Four actions your business needs to take to unlock its ESG potential

Economy Matters Blog: October 2022

Reimagining our region through ESG: The 2022 Middle East report

The past year has seen more concerted efforts in the Middle East to advance the ESG agenda, with Saudi Arabia, the UAE and Bahrain all making net zero pledges. As these commitments trickle down to businesses, current discussions revolve around creating sustainable roadmaps that will enable national targets to be achieved. To better understand the current state of maturity of ESG in the region, earlier this year PwC launched its first ever ESG survey in the Middle East of business leaders across the region and their ESG business practices. In this article we highlight the key challenges and opportunities that business leaders anticipate, and what businesses should do now to accelerate progress on their ESG journey.

Challenges and Opportunities in the ESG Environment

The pressure to adopt ESG is multi-faceted. Businesses perceive that the strongest pull comes from the need to comply with ESG policies and regulations that are put in place to achieve national commitments, as well as alignment with broader corporate values and culture. Increasing investor scrutiny and shifts in preferences towards eco-friendly products and services are also important drivers.1

Top reasons for business ESG adoption.

Areas of ESG businesses are focused in

Aligning government and private sector priorities

There is a disconnect between the priorities of national governments and businesses. For example, while addressing water scarcity is a top priority for all governments in the region, with billions of dollars invested each year in building new desalination capacity to compensate for dwindling freshwater reserves, only 27% of business respondents mentioned water security as a priority. A similar gap exists for concerns over the accelerating loss of natural habitats and plant and animal species, with only 16% of respondents prioritising biodiversity preservation. Bridging this gap is critical for greater alignment between corporate and national ESG strategies, otherwise there is a risk of counter-productive actions.

This suggests that there is an untapped opportunity for businesses to anticipate and meet demand for new services and products that are aligned to national priorities and the ensuing economic transformation. While not all industries have direct impact on say water conservation and biodiversity preservation, companies can take steps to reduce resource use and increase resource efficiency across their value chain by sourcing from ESG-compliant providers.

From ‘startup’ to maturity

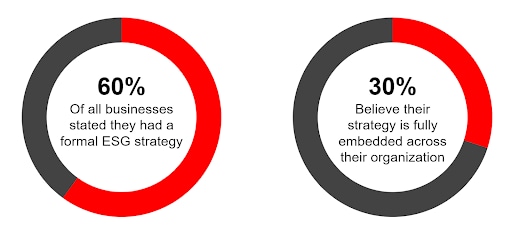

While awareness of ESG issues is growing across the corporate environment, survey responses show that companies in the Middle East are still in the early stages of developing their ESG strategies. While 60% say there is a formal ESG strategy, less than one-third of businesses believe that their strategy is fully embedded across their organisation.

This is evident in two areas. First, more than 55% of the businesses surveyed indicated that the CEO was responsible for leading the ESG agenda within their companies. Second, effective ESG strategies require clear accountability at the top with roles and responsibilities properly defined, which many companies still lack. Only 18% of respondents stated that their companies had teams and systems in place to cover the full remit of ESG functions, with gaps remaining in strategy and policy monitoring and reporting, risk management, stakeholder engagement, ESG input on product and service offerings, and communications marketing.

As ESG practices grow in maturity, the scale and ambition of ESG commitments in the region calls for specialized ESG teams and systems. Organizations that are able to design and implement comprehensive ESG structures, supported by technical capabilities will gain a competitive edge. As ESG evolves and more companies commit to ESG auditing, structured ESG strategies will also result in improved ESG metrics, which could lead to stronger branding, improved compliance, and increased ESG data quality.

A call for clearer policy direction

Businesses also value clearer direction from the public sector. 86% of larger organizations want regulatory and enabling policies to accelerate the implementation of ESG strategies, especially on sustainable procurement, impact measurement, and disclosure standards.

A good example is the region’s continued dependence on fossil fuels as a source of energy, which is a barrier to industrial decarbonisation. Governments should focus on developing these policies that will enable energy efficiency measures, renewable energy investments, directives on how to measure carbon emissions, circular economy initiatives, and policies to save and reuse water. These measures would give companies more direction in shaping their own tangible ESG roadmaps that are better aligned to national goals.

“ Governments can encourage and incentivise certain initial behaviours to move ESG agendas forward. They are taking the lead in certain areas such as power generation.”

Actions businesses should consider

While businesses may be at different stages of their ESG journey, there is a set of enabling actions that should be established from the outset and embedded within the organisation.

Embed your ESG strategy:

In order to successfully embed their ESG Strategy, businesses should define ambitions and priorities that are aligned with their business rationales and national goals. Businesses should have an ESG lead in charge of overseeing and coordinating the full suite of ESG functions. This person will require access to people with the right skills and capacity to deliver the ESG strategy.

Define KPIs and Establish Data Systems

KPIs must be set to measure progress and will be enabled through robust data collection and reporting systems. Companies should invest in obtaining the capabilities to align with global standards and that capacity is built to collect and report on non-financial ESG metrics for internal and auditing purposes alike.

Understand the business context for ESG

Businesses should identify existing opportunities and understand how they align with the company’s priorities as well as those of governments’. Early adopters will define the creation of new business services and products that could create real value and wider benefits for society. An effective ESG strategy will also help anticipate and manage risks in a proactive manner

- Integrate the three ESG pillars

The three pillars of ESG are complex and interconnected subjects. While the environmental pillar has been at the forefront of ESG conversations, an integrated approach including social and governance issues is critical for sustainable outcomes. In this system, traditional financial measures of success are complemented by new considerations that create value, including environmental sustainability, employee engagement, external partnerships, and broader societal wellbeing.

Conclusion

As the hosting responsibilities for COP27 (Egypt) and COP28 (UAE) bring attention to the region, policymakers and businesses have the opportunity to make progress and demonstrate regional leadership on ESG. By embedding their strategy across their organizations with a clearly defined governance, establishing ESG KPIs with reliable data systems, understanding their industry value within the problem statements, and integrating all three ESG pillars across their operations, businesses can sustainably activate and measure the value creation from their ESG journey.

1- 60% of regional respondents of the PwC Global Consumer Index Survey said they are more eco-friendly than they were six months ago and consider sustainability factors when deciding what to buy.