Foreword

For over a decade, the PwC Capital Projects and Infrastructure Survey has provided a vital ‘pulse check’ on investment and execution of capital projects across the Middle East. It brings together data and analysis from across the sector, with perspectives from project sponsors, developers, functional and technical experts, contractors, financiers and asset managers, in order to understand sector opportunities, challenges and underlying sentiment from those closest to it.

The message from this unique dataset is clear: growth has returned, and so have the challenges of growth.

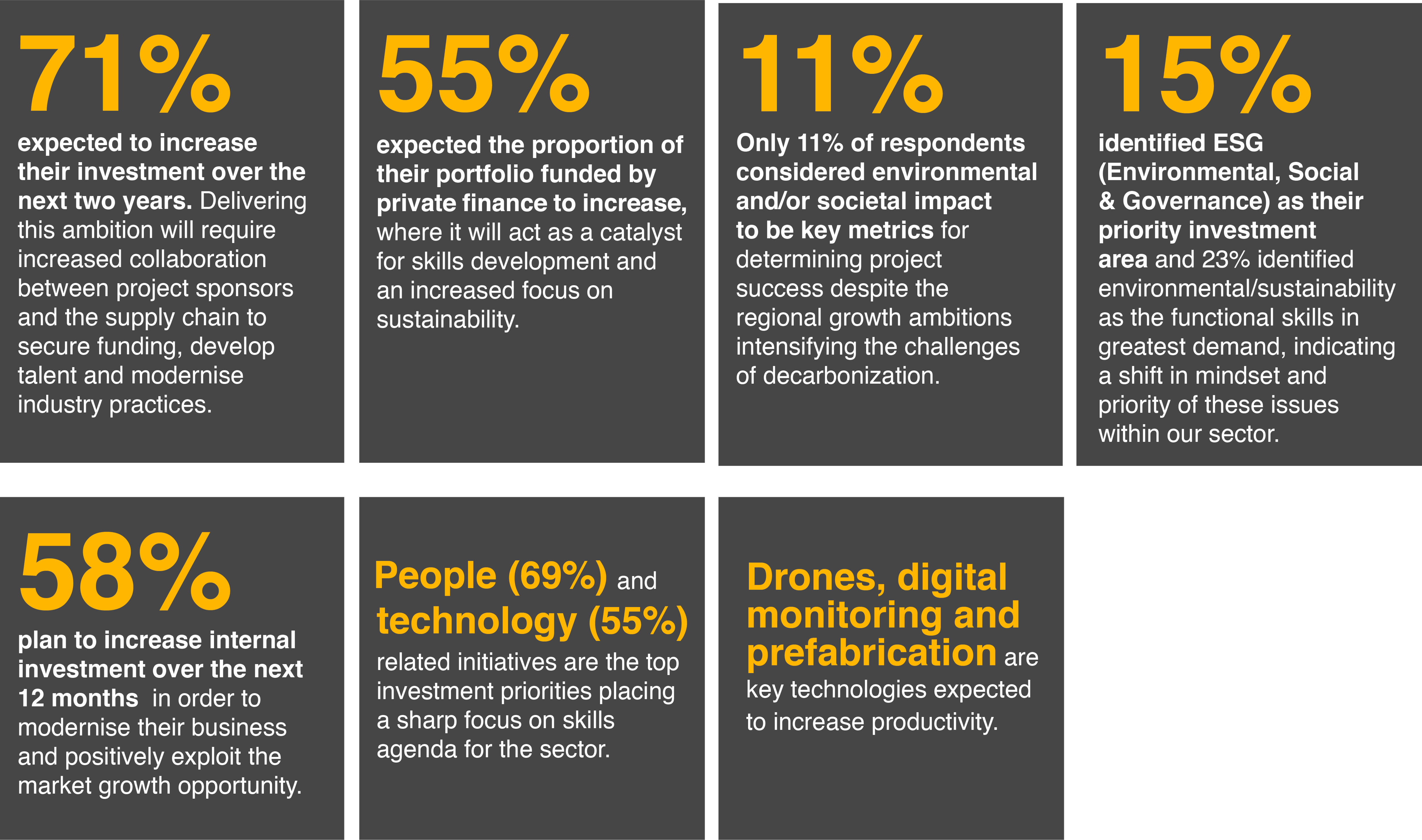

The survey reveals that in order to exploit the growth potential within the sector and achieve greater efficiencies, those operating within it must modernise by embracing digitisation, localisation, privatisation and decarbonisation.

Key Findings

Our previous survey in 2020 marked the crisis brought about by the health crisis and the sudden pullback of public funding that accompanied it. In 2021, the capital projects and infrastructure sector in the Middle East region saw activity rebound to near pre- health crisis levels.

"As every construction professional knows, the time to repair the roof is when the sun is shining. And the sun is shining right now: thanks to historically high Middle East government revenues from oil and unprecedented levels of investment confidence among policymakers, there has never been a time like the present for the construction sector. The project pipeline is huge, and the projects themselves are more ambitious and more transformative than ever before."

Maarten Wolfs

Deals Capital Projects & Infrastructure Leader

PwC Middle East

Situation Analysis

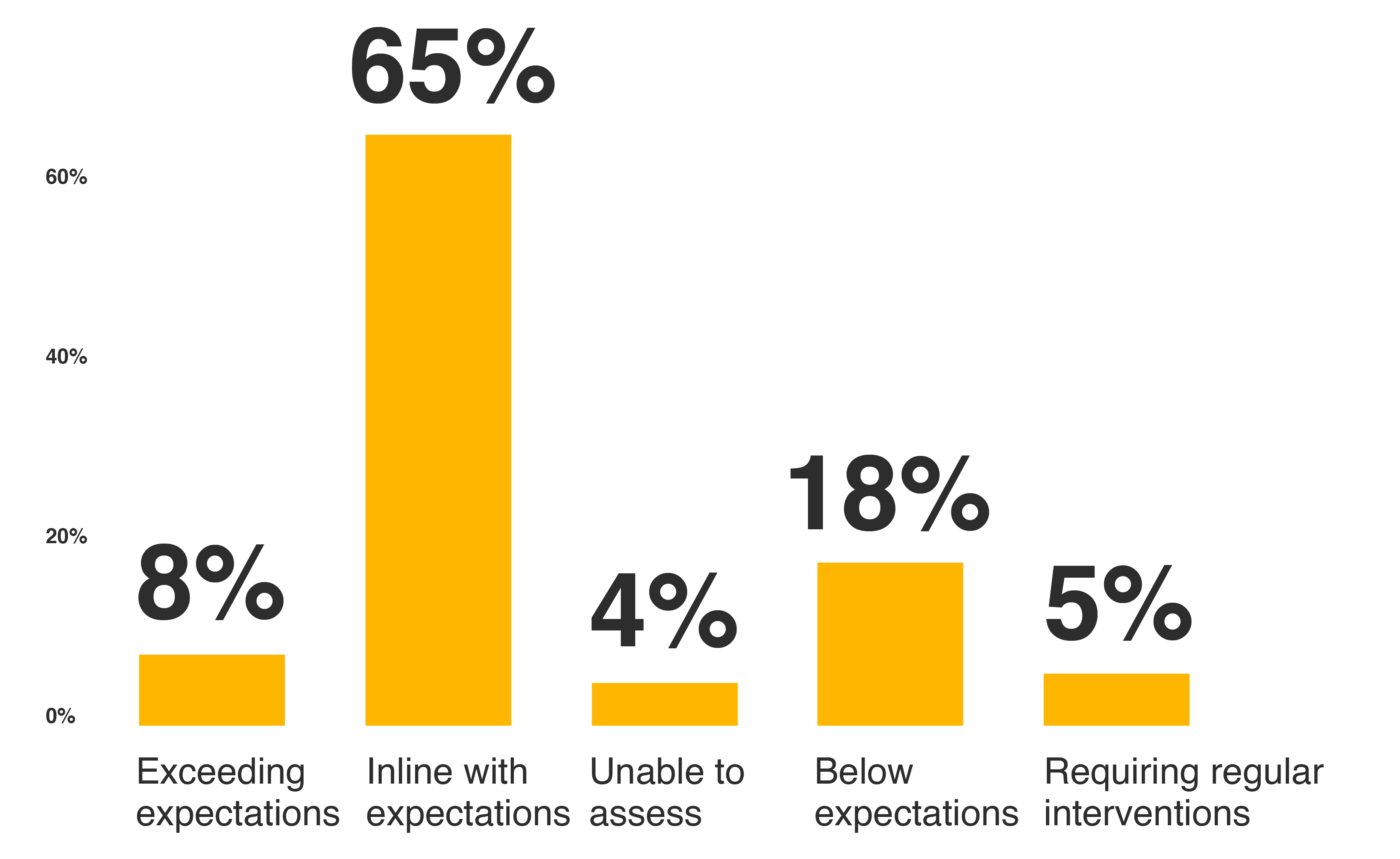

Demand and delivery are strong

These results are markedly better than those of two years ago. In 2020, our survey reported that more than half of organisations had experienced a major delay in projects during the previous year, while 38% of organisations had seen projects run over budget in the preceding 12 months.

There are cracks beneath the surface

More than a third of respondents (43%) cited the conversion of strategy into implementation as the most significant internal obstacle affecting the ‘health’ of their capital investment portfolio, programme or projects. We interpret this response as a measure of the difficulties that companies are experiencing in embedding new technologies, ideas and future visions. It is no coincidence that 37% of respondents also included ‘risk and change management’ and 34% cited ‘improving the technologies and tools available to their workforce’ when asked about internal obstacles to improving the health of their portfolios.

These three challenges of strategic implementation, technology and change management are inextricably linked. They point to an industry that is trying to respond to increasing client demands, new technology and digitisation, demand for new skills and workplace practices, and fast-evolving environmental and societal obligations.

Cash flow and financing are high on the agenda

Significantly, 34% of our respondents identified that the financial performance of their portfolio was one of the key internal challenges affecting their business health and growth. The capital-intensive nature of this sector makes it susceptible to global and local economic shifts specifically in relation to access to capital and access to the required supply chain.

It is likely that there are a number of contributing factors in this area, including the rapid increase in overall project initiation placing a strain on the capital available. However, our survey shows that working capital remains the most acute area of challenge, with 47% of respondents citing delayed payments from clients as their top financing issue.

Companies are ready for change

Our 2022 survey shows that companies are ready for change, hungry for modernisation, and poised to invest.

Companies that participated in our survey recognised that they need a step-change in skills and organisational capacity if they are to configure their business for the demands of this Giga-project era. The top three areas of urgency they identified were in hiring and retaining high-skill employees (48%), developing accurate cost estimates and forecasts for their projects (47%), and creating suitable governance and risk management processes (37%).

Change is coming: Together we deliver

Our 2022 survey captures the sector optimism that has been driven by a surge in capital investment following the global health crisis. The investment uptick has been region-wide but catalysed by Saudi Arabia, which has ramped up its Public Investment Fund Giga-projects programme. In particular, the sheer scale of the ambition in Saudi Arabia, when quantified as investment dollars, will have to be delivered as a mix of domestic, Foreign Direct Investment (FDI) and public-private partnership financing structures. This momentum is expected to continue over the next few years as KSA pursues its Vision 2030 national transformation programme, and other regional governments pursue their own modernisation and transformation agendas. Infrastructure investment is a key part of the overall transformation of society in the region.

However, it was also clear from our survey that in order to exploit the growth potential within the Middle East capital projects and infrastructure sector, those operating within it must respond positively to the market’s dynamic of change.

This is the era of the Giga-project, and these developments are bringing investment and an unprecedented project pipeline to the sector. But such projects are big enough and complex enough to demand new skills and capabilities. These capabilities, in turn, demand the adoption of new technologies and new sources of capital.

There is only one viable route to wholesale technology and skill transformation, and that is through collaboration between clients, advisers, financiers and stakeholders throughout the supply chain. Giga-projects bring challenges that no one organisation has the skills and abilities to confront alone. Companies will need to seek out collective wisdom, insight and the innovation of the entire value chain.

For the regional construction sector, these may be unfamiliar ways of working. But they will be necessary. Governments, public institutions and private sector companies- both local and international- have a stake in the built future. And they will successfully build it together.

Contact us

Maarten Wolfs

Capital Projects and Infrastructure Leader, PwC Middle East

Tel: +971 4 304 3100

Dr. Martin Berlin

Real Estate, Hospitality & Leisure Leader, Deals, PwC Middle East

Tel: 971 4 304 3182