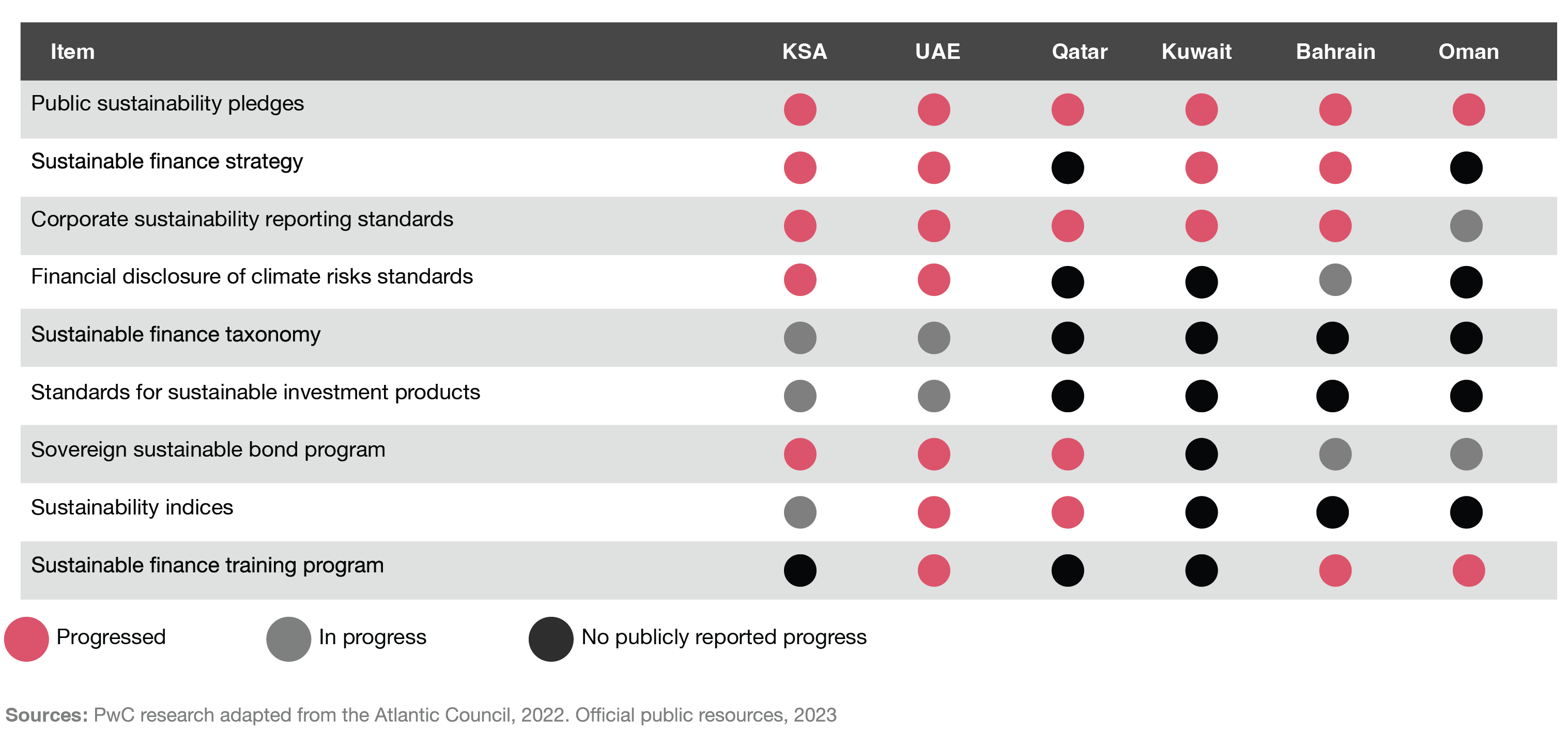

The UAE has been a pioneer in sustainable finance in the GCC region, marked by the Dubai and Abu Dhabi Sustainable Finance Declarations in 2019, as well as the publication of its first guiding principles on sustainable finance in January 2020.

The UAE Sustainable Finance Framework 2021-2031 has set a common national agenda for sustainable finance, while ADGM and DIFC have collaborated with global organisations to provide training programs for finance professionals.

UAE was the first government within the region to commit to a net-zero emission objective with substantial initiatives, including mandating ESG reporting from publicly traded corporations. Recently, Abu Dhabi’s sovereign wealth fund, Mubadala, established an independent ESG business and Dubai’s Emirates NBD raised $1.75 billion in the Gulf region’s first sustainability-linked loan.

Additionally, Masdar Green is issuing green bonds to facilitate sustainable asset development for Masdar City’s future growth.