Tax Insights: New rules on the taxation of employee stock options are now in effect ─ Are you ready?

July 19, 2021

Issue 2021-18

In brief

On June 29, 2021, Federal Bill C-30, Budget Implementation Act, 2021, No. 1, received royal assent. Bill C-30 enacts the new rules for the taxation of employee stock options that had been announced in the federal government’s November 30, 2020 Fall Economic Statement. These new rules, which are effective for stock options granted after June 30, 2021:

- impose a $200,000 annual vesting limit (based on the value of an option’s underlying shares at the date of grant) on options that can qualify for the 50% employee stock option deduction

- introduce an employer deduction for the amount of stock option benefits that exceeds the new annual vesting limit, subject to certain conditions

The new rules do not apply to Canadian-controlled private corporations (CCPCs) or non-CCPC employers with consolidated group revenue of $500 million or less. Employers will need to understand how these new rules affect them and their employees and implement processes to ensure that they adhere to them. Employers must comply with new notification requirements so that they are eligible for the new corporate tax deduction.

This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic.

In detail

Background

Under the employee stock option rules in the Income Tax Act, employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid. Provided certain conditions are met, an employee can claim an offsetting deduction equal to 50% of the taxable benefit. This effectively reduces by half the tax payable by the employee, which is a significant tax savings. Before the implementation of the new rules on July 1, 2021, there was no dollar limit on this favourable treatment.

Employees

The new $200,000 limit applies to an employee on a calendar year basis, for each separate employer (but options issued by multiple non-arm’s length employers have only one $200,000 limit). If the value of the stock to be acquired under options vesting in a year by an employee exceeds $200,000, the stock option deduction will not apply to taxable benefits realized on a related portion of those options.

The determination of when the option first becomes exercisable must be made at the time of grant. If the option agreement:

- specifies the calendar year in which the right to acquire a security first becomes exercisable, the vesting year will be that calendar year (unless the vesting is the result of an event that is not reasonably foreseeable at the time of grant)

- does not specify the calendar year of vesting, the vesting year will be determined assuming the options become exercisable on a pro-rata basis over the period of time between the option grant date, and the last date under which the option could become exercisable under the agreement; this period is limited to 60 months

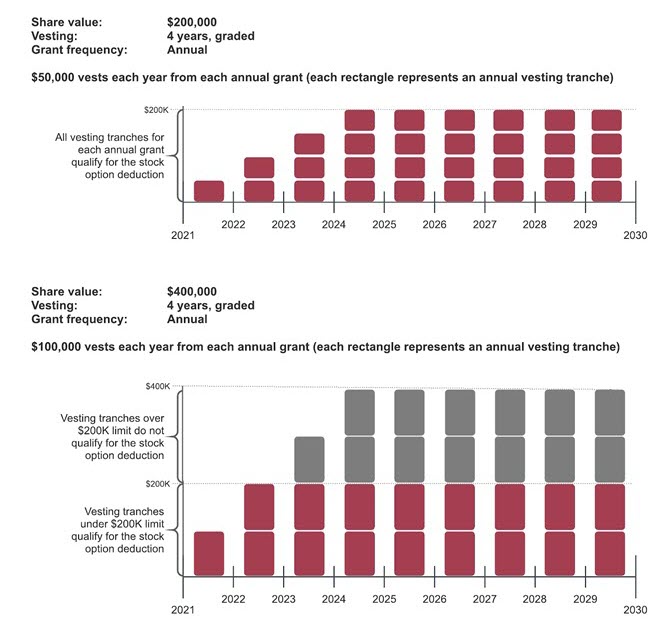

Examples of $200,000 annual vesting limit

The new rules also clarify that an employee donating publicly listed shares acquired under a stock option that exceeds the $200,000 limit is not eligible for the related stock option deduction. The employee should still be entitled to claim the charitable donation tax credit for the full value of the shares donated.

Employers

Provided that an employer complies with certain notification requirements, the portion of an employee’s stock option employment benefit in a year that does not qualify for the stock option deduction under these new rules will be deductible by the employer in that year. The employer can also elect to have this tax treatment apply for stock options below the $200,000 threshold.

The rules apply to options issued by an employer that, at the time the options are granted to an employee, is:

- a corporation or mutual fund trust, other than a CCPC, and

- a member of a group with consolidated gross revenues greater than $500 million*

*As reflected in the last annual consolidated financial statements presented to the shareholders or unitholders of the ultimate parent entity of that group.

Employers not subject to the new rules will not be permitted to opt in to the new tax treatment.

To be eligible for the new corporate tax deduction, the stock option agreement must be between the employee and the employer. However, the new rules do permit a deduction when securities are issued under a stock option agreement by a non-arm’s length party, such as a parent company, so that the deduction is available to Canadian subsidiaries of foreign issuers, where stock option agreements are usually with the parent company issuer. It is important to note that it is the employer – and not the grantor of the option – that is required to notify an employee within 30 days of granting an option on a non-qualifying security. This timely notice is a precondition for any corporate tax deduction and requires subsidiaries to stay abreast of any options granted to their employees by the parent company to ensure that the notification requirement is met.

The new rules also restrict the employer’s deduction in situations involving non-resident employees. A non-resident employee may not be required to include in their Canadian taxable income the full amount of the option benefit in situations where they perform their services partially outside Canada; the new rules only permit a corporate tax deduction to the extent the employee’s stock option income is reported as taxable income in Canada.

Furthermore, an employer deduction is not available in respect of employees who received their stock options while working for a foreign employer, but have since transferred to a related Canadian employer. This is a typical “expat” or “international secondee” scenario. In this situation, the Canadian employer cannot claim a deduction, because the legislation requires that the Canadian entity:

- be the individual’s employer at the time the option is granted to the employee, and

- notify the employee within 30 days of an option being granted that the employee cannot deduct (i.e. a “non-qualifying option”), which is unlikely to occur if the individual was not employed by the Canadian entity at the time the option was granted

Frequently asked questions

Do the new rules apply to public companies?

Yes, but only if their revenue exceeds $500 million. Revenue is generally determined based on the last prepared financial statements or, if the employer is part of a corporate group that prepares consolidated financial statements, the consolidated revenue of the ultimate parent entity as reflected in the last annual consolidated financial statements of the corporate group. Definitions from subsection 233.8(1) of the Income Tax Act are used to determine consolidated revenue.

Do the new rules apply to CCPCs?

No, all CCPCs are specifically exempt from the new rules.

We are a subsidiary of a foreign parent company. Are we subject to the new rules and what does that mean for us?

If your revenue or the revenue of your consolidated group (see above) exceeds $500 million, you are subject to the new rules.

What do employers have to do under the new rules?

Employers need to:

- decide whether to designate any options as non-qualifying for option grants below the annual $200,000 vesting limit; this essentially determines whether the employee or the employer benefits from the tax savings

- notify employees within 30 days after the stock option agreement is entered into (but preferably at the time of and in their grant agreements):

- of any options that exceed the $200,000 annual vesting limit

- if they have designated options that do not qualify for the stock option deduction

- ensure that the company’s human resource and tax functions coordinate information sharing so that the Canada Revenue Agency is notified in a yet-to-be-prescribed form of any option grants with non-qualifying securities (to be filed with the annual corporate tax return)

- track option grants and exercises and ensure that payroll tax withholdings are taken at the correct income tax rate for any exercises resulting in non-qualifying securities being issued

- track stock option exercises, qualified/non-qualified status of stock options and accumulate related taxable amount information for purposes of claiming a corporate tax deduction

- for financial accounting purposes, assuming the company is amortizing the fair value of stock options, calculate a deferred tax asset for non-qualifying stock options

What happens to options granted before July 1, 2021?

These options continue to be taxed under the rules that do not limit the stock option deduction.

The takeaway

The new stock option rules have implications for a company’s compensation committee, its corporate tax, accounting and payroll departments and, of course, its employees who receive stock options. In light of the new rules being enacted on July 1, 2021, employers could consider:

- granting more options to compensate an employee for the increased tax burden on non-qualifying options

- issuing other forms of stock-based compensation (i.e. restricted stock or, when appropriate, interests in partnerships, such as profits interests)

However, larger option grants will be scrutinized by compensation committees of a company’s board of directors or shareholder advocacy groups, and issuing other forms of equity incentives may require a more in-depth review of an employer’s overall compensation strategy.

Companies should have new processes in place to deal with the additional information reporting and notification requirements, because failure to meet these requirements could result in the loss of the new corporate tax deduction.

Contact us