Helping you navigate the complexities of financial reporting

IFRS reporting

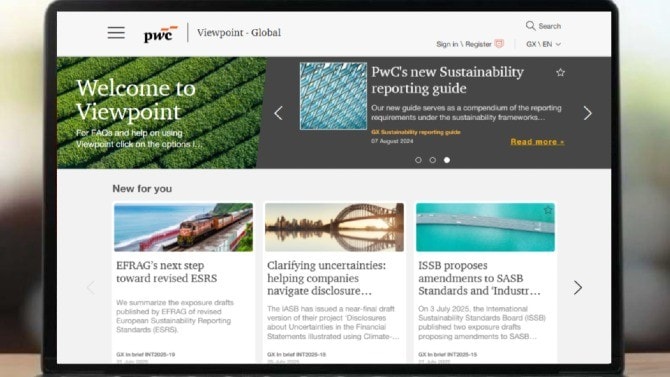

IFRS® is the global language of financial reporting. New standards for financial instruments, revenue recognition and leasing bring challenges for those preparing financial statements. You'll find our IFRS resources, including PwC's Manual of accounting, and the latest guidance on our digital platform Viewpoint.

Viewpoint offers timely, relevant insights on accounting, financial reporting, business and regulations. With powerful search tools, real-time updates and curated hot- topic pages, Viewpoint delivers the intelligence you need—when you need it.

Podcast series: IFRS Talks

Drowning in the sea of financial reporting complexities? We’ve got you covered. Our professionals bring you clear insights and fresh perspectives that cut through the noise. Dive into our episodes whenever you like—on your desktop or smartphone—and navigate the financial reporting world with confidence.