PwC Canada's cannabis series

Chapter 1 - The cannabis landscape

The budding industry will rapidly change. Only some will survive.

For years, registered patients in Canada have had legal access to medicinal cannabis, and with the adoption of the Cannabis Act on October 17th, 2018, Canada has become the first G-7 country to federally legalize adult-use cannabis.

The market now sits in the midst of a seismic shift that has already enticed investors to pour billions of dollars into cannabis companies and attracted adjacent industries, including tobacco, alcohol and pharma, into the fray. The legalization of dried leaf and oils on October 17th, 2018 was only the initial wave of adult-use legalization to strike the country, with expanded product ranges coming in 2019.

To succeed in this rapidly evolving industry, companies will need to grasp the realities of the marketplace and quickly enact a focused, disciplined plan of attack.

Deal mania

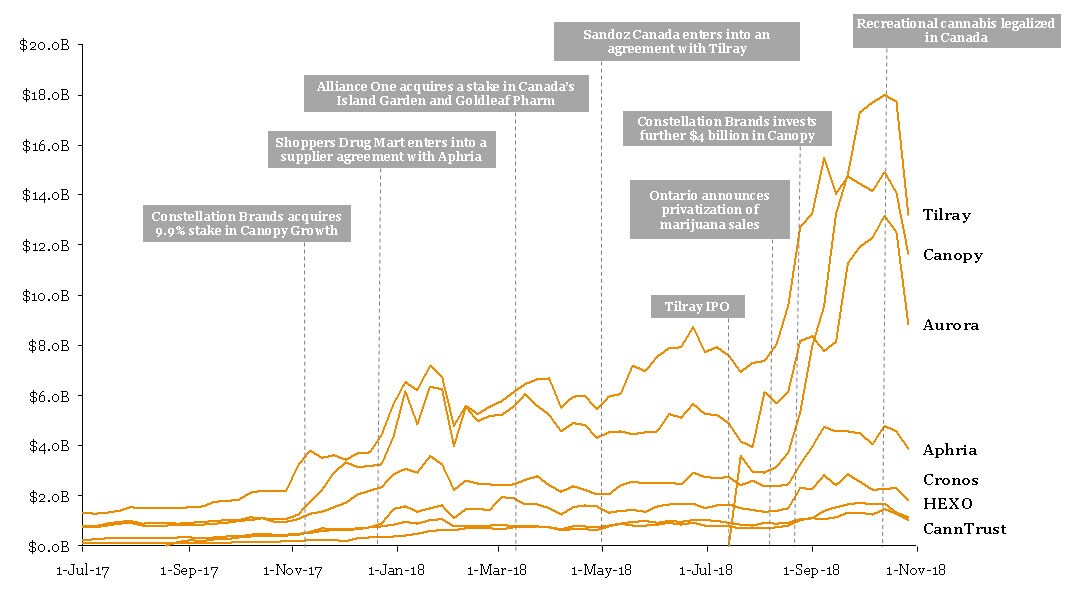

More than 130 licensed producers (LPs) already populate Canada’s cannabis landscape with hundreds more awaiting government approval. Most LPs continue to function as startups despite being in operation for a few years. Notwithstanding a considerable lack of strategic focus within the sector, LPs have been handsomely rewarded in capital markets.

Circling on the periphery, large corporations from adjacent industries are selectively putting stakes in the ground:

- Constellation Brands Inc. purchased a 37 per cent stake in Canopy Growth Corp. for over $5-billion in two transactions, first in November, 2017, and later in November 2018.

- In December 2017, Shoppers Drug Mart inked its first cannabis supply deal with the acquisitive grower Aphria Inc.

- In February 2018, US tobacco company Alliance One International Inc. bought a majority stake in Goldleaf Pharm Inc. and Canada’s Island Garden Inc. for an undisclosed amount.

- In March 2018, Sandoz Canada announced an agreement with producer Tilray Inc. to develop and distribute non-combustible cannabis medical products, such as sprays and caplets for hospitals and pharmacies.

- In May 2018, Southern Glazer’s Wine & Spirits LLC announced a partnership with Aphria Inc. to represent Aphria products to Canadian retailers and regulators via a new Canadian subsidiary, Great North Distributors Inc.

- In August 2018, Molson Coors Canada announced a joint venture agreement with Hydropothecary to pursue opportunities for non-alcoholic cannabis-based beverages in the Canadian market.

- In September 2018, Breakthru Beverage Corp. announced an exclusive partnership with CannTrust Holdings, agreeing to represent their specialty products in Canada and develop a route-to-market platform.

Largest LPs market capitalizations over past 12 months

Source: SAP CapIQ as of market close on November 12th, 2018.

Regulatory rulebooks

In the new recreational regime, adult-use and medicinal segments of the market operate separately with oversight from Health Canada. Federal government bodies oversee commercial production and processing of adult-use cannabis, while the provinces and territories are responsible for providing oversight of distribution, wholesaling and retailing. Most provinces and territories have elected to set up exclusive distribution channels for adult-use cannabis through their liquor control boards. As an exception, Ontario’s new Progressive Conservative government has decided to allow for private retail sales, limiting provincial involvement to the online Ontario Cannabis Store (OCS). Meanwhile, Health Canada has announced new federal commercial licenses to replace the Access to Cannabis for Medical Purposes Regulations (ACMPR) with a new set of production, processing and sales licenses that will allow greater flexibility for all types of cannabis companies.

The net result is that the provinces and territories have created a unique marketplace with their own regulatory requirements. At the same time, the new federal commercial licenses have rendered the core ACMPR license obsolete and allowed for greater intermediation along the value chain.

Strategic moves

While governments developed the legal and governance frameworks for the cannabis sector, LPs pushed ahead with a variety of strategic initiatives.

Numerous LPs positioned themselves for a role in the medical market, establishing supply agreements with pharmacies and product development arrangements with biotechs and pharmaceutical companies. This strategy also had LPs working with patients and physicians on education initiatives and with healthcare institutions and universities to fund research programs.

When the recreational cannabis marketplace opened, both recreational and medical consumers encountered a significant supply shortage. Many of the nation’s new cannabis stores went days without supply, with some provincial shops closing their doors due a lack of product. However, this shortfall is expected to last only 6-12 months, as most LPs have moved to aggressively expand their production–a move encouraged by investors–and Health Canada is quickly licensing a significant number of new producers.

LPs have also been challenged on how to differentiate their products, as Health Canada currently restricts branding activities and is still hesitant to allow new product forms/formulations. The government is expected to legalize new product categories, including edibles and cosmetics, by 2019 or later. For now, most producers are aiming to stand out in a crowded marketplace by offering a variety of cannabis strains, with some also trying to develop brands that register as “premium” lifestyle products. However, it will take time before the nascent industry develops the sophisticated branding and marketing techniques employed by other consumer packaged goods companies.

LPs are also pursuing supply agreements with provincial liquor boards. To succeed, these companies will need to have the right resources and tools in place to develop, submit and update the data these provincial bodies require. And when initial supply shortage is solved, they will need to adequately advise and service the liquor boards for supply continuity.

Finally, the liberalization of medical cannabis laws in the United States and overseas may help producers avoid potential oversupply in Canada and pursue more attractive economic opportunities. As such, LPs are looking to export both products and expertise. The risk here is that too many Canadian LPs are trying to become global corporations before they have established sustainable domestic businesses, opening the door to complications down the road.

The net result is that over the long term, cannabis supply will almost certainly exceed demand.

The future: seven drivers

The cannabis market will evolve quickly over the next few years, propelled by seven connected drivers of change.

The licensing regime created through The Cannabis Act replaced the previous ACMPR licenses with a wider variety of licenses for cannabis companies that allow for greater flexibility in their business models.

Expanding government regulations around cannabis product forms/formulations will enable companies to create a wider variety of products and develop distinguished offerings.

The market’s growing sophistication will see profit margins move downstream, away from growers to value-add operations which include extractors, who blend products to consistent specifications, and processors, who use the cannabis buds and oils to create foods, drinks, creams and other innovative products.

As the market becomes more established, institutional investors will step in and expectations will change. Companies will find themselves under greater pressure to deliver profits. Those that prove unable to adapt to this new reality could find themselves pushed towards mergers or acquisitions.

The arrival of well-financed participants from adjacent industries will not only boost competition in the marketplace but also raise the standard of products and services. At the same time, with so many emerging players in the field, LPs will be forced to move away from a vertically-integrated business model.

The gradual internationalization of both the medicinal and adult-use cannabis segments will offer successful Canadian LPs lucrative expansion opportunities. However, the export market will also bring new challenges and companies will find partnerships and or joint ventures essential for success.

In the medicinal market segment, there will be an increase in research and development to understand the effects of cannabinoids, which will lead to greater physician awareness and support to recommend cannabis as a therapy. As a result, insurance companies will begin to offer improved medicinal cannabis coverage and businesses will design new cannabis formulations that target specific therapeutic areas and conditions.

On the horizon

Over supply of raw cannabis and increasing competition

Canada’s cannabis market is going to find itself transformed before it is even fully developed. An eventual oversupply of raw cannabis, together with the arrival of well-established businesses from neighbouring industries, will force the sector to accelerate its consolidation. Even before legalization, rapid consolidation was seen in mid-May when two of the country’s largest LPs confirmed they were merging as part of a $3.2-billion stock deal.1 Aurora Cannabis Inc.’s deal with MedReleaf Corp. came just days after Aurora closed its $1.1-billion cash and stock acquisition of CanniMed Therapeutics Inc.

More stringent investor expectations

As cannabis players look to separate themselves from the pack via acquisitions to expand capabilities and enhance their brand, investors have been largely supportive of the perceived “winners” and have provided the requisite equity to negotiate high-priced deals. The bigger challenge will be meeting investor expectations and delivering on deal value. Integrating the people, processes and technology acquired could prove a bigger hurdle than completing the deal itself. Few, if any, of today’s cannabis companies will have the necessary skills in-house to manage such a process. Investors will hold leadership teams accountable to ensure that the integration is completed quickly and is ultimately accretive to the company.

Emergence of new players

Health Canada’s licensing regime allows for variations on the current LP business model, permitting newfound flexibility. Companies are now able to focus on discrete areas of the value chain where they wish to compete and ultimately win. This focus drives these players’ allocation of resources towards creating a compelling competitive advantage against the current LPs.

Vertically integrated LPs must assess and make critical strategic choices on their own value proposition to sustain their current competitive advantage.

Source: 1 Press Release (May 14, 2018) https://www.newswire.ca/news-releases/aurora-cannabis-to-acquire-medreleaf-682519231.html

Beyond the horizon

The market issues outlined above will, in our opinion, lead to the following outcomes:

- Industry consolidation – An increase in the amount of M&A transactions among industry players is likely, though not all will be successful.

- Business model redesign – Some players will refocus their strategy and align their business model accordingly.

- Capability and system enhancement – Many companies will need to build or enhance their capabilities and systems to support their strategy.

- Bankruptcies and restructurings – A number of players will be unable to build a position of relevance and will be required to divest or restructure their debt.

The net result is a drastically different market landscape than what we see today. We believe the industry of tomorrow has fewer larger players, but an abundance of niche companies offering specialized products and services.

Taking the right steps

There are several things businesses in the cannabis sector may want to consider to respond to market forces and be prepared for the outcomes we’ve described. For example:

- Develop a focused strategy;

- Identify the requisite capabilities and systems to deliver on the strategic direction;

- Understand the core value proposition and how to leverage it in the value chain of tomorrow;

- Invest in deal integration for any acquisitions to capture all synergies and truly deliver on deal value;

- Acknowledge the need for appropriate financial controls and have them in place to comply with all regulatory requirements;

- Ensure the right tax and accounting structures are in place for all jurisdictions targeted in any international expansion strategy; and,

- If restructuring becomes the only solution, find the right partners to increase shareholder value and put the company in a position to succeed.

A window of opportunity

While Canada’s federal and provincial governments were developing the framework for a nationwide adult-use cannabis market, businesses and investors already built much of their contents. And with legalization here, the market for adult-use cannabis has already begun to rapidly evolve.

Today, it is imperative for cannabis companies to understand what is happening and where the challenges and opportunities lie. More importantly, players need to know how to adapt their businesses to thrive in a fast-changing sector.

What’s needed for a winning strategy is covered in chapter 2 of our cannabis series.

This publication is made available by PricewaterhouseCoopers LLP (PwC) for educational purposes only as well as to give you general information and a general understanding of the cannabis landscape, not to provide specific financial, investment or other advice. By using this publication you understand and agree that there is no client relationship between you and PwC, or any of its member firms. The publication should not be used as a substitute for competent financial, investment or other advice from a professional services firm.