As regional governments accelerate digital transformation, there is an increasing demand from tech-savvy end-consumers, creating a favourable environment for growth in the Middle East. This is strengthened by new technologies, operational efficiency, tower companies, and telcos eager to diversify. As a result, deal activity centres on acquiring new capabilities to gain market advantages at low costs.

trans act 2024

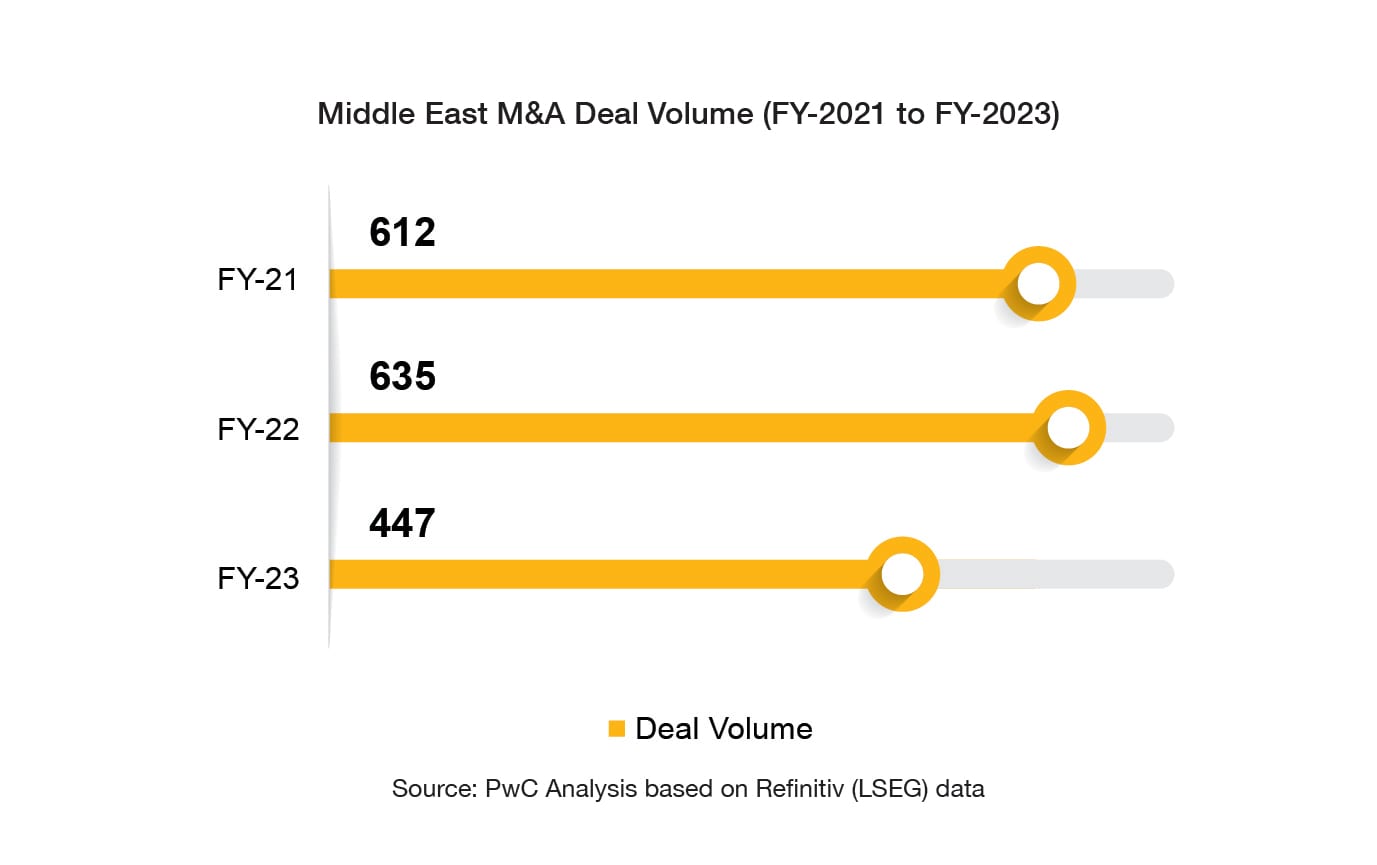

In 2023, the global mergers and acquisitions (M&A) market showed a mixed performance. Although the deal activity improved slightly during the first half of the year, compared to the declines in 2022, the prospects for a full recovery were hindered by the impact of rising interest rates, financing challenges and slowing economic growth in many regions.

However, mid-market deals held up better than expected, as predicted in our 2023 mid-year M&A outlook, because they were easier to get done in a difficult financing environment. Deal makers made a series of smaller deals to drive transformation and growth, which helped maintain mid-market deal activity.

The second half of the year witnessed a more bearish sentiment among dealmakers, contributing to M&A volumes and values declining by 6% and 25% in 2023, compared to the year before.

Despite the slower growth rate experienced by the global economy, the Middle East has remained resilient, supported by solid economic fundamentals and supportive government policies. This resilience has boosted stability and investor confidence in the region, leading to a relatively active deal market compared to other regions that are more susceptible to higher interest rates and recessionary fears.

“The Middle East's M&A market has shown remarkable resilience, which has boosted investor confidence in the region and led to an increase in active dealmaking. We anticipate that 2024 will be a year of growth and activity will be driven by economic diversification goals, decarbonisation, and a focus on localisation and value creation, as organisations transform their business models and look to expand capabilities.”

Romil Radia

Deals Markets Leader, PwC Middle East

2024 key themes

Economic diversification propels M&A growth, as private sector gains in prominence

Localisation agenda at the core of regional reforms

Net zero targets accelerate search for green deals

Digital transformation competencies a key priority for deal making

Mid-market deals dominate as investors focus on value creation

Country highlights

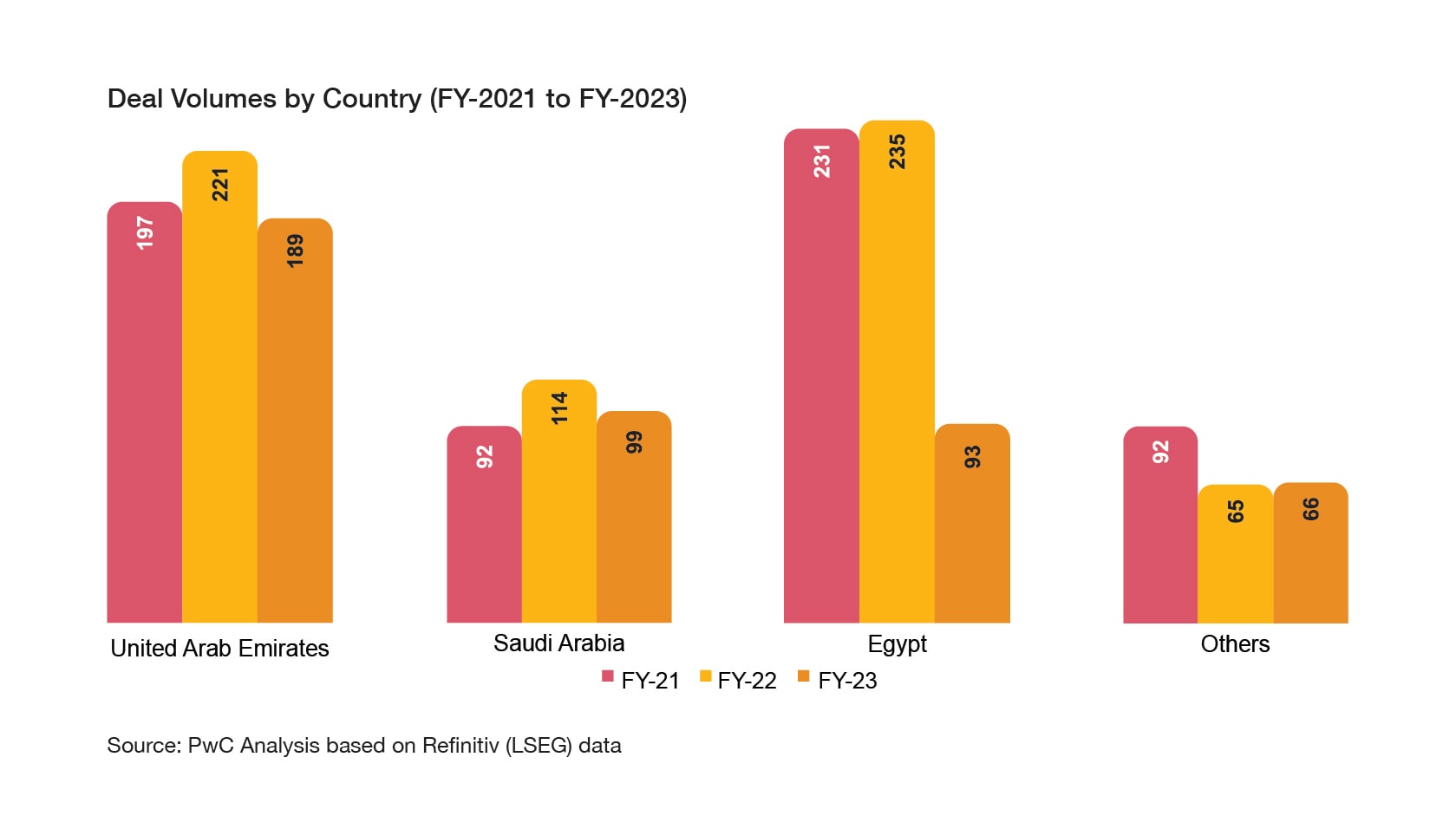

In line with global M&A trends, these countries experienced a decline in deal volume compared to 2022 when each of them observed a considerable increase in deal activity. Egypt experienced the sharpest decrease of 60.4% on the back of currency devaluation, high inflation, and wider macroeconomic challenges over the course of the year. This highlights a significant shift in the momentum noted in previous years when the country recorded the highest number of deals in the region. However, it's worth noting that the devaluation of the Egyptian pound shifted deal dynamics in favour of buyers, attracting investors to sectors such as energy, healthcare, financial services, and tourism, among other sectors, amid economic uncertainties in 2023. The underlying potential of Egypt's population and infrastructure needs is expected to attract more investors, as seen in Abu-Dhabi ADQ's recent announcement to invest $35bn in Ras El-Hekma with the aim of transforming the region into a premium international tourism destination.

In comparison to Egypt, the UAE and Saudi Arabia saw less substantial declines, with deal volume decreasing by 14.5% and 13.2% respectively. For the UAE particularly, it is worth pointing out that this decline counteracts the 12.2% increase witnessed in 2022. Meanwhile, the rest of the region collectively saw a marginal 1.5% in deal volume, from the 23.9% decrease recorded the year before.

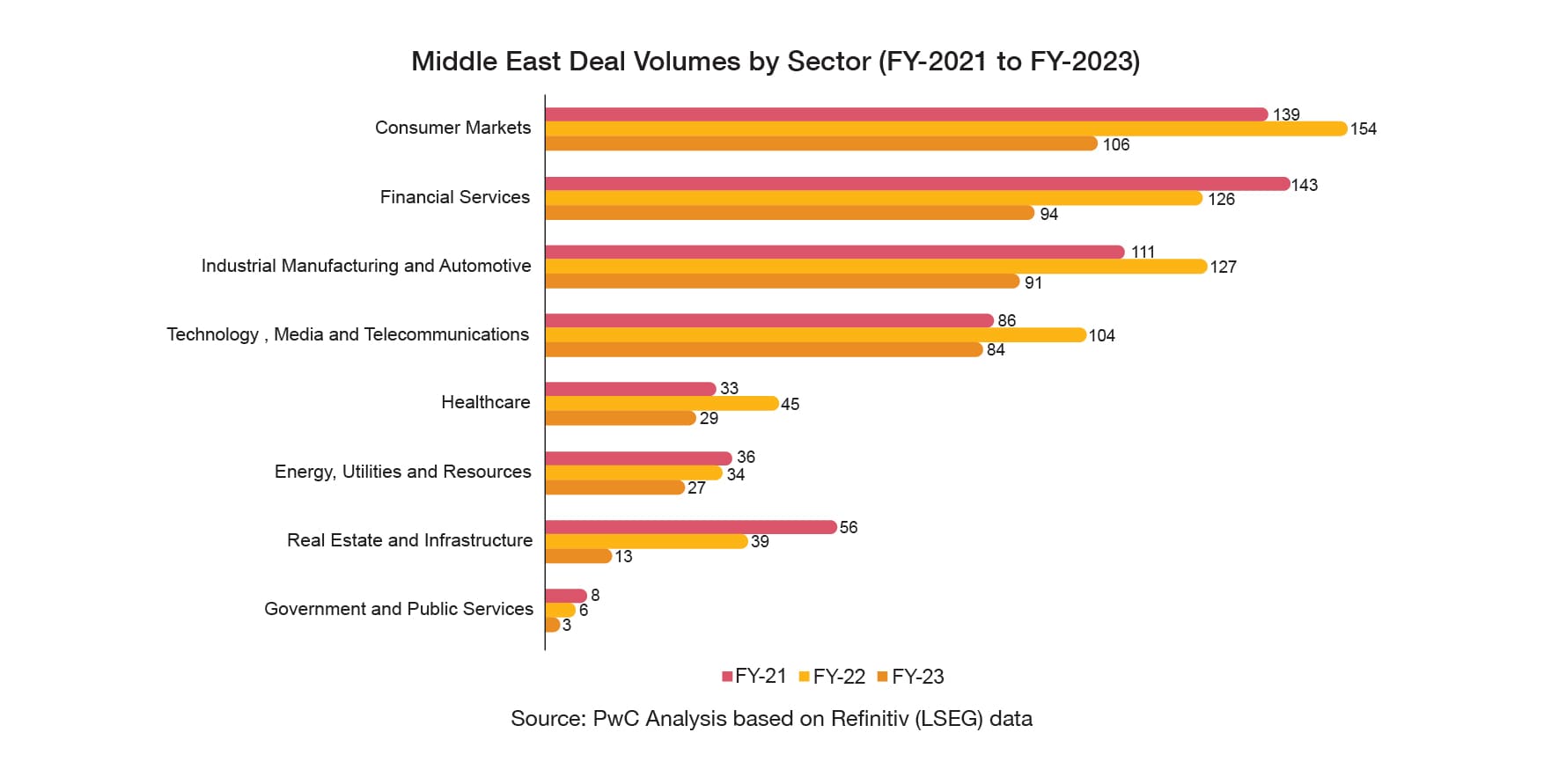

The technology, energy, industrial and financial services sectors were the most active in the UAE, as a result of the country's business-friendly regulations and streamlined legal framework. Additionally, the country's sovereign wealth funds remain active in investing in forward-looking sectors both domestically and internationally.

In the case of Saudi Arabia, a similar observation was made. The country’s commitment to achieving its Vision 2030 objectives, aimed at diversifying the economy away from oil, saw expanded activity in the non-oil private sectors, across the infrastructure, industrial manufacturing, and clean technology industries. Moreover, the enactment of the New Companies Law in January 2023 and the Civil Transactions Law in December 2023, aimed at fostering alignment with Vision 2030 goals and providing greater legal certainty to businesses seeking to operate in the Kingdom, is set to further position it as an appealing investment destination.

Capital markets and IPOs

Amidst a decline in global capital market activities since 2022, the Middle East has continued to thrive, maintaining its momentum amid continuous efforts to attract increased foreign investments to key economies like Saudi Arabia and the UAE. These efforts are reinforced by active pipelines in both the public and private sectors, alongside growing investor recognition of the region's prospects.

The region noted a total of 47 IPOs which generated US$ 10.7bn, according to PwC’s GCC 2023 IPO+ Watch. The energy and utilities sector led the way, with a mega IPO in H1-2023 by UAE’s ADNOC Gas Plc, which raised US$ 2.5bn, and an IPO by Ades Holding Co., which raised US$ 1.2bn in proceeds. Other top IPOs in the region covered a range of sectors, including the consumer market, health and technology sectors.

Number of Primary Listings by country (FY-2021to FY-2023)

Source: PwC analysis based on S&P Capital IQ data

“Deal making has remained resilient in Saudi Arabia, given its keen focus on the national development agenda. We see an expansion of activity in the non-oil private sectors, particularly infrastructure, industrial manufacturing, and clean technology industries. Compared to other territories in the region, KSA has seen less substantial declines in deal volume. IPO activity has also remained strong and we are confident that the region will continue to see a strong pipeline coming through in 2024. We expect the positive momentum to continue as the government privatises state assets and encourages private sector companies to list in a bid to attract investment, push reforms and move away from dependent on fossil fuels.”

Imad Matar

Transaction Services Leader, PwC Middle East

Sector highlights

Five largest Middle East M&A transactions in 2023

Spring into action: Key takeaways for deal makers

Going into 2024, the Middle East is likely to see a robust deal making environment, as governments continue to advance their strategic agendas and diversify their economies. As the global M&A outlook improves and the macroeconomic environment stabilises, we also anticipate a further surge in deals and valuations in the region.

Here’s what deal makers should be thinking about:

Reinventing the business model

Findings from our 27th Annual CEO Survey reveal that Middle East CEOs recognise the urgent need to reinvent their businesses, with 73% of regional leaders anticipating significant changes in how their companies will generate, deliver, and capture value by leveraging through Gen AI in the next three years. Dealmakers need to take proactive steps to assess the risks and opportunities and be prepared to pivot to find new sources of value.

Talent as a key value driver

As business leaders look to leverage emerging technology and transform, generative AI will become more widely deployed. Our 27th Annual CEO Survey findings have also revealed that Middle East CEOs are more optimistic that GenAI will create jobs rather than destroy them. In this new business environment, taking a proactive approach towards skills development and education is going to be crucial to preparing the workforce for future opportunities.

Be agile and adaptable

In a market where adaptability is crucial for competitiveness, businesses need to swiftly transform and generate value. Dealmaking presents a ready means for business leaders in the Middle East to stay abreast of market developments. Gulf SWFs have shown a keen interest in investing in technology and innovation-driven companies, alongside infrastructure and renewable energy sectors. Besides their key priority to propel the domestic economy, contribute to decarbonisation goals, and generate employment, these funds must also exhibit an increasing appetite for risk as they continue to to look into diversified areas of investment and fortify their domestic deal pipeline.

2024 TransAct Middle East

Contact us

Imad Matar

Partner, Transaction Services Leader, PwC Middle East

Tel: +966 (11) 211 0400 (ext 1501)