Contact us

Is your business prepared for an Indirect Tax Audit?

09 December, 2020

The focus in the GCC on VAT, customs and excise taxes highlights the importance of indirect taxes to national treasuries, and the objective of ensuring full compliance with the relevant tax requirements.

As these legislative frameworks evolve, businesses are expected to ensure that their VAT policies, procedures and processes are compliant with the VAT Law and Regulations. The tax authorities of the GCC implementing States have issued a number of guidelines and public clarifications, and organisations should be reviewing these in good time to ensure that their business is, and remains, compliant.

With the tax authorities around the region focussing on indirect tax audits across all industries, businesses need to be prepared to meet the relevant audit requirements and timelines. The penalties for non-compliance may have a significant impact on business operations and would be more serious where businesses have not disclosed any non-compliance prior, or during, an indirect tax audit.

In light of these considerations, coupled with the short timeframe for businesses to revert on any tax authority request, we have developed a methodology that aims to bring comfort to you and your business.

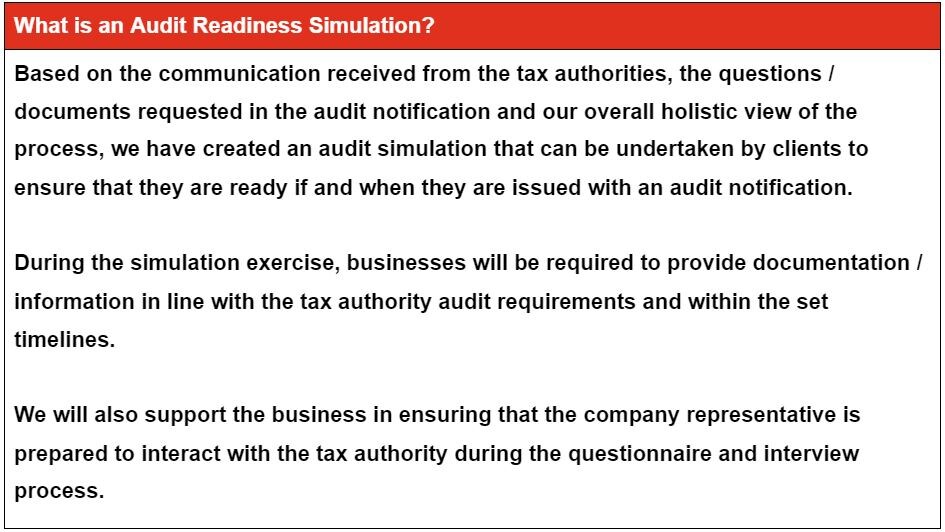

The PwC audit readiness simulation focuses on identifying any weaknesses in the business that could be rectified prior to the tax authorities initiating an official audit.

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

Hear from our PwC Middle East Indirect Tax experts

Our indirect tax audit readiness simulation will allow businesses to determine the gaps / weaker spots in the internal processes followed and enable businesses to ensure they are adequately prepared for an official audit process.

As businesses are looking to recover from the events of 2020, exercises such as an audit readiness simulation are important to understand any potential gaps that are evident in the indirect tax controls implemented and rectify these to avoid unnecessary penalties.

Reach out to the team if you have any questions or if you would like to discuss how we can help you be better prepared for a tax audit.

Contact us

© 2017 - 2025 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.