GCC Capital Markets Watch Q1 2019

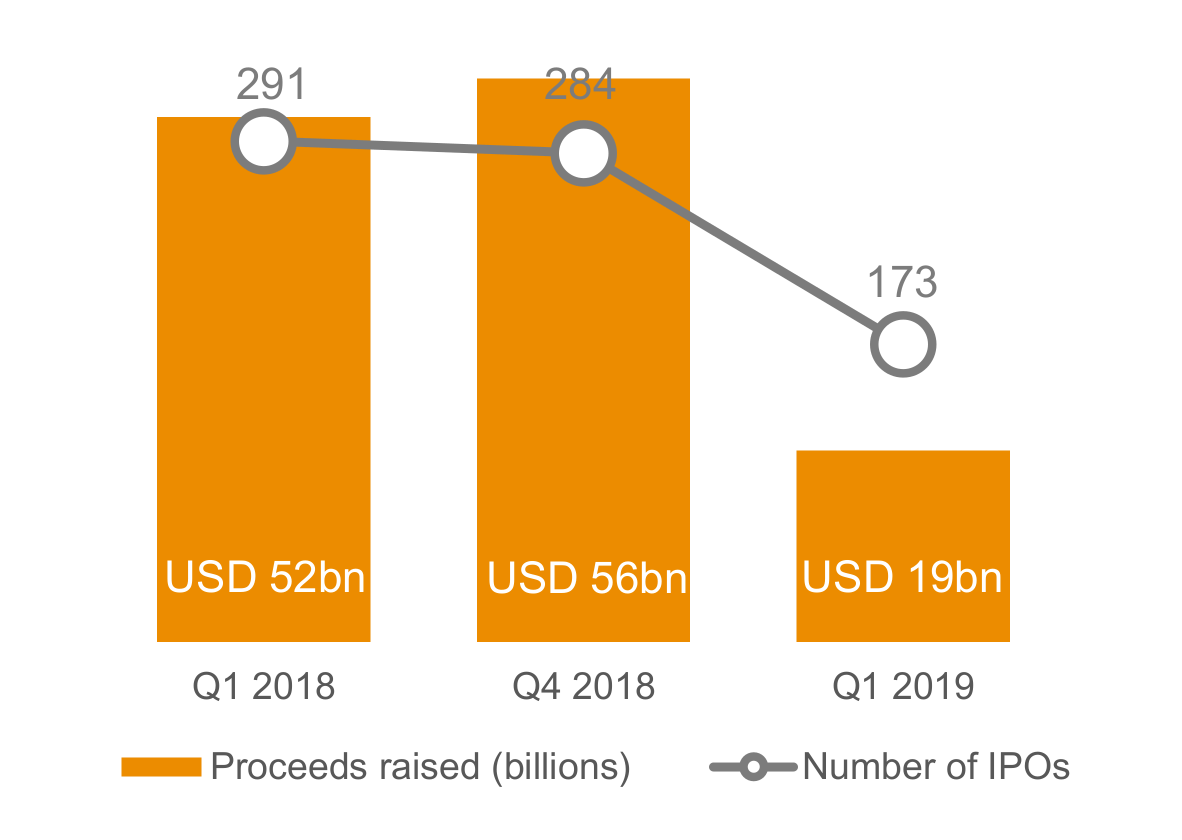

After a busy end to last year, 2019 started softly with just one IPO in the GCC during the first quarter. Global activity was also muted, with IPO proceeds more than halved compared to the same quarter in 2018. This is perhaps reflective of continuing geopolitical uncertainties including Brexit, the US-China trade war, and the longest ever shutdown of the US government.

In the GCC, efforts to attract investments continue, with the UAE Government set to confirm the sectors eligible for 100 percent onshore foreign ownership. Continued privatisation efforts across Saudi Arabia, Oman and Kuwait will also drive activity.

Looking ahead, we expect some rebound in the level of GCC IPO activity with a number of companies in the region having announced their plans to list in the next 12 to 18 months. On 10 April 2019, Network International, the largest payment services provider in the region, priced its London Main Market premium IPO, raising proceeds of over USD 1bn – becoming the largest IPO on the London Stock Exchange so far in 2019.

The region’s debt market continues to be active, with debt products proving to be of interest to investors. In addition to the seasoned bond issuers, the quarter also witnessed a debut debt offering – Almarai’s USD 500m sukuk. With the significant oversubscription of Saudi Aramco’s first ever bond offering on 9 April, we move into the second quarter of the year on an optimistic note.

Steve Drake

PwC Middle East Capital Markets Leader

IPOs by country

IPO activity eased in Q1, consistent with the trend observed in Q1 2018

Overview

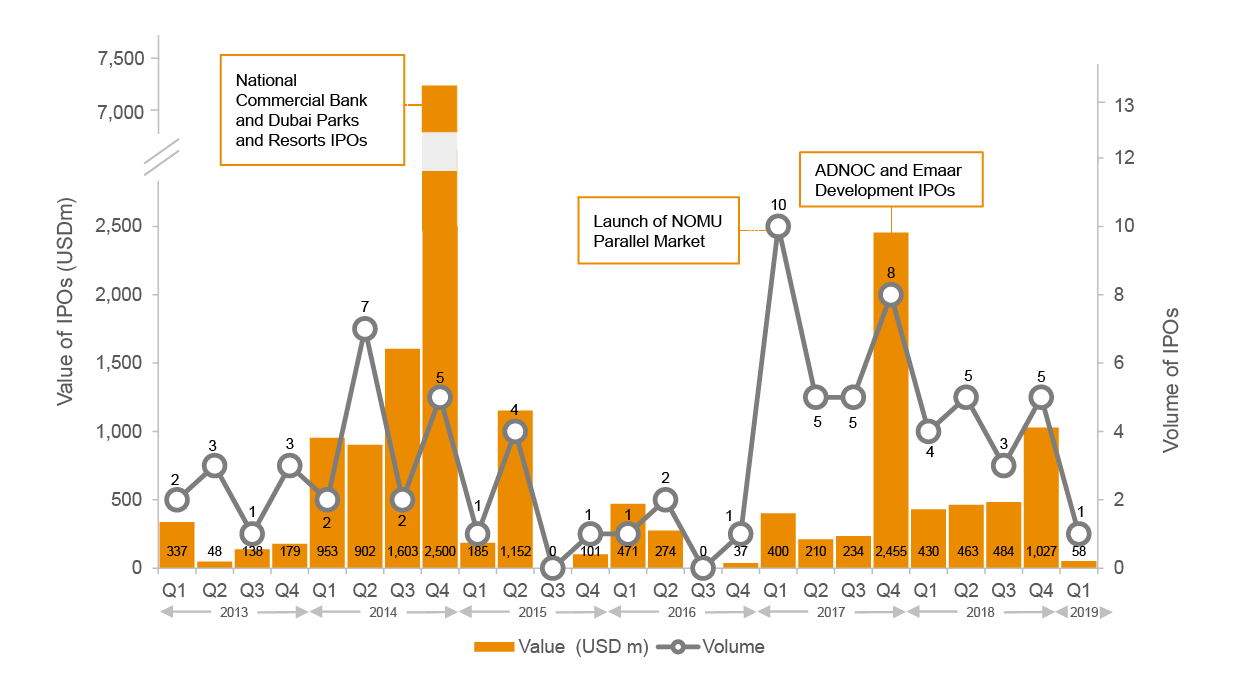

Although 2018 closed on a promising note, 2019 started slowly with only one IPO in the GCC. Al Moammar Information Systems Company raised USD 58m on Tadawul. This is compared to five listings in the last quarter of 2018, raising over USD 1bn, and four in Q1 2018 with proceeds totalling USD 430m. This sole IPO was, nonetheless, a milestone for the Kingdom as it was the first ever IT company to list on Tadawul.

Although the price of oil increased during the quarter, this was cautiously received by investors, given that the increase was mainly driven by OPEC agreements on reducing production.

Expansionary policies, government incentives and continuing privatisation efforts in the region are helping to improve market sentiment. A number of GCC companies have announced their IPO plans for the next 12-18 months.

Al Moammar Information Systems Company was the first IT company to list in the Kingdom and was 149% oversubscribed

GCC IPOs during Q1 2019

Al Moammar Information Systems Company

| Sector | Information Technology |

| Exchange |

Tadawul |

USD 58m

4.8m

GCC IPO trends

The GCC equity market started slowly with a single listing in the quarter

GCC IPO activity since 2013

GCC quarterly IPO activity since 2013

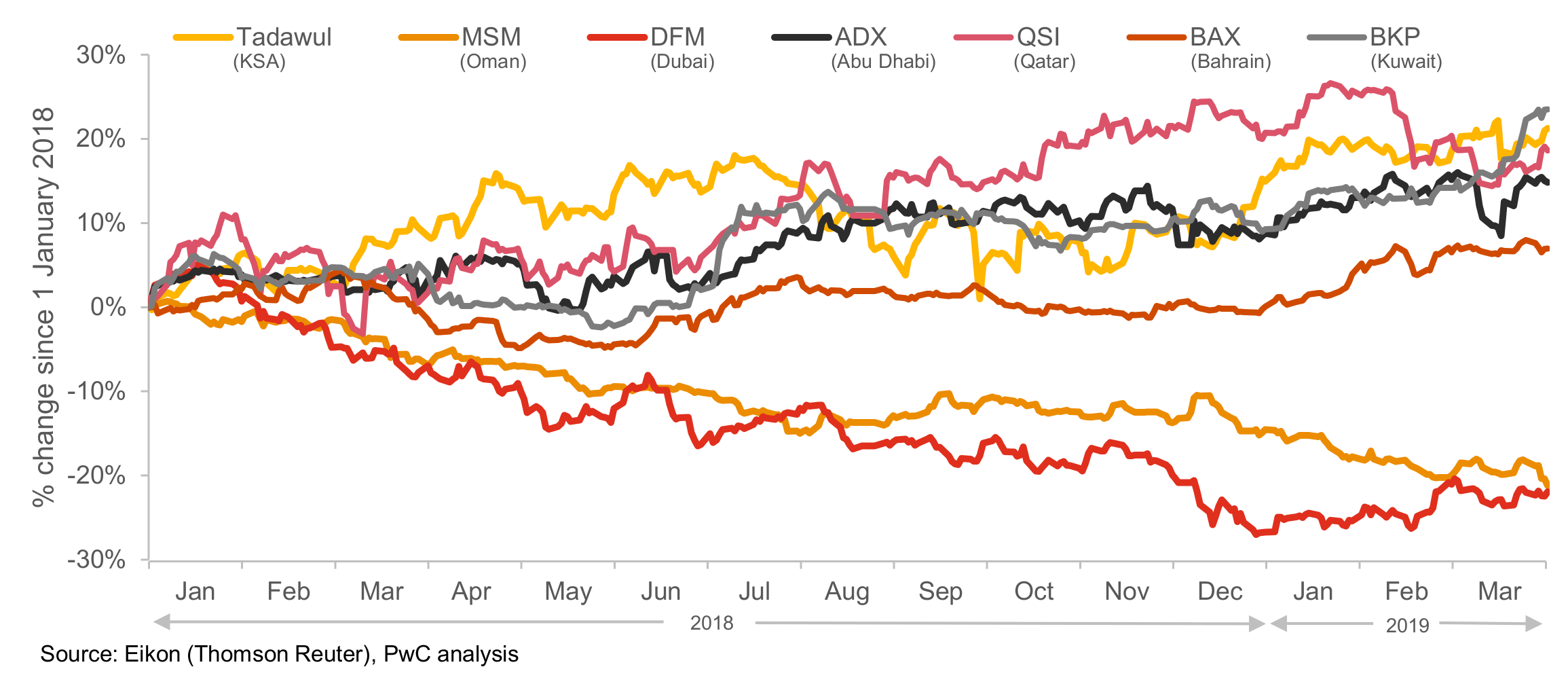

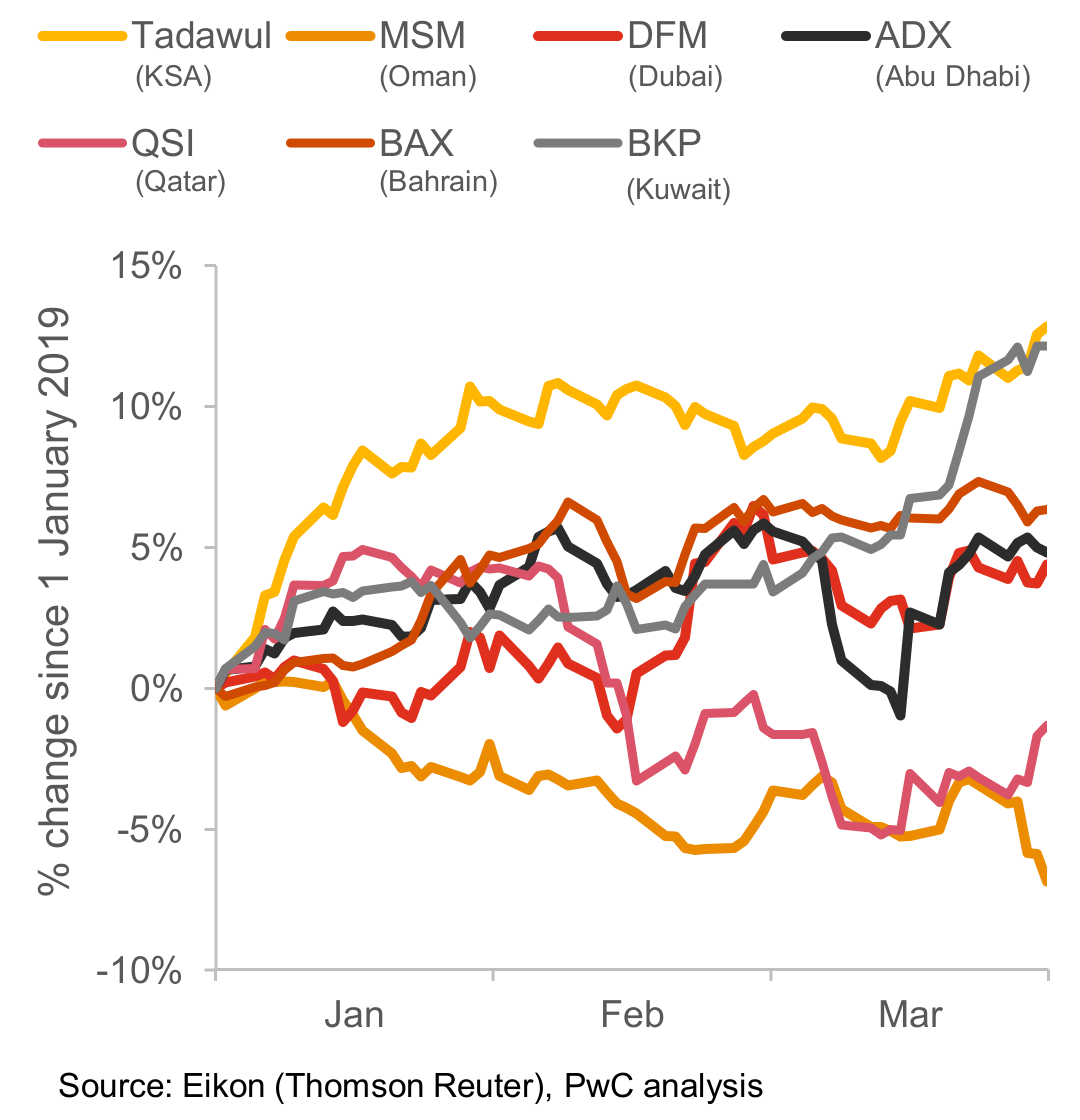

Market performance

The markets performed steadily in Q1. Tadawul continued to lead the GCC stock markets, followed closely by Boursa Kuwait.

GCC equity markets performance by cumulative total return since 1 January 2018

GCC equity markets performance by cumulative total return since 1 January 2019

Share price performance of 2018 and 2019 GCC IPOs* by sector, relative to the respective all share index, from the IPO date to 31 March 2019

*The IPOs of Integrated Holding Co KCSC, National Building and Marketing, Al Nefaie Umm Alqura REIT and Al Moammar Information System Company have been excluded due to insufficient data.

Global IPOs

The Americas was the IPO leader in Q1 2019 in terms of proceeds, whereas Asia Pacific led by volume. EMEA activity suffered from geopolitical uncertainties and weakening of local economic fundamentals.

Despite strong performance in share prices across a number of global markets, activity levels on the IPO and Further Offering markets were minimal – even for a quarter that is typically weak. Remaining geopolitical uncertainties have caused investors to proceed with caution. EMEA suffered especially from Brexit haggling and weakening economic fundamentals, whereas US markets got off to a late start as the government endured its longest shutdown in history.

In Q1 2019, global IPO proceeds fell by 64% against a 41% reduction in volume compared to the same quarter in 2018. In total, 173 IPOs raised USD 19.1bn compared to 291 IPOs with proceeds of USD 52.3bn in Q1 2018. The FO market suffered as well, as proceeds fell by 34% and the number of transactions by 29%. In total, 602 FOs raised USD 94.7bn in Q1 2019, compared to 845 transactions with total proceeds of USD 143.3bn in Q1 2018.

The Americas became the leading region in terms of IPO proceeds raised, whilst Asia Pacific led by volume. The Americas accounted for 51% (USD 9.8bn) of the global proceeds and 24% (42) of the total number of IPOs in Q1 2019, whilst Asia Pacific accounted for 43% (USD 8.3bn) of proceeds and 66% (USD 115) of the number of transactions. EMEA witnessed little activity in the quarter due to Brexit uncertainties and a weakening of local economic fundamentals. The region accounted for 5% (USD 0.9bn) of global proceeds and 9% (16) of the number of IPOs globally.

Top exchanges by % of total IPO proceeds raised

Global IPO activity

Top 3 global IPOs in Q1 2019 by proceeds

Lyft

- Exchange: NASDAQ

- Pricing date: 28 Mar 2019

- Money raised: USD 2.34bn

- Free Float: 11.4%

PIMCO Energy and Tactical Credit Opp. Fund

- Exchange: NYSE

- Pricing date: 30 Jan 2019

- Money raised: USD 892m

- Free Float: 0%

Levi Strauss & Co

- Exchange: NYSE

- Pricing date: 20 Mar 2019

- Money raised: USD 717m

- Free Float: 10.9%

GCC bond and sukuk issuances

The demand for GCC sovereign bonds is high

The GCC debt market continues to be strong, with sovereign issuances being a dominant factor. The first quarter has seen notable multi-tranche issuances by the State of Qatar (USD 12bn) and the Kingdom of Saudi Arabia (USD 7.5bn).

The inclusion of GCC sovereign bonds to JP Morgan’s Emerging Market Bond Index (EMBI) from January 2019 is expected to further boost the demand for GCC sovereign bonds, as evidenced by the over-subscription of the recent KSA and Qatar bond issuances.

Corporate debt activity was also very active with a number of issuances in this quarter stemming from banking institutions, including a Tier 1 sukuk by Dubai Islamic Bank PJSC and programme drawdowns by Qatar International Islamic Bank, Mashreqbank PSC and First Abu Dhabi Bank PJSC.

We expect a significant spike in GCC debt activity with the debut issuance by Saudi Aramco in Q2.

Total value of sovereign bonds issued in Q1 2019 by the State of Qatar

The State of Qatar issued USD 12.0bn worth of sovereign bonds in three tranches: a USD 6.0bn tranche with a coupon rate of 4.8%, maturing in 30 years; a USD 4.0bn tranche with a coupon rate of 4.0%, maturing in 10 years and a USD 2.0bn tranche with a coupon rate of 3.4%, maturing in five years.

Value of corporate bond issued by QNB Finance Limited in Q1 2019

QNB Finance Limited issued a single tranche of corporate bonds with a coupon rate of 3.5%, maturing in five years.

Value of Sukuk issuance in Q1 2019 by FAB Sukuk Company Ltd.

FAB sukuk Company Ltd, an SPV of First Abu Dhabi Bank PJSC, issued a five year sukuk of USD 850m under its USD 2.5bn Trust Certificate Issuance Programme, with a coupon rate of 3.9%.

How PwC can help

At PwC we understand that good preparation is essential to a successful IPO and debt issuance. We have experience of a wide range of international, regional and domestic IPOs and debt issuances, and can provide expert guidance from initial planning, through execution and beyond.

IPO and debt preparation

Our IPO and debt Readiness Assessment is an early stage diagnostic review of the critical areas needed for a successful issuance. We will highlight where current processes, procedures, structures and practices fall short of the requirements for a company whose securities are to be publicly traded and provide recommendations on how to address these gaps.

IPO and debt execution

We work with issuers and their advisors to provide IPO and debt advisory and assurance services. This may include working capital reports, financial due diligence report, financial positions and prospects procedures assessment, assistance with MD&A drafting in relation to a prospectus, comfort letters and project management.

Contact us

Haitham Aljabry

Finance & Accounting Consulting, Partner, PwC Middle East

Tel: +966 54 732 2225