-group services are an important part of all processes in the E&R value chain. A significant variety can also be observed between the intragroup services provided within the upstream, midstream and downstream phases of the value chain.

In this regard, it is key for companies to ensure:

This must be well documented and be periodically reviewed to ensure consistency between the charging mechanism on paper and its practical implementation.

Use of intangible property

Intellectual property (IP) is a significant issue in many industries and specific challenges also arise concerning the use of IP in the E&R sector.

In the upstream phase of the value chain, a good example is the research and development activities that led to improvements in hydraulic fracturing (fracking) allowing companies to extract shale oil, which was unrecoverable a few years ago. This in turn led to the registration of some patents in relation to the technology used, which is currently generating revenues and profits as a result of the technological and process advancements conducted over time.

Another example in the upstream phase relates to the rights granted to multinationals (MNEs) for the exploration of O&G or mining fields. In the midstream phase, refining methods and technologies with design configurations have been patented by large MNEs (e.g. fluid catalytic cracking). In the downstream phase of the value chain, an example arises with the use of the brand of well recognised and established global players in the retail sale of fuels. The key question is whether these intangible assets should be remunerated, and if so, how and what part of the residual profit should be allocated to their owners. Moreover, it is important to assess whether the legal owners of these intangible assets are also their economic owners to whom the residual profit should be allocated. It is therefore important to identify the entities:

- Performing the DEMPE functions (Development, Enhancement, Maintenance, Protection and Exploitation) in connection to the intangible assets

- Making the key decisions relating to the control over the risks

- Which have the financial capacity to bear those risks in case they materialise

Leasing of equipment10

Characterised as an offshore service activity, vessel and/or rig charters represent specific TP challenges in the upstream phase of the value chain. In the E&R (mainly O&G) service sector, vessel charter arrangements between related parties often relate to offshore construction services, servicing, subsea equipment and pipeline installation, and contract drilling. Offshore and oilfield service companies are very important to the E&R sector since they own the equipment and vessels to assist major companies with locating, drilling and producing offshore oil and gas, but do not extract and sell it in their own name. In this regard, the operating models through which vessel or rig charter companies operate often give rise to permanent establishment issues in the countries in which the vessels operate. The attribution of profit to these entities can be complicated, particularly given that functions are undertaken, and risks are managed and controlled in relation to the charter, both inside and outside the country where the vessel is operating.

On this basis, TP issues may arise, for example, on how to remunerate the different parties involved, from the shipowner, to the charterer, to the service provider (e.g. contract drilling company) and so due care should be taken in terms of the involvement and characterisation of each entity involved, apart from determining the location of the key personnel responsible for controlling the risks related to these transactions and the entities that have the financial capacity to bear such risks should they materialise.

Vessel chartering is also common across the midstream phase of the value chain, especially in transportation activities, whilst the leasing of heavy earth-moving and construction equipment is frequent during natural resources mining activities.

Intra-group funding

Group funding, mainly from the parent company to subsidiaries or branches, is common in the E&R sector. Due to the highly capital intensive nature of the business and the related commercial risks, intra-group funding is undertaken in almost all phases of the value-chain ranging from exploration and discovery, project development, transportation (to fund acquisition of transportation assets), refining/production and downstream distribution (to fund various distribution activities).

From a TP perspective, typical areas to consider are the arm’s length nature of the interest rates on loans and other forms of intra-group financing, the pricing of risk on financial and performance guarantee fee payments, the hedging activities to protect the Group from exposure to future price volatility, thin capitalisation and interest limitation rules.

10 Payments under an “operating lease” generally comprise rental payments whereas payments under a “finance lease” comprise a notional repayment and an interest income component.

Key considerations

The pandemic impacted global demand in the entire E&R sector during 2020, disrupting supply chains across the world. The effects of the pandemic have spilled over into 2021, with slow economic recovery expected amidst the ongoing travel restrictions and government lockdowns across the world.

The impact of COVID-19 has put governments’ budgets worldwide under pressure, with a strong emphasis on countries whose economies are predominantly dependent on E&R related activities, such as in the Middle East. Governments are therefore looking to diversify their economy with alternative revenue generating sources (e.g. by implementing new taxes, increasing scrutiny on MNEs, etc.), leading to an augmented focus on taxpayers’ business activities and their profit allocation across the different countries where they operate. These facts are increasingly exposed as information is more readily available than ever to tax authorities around the world through the obligations imposed, such as Country-by-Country reporting, DAC6 and the general exchange of information between countries.

Transfer Pricing is at the forefront of important international tax developments, such as the Base Erosion and Profit Shifting (BEPS) Project lead by the OECD and the G-20. In this regard, tax revenue (regardless of its source being direct or indirect) represents an ideal opportunity to bolster respective national budgets, particularly in the Middle East, where large scale strategic economic diversification away from O&G is of utmost importance for the sustainability of economies in the region.

The complexity of the business operations of multinationals in the E&R sector continue to draw increasing examination by tax authorities across the globe. As many countries in the Middle East only recently introduced TP legislation or began to enforce TP regulations, E&R multinationals operating in the region face a greater challenge with respect to their TP practices, which has made it crucial for them to assess their TP risks and develop strategies to mitigate them. This is further exacerbated by the fact that local reliable and appropriate comparables remain a challenge in the region.

Looking at the value chain holistically, identifying the key value drivers of the business and linking them with the contribution of the Group entities operating in the different phases of the value chain is crucial to determine whether the current profit allocation across the Group is in line with the value creation of each individual entity. This is particularly crucial in scenarios where there are overlapping roles and responsibilities by individual Group entities which could create even more potential issues especially in light of the cost pressures and the international mobility restrictions of key personnel resulting from the pandemic.

E&R multinationals should assess their group’s related party transactions and adopt efficient global documentation strategies that can be tailored to meet local requirements and formulate dispute resolution plans, both on a preemptive and corrective basis. These should form part of their Tax Risk Framework (including internal tax controls and tax corporate governance) given that the consequences of not doing so can effectively lead to unexpected additional tax payable, penalties and, potentially, reputational risks. This is particularly relevant in the Middle East, where unilateral or bilateral advanced pricing agreements are yet to be fully embraced by tax authorities in the region, leaving taxpayers with a lack of juridical certainty about their transfer pricing policies.

If you feel that any of the areas addressed in this article are of concern or potential risk to your business, the PwC Middle East Transfer Pricing Team is available to assist you with your challenges and questions, guide you through the complexities arising for the ever-changing tax landscape in the Middle East and share our experience interacting with tax authorities across the region.