Jordan is a talent powerhouse with a strategic geographic location that connects continents and markets. Its strong bilateral relations and free trade agreements provide businesses with access to a diverse and expansive global customer base. Amidst a complex geopolitical landscape, Jordanian CEOs are optimistic about growth and are focused on reinvention and the adoption of emerging technologies, forging new trade partnerships, prioritising investments in high-potential sectors such as technology, healthcare, and tourism, and accelerating the digitisation across sectors to strengthen the national economy.

28th CEO Survey: Jordan findings

Listen to the audio version of this content

Despite geopolitical tensions in the region, Jordan’s political stability and economic reforms have enabled it to remain resilient. The country has shown remarkable strength amidst challenges, with its economy supported by a well-educated population, strategic location, world-heritage tourism sites, and a reputation for stability. According to the World Bank, Jordan has maintained a steady average growth rate of 2.5% over the past decade.

Businesses in Jordan have demonstrated adaptability, with certain sectors, particularly tourism, showing significant recovery with increased visitor numbers.1 Economic experts project Jordan’s growth rate to range between 2.5% and 3% in 2025, supported by an improved business environment and rising investments.2

The country’s emphasis on education and its growing tech-savvy young population are positioning it as a potential hub for innovation in the region. But the confidence of Jordan’s CEOs is somewhat tempered by the threat posed by geopolitical unrest.

Michael Orfaly

Jordan Country Senior Partner, PwC Middle East

The need for reinvention is urgent and stronger than ever

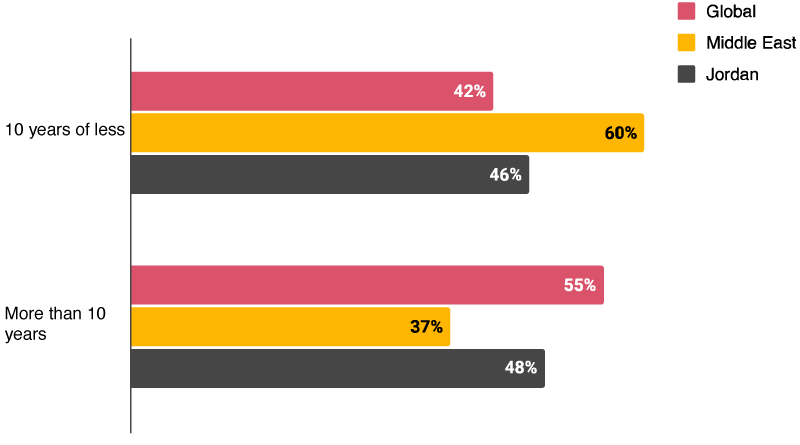

Amid evolving geopolitical tensions in the Middle East, Jordan’s business leaders understand the urgent need to reinvent their business. Nearly half (46%) believe they will need to adapt their businesses in 10 years or less to remain viable, higher than 42% of their counterparts globally.

Q. If your company continues running on its current path, for how long do you think your business will be economically viable?

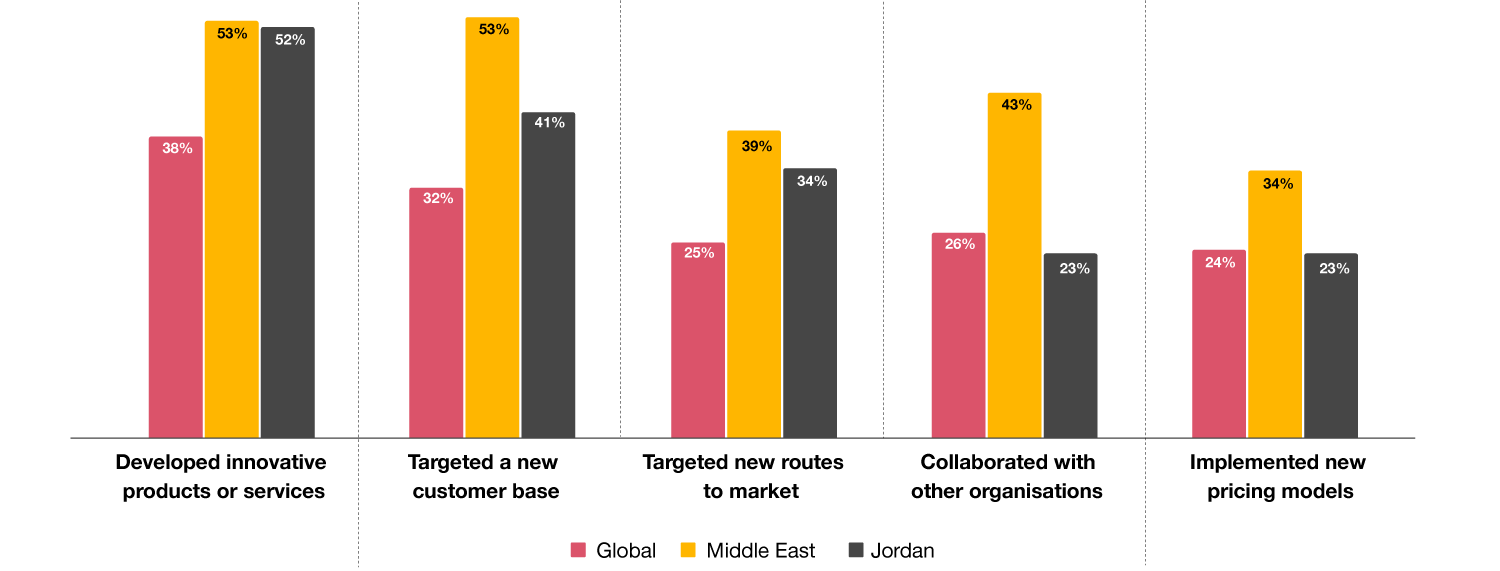

Over the past five years, CEOs in Jordan have taken a proactive approach to driving value by focusing on innovation, market expansion, and diversification. 52% have developed new products and services (compared to 38% globally), 41% have targeted a new customer base (compared to 32% globally) and 34% have targeted new routes to market (compared to 25% globally). This underlines Jordan CEOs’ resilience and forward-thinking strategies, enabling businesses to navigate challenges and capture opportunities.

Q. To what extent has your company taken the following actions in the last five years? (Sum of ‘large’ & ‘very large’ extent)

Reinventing business models with AI

Businesses in Jordan are keen to leverage big data for a deeper understanding of the market, elevate customer experience, and make decisions based on accurate information. A study by the Information and Communications Technology Association of Jordan, revealed that 42% of companies in the country are interested in integrating data analysis tools and techniques into their products, while 63% incorporating AI into their products and services.3

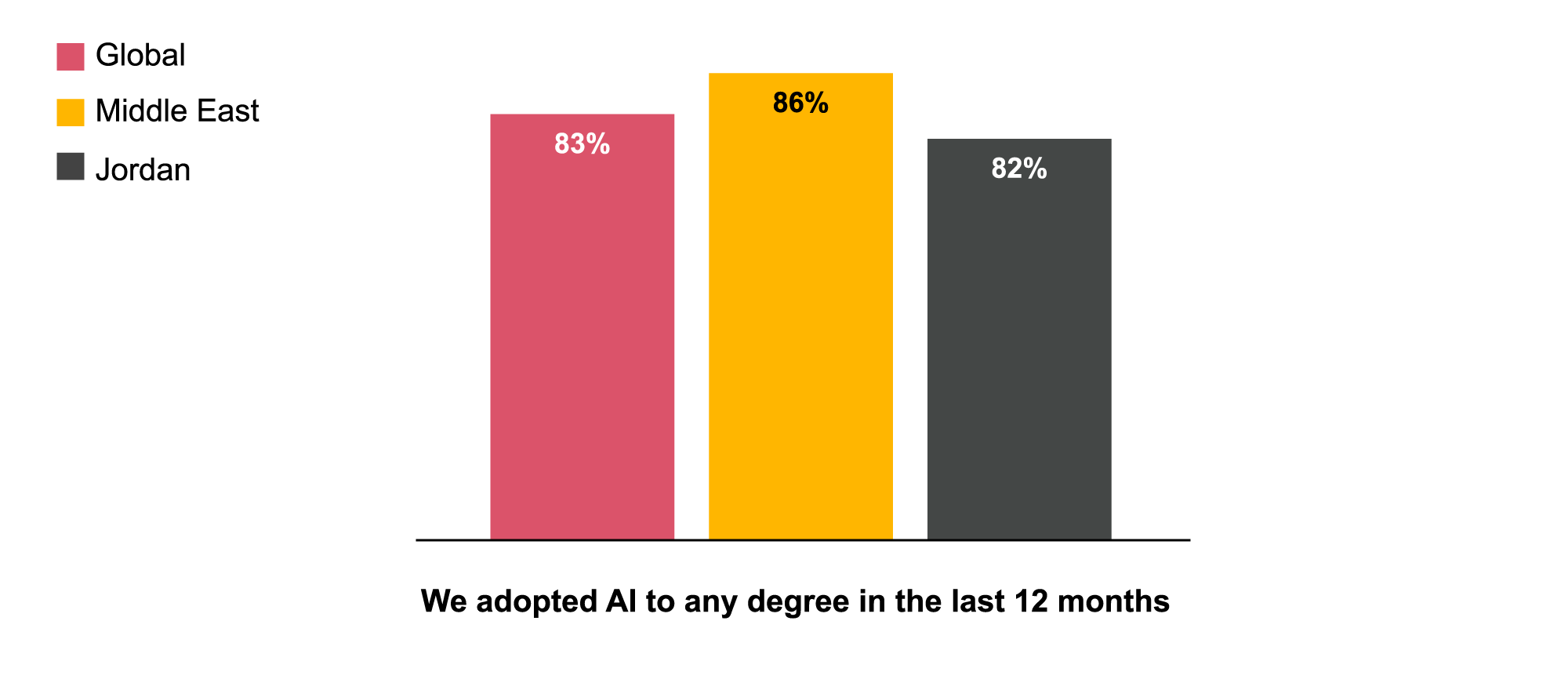

The emergence of GenAI, therefore, presents powerful new opportunities, with 82% of CEOs in Jordan adopting the technology in the last 12 months.

Q. Did your company adopt generative AI to any degree in the last 12 months?

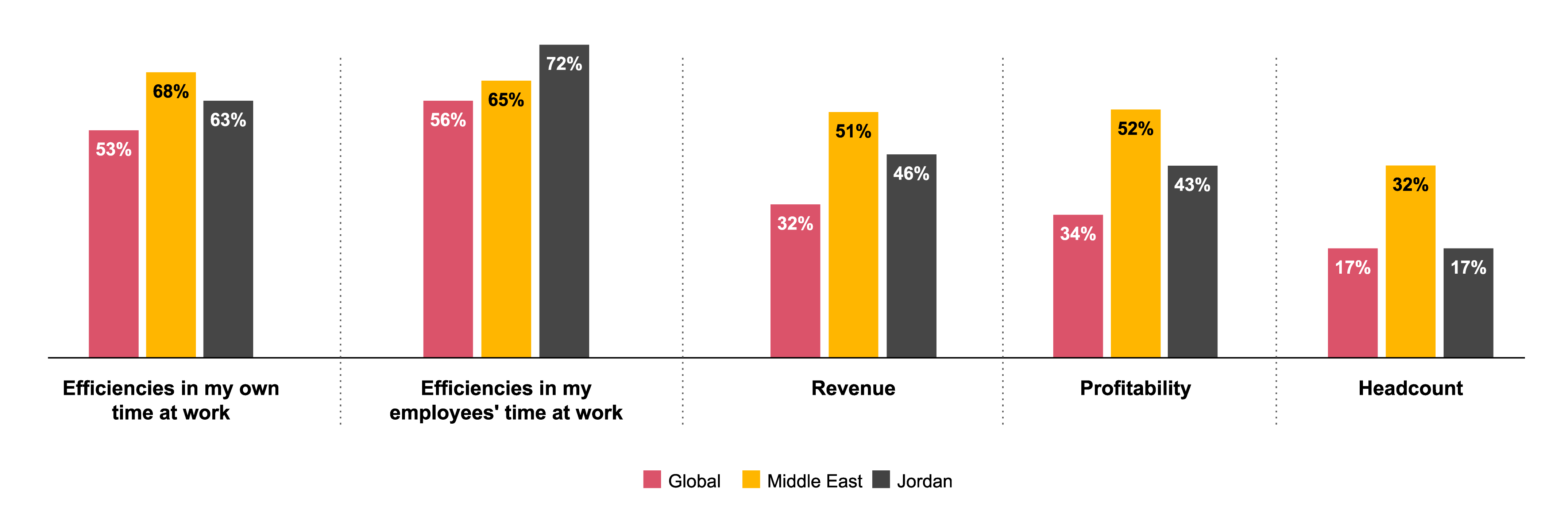

CEOs are already reaping significant benefits from the implementation of GenAI in the workplace. In the past 12 months, nearly three quarters have reported that the technology has improved employee efficiency, while 63% say it has optimised their own time at work. Moreover, 46% of business leaders highlighted increased revenue during the same period as a direct result of GenAI adoption.

In Jordan, nearly 20% of CEOs also indicated that integrating GenAI over the last year has led to increased headcount, reflecting the technology's role not only in driving operational efficiencies but also in creating opportunities for workforce expansion. These findings underscore the transformative impact of GenAI in enhancing productivity and contributing to both growth and job creation.

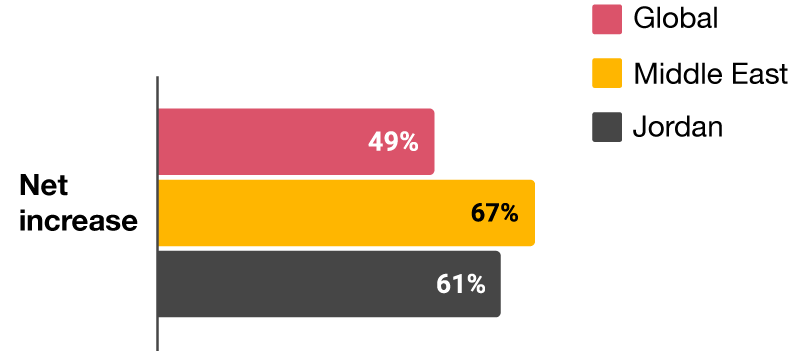

Q. To what extent did generative AI increase or decrease the following in your company in the last 12 months? (Net increase)

In the next 12 months, 61% of CEOs in Jordan believe that GenAI will drive profitability, significantly outpacing the global average of 49%. This optimism reflects the proactive adoption of AI technologies in Jordan as a competitive differentiator.

Q. To what extent will generative AI increase or decrease the profitability of your company in the next 12 months?

Furthermore, 82% of CEOs in the country express high levels of trust in embedding AI (including GenAI) into their key processes, compared to just 67% globally. This indicates that business leaders are more confident in leveraging GenAI's transformative potential to enhance operational efficiency and generate tangible business outcomes.

To accelerate adoption, in the next three years, more than six out of 10 business leaders in Jordan expect that AI, including GenAI, will be integrated into their technology platforms and half expect the technology to be integrated into business processes and workflows.

A growing interest in climate-friendly investments

Jordan’s CEOs see sustainability and environmental initiatives as a major driver of business reinvention in the coming years. 73% have initiated climate-friendly investment in the past five years and this is likely to increase as the national Green Jordan plan, which aims to encourage sustainable practices as a pillar of future economic growth, develops4.

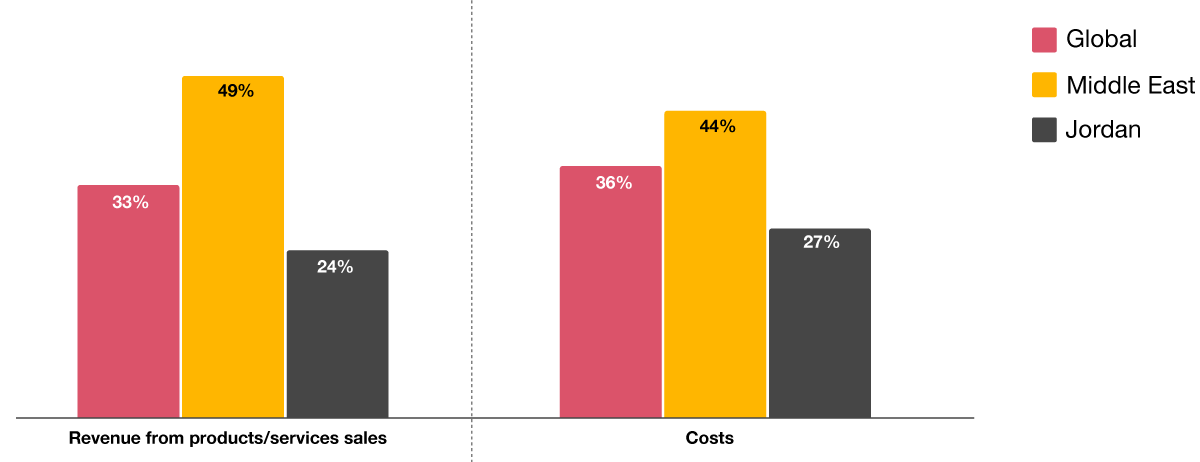

Q. To what extent have climate-friendly investments initiated by your company in the last five years caused increases or decreases in the following? (Net increase)

Sustainability is an important pillar of Jordan’s Economic Modernisation Vision5 and is expected to help create ‘a new phase of economic growth’ by fuelling investments in greener projects.

A quarter of Jordan’s CEOs say that climate-friendly investments have already increased revenue for their organisation in the past five years. However, despite this 36% say that they are not willing to accept a lower rate of return for climate-friendly investments.

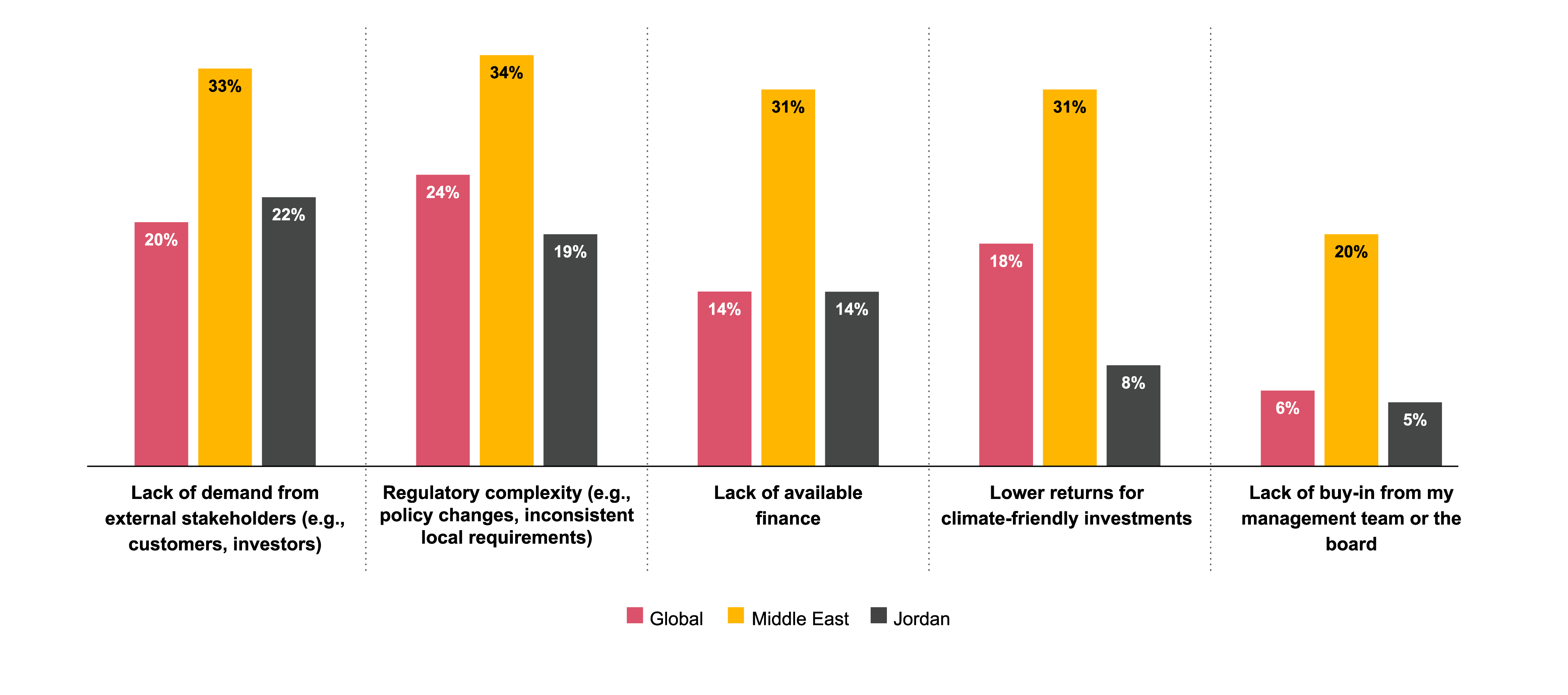

Compared to their counterparts across the Middle East, business leaders in Jordan are less likely to cite regulatory complexity (19% vs. 34%), lack of available finance (14% vs. 31%), or lower returns on climate-friendly investments (8% vs. 31%) as key barriers to decarbonising their business models.

This suggests that Jordanian businesses may have a relatively more supportive regulatory and financial environment for sustainability initiatives. But while these lower figures indicate fewer perceived barriers, they also highlight a need in tackling the climate crisis.

Q. To what extent, if at all, have the following factors inhibited your company’s ability to initiate climate-friendly investments in the last 12 months?

Economic confidence tempered by regional challenges

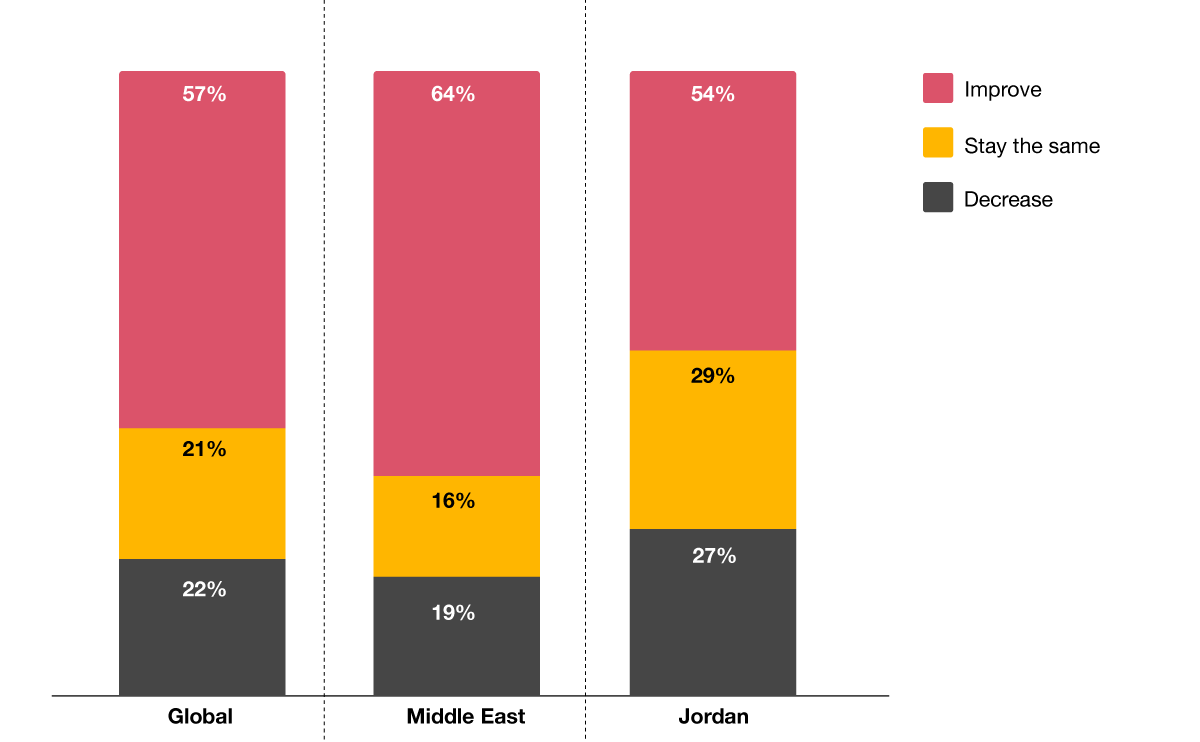

Despite Middle East CEOs indicating robust confidence in regional economic growth, driven primarily by key GCC nations, CEOs in Jordan have a more tempered outlook with the economic aftershocks of the war in Gaza felt more deeply in Jordan. So, despite the World Bank describing Jordan’s economy as ‘resilient’ in 20246, only 45% of CEOs in Jordan express confidence in their territory's economic growth, significantly lower than 64% of CEOs in the Middle East who feel the same about the regional economic growth.

Q. How do you believe economic growth (i.e., gross domestic product) will change, if at all, over the next 12 months in your territory?

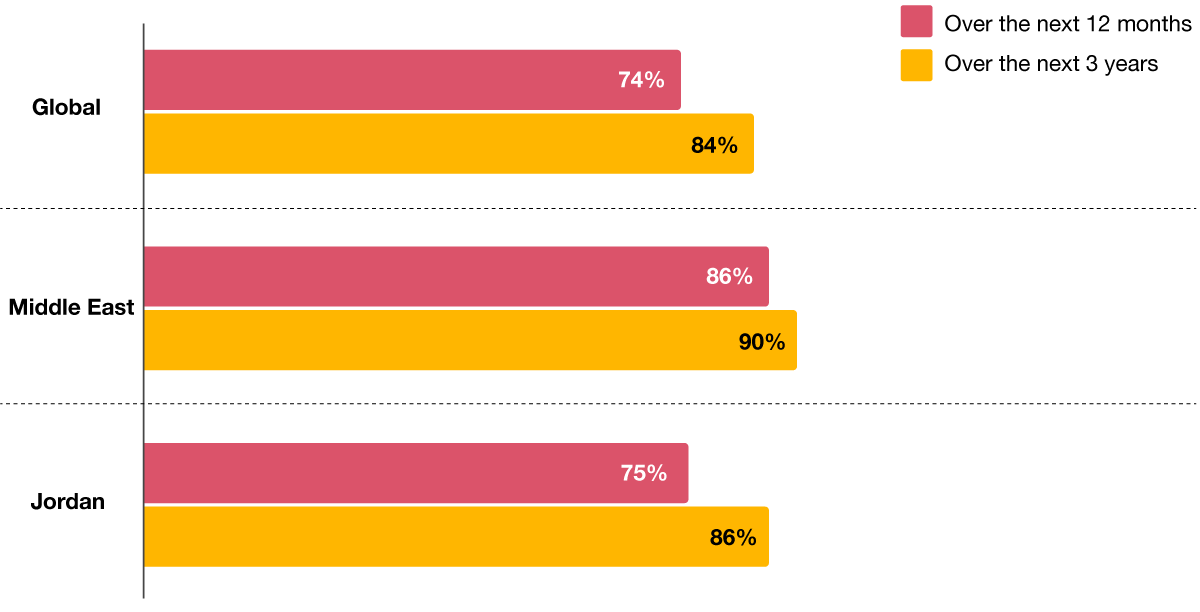

This caution about growth is also reflected in CEOs’ views about their own companies’ revenue growth. 75% of business leaders feel moderate to extremely confident in their companies' revenue growth over the next 12 months.

Q. How confident are you about your company’s prospects for revenue growth over the next 12 months? (Sum of ‘moderately’, ‘very’ and ‘extremely’ confident)

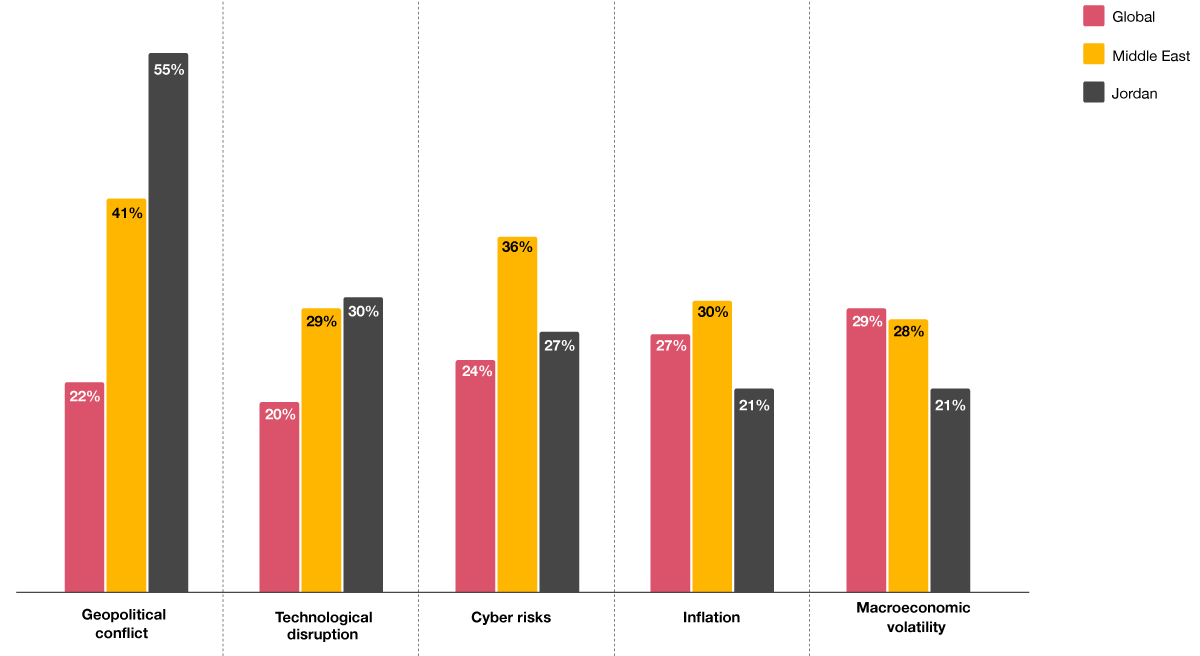

Geopolitical conflict remains a significant concern for business leaders in Jordan, with 55% of CEOs indicating that their companies will be ‘highly’ or ‘extremely’ exposed to this risk in the coming year.

In addition to geopolitical risks, CEOs identify technological disruptions (30%), cyber risks (27%), and macroeconomic volatility (21%) as the top threats to their day-to-day operations. These findings highlight the multifaceted challenges Jordanian businesses face, requiring leaders to balance immediate crisis management with long-term strategic planning.

Q. How exposed do you believe your company will be to the following key threats in the next 12 months? (NET: Highly or extremely exposed)

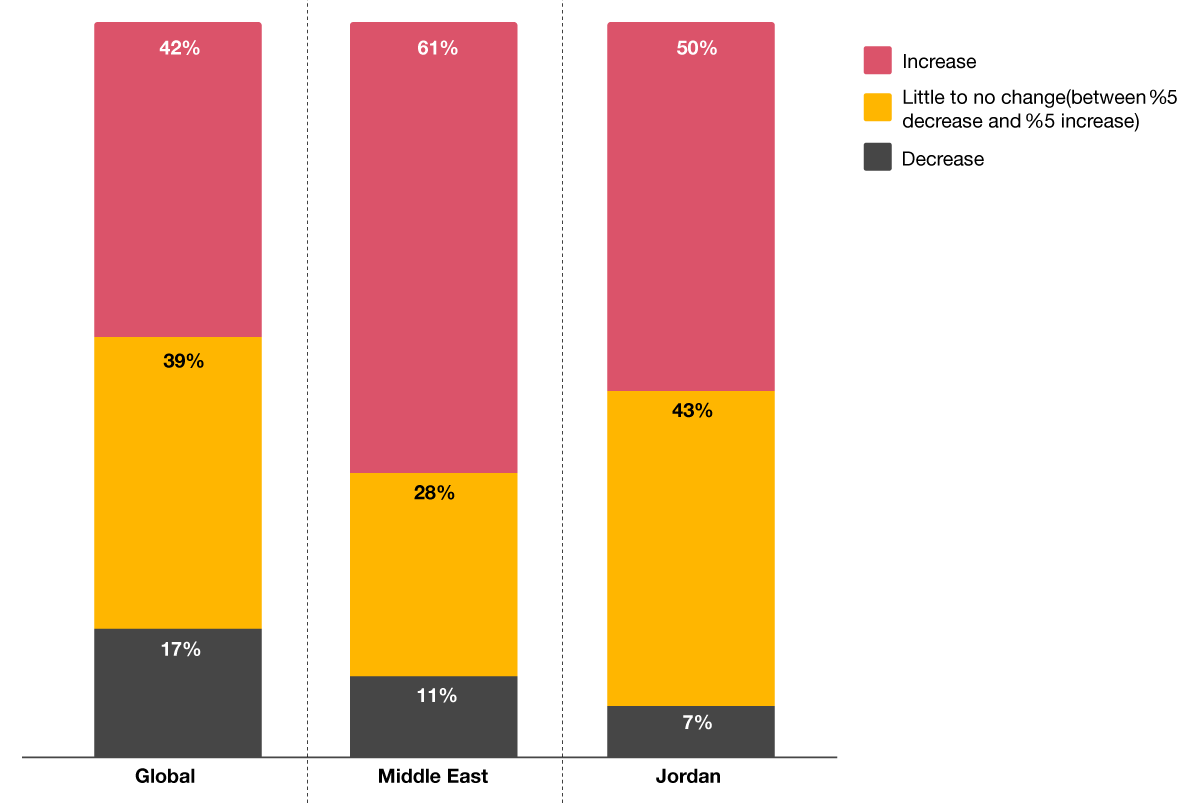

Business leaders in many Middle East countries and worldwide see the potential for a skill shortage in the coming year; 27% of CEOs in the Middle East see this as a serious threat. But in Jordan, only 16% of business leaders are concerned about this, perhaps as a result of the Jordanian government’s ambition to build digital skills and capabilities nationwide. The Ministry of Digital Economy and Entrepreneurship has launched a program under the Youth, Technology, and Jobs Project aimed at improving the employability of Jordanian graduates by offering comprehensive practical and theoretical training in essential skills.7 This has been a positive move, given that now half of the CEOs surveyed across Jordan plan to increase their headcount.

Q. To what extent will your company increase or decrease headcount in the next 12 months?

Industry convergence is aiding the reinvention agenda

The blurring of boundaries between traditional industries as companies seek to partner with innovative technology companies and find new ways of reaching customers8 can be seen clearly in Jordan, as it continues its journey towards economic diversification. Last year, for example, the partnership between Presight and Jordan's Ministry of Digital Economy and Entrepreneurship (MODEE) serves as a prime example of industry convergence, where cutting-edge advancements in big data analytics and generative AI are transforming the healthcare sector.9

More than half (54%) of Jordan’s CEOs say that in the past five years, their company has begun competing in new sectors or industries, and 43% report that more than 20% of their revenue has come from this diversification. Industrials and services, technology, media and telecommunications, consumer markets, and financial services are the most popular new sectors for Jordanian companies to explore.

Many CEOs across the region are also seeking out partnerships as part of their reinvention strategy. Just under a quarter (23%) of Jordan’s CEOs say that their company has made a major acquisition in the past three years, and four in 10 are planning at least one acquisition in the future.

CEOs in Jordan can set reinvention plans on a course for success if they:

- Proactively address geopolitical headwinds by developing comprehensive contingency plans to mitigate risks from ongoing conflicts in neighboring territories. This includes diversifying supply chains, expanding into alternative markets and reinforcing cybersecurity measures to protect against increased cyber threats.

- Strategically focus on sectors in Jordan that are likely to attract healthy foreign direct investment in alignment with Jordan’s Economic Modernisation Vision that aims to secure $60 billion in investments and create 1 million jobs over the next decade in key sectors, such as ICT, healthcare, tourism, real estate, mining, and agriculture10. These sectors present significant opportunities for growth and should be prioritised to drive long-term business.

- Leverage AI and Generative AI (GenAI) to enhance operational efficiency, improve customer experience, and unlock new revenue streams. Use data to gain deeper market insights and make data-driven decisions.

- Align business strategies with the Green Jordan plan and Economic Modernisation Vision to capitalise on government incentives for sustainability. Invest in climate-friendly projects that drive revenue while contributing to long-term environmental goals, even if short-term returns may be lower.

Related content

Contact us

Michael Orfaly

Jordan Country Senior Partner, Jordan, PwC Middle East