In 2023, the global economy experienced a slower growth rate, marked by high interest rates, inflation and geopolitical tensions. Nevertheless, growth in the Gulf Cooperation Council (GCC) countries remained remarkably resilient. The 2.8% contraction in oil sector activities in 2023, resulting from the successive oil production cuts by OPEC+, was largely offset by expansion in the non-oil sector, which is estimated to have grown by 4.3% in 2023, buoyed by government investments linked to various economic diversification agendas taking place across the GCC.1 As a result, the overall GDP growth in the GCC is estimated to be 1.5% in 2023, following annual growth of 7.9% in 2022.

Looking ahead, there are reasons to be optimistic about the potential economic performance of countries in the region, given their commitment to economic diversification and their ability to adapt to changing market conditions. In the following sections, we explore the top five economic themes that we believe will shape the economies of GCC countries in the year ahead.

1. Global growth to slow but GCC economy to remain resilient

At the time of writing, economic forecasters expected moderate global growth of about 3% in 2023, lower than the 3.5% in 2022. Meanwhile, global inflation is expected to ease (in relative terms) to 6.9%, down from 8.7% in 2022, as interest rates reached 17-year highs globally. This can be attributed to reduced energy prices, slowdown in consumption and investment as higher interest rates took hold, as well as base effects stemming from year-over-year comparisons.

The effects of tighter monetary policy to curb inflation are expected to dampen consumption and investment activity in 2024. A mild slowdown is expected in 2024 for the global economy, with GDP reaching 2.9% - the weakest global growth profile since 2001 (barring the global financial crisis and the peak of the global health crisis).

In contrast, the GCC states are poised to effectively navigate through a decelerating global economy, aided by a loosening of OPEC+ oil production quotas, relatively strong growth in key Asian markets including in India (6.3% real GDP growth), and China (4.2%), and continued government investment in the economy in line with the economic diversification goals. As a result, GDP growth in 2024 is expected to strengthen at 3.7%.2

While the region may not be entirely shielded from a global economic deceleration, there are several reasons for cautious optimism:

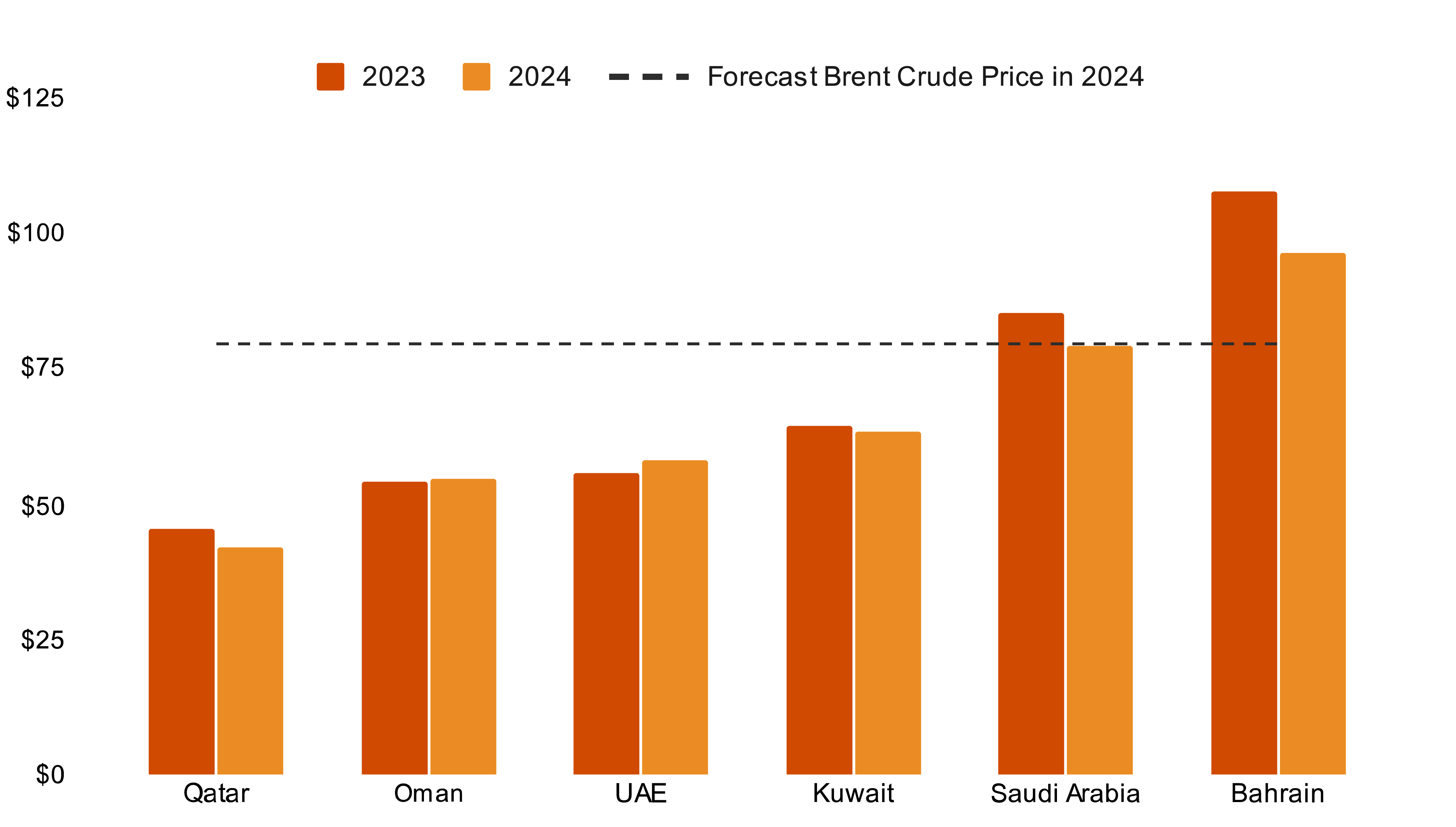

- First, although Brent crude prices are unlikely to reach the highs of late 2021 and early 2022, oil prices are expected to remain above US$80 per barrel in 2024. While a sluggish global economic outlook could impact oil demand growth, the growth in Asian markets means that global oil consumption is projected to rise by 1.1m barrels per day in 2024 compared to 2023.3 The biggest economy and oil producer in the GCC - Saudi Arabia - is also set to gradually phase out unilateral oil output cuts, imposed in mid-2023. These factors will support a recovery in the oil sector in 2024 and support healthy fiscal positions, with the regional fiscal balance projected to register a surplus of 3.3% of GDP in 2024.4

Figure 1: Historical and forecast Brent crude spot prices (US$/barrel)5

Source: International Energy Agency

Figure 2: Fiscal breakeven oil prices for GCC states (US$/barrel)6

Source: IMF

- Second, the non-oil sector will remain a key driver of economic growth in the region. The sector is expected to grow by 4% in 2024, fuelled by positive momentum in the retail and service sectors, supported by robust liquidity, ongoing reform initiatives, and a rapid surge in private and government investment. These factors will help offset the effects of sluggish growth in major trading partners.

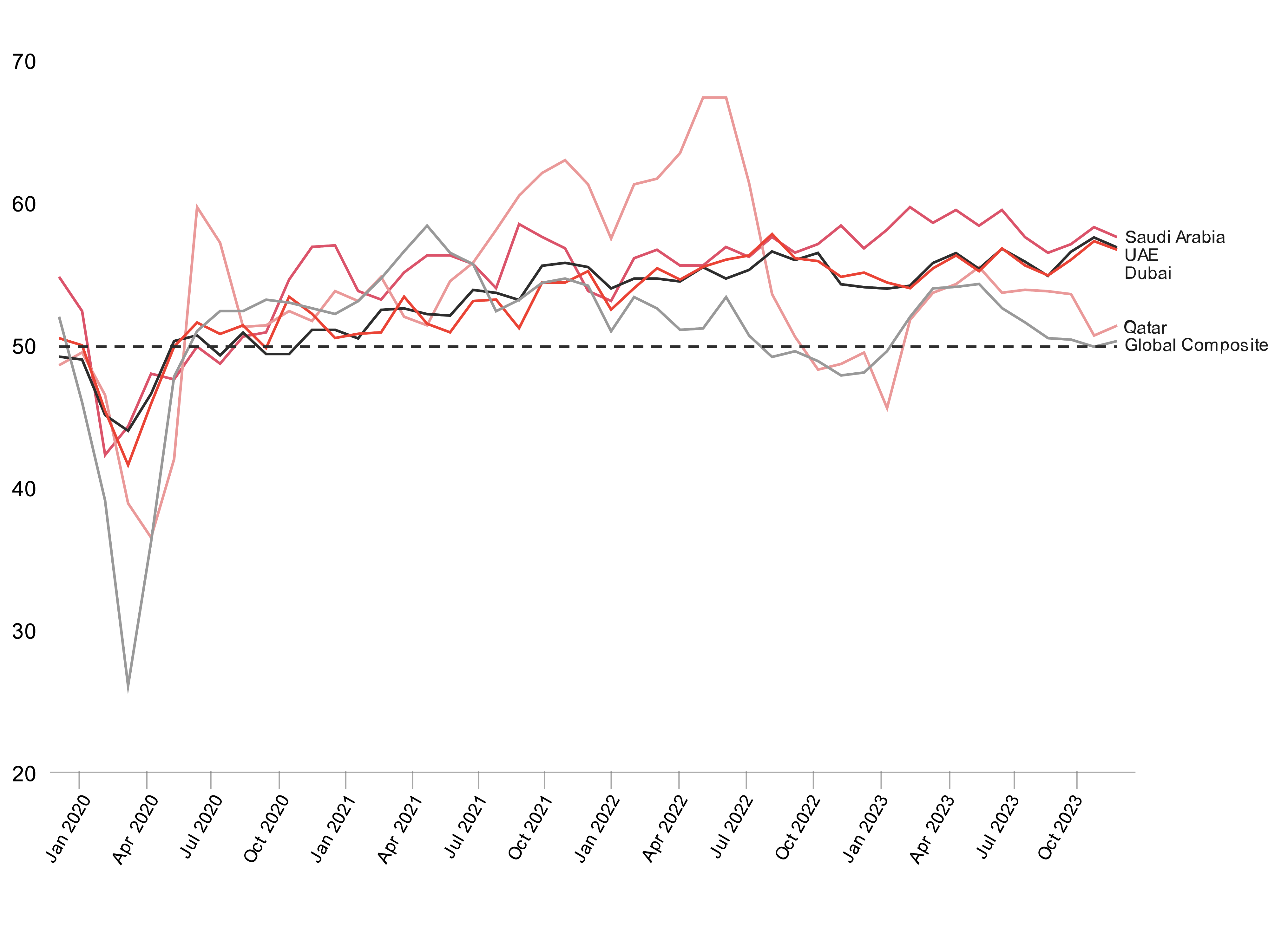

- Third, according to the purchasing managers' index (PMI) data from the GCC - an indicator of business confidence and a leading indicator of non-oil private sector performance - regional economies are in relative health and maintain a positive momentum.

- And fourth, PMIs in the UAE and Saudi Arabia have consistently remained in expansionary territory since the aftermath of the global health crisis, and continue to outperform the global average.

Figure 3: Purchasing Managers’ Index

Source: S&P Global Purchasing Managers' Index

A reading above 50 indicates an expansion of the non-oil private sector compared with the previous month;

below 50 represents a contraction; 50 indicates no change

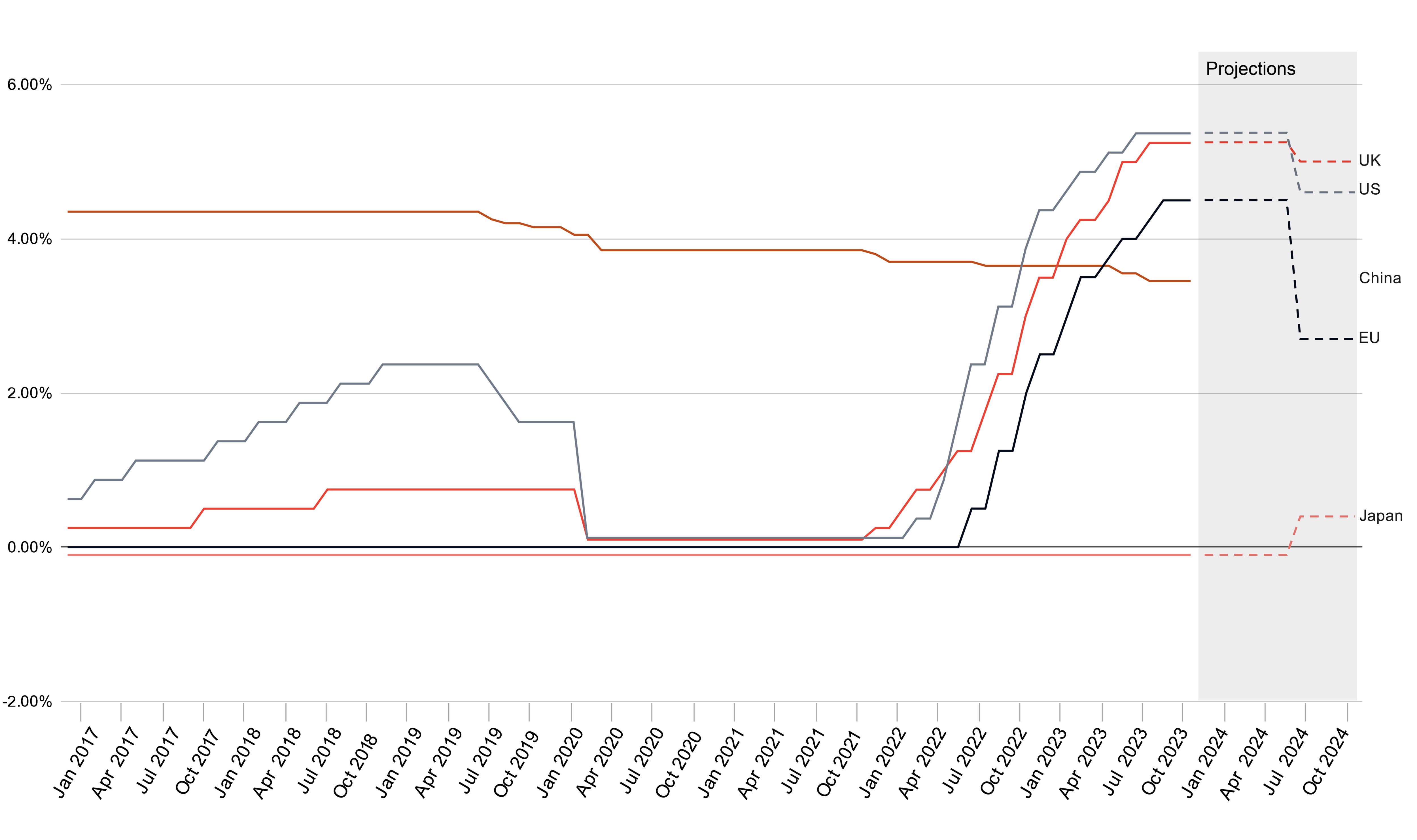

2. With inflation cooling, monetary easing is expected by the end of the year

Inflation is declining in most nations, reflecting the effects of tighter monetary policies. The International Monetary Fund (IMF) anticipates a notable reduction in global inflation to 5.8% in 2024 from 6.9% in 2023.8 In the GCC, inflation has mostly returned to pre-crisis levels after a series of interest rate hikes, and it is expected to average 2.3% in 2024, down from 2.6% in 2023.

With the cooling of inflation rates, the end of the interest rate hike cycle is in sight. Last December, the US Federal Reserve declared its intention to maintain the federal fund rate within the existing target range of 5.25%-5.5%. Markets are also anticipating reductions in major policy rates in the latter half of 2024, as inflationary pressure continues to alleviate.9

Figure 4: Global key policy rates: historical trends and future projections

Source: Bank for International Settlements

The GCC countries, which predominantly have pegged currencies, are positioned to mirror these cuts, which will help reduce financing costs, improve liquidity conditions and support regional consumption and investment.

That said, risks to inflation are weighted to upside, driven by exogenous shocks to the price of commodities and other goods. For example, geopolitical risks in the Middle East are disrupting trade flows through the Red Sea and Gulf of Aden, which could lead to higher shipping costs. IMF analysis suggests that a doubling of shipping costs could cause inflation to increase by 0.7 percentage points.10

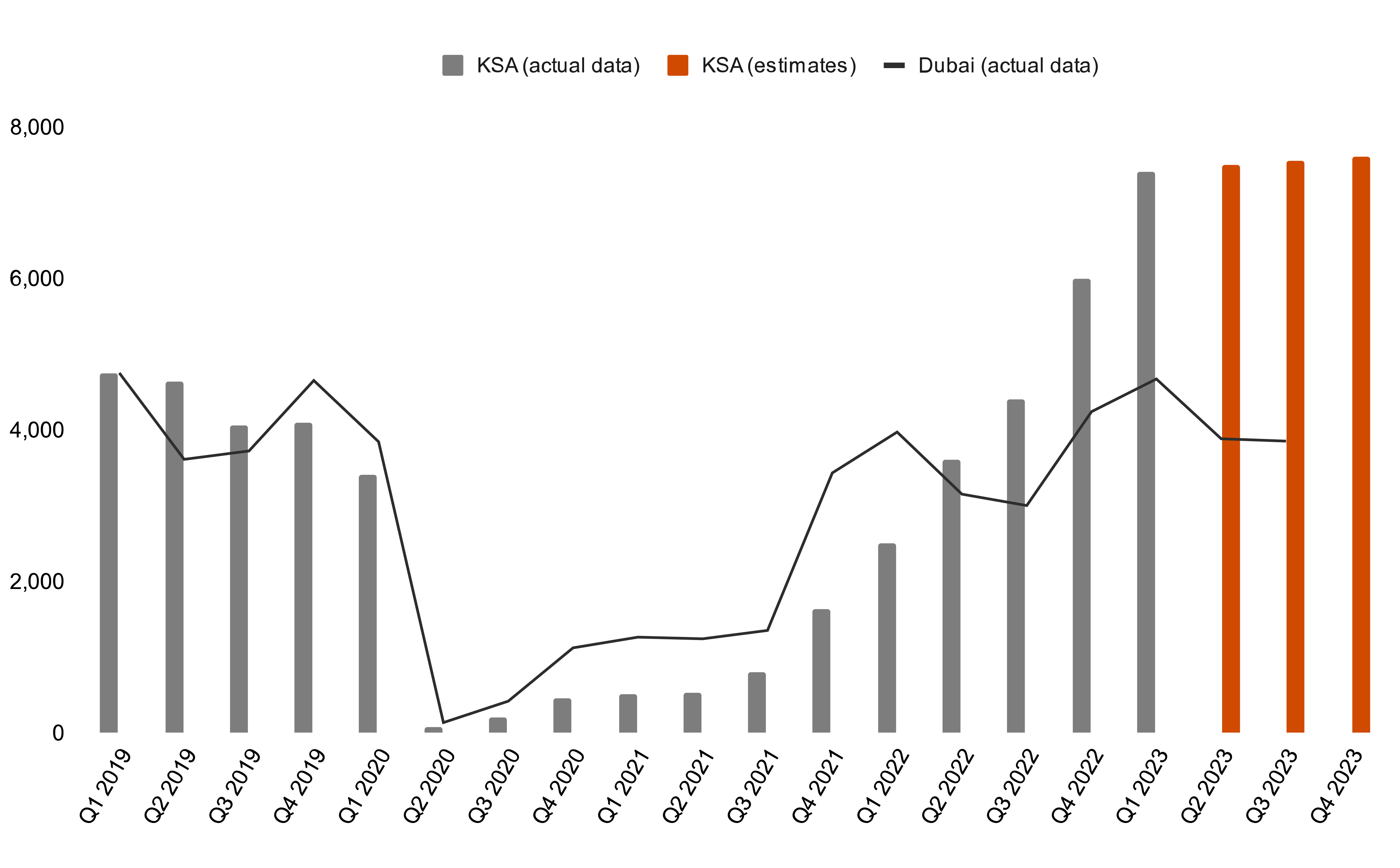

3. The emergence of Saudi Arabia as a tourist destination

Saudi Arabia has been experiencing significant growth as a tourist destination in recent years, driven by ambitious initiatives and reforms under its Vision 2030 programme that aims to transform the Kingdom into one of the world's most visited countries.

Ongoing investments in tourism-related infrastructure, including airports, hotels and transportation, have also improved the overall tourism experience and accessibility. A 10-year US$1tn investment package for the tourism sector has been promised by the Ministry of Tourism, as the country aims to increase hotel capacity by 310,000 rooms by 2030.11 The Kingdom has simplified the process for obtaining tourist visas, making it more convenient for prospective visitors to enter and explore the nation, while investing heavily in restoring and promoting its rich historical and cultural heritage sites as tourist attractions. These include the ancient city of Al-Ula, the Nabatean ruins of Madain Saleh, and the historical city of Jeddah. The government has also adopted a strategy of attracting investment and tourist spending through high-profile events and sports tourism.

A number of significant events are set to take place in 2024, including the Formula 1 Saudi Arabia Grand Prix in Jeddah, as well as a number of conferences and summits. In December last year, the Kingdom was named as the host of the 2030 Expo to be held in Riyadh. As the sole bidder for the 2034 World Cup, Saudi Arabia is also likely to be confirmed to be the host nation this year by FIFA.

These efforts are already positively impacting the country’s tourism industry. According to the UN’s World Tourism Organisation, the Kingdom emerged as the second-fastest growing tourism destination in the world based on international tourist arrivals during the first quarter of 2023. In 2023, the Kingdom expects an estimated 70 million domestic visitors and 30 million international visitors.12

The sector’s contribution to the country’s GDP is also expected to double to 6% of GDP in 2023, from 3% in 2019, and is on course to reach the target of 10% by 2030. In line with other forecasts, the tourism sector is expected to grow by 11% annually over the next decade.13

Figure 5: International tourist arrivals (‘000s)

Source: WTO

4. The transformative rise of GenAI continues apace

Recent advancements in Artificial Intelligence (AI), particularly the development of Generative AI (GenAI), are expected to create numerous opportunities for businesses and society.

Recognising the potential significance of these forthcoming shifts, countries across the GCC are actively investing in research and development initiatives focused on advancing AI. Saudi Arabia, the UAE, and Qatar are leading the drive towards new technologies that align with the objectives of their respective transformation agendas. G42, a UAE-based technology holding group, partnered with OpenAI in late 2023 to deliver AI solutions for the UAE and regional market leveraging OpenAI’s GenAI models. In parallel, G42 also spearheaded the development of Jais, a 13-billion parameter bilingual model and the world’s first high quality Arabic large language model (LLM). Similarly, the Technology Innovation Institute (TII) is investing heavily into its Falcon 180B LLM.14 Saudi Arabia has also launched a GenAI accelerator (GAIA) with a $160m fund to invest in early stage GenAI start-ups, while Invest Qatar has partnered with Microsoft Azure to develop Ai.SHA, an AI assistant that can help businesses and investors better understand Qatar’s investment landscape and inform investment decisions.

In the coming year, we can expect GenAI adoption to accelerate in the region, notably in the healthcare, finance, media, and technology sectors, which are characterised by high research and development (R&D) intensity and frequent customer interactions. The impacts of GenAI are expected to be realised through workforce transformation as well as AI automation. By empowering the workforce with tools and training for GenAI technologies, employees' knowledge and capabilities will be significantly augmented, particularly in areas requiring creativity and data analysis. For example, within the context of R&D, GenAI will enable researchers to analyse large datasets more efficiently and intuitively.

The implementation of AI automation will help streamline organisational processes, as well as enhance critical business operations and deliver superior customer experiences. For instance, in customer service, GenAI can revolutionise the sector by providing automated, yet personalised assistance.

As with AI, the widespread adoption of GenAI also creates risks. These include the legal and intellectual property issues over the ownership of generated content as well as the complexity and lack of transparency over GenAI models which make understanding their decision-making process challenging. The usage of customer data also creates potential ethical and regulatory risks, as well as the need to monitor and address the risk of bias in underlying models. We can expect further regulatory developments to manage these risks across the region this year.15

5. The emergence of the GCC as key player in the global energy transition

The region has the opportunity to accelerate investments in greener sources of energy. The proportion of renewables within the total energy generation capacity of the GCC continues to be minimal, constituting just 3% of total power output.16 The UAE leads the GCC nations, with approximately 14% of the country’s energy generation being driven by renewable sources, and this represents approximately 60% of the region’s total renewables capacity.17 Saudi Arabia currently produces less than 1% of its total power output from renewable sources and needs to continue to push efforts to meet its decarbonisation goals.18

For Saudi Arabia, along with the rest of the GCC, much of this investment into renewable energy also needs to be frontloaded, not least because it takes time for capacity to come on stream, but also because it is necessary to support the decarbonisation of downstream sectors like transport and manufacturing, via greater electrification.

While progress has been slow, we expect additional renewable energy generation capacity to grow in 2024 in line with national ambitions. The Dubai Waste-to-Energy facility is expected to become fully operational this year, generating up to 220MW of electricity that can supply power to 135,000 homes in the region. ACWA Power’s Layla PV solar project in Riyadh is expected to be operational in 2024.

Figure 6: Renewable energy share of electricity capacity and generation

The ‘COP effect’

The UAE’s leadership of COP28 and the successful negotiation of the UAE Consensus demonstrates the GCC’s emergence as globally significant players in the energy transition and the pursuit of net zero goals. Notable features of the UAE Consensus include the commitment of signatories to transition away from fossil fuels, as well as the introduction of a new, specific goal: to triple renewable energy and double energy efficiency by 2030, and promote the development of a new structure for climate finance.19

The region is well-positioned to facilitate the global transition towards renewable energy, stemming from two key advantages:

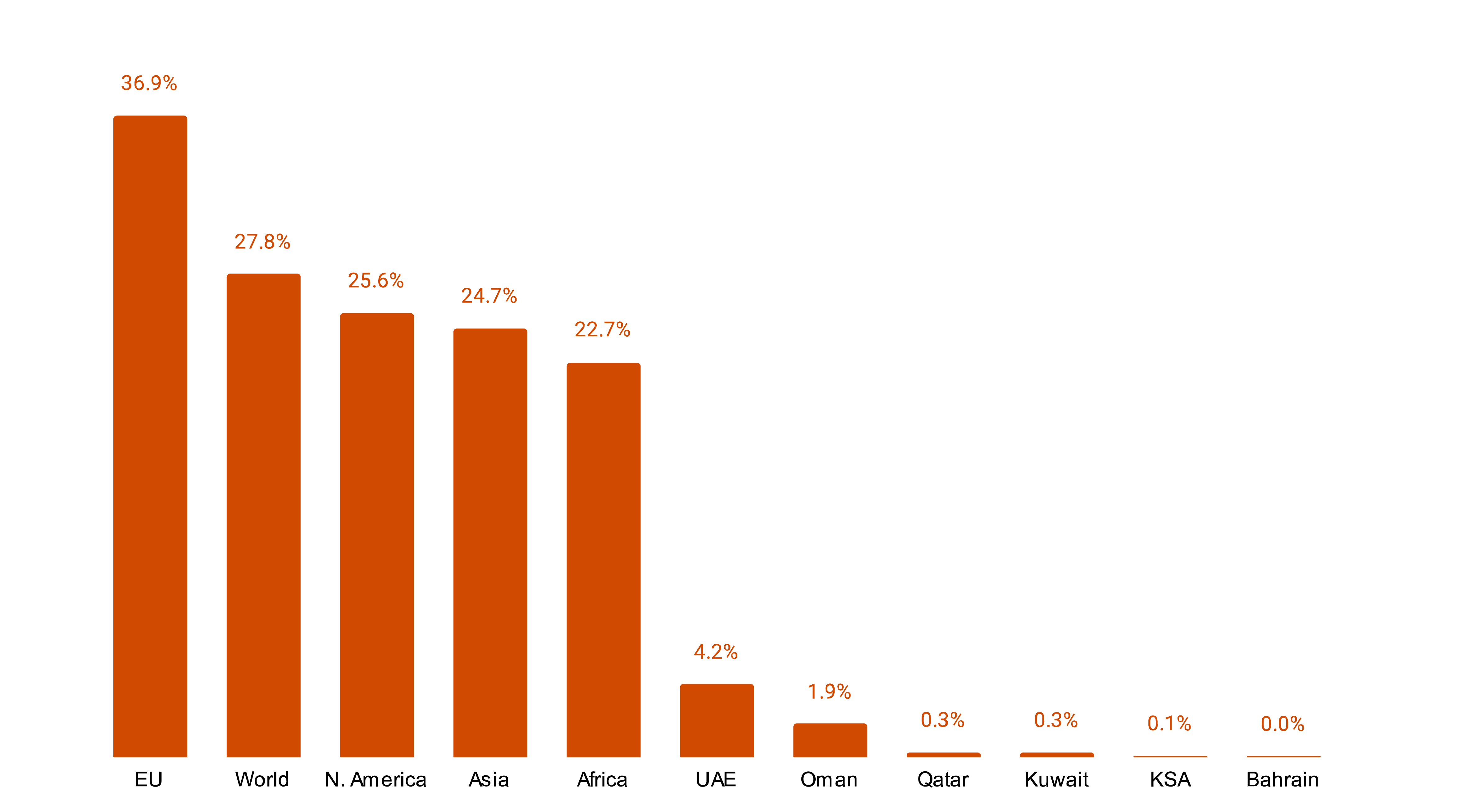

- Access to capital: In 2022, GCC sovereign wealth funds (SWFs) contributed 29% of sovereign investment into renewables, with Mubadala being the second-largest single investor.20 This trend is expected to continue, with SWFs continuing to fund renewable asset investments in Europe and North America. The relative macroeconomic stability and strong growth outlook in the region also confer an advantage to SWFs that can continue investing in renewables amidst global economic uncertainty.

- Access to cheap sources of renewable energy: The region has some of the highest solar power potential in the world, with high solar irradiation rates, and large amounts of available and suitable land. 2023 saw the opening of the Al Dhafra Solar Plant, the largest single-site solar plant in the world. While solar is the dominant source of renewable energy, parts of the region, such as Oman, benefit from good wind resources. This capability, combined with investment in producing and exporting green hydrogen and derivatives means that the region is well-positioned to transition from its role as a primary exporter of fossil fuels to becoming a leading exporter of renewable energy.

Looking ahead

The outlook for the GCC region in 2024 is more optimistic in comparison to the rest of the world, supported by the reversal of oil production cuts, still strong international oil prices and growth in the non-oil economy. The moderation of inflation and the central banks' decision to ease monetary policy from the second half of the year will continue to add to this growth, while the tourism sector is also expected to see continued growth, particularly in Saudi Arabia.

For more, keep an eye out for our upcoming Middle East Economy Watch where we examine the latest economic developments across the region, as well as our Economy Matters blogs and Economy Bites podcast series.