Executive summary

The UAE is rapidly emerging as a global hub for climate innovation, driven by a recognition among its leaders and entrepreneurs of the urgent need to decarbonise. The country has revised its energy strategy to triple the share of renewables by 2030, with a goal of generating 55% of Abu Dhabi’s electricity from clean sources by 2025.

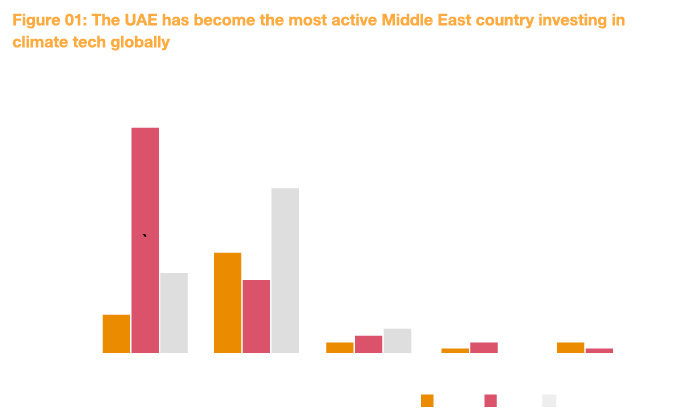

This commitment to climate goals is reflected not only in domestic policies but also in the UAE's growing role as a global leader in climate tech investment from within the region. Findings from PwC Middle East’s latest climate tech report reveal that while global climate tech investment contracted sharply, dropping 29% in the 12 months to September 2024, the UAE increased its climate tech investments globally by 138% between 2023 and 2024, spending US$2.3 billion over this period1.

Within its borders, the UAE is driving innovation through initiatives in renewable energy, sustainability and environmental conservation. Initiatives such as the UAE Climate Tech programme, combined with climate-focused investments from sovereign wealth funds like Mubadala and ADQ, position the country as a leading source of start-up capital and innovation. Meanwhile, hubs like Masdar City’s Catalyst, Hub71 and the Dubai Future District Fund play a pivotal role in supporting climate tech start-ups through funding, mentorship and access to valuable networks.

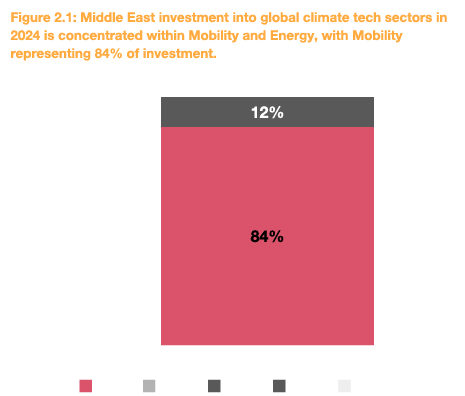

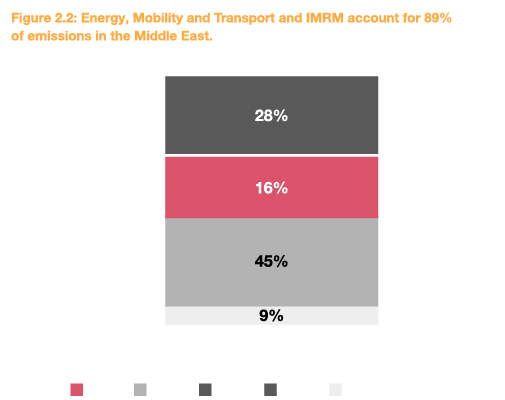

Despite these efforts, greater emphasis is needed on fostering homegrown innovation in climate technologies, integrating climate tech start-ups into domestic supply chains and advancing solutions for high-emission sectors. For example, according to the findings of the 2024 Middle East Climate Tech report, at the regional level, investment in energy by Middle East investors saw a decline from US$22 million in 2023 to US$13 million in 2024. Given that energy accounts for 45% of the Middle East's emissions, these levels are far from sufficient. This disparity suggests a critical underinvestment in one of the region’s most significant sources of emissions. Addressing these gaps is essential to tackling the region’s unique climate challenges, driving innovation and building resilience.

During COP28 in the UAE, Abu Dhabi Sustainability Week (ADSW), in partnership with PwC Middle East, held a roundtable on scaling climate tech innovations, the output of which concluded with the importance of prioritising local investments to ensure greater capital deployment within the region and the need for incentives and policies to develop local climate tech hubs.

Now, 12 months on, we set out the findings of the latest discussions held by key stakeholders in the climate tech ecosystem who are committed to help scale climate tech deployment in the UAE. These discussions took the form of virtual roundtables hosted by the ADSW Virtual Working Group which comprised corporate participants, PwC Middle East, who hosted participants from their Net Zero Future50 initiative2 and the Global Climate Finance Centre (GCFC). They gathered insights from members of accelerator programmes, a multinational energy company and a UAE-based research hub. We would like to thank them for their time and contributions.

This continuing initiative, led by ADSW in collaboration with PwC Middle East and the GCFC, aims to drive growth in this area through targeted roundtables, networking events and pilot projects with selected industry champions, providing actionable pathways to bridge the gaps inhibiting progress, aligning with the UAE's ambition to lead global efforts in sustainability and innovation.

This paper details the output of discussions structured across seven key challenge areas:

01

Complex regulatory frameworks Highlights the need for unified standards, sandboxes and dynamic policy reviews.

02

Financial constraints and restricted research, development and innovation funding Discusses mechanisms such as government-backed loans, financial guarantees, tax incentives and grants for research, development and innovation.

03

Lack of centralised piloting and testing infrastructure Emphasises the need for national testing facilities, regional innovation hubs and effective incubators.

04

Barriers with corporate procurement and integration Explores the misalignment of objectives between large corporations and climate tech start-ups.

05

Limited access to resources, skilled talent and scaling opportunities Addresses the limitations in accessing skilled talent, resources and scaling opportunities, particularly in capital-intensive sectors.

06

Gaps in collaborative innovation Advocates for partnerships between start-ups, corporates, government entities and academia can uplift the UAE climate tech ecosystem.

07

Unlocking market opportunities through offtake agreements Highlights how such agreements enable climate tech start-ups to unlock new market opportunities.

Section 1: Complex regulatory frameworks

The UAE’s regulatory landscape plays a pivotal role in driving sustainability innovation, yet it remains fragmented and inconsistent across the emirates. This decentralisation imposes significant compliance costs, operational inefficiencies and delays in adopting new technologies. As the group vice-president of sustainable design, construction and supply chain at a prominent Abu Dhabi-based real estate development noted, “differing regulations across emirates complicate compliance for innovative climate technologies,” limiting scalability for local start-ups and discouraging international entrants. Additionally, existing regulatory frameworks lack adaptability to rapidly evolving sectors like hydrogen and renewable energy, hindering progress. Addressing these challenges is vital for creating a more streamlined and innovation-supportive regulatory environment, that fosters innovation and accelerates sustainability initiatives.

Ideas for action: Cultivate a regulatory ecosystem for innovation

Global spotlight: Forest Valley, a European climate technology start-up accelerator, offers a sandbox programme tailored to the needs of climate innovators3.

Section 2: Financial constraints and restricted RDI funding

Financial constraints pose significant challenges for start-ups in the UAE’s sustainability sector. As the executive director of strategy and planning at a large water and electricity utilities provider in Abu Dhabi said, “start-ups often fail to demonstrate bankability,” a critical factor in attracting investment.

High capital expenditure (CAPEX) requirements, limited access to affordable financing and insufficient research, development and innovation (RDI) grants hinder growth and scalability. Ammar Alali, Co-founder and President of geothermal power start-up Eden GeoPower, discussed the challenges in integrating his company’s innovative solution into pre-existing cooling systems due to high CAPEX. “We are exploring geothermal energy as a solution for cooling and power generation. While the value proposition is clear and compelling, integrating this technology into existing developments with pre-established cooling systems presents significant challenges. The specialised hardware required for integration is not readily available in the region, driving up CAPEX for development. However, this challenge is not unique to our solution – it's a common hurdle for any new technology or product. We are optimistic that, as we scale up, market dynamics will address these limitations over time.” Bridging this gap is key to nurturing a sustainable and innovative start-up ecosystem in the UAE.

Ideas for action: Address financial barriers

Global spotlight: The US Department of Energy’s Title XVII Innovative Energy Loan Guarantee Programme promises to repay 100% of the principal and interest on private loans (with terms of up to 30 years) for up to 80% of construction costs4.

Section 3: Lack of centralised piloting and testing infrastructure

A lack of centralised infrastructure for testing and validating technologies presents a significant obstacle for sustainability start-ups in the UAE. Fragmented and decentralised resources result in higher costs and delays, particularly in capital-intensive sectors like renewable energy.

This challenge was also highlighted by Michel de Ruiter, Founder of GraphenePioneer. Sharing his experience, he said, “It’s very hard to introduce graphene into concrete because no one wants to test it in critical structures like bridges or load-bearing walls. So, we’re trying to come up with new ideas that avoid these regulatory hurdles, focusing on products that can be more easily implemented into the market. It's about being creative in addressing these challenges. Every product will have aspects that may face regulatory scrutiny, so building confidence through other means is also important.” Addressing these infrastructure limitations is essential for accelerating innovation and the commercialisation of sustainable technologies.

Ideas for action: Build the right infrastructure

Global spotlight: Ülemiste City in Estonia launched Test City, an environment in the Baltic and Nordic region for start-ups to experiment with green transition, health and smart city innovation6.

Section 4: Challenges in corporate procurement and integration

Corporate procurement practices in the UAE often prioritise cost efficiency and risk mitigation, making it difficult for start-ups with innovative technologies to integrate into supply chains. The representative of a utility provider observed that “corporate procurement teams focus on least-cost solutions, sidelining innovative but unproven technologies.” Internal misalignments between sustainability and procurement teams further slow the adoption of climate tech solutions. Solving these challenges will be crucial to improving collaboration and helping start-ups scale their solutions.

Haisam Jamal, Founder and CEO of Distichain, a B2B cross-border trading platform that integrates carbon-offsetting solutions for businesses, highlighted the challenges of finding reliable real-time tools for carbon footprint estimation and offsetting within supply chains. Speaking about carbon calculators, he noted, “There are many, but while there are lots of promises, not all of them deliver. It becomes a process of trial and error – testing and moving on.”

Ideas for action: Integrate into corporate supply chains

Global spotlight: The Caiman Ecological Refuge in Brazil is a public-private partnership focused on conserving wetlands and wildlife, including jaguars7. It involves private investors, conservation groups and local communities. Income from ecotourism funds monitoring, habitat restoration and community development. The refuge's success has attracted private and international funding for climate finance efforts to preserve wetland ecosystems and biodiversity.

Section 5: Limited access to resources, skilled talent and scaling opportunities

Climate tech start-ups frequently lack the resources needed to scale their operations, especially in sectors requiring significant capital investment, such as hydrogen technology, battery storage and green building materials. Lack of talent, high upfront costs and limited infrastructure exacerbate these challenges, making it difficult for start-ups to transition from pilot projects to commercialisation. Mohammed Al-Shaker, Founder and Group CEO of Ard Group, a provider of climate security solutions to businesses and consumers, cited the difficulty in finding skilled data scientists and experts who can work with their decision-making tools to help companies become more climate-secure, particularly those impacted by climate consequences in their operations.

Ideas for action: Leverage PPPs to bridge the gaps

Global spotlight: Google, Microsoft and Nucor, a US-based sustainable steelmaker, are collaborating to aggregate demand to scale the adoption of advanced clean electricity technologies8.

Section 6: Gaps in collaborative innovation

Effective collaboration between start-ups, corporates and government entities is essential for fostering innovation, yet remains insufficiently structured in the UAE. This lack of collaboration often leads to missed opportunities for co-developing solutions and delays in the deployment of climate technologies. Furthermore, start-ups often struggle to engage with large corporations, which operate at a much slower pace. As noted during the PwC Middle East Net Zero Future50 virtual roundtable, “Corporations are like large ships, while start-ups are like motorcycles; bridging this speed gap is critical for fostering partnerships.”

Ideas for action: Collaborate to advance innovation

Global spotlight: Masdar City partnered with Alesca Technologies, a developer of agri-tech solutions, to launch an indoor vertical farm that uses automated equipment and AI software to grow multiple varieties of leafy greens, lettuces and herbs while educating visitors about vertical farming as a means of addressing food security challenges9.

Section 7: Unlocking market opportunities through offtake agreements

The lack of structured offtake agreements is a significant barrier to scaling climate tech solutions in the UAE. In renewable energy, for example, an offtake agreement might involve a company agreeing to purchase a set amount of clean energy from a solar or wind project, providing the developer with financial certainty to scale operations. Start-ups often struggle to secure long-term contracts, which are essential for demonstrating market viability and attracting investment – and the absence of such agreements in the UAE can hinder the adoption and scaling of climate tech solutions because producers may struggle to attract investment or sustain operations without guaranteed buyers. Participants from SRTI Park indicated that structured agreements with corporates fuel commercialisation and attract greater investment, while a representative from Startup Genome, an innovation ecosystem development organisation, highlighted the benefits of new, flexible due diligence models for accelerating industry offtake.

Ideas for action: Drive market demand and scale opportunities

Global spotlight: Enterprise software provider Workday has signed multiple offtake agreements with carbon projects, including forest preservation in the Amazon and carbon removal via biochar in Namibia10.

What’s next?

The path ahead involves a concerted effort from all stakeholders – climate tech start-ups, investors, large UAE-based corporations and government officials – to address the challenges and harness the opportunities identified in this white paper. As Michel de Ruiter of GraphenePioneer said, “You shake your head, stumble, dust off your knees and go at it again. The more opportunities we have and the more progress we see, the more we’re motivated to keep going.”

To build on the momentum:

- Climate tech start-ups should focus on innovation and agility. Leveraging pilot projects, engaging in collaborations and seeking mentorship can overcome initial hurdles. Start-ups must showcase their viability to attract investment.

- Investors and VC funds play a crucial role by providing capital and strategic guidance, helping start-ups navigate market complexities and scale solutions. They should stay attuned to emerging technologies and regulatory changes.

- UAE corporations must align procurement practices with sustainability objectives. Reforming policies to prioritise long-term value and collaborating with start-ups are key steps.

- Government officials should create and maintain an enabling environment for climate tech innovation. This includes expanding regulatory sandboxes, unifying standards and providing financial incentives. Dynamic policy reviews and fostering public-private partnerships are crucial for sustaining momentum toward a sustainable future.

Collectively, these efforts will ensure that the UAE remains at the forefront of climate tech innovation, driving national sustainability goals while setting an inspiring example for the rest of the world.

This report was produced as part of a collaboration between Abu Dhabi Sustainability Week, PwC Middle East and the Global Climate Finance Centre.

This thought leadership paper has been produced as part of a collaboration between Abu Dhabi Sustainability Week, PwC Middle East and the Global Climate Finance Centre. Together, we build our foresight on solid analytics combined with deep and diverse industry expertise. This gives us rich and surprising insights and a keen eye for new opportunities. We believe in sharing our insight and foresight so that organizations can benefit from them.

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 149 countries with nearly 370,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

Established in the Middle East for 40 years, PwC has 30 offices across 12 countries in the region with around 12,000 people. (www.pwc.com/me).

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

About Abu Dhabi Sustainability Week

Abu Dhabi Sustainability Week (ADSW) is a global platform supported by the UAE and its clean energy leader, Masdar, to address the world’s most pressing sustainability challenges through crucial conversations accelerating responsible development and fostering inclusive economic, social and environmental progress.

For more than 15 years, ADSW has convened decision-makers from governments, the private sector and civil society to advance the global sustainability agenda through dialogue, cross-sector collaboration and impactful solutions. Throughout the year, ADSW conversations and initiatives facilitate the knowledge sharing, innovation and collective action that will ensure a sustainable world for future generations.

About Global Climate Finance Centre

Launched at COP28, the Global Climate Finance Centre (GCFC) is based in Abu Dhabi Global Market (ADGM), the UAE’s international financial centre. Established in partnership with leading global institutions, GCFC aims to position the UAE as a premier hub for climate investment. The Centre drives accountability for COP28 initiatives, mobilizing capital and advancing climate technologies to support green and transition projects in emerging markets. Through partnerships and innovative de-risking strategies, robust finance mechanisms and high-integrity carbon markets, GCFC delivers scalable solutions to global climate challenges.

As the host to the secretariats of Innovate for ClimateTech (I4C) and the Africa Green Investment Initiative (AGII), GCFC connects startups, corporates, and governments to drive innovation, streamline regulatory frameworks, and create scalable solutions. By championing de-risking strategies and facilitating access to capital, GCFC empowers climate-tech startups and accelerates clean energy deployment, aligning with the UAE’s climate ambitions and global leadership in sustainability.