Companies are facing an increasingly complex set of financial risks due to factors like foreign exchange rate volatility, fluctuating interest rates and commodity price uncertainty. At the same time, the financial instruments available to manage these risks have become equally complex and challenging to understand and use effectively.

This results in complicated models to quantify the value and risks of these instruments. Adding to these challenges is the adoption around the world of accounting standards that are difficult to apply, which makes financial reporting in this area more challenging.

By starting with their strategic objectives and risk appetite, companies can increase their economic resilience. They can identify and pursue new opportunities by enhancing their understanding of their exposure and risks through their financial risk management.

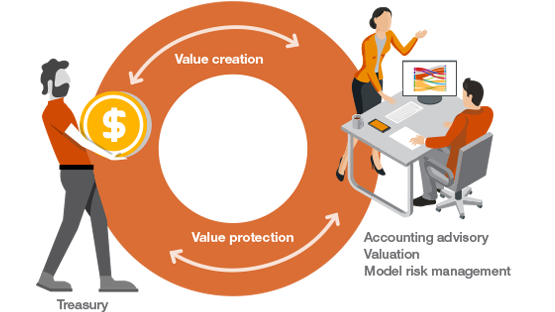

Protect and create value

PwC Canada’s financial risk management team has the resources to support organizations in protecting and creating value. A multidisciplinary group consisting of experts in financial instrument accounting, specialists in valuation and quantitative modelling and professionals in corporate treasury, we help companies in all aspects of financial risk management, including policies and strategies, processes and controls, technology selection and implementation, valuation and risk modelling and financial reporting.

How we can help:

Financial instruments are widely used in all companies. The accounting rules and disclosure requirements related to financial instruments are diverse and complex, which can create practical issues for companies. These issues generally relate to the accounting for complex on-balance sheet instruments, derivatives and newly invented products and transactions, hedge accounting and related documentation and disclosures and valuation of financial instruments.

How we can help:

- Assist with hedge accounting by putting in place required hedge documentation in alignment with risk management activities, hedge effectiveness testing and hedge ineffectiveness measurement

- Support the design and development of economic hedging strategies

- Analyze the appropriate accounting treatment, presentation and disclosure requirements for new debt/equity issuance and innovative financing transactions

- Identify embedded derivatives that must be divided and assist in the calculation of the related fair value

- Calculation of the fair value of financial instruments, complex derivatives and other complicated financing arrangements

Complex financial instruments give rise to many financial risk and valuation issues. These issues need to be understood, managed and quantified through intricate valuation and risk models.

How we can help:

- Development of best-in-class model risk management framework that complies with the latest model governance standards

- Development and validation of financial risk and valuation models

- Assist in carrying out audit procedures in areas like model risk management and quantitative model testing

An expanding risk landscape is placing treasurers and chief financial officers under increased pressure to stay on top of current and emerging issues, such as commodity trading, foreign exchange volatility, market complexity and changing regulations. As the scope of corporate treasury continues to expand to an increasingly virtual, company-wide management initiative, corporate treasury is becoming increasingly important, which, in turn, provides it with opportunities to add value.

How we can help:

- Treasury strategy and organization: understand the current state, determine the treasury vision and design a target operating model and execute a treasury transformation

- Treasury internal audit: helping internal audit to design and improve your treasury processes by reviewing policies and procedures to close gaps, including cybersecurity, fraud risk, internal controls and board expectations

- Cash and liquidity management: evaluation and selection of banking partners, development of robust cash forecast program, design and implementation of in-house banking

- Risk management: analysis of interest rate, foreign currency and commodity risk; development of risk mitigation solutions; improved process and controls

- Treasury technology: technology strategy development, definition of functional requirements for system selection, system implementation

- Deal support: navigating the full transaction life cycle from pre-close diligence and support through post-deal operations, treasury optimization and value enhancement

Related Services

Related Insights

Contact us

Shirley Hu

Senior Manager, Financial Risk Management – Financial Instrument Accounting and Valuation Advisory, PwC Canada

Tel: +1 416 687 9045