Executive Summary

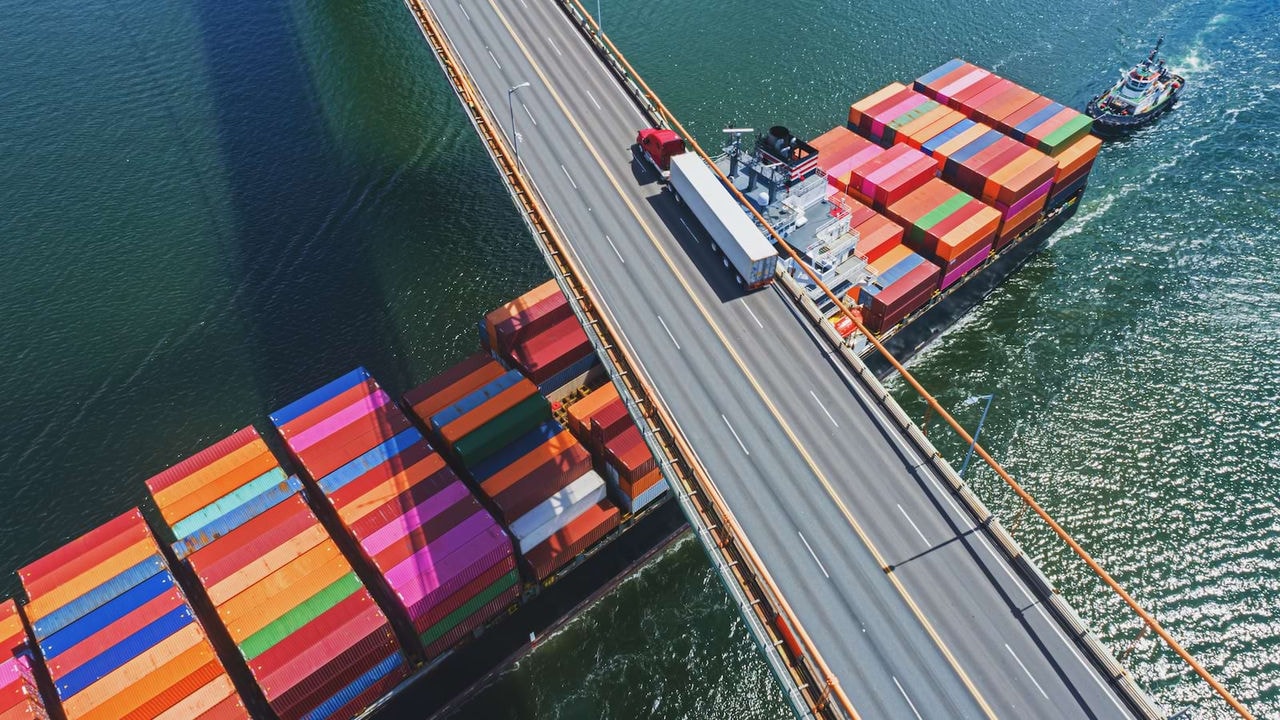

For centuries, the Middle East has acted as a global trading and logistics hub due to its location at the intersection of Europe, Asia, and Africa. Since the First World War, the discovery of vast onshore and offshore oil and gas reserves has reinforced the region’s strategic importance. Today, the Middle East - covering, in this report, the six GCC countries plus Egypt - remains an indispensable conduit for global trade flows. For example, in 2023, around 12% of global trade volumes passed through the Red Sea, according to data compiled by the US Congressional Research Service (CRS).[1]The International Energy Agency (IEA) estimates that in 2023, around 30% of the world’s traded oil and around 20% of all liquefied natural gas (LNG) was shipped via the Strait of Hormuz.[2]

The resilience of the Middle East’s trading and logistics landscape, which also includes fast-growing land and air cargo traffic, is remarkable given the series of recent external shocks that have affected world trade in general and the region specifically. The COVID-19 pandemic and the Red Sea crisis have both placed severe strain on trade flows and supporting infrastructure across the Middle East, with shipping costs and insurance rates rising sharply between 2020 and 2024.[3] The Suez Canal obstruction in 2021 and the Ukraine conflict have added to this pressure.

Fortunately, these recent challenges have further spurred Middle Eastern governments and policymakers to upgrade and expand existing capabilities to secure the region’s status as one of the world’s leading trading and logistics centers. One recent example is the UAE’s launch, in February 2025, of the Emirates Council for Logistics Integration.[4] The council aims to reinforce the country’s pivotal position in global trade and increase the annual revenue from the UAE’s logistics industry from $35 billion to $54.4 billion by 2032.

This report focuses on how Middle Eastern countries’ national transformation programs can be leveraged to navigate structural and practical obstacles, such as:

Limited cross-border collaboration in logistics between Middle Eastern countries.

Limited intermodal integration between maritime, aviation, rail and road logistics.

Shortage of skilled logistics personnel.

Limited alignment of Middle Eastern logistics companies with international sustainability regulations.

Two factors make transformation programs such as Saudi Arabia’s Vision 2030,[5] 'We the UAE 2031',[6] and Qatar’s National Vision 2030[7] well adapted to develop world-leading trading and logistics capabilities throughout the Middle East.

Firstly, all these programs correctly see investment in logistics as a critical enabler of national modernization and economic growth, while recognizing that greater regional collaboration is an important part of realizing the sector’s full potential. With this goal in mind, Gulf Cooperation Council (GCC) countries hold regular joint dialogues covering a wide cross-border logistics agenda, such as strengthening regional land transport strategies and aligning transport regulations. Secondly, these national programs envisage significant and continuing public and private sector investment in infrastructure, much of which will incorporate new technologies that often leverage artificial intelligence (AI).

Nonetheless, a greater degree of collaborative thinking is still needed to turn a series of national initiatives into a coordinated regional effort to secure the Middle East’s historic trading and logistics advantage for future generations. To be clear, there has been progress on specific cross-border projects recently, despite significant economic and geopolitical headwinds. The Gulf Railway Project, which aims to connect six member states via a 2,177-kilometer high-speed railway network, is a good illustration.[8] Yet, too often, logistics investments and programs are geographically limited, meaning they do not fully exploit economies of scale and risk overlapping with similar projects in other Middle Eastern countries.

This report deliberately adopts a broader, transnational approach, identifying several critical areas where coordinated action by Middle Eastern governments will deliver trading and logistics benefits for all participants. We make the following key recommendations:

Increase cross-border coordination and collaboration on logistics projects to promote economic integration.

Continue to use technology to accelerate development.

Expand training for expatriate and local logistics workers to equip them with the skills to operate advanced logistics technologies.

Ensure full compliance by Middle Eastern logistics and shipping companies with international sustainability regulations.

How to secure the Middle East’s global trade and logistics advantage

Resources:

1- Congressional Research Service (CRS). Red Sea Shipping Disruptions

2- IEA, Strait of Hormuz – Factsheet (undated)

3- U.S. International Trade Commission, Executive Briefings on Trade, April 2021

4- UAE sets Dh200bn transport logistics goal to drive global trade, Feb 3, 2025

5- Government of Saudi Arabia

6- Government of the UAE

7- Government of Qatar

8- Gulf Cooperation Council Media Center, Nov 7, 2024