As Transfer Pricing (TP) regulations are in the process of being adopted and introduced across the Middle East including the Kingdom of Saudi Arabia and Egypt, it has become increasingly important to understand what TP means for businesses operating in the Middle East.

We are pleased to offer the results of our first survey, involving over 100 companies with operations in the Middle East. This survey provides key insights as to what various finance / tax executives across industries are thinking about in respect to TP matters. One of those key insights is the fact that executives are now heavily relying on TP in respect to strategic planning and developing an effective and compliant TP structure that is fit for their business from a commercial, tax and regulatory perspective across the jurisdictions in which they operate.

We are very excited to be presenting the results of this survey and hope it provides all our readers with valuable insights in an increasingly important area.

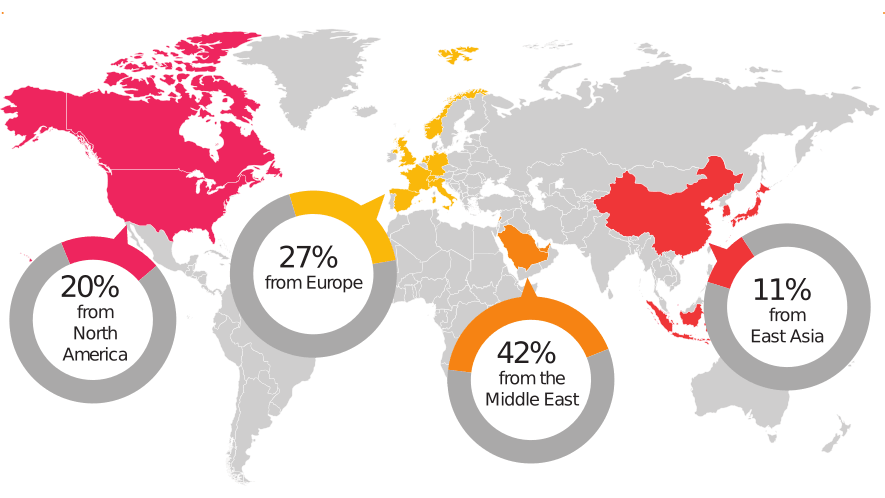

Percentages of respondents by region

Percentage of respondents by Industry sector