Economic performance and outlook

OPEC+ shifts strategy

After years of deeper and longer cuts, OPEC+ has now increased production, implementing previously planned - though delayed - output hikes. In April, eight of its member countries increased their production allocations for the first time since September 2022.1,2

Three days into the first month of tapering, and just a day after oil prices dropped in response to President Trump’s Liberation Day tariff announcement, OPEC+ announced an acceleration of its tapering schedule. The revision applied three months of planned tapering increases in May, raising Saudi Arabia’s required output to 9.20 million barrels per day (b/d), up from the previously planned 9.09m. At the subsequent OPEC+ monthly meeting, it was decided to accelerate by a further three months in June, lifting Saudi output to 9.37m b/d, a level which had previously been scheduled for October.

Several explanations were provided for the shift in strategy. OPEC+ justified the move by citing “healthy market fundamentals, as reflected in low oil inventories”.3 Energy analysts, however, interpreted the acceleration as a signal to overproducers, particularly Kazakhstan, which has been producing at record levels due to an expansion in its Tengiz field. It had not adhered to its current quota, nor did it implement its compensation plan.4 Other possible motivations behind the decision, include responding to President Trump’s request for lower prices and attempting to discourage production growth in non-OPEC+ states, particularly the United States.

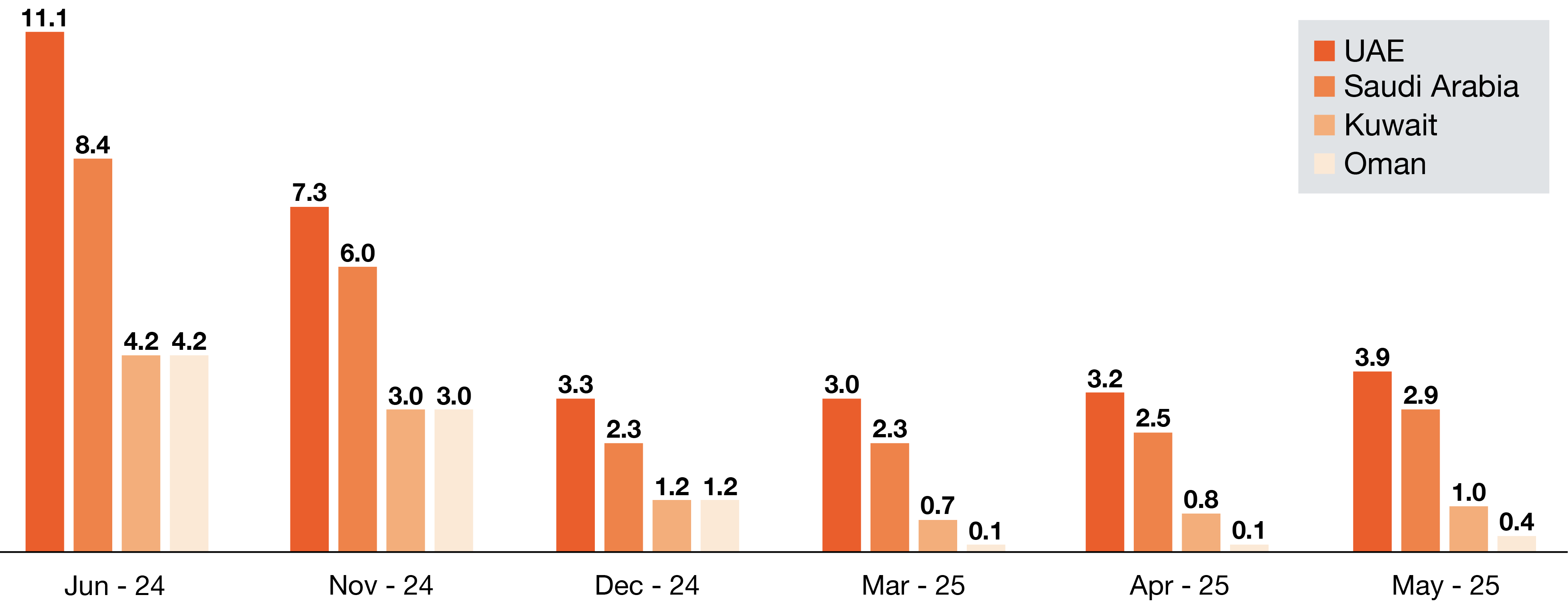

The production increases announced so far remain relatively modest. The plan – as of the May meeting – is that the UAE’s average output in 2025 would be just 3.9% higher than its pre-tapering baseline, in line with its 2024 average production. This marks an increase from the 3.0% growth targeted in the March plan and is slightly higher than the December projection. However, it remains below the 11.1% increase outlined in the original June 2024 tapering schedule. Saudi Arabia’s average production for 2025 is scheduled to be 2.9% above baseline levels. Kuwait and Oman have been allocated minimal production growth on average. There have been suggestions of further acceleration, with some OPEC+ sources indicating that the entire 2.2m b/d in voluntary cuts could potentially be reversed as early as November.5

OPEC+’s evolving allocations for 2025 oil production (% change vs September 2024 levels)

Source: OPEC

GDP growth should pick up in 2025

For most GCC states, the evolving OPEC+ tapering plans are playing a key role in shaping GDP growth projections. These changes also have a moderate impact on projected fiscal revenue, as lower prices – resulting from increased supply - partially or wholly offset the gains from increased sales volumes. The International Monetary Fund (IMF) has projected that the GCC’s oil sector will grow by 1.7% in 2025, following a -2.8% contraction in 2024 plan (see data and projections table section). However, this forecast was made prior to the accelerated tapering, which is now expected to boost oil GDP growth by an additional 0.5 percentage points under the current plan.

Non-oil GDP ended 2024 on a strong note across the GCC, with growth in Q4 ranging from 4.0% year-on-year in Kuwait to 7.1% in Abu Dhabi. In Saudi Arabia, Q1 data shows a slight slowdown - from 4.9% in Q4 to 4.0% - which still indicates solid momentum, while the UAE’s non-oil sector continues to show resilience, supported by strong Purchasing Managers Index (PMI) readings. The IMF projects 3.4% non-oil growth for the GCC in 2025 – a modest dip from 3.8% in 2024.6 While lower oil prices could eventually lead to spending cuts impacting non-oil activities in the region, no major cuts have been reported yet.

With robust non-oil growth and rising oil production, GDP growth in the GCC is expected to reach 3.1% in 2026 according to the IMF, the highest since 2022 and nearly triple the average growth recorded in 2023-24.

Fiscal challenges

The region is facing renewed fiscal pressure due to low oil prices and continued high levels of government spending, which will potentially result in the GCC’s weakest fiscal performance since 2020. In December 2024, Saudi Arabia anticipated a budget deficit of -2.3% of GDP for 20257, but the IMF’s April update projects it will be more than double. Larger deficits are predicted for Kuwait (-7.9%)8 and Bahrain (-10.4%), and while Oman and Qatar are projected to achieve fiscal balances, both could slip into deficit as well if prices remain low.9

For most GCC countries, financing these deficits is unlikely to pose significant challenges. In Saudi Arabia, the 2025 budget had already accounted for a deficit, and the Kingdom issued a record US$31 billion in debt in Q1 - amid rising regional borrowing costs. Meanwhile, Kuwait passed a debt law after an eight-year hiatus,10 reopening access to capital markets. Bahrain, although more fiscally constrained, successfully issued US$2.5bn in bonds and sukuk in April.11 However, if low oil prices persist, governments may need to consider fiscal consolidation measures, such as reducing subsidies, raising taxes and cutting expenditures. The appropriate combination of these measures will vary depending on the local context of each state.

Fiscal breakeven oil prices (2025)

Sources: IMF WEO

References

[1] OPEC Press release, 3 April 2025 ‘Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman reaffirm commitment to market stability on healthier oil market outlook and adjust production upward’

[2] Plans to taper the 2.2m b/d in voluntary cuts - introduced in January 2024 - were announced in June 2024. It was postponed three times resulting in a six months' delay. Only 0.14m b/d was restored, partly offset by extra cuts announced in March to compensate for past overproduction, primarily from Iraq and Kazakhstan, with minor adjustments for each of the GCC states – OPEC 20 March 2025

[3] OPEC, Press release 3 May 2025

[4] Bloomberg.com, 3 May 2025 ‘Saudis double down on seismic OPEC shift to sink oil prices’

[5] Reuters.com, 4 May ‘OPEC+ further speed-up-oil-output-hikes-three-sources-say’

[6] IMF Publications, 24 April 2025 ‘Regional economic outlook Middle East Central Asia April-2025’

[7] IMF ‘Press Release and Staff Report, Saudi Arabia: 2024 Article IV Consultation

[8] IMF, 6 December 2024 ‘IMF Executive Board Concludes 2024 Article IV Consultation with Kuwait’

[9] IMF, April 2025 ‘Regional Economic Outlook Middle East and Central Asia’

[10] Kuwait Times, 26 May 2025 ‘Kuwait sets KD 30bn debt cap with 50 year borrowing plan’

[11] Zawaya, 1 May 2025 ‘Bahrain prices $1.74 bln sukuk and $750mln bond’

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100

Carlos Garcia

Partner, Middle East Customs & International Trade, PwC Middle East

Tel: +971 56 682 0642