The implementation of IFRS 17 is a major challenge for the insurance industry, fundamentally changing accounting, actuarial and reporting practices and significantly impacting the supporting systems and processes. Secondary impacts will affect tax, products and investments.

IFRS 17 is a complex and resource intensive change, but presents immense opportunities to harness data more effectively, to improve the structure of your finance function and to better inform your decision making. The standard will have significant implications for IT systems, strategic management, business processes and employee skill sets.

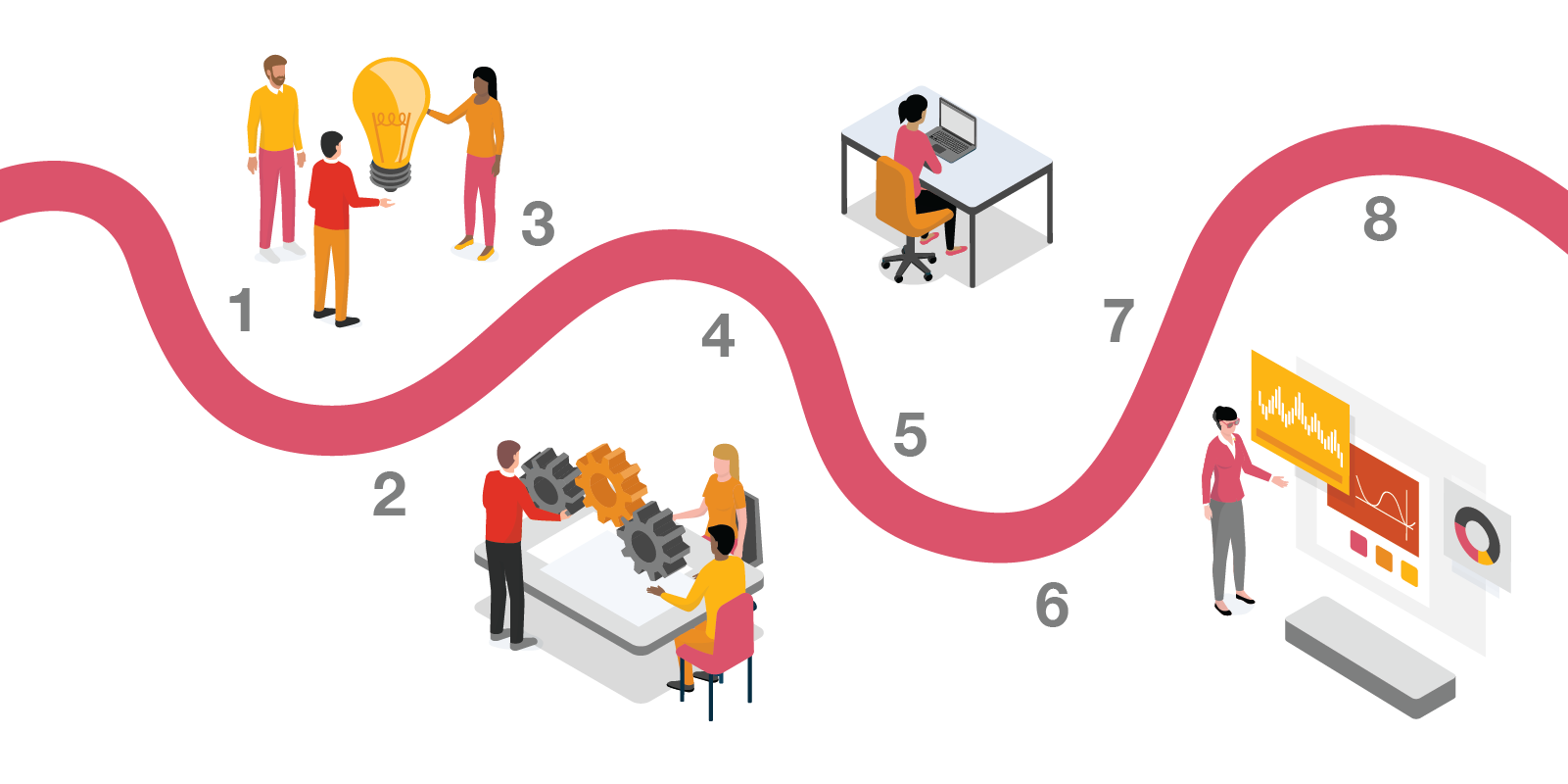

Where are you in your journey?

The road to IFRS 17 is a journey. Your needs will depend on how far along the IFRS 17 journey you are and whether you’re looking for a financial reporting infrastructure that will provide only compliance, complete finance modernization or something in between. We’ll work with you to assess your progress in that journey, look at how you compare to your peers and choose the right target structure for your organization.

Explore each step in the journey below by clicking on each number.

Simplified Solution for IFRS 17

Our Simplified Solution for IFRS 17 (SS17) is a managed service that accelerates insurers’ IFRS 17 projects and de-risks implementation and ongoing reporting with minimal changes to current systems. We have combined specialists from actuarial, accounting, IT and data analytics to implement a cloud based “model office” in a productionalized, controlled environment. You give us your input data, we provide you the IFRS 17 files and reports you need for your financial statements and disclosures.

How we can help

With over 190 IFRS 17 projects globally, our team of IFRS 17 specialists from each discipline brings key learnings, tools and accelerators used in our local and global work. You’ll gain insights into the latest developments in the industry, vendor solutions and what’s happening with your peers.

- Target operating model for financial reporting

- Accounting papers and advice

- Actuarial modelling, including quantitative impacts and PAA eligibility

- IFRS 17 Chart of Accounts and Data Dictionary

- Systems integration and configuration

- IFRS 17 transition advisor

Target operating model for financial reporting

Understand and design how your financial reporting model needs to change under IFRS 17. This includes addressing key questions around who, what, when and how your people, processes, systems and data will need to be changed and work together to comply with IFRS 17 requirements. Whether you’re looking at a minimum viable product (MVP) or finance modernization, our specialist and target operating model accelerators will help you plan for success and visualize how all the pieces will fit together in the best way.

Accounting papers and advice

Move forward with confidence with your new IFRS 17 accounting policies by using our accounting paper templates, accounting manual and FAQs on applying IFRS 17. We can also help you evaluate and assess key judgments, provide worked examples and navigate areas of uncertainty.

Actuarial modelling, including quantitative impacts and PAA eligibility

Make informed decisions by using our IFRS 17 actuarial modelling tools to evaluate quantitative impacts of your new IFRS 17 accounting policies. Accelerate your purchase accounting adjustment (PAA) eligibility testing with our tools and templates that can help you demonstrate eligibility over a range of scenarios.

IFRS 17 Chart of Accounts and Data Dictionary

Accelerate your IFRS 17 solution implementation with our IFRS 17 Chart of Accounts tool and illustrative mapping to underlying data sources and storage. Use our IFRS 17 Data Dictionary tool to define and validate your data requirements.

Systems integration and configuration

Our systems integration and configuration team brings in-depth working knowledge to support your integration plan and detailed configuration needs. Our agile-based approach to IFRS 17 vendor selection and system implementations will reduce your time to the finish line. We provide a specialized service for the implementation of Moody’s AXIS and Risk Integrity for IFRS 17.

IFRS 17 transition advisor

We’ll partner with you as you navigate your IFRS 17 transition journey, bringing you the latest on accounting, actuarial, IT, data, regulatory and broader transition impacts. Our subject matter specialists can enhance and supplement your team in both a hands-on delivery role and in an advisory capacity to support your project leads, sponsors and those charged with governance.

Every stage of the journey requires training and education

The breadth and depth of knowledge required by your key stakeholders in your business will expand as you progress along this implementation path. We’ll help you confirm whether an appropriate level of training has been received by the stakeholders who need it most up to this point and whether the right people are upskilled at the right time to enable timely and effective implementation. Our unique IFRS e-learning curriculum aims to create a solid IFRS understanding, focusing on insurer-specific topics.

Contact us

National Insurance Sector Leader, Partner, Strategy&, PwC Canada

Tel: +1 416 815 5052