{{item.title}}

{{item.text}}

{{item.text}}

The decision to take a company public can be driven by various objectives, including raising capital for growth or acquisition, creating liquidity for investors or an exit for current owners.

Market conditions are rarely static, and being ready to launch an initial public offering (IPO) and operating as a public company means you’ll be positioned to act quickly and take advantage of favourable sentiment when it arises.

An IPO is a transformational event for a company and has significant implications across the business. The complexity involved and the time it will take to prepare need to be carefully considered and addressed to optimize value for the many stakeholders impacted by the transaction. For many organizations, it’s not always clear when and where to start the IPO or whether your company is even ready for this process. It’s what makes an IPO assessment such an integral part of the process.

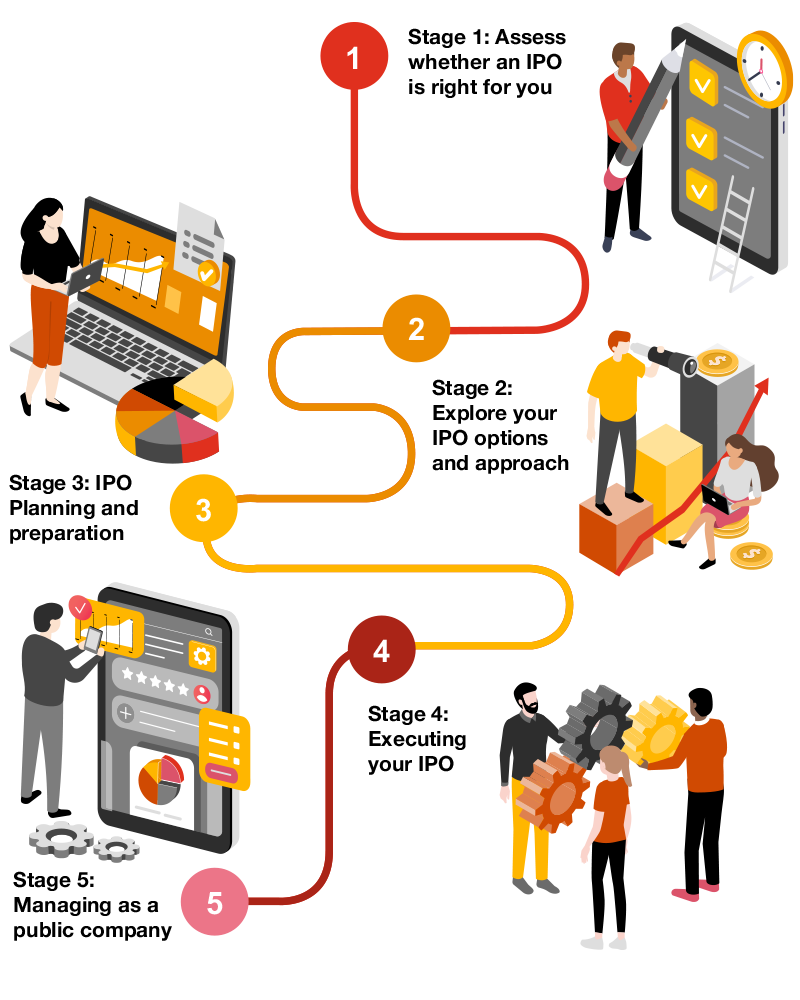

There are five major checkpoints on the IPO readiness journey, from choosing your exit strategy and exploring your IPO options to an IPO assessment, planning and preparation, execution and post-IPO considerations.

If you manage the journey well, you can ensure a smooth transition to becoming a public company. Explore these checkpoints in more detail, as we examine the key considerations an IPO consultant considers for successfully taking your company public.

What are some of the ongoing tasks to manage now that you’ve successfully executed an IPO?

{{item.text}}

{{item.text}}