Introduction

PwC Middle East’s Voice of the Consumer 2024 survey explores the evolving landscape of consumer preferences in Qatar, drawing insights from 303 respondents aged primarily between 18 and 44. The study identifies three key consumer profiles - tech-savvy, empowered, and environmentally conscious - each with distinct demands. Trust, sustainability, and digital innovation emerge as core themes, with a strong consumer preference for digital tools like mobile payments and virtual reality. Key concerns include data privacy, inflation, and health risks, while in-store shopping maintains popularity, underscoring the unique priorities of Qatar’s forward-looking consumer base.

Trust in industries

In Qatar, airlines and energy companies have emerged as the most trusted sectors, both scoring 7.99 on a 10-point scale. In contrast, social media companies relatively score the lowest, with a trust score of 7.29, highlighting a significant gap in consumer confidence.

Airlines in the country have earned their trusted status not only through extensive network expansion but also through a deep commitment to sustainability and service excellence. Similarly, the energy sector's focus on meeting the world’s growing demand for cleaner energy is likely to have strengthened consumer trust.

Deep diving into consumer trust in Qatar, 76% of consumers ranked ethical treatment of employees and good quality products as the most important factors. This indicates a strong emphasis on fairness and product quality as key drivers of trust. Regionally, data protection topped the list for 85% of consumers in the Middle East, followed by ESG practices, ethical employee treatment, and affordable products.

Health risks, Inflation remain key concerns

Inflation and health risks remain the top concerns for consumers in Qatar, with 47% identifying inflation as the biggest concern and 44% focused on health risks. Despite rising food prices, projections suggest that inflation may ease as Qatar's non-oil economy, which now contributes to two-thirds of the country’s GDP, continues to grow.

Qatar's 2024 budget has also prioritised healthcare spending, with key investments in the healthcare space such as the development of the National Cancer Hospital, the establishment of a psychiatric hospital for mental health care, and the renovation of existing healthcare infrastructure. This focus aligns with consumer concerns about health risks.

Regionally, inflation is also a top concern, with 56% of consumers citing it as the most significant threat, followed by climate change at 43%.

Consumers embrace sustainability: From green purchases to tech-driven solutions

Sustainability is a key focus for consumers across the region, with many striving to live more environmentally responsible lives. In Qatar, 57% of consumers report buying more sustainable products, 41% are making considered purchases, and 52% support green policies. Notably, 31% of Qataris are willing to pay 11-20% above average prices for products with lower carbon footprints, compared to 21% regionally and 16% globally.

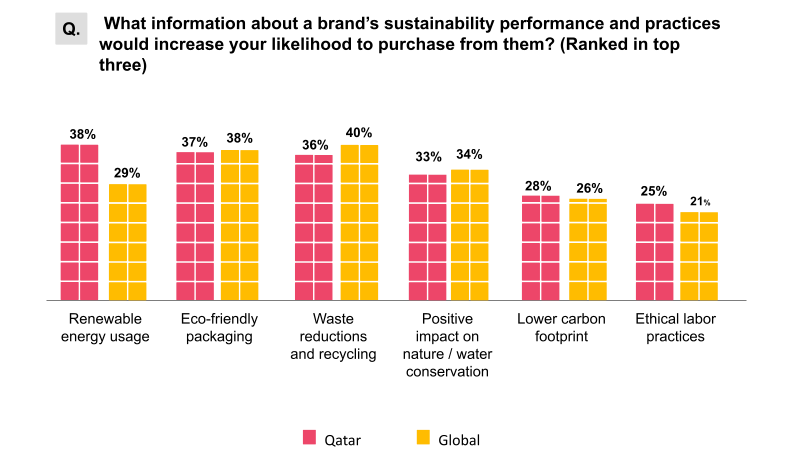

Consumer preferences in Qatar also reflect a strong demand for brands that prioritise sustainability, with over 30% of consumers favouring brands that utilise renewable energy, eco-friendly packaging, and waste reduction and recycling, reflecting a growing awareness and appreciation for environmentally friendly practices in the region.

Sustainability is even seen to influence dietary choices, with about 70% of consumers surveyed seeking information on whether the food products they buy are sustainably grown or manufactured.

These preferences may be largely driven by the country’s commitment to sustainability. Qatar’s recent pledge to the Middle East Green Initiative, along with long-term goals like reducing greenhouse gas emissions by 25% and planting 10 million trees by 2030, reflect the nation's proactive stance on environmental issues.

This growing awareness of sustainability is influencing preferences towards mobility, with 21% of consumers in Qatar already owning an EV and 40% having an appetite for acquiring an electric vehicle in the next three years. Moreover, 67% of consumers surveyed supported a car-free city centre and 66% were willing to trust drones for delivery- indicating their openness to embracing technology-driven solutions that would be more sustainable in the long run.

Consumers trust AI for low-risk tasks

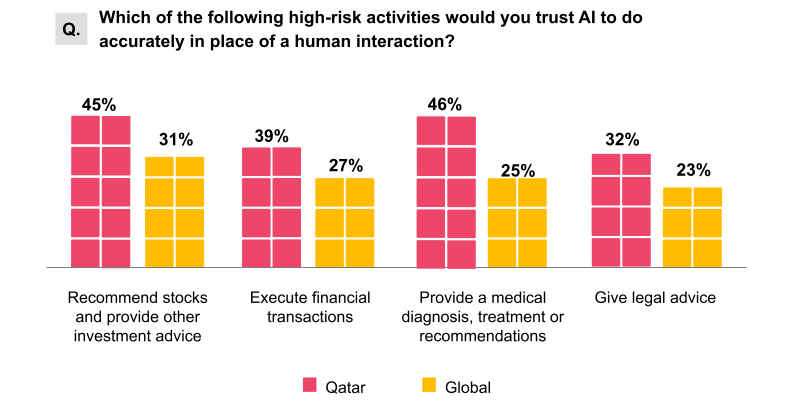

When it comes to trust in AI, results in Qatar align with the rest of the region. Nearly 60% of consumers in Qatar are willing to trust AI for low-risk activities, such as collecting information on a product before purchase, drafting reviews and recommendations on products they own, written communication support, and customer service. Conversely, respondents in Qatar were least likely to trust AI for high-risk activities, such as executing financial transactions on their behalf (39%) or giving legal advice (32%). While less than half trusted AI to provide them with medical diagnosis and treatment recommendations (46%), they were substantially more trusting in this category than other Middle Eastern respondents, who averaged 30%.

More than 70% of consumers in Qatar express worry about a range of issues, from increased risks of being hacked to the potential for job loss due to AI's capabilities for replacing human roles.

Chatbots gaining traction

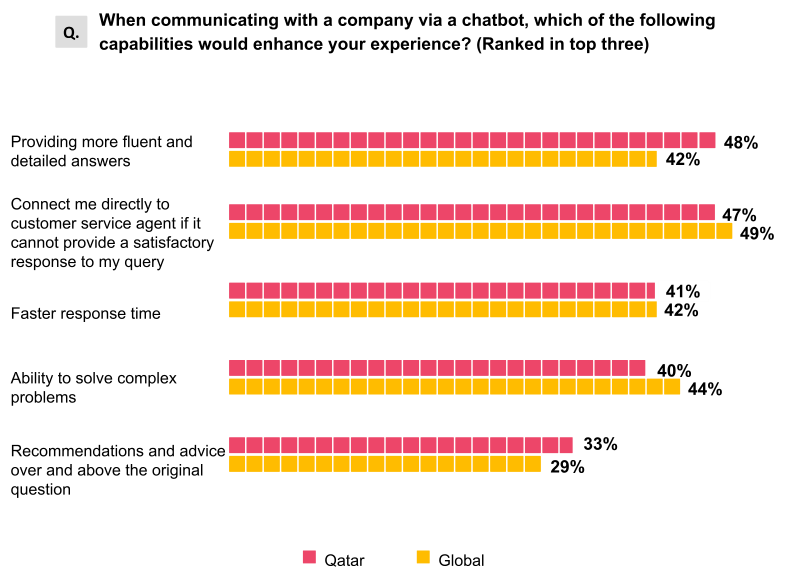

Chatbots and digital assistance are gaining traction among consumers in Qatar, with 48% valuing them for providing fluent and detailed guidance, as well as offering quick connections to human service agents (47%). However, surveyed consumers seemed less confident in a chatbot's ability to solve complex problems, with only 40% expressing trust in this capability compared to 46% regionally.

Data privacy and security concerns remain critical

Data privacy and security remain critical concerns for consumers in Qatar, with 60% expressing concern about their privacy and data sharing, with 50% uncomfortable making a purchase directly through social media.

Moreover, over 75% of consumers surveyed indicated the importance of knowing that their devices are safeguarding their information, a sentiment shared by global and regional consumers alike. Interestingly, Qatar consumers are more willing to share their data for personalised services, with 65% expressing openness to this, compared to 61% globally and regionally. However, 35% of Qatar consumers, slightly higher than the regional average (31%) but lower than the global average (39%), have encountered suspicious online activities such as spam, phishing, or fraudulent calls.

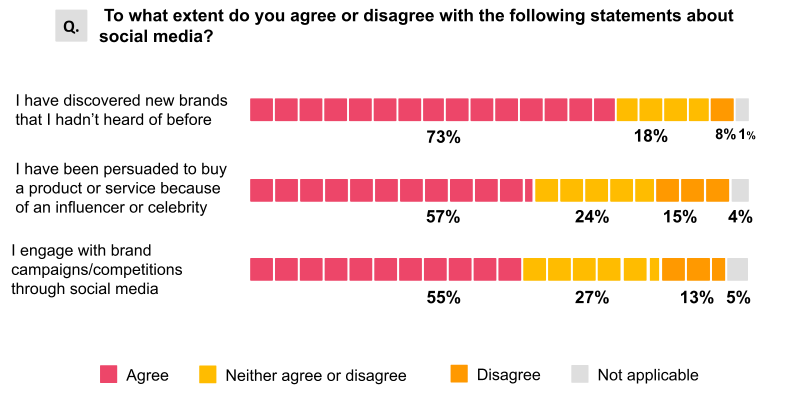

Despite these concerns, social media continues to play a pivotal role in consumer behaviour in Qatar. Nearly three-quarters (73%) of respondents have discovered brands via social platforms, and more than half have been persuaded to purchase or engage with a brand through social media. With 95.2% of Qatar’s population1 active on social media, these platforms remain essential for businesses aiming to engage with the country's tech-savvy consumers, despite the lingering concerns over privacy and security.

In-store shopping a top choice

In-store shopping remains the top choice for consumers in Qatar (54%), echoing the sentiments of the wider region. However, online shopping via mobile phones is also gaining popularity, with 43% of consumers in Qatar opting for such purchases.

The adoption of mobile payments and contactless solutions plays a crucial role in encouraging in-store shopping, cited by 42% of surveyed consumers in Qatar. Self-checkout technologies are also valued by 35% of Qatar consumers, enhancing convenience and efficiency in-store, although in-store navigation scores lower as a motivating factor, with only 20% of consumers in Qatar and regionally seeing it as beneficial.

Virtual Reality (VR) is gaining traction in Qatar, with 14% of survey participants frequently using VR for shopping needs, compared to 9% globally. This indicates a significant opportunity for retailers to integrate VR into their customer engagement strategies, enhancing the shopping experience and providing a competitive edge.

What are consumers spending on?

Looking ahead, Qatar consumers expect to increase spending on groceries (60%), travel (55%), and health and beauty products (53%) over the next six months, while regionally we see the focus being on clothing (65%), health and beauty (63%), and travel (61%).

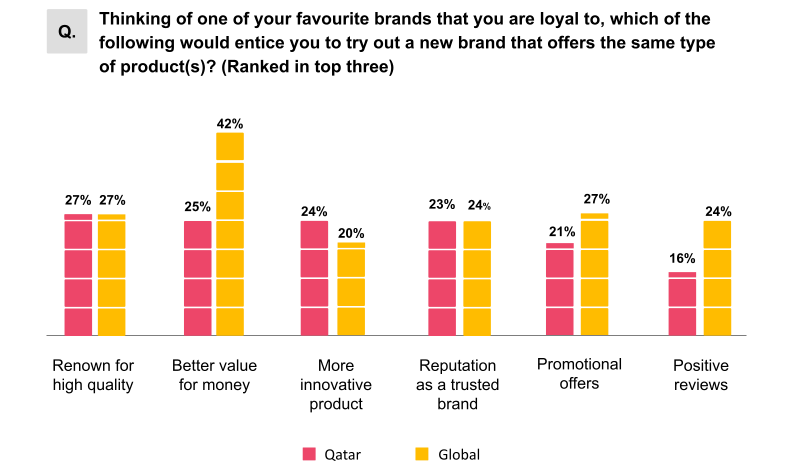

When considering new brands, high-quality products (27%) and better value for money (25%) were key factors. A significant proportion of consumers surveyed are also open to purchasing products online without seeing them in person. For example, 52% have bought technological products, 42% have purchased luxury items, and 27% have bought cars online.

Despite this, some hesitation remains for large purchases, as 52% of Qatar consumers have not bought houses or apartments online but are open to doing so.

Health and nutrition drive food choices in Qatar

Survey data indicates that consumers in Qatar are increasingly mindful of their dietary choices. Over half (55%) of respondents consider their general health when selecting food, while 46% pay attention to nutritional information. This trend aligns with other Middle Eastern consumers, though Qataris are 10% less likely to consider the cost of food products, despite inflation being their top concern (47%).

Interestingly, factors like food trends and environmental impact are less important to Qatar consumers, with only 28% and 32% considering these aspects, respectively. However, there is a growing awareness around sustainability, as 69% of Qataris would find an independent sustainability score on food labelling useful, compared with 60% globally and 72% regionally. Additionally, 6 out of 10 consumers in Qatar, in line with global and regional averages, are willing to purchase food near its expiry date if offered an incentive, indicating keenness to reducing food waste when practical benefits are present.

Key actions for retailers

In the rapidly evolving retail landscape of Qatar, retailers must prioritise aligning with the growing consumer demand for sustainability and digital innovation. By offering eco-friendly products, utilising renewable energy, and implementing sustainable practices like eco-friendly packaging, they can effectively resonate with environmentally conscious consumers.

While social media remains a crucial platform for brand discovery and purchasing, data privacy is a top concern. Transparent data practices are essential for building trust. Additionally, although more than half of consumers in Qatar express concerns about AI's capabilities related to cybersecurity and job replacement, chatbots are gaining traction for their quick responses, detailed answers, and problem-solving abilities. Retailers should leverage chatbots to provide efficient support and personalised interactions, thereby building trust.

To enhance customer engagement, retailers should invest in digital tools such as mobile payments, virtual reality shopping, and chatbots, which appeal to Qatar’s tech-savvy population. Ensuring robust data privacy and transparency will be key to building trust, while personalised services can encourage consumers to share their data.

There should also be a focus on health-conscious offerings by providing clear nutritional information and sustainability scores on food products to meet the rising awareness of health and wellness. In-store shopping remains popular, so enhancing the in-store experience through self-checkout technologies and seamless integration with digital tools will help retailers thrive in a hybrid shopping environment, ensuring they stay competitive and relevant in Qatar’s rapidly evolving market.

Contact us

Norma Taki