How Canada's banks can position themselves for success

While it offers the prospect of increased competition, the good news for Canada’s largest banks is they’re already trusted custodians of customer data with strong brands that they can take advantage of to position themselves for success in an open banking framework. The opportunity will be to develop a clear vision of what role they want to play so they can continue to meet customers’ changing expectations.

For smaller and mid-sized banks, open banking represents a significant opportunity for them to attract new customers as they take advantage of the data made available by their larger counterparts to reach new markets. On the other hand, including them in a data-sharing regime could impose significant costs on them, which is why open banking in other jurisdictions has tended to focus on larger banks at the initial stages.

Successful banks will have a number of characteristics, such as a customer-centred focus aimed at creating personalized solutions to win the hearts and minds of their customers. An important part of that will be mastering their analytics capabilities so they can use the insights available to offer the right suite of products and services to customers at the right time.

Banks will also need to differentiate themselves through smart use of data. The challenge will be to get their data sets in order so they can make information available on request. A foundational step for open banking is undergoing a data-mapping exercise to see where customer data is housed across systems so they can respond to customer requests and requirements for access and changes to, as well as deletion of, their own data in light of privacy requirements.

For the banks, the idea of sharing data may be uncomfortable, but it’s important to remember that open banking offers them many opportunities and benefits. Besides tapping into new innovations, the efficiencies created by open banking can help the banks reduce costs. Open banking also has the potential to reduce other risks faced by big banks, such as fraud and money laundering, as the increased access to and sharing of data among institutions will make it easier to spot anomalies.

The benefits of open banking for bank customers

For customers, open banking is a significant opportunity to bring more of the innovations they enjoy in other areas of their lives to their banking services through new and better processes, products and services.

Among the possibilities created by open banking is the ability to see a fuller picture of customers’ creditworthiness through their bank account activities. For example, retail customers with credit problems may be able to access credit they would otherwise be unable to get based on their credit bureau file alone. Alternatively, open banking could help speed up the credit process for them.

For businesses, open banking could similarly improve the credit process by, for example, letting a bank see their cash inflows and outflows at other institutions. That would give the bank a richer profile of a business’s finances, including cyclicality and seasonality, which it could take into account in its credit decision.

While customers would see many benefits, there’s no guarantee they would actually take advantage of the opportunities created by open banking. For customers to consent to giving access to their financial data, they would need to trust that the services made possible by open banking are secure and that it adequately protects their data.

But there’s no guarantee of that trust. According to our latest Global State of Information Security Survey, nearly half (49%) of Canadian respondents said security incidents had impacted customer records. So in an era of data breaches and privacy concerns, a strong information security infrastructure and proper consent mechanisms are critical for open banking to reach its full potential.

It will also be important for banks and other service providers to create truly valuable products that will encourage customers to give their consent. Even simple services can address customer pain points. In the United Kingdom, for example, one provider uses access to customer bank transaction data to help creditors confirm income and calculate disposable income. The service can also determine a customer’s payday schedule to help set repayment dates.

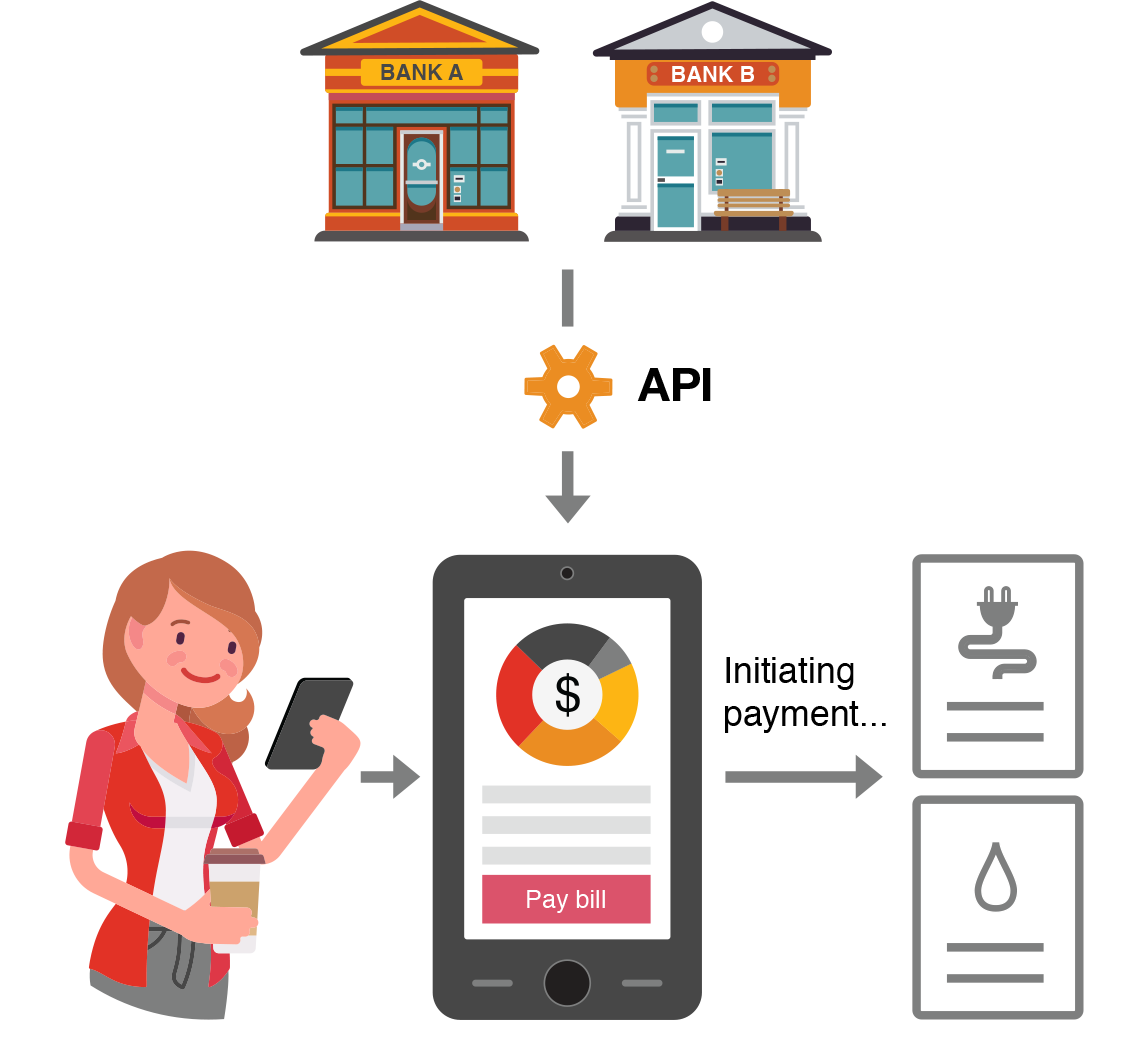

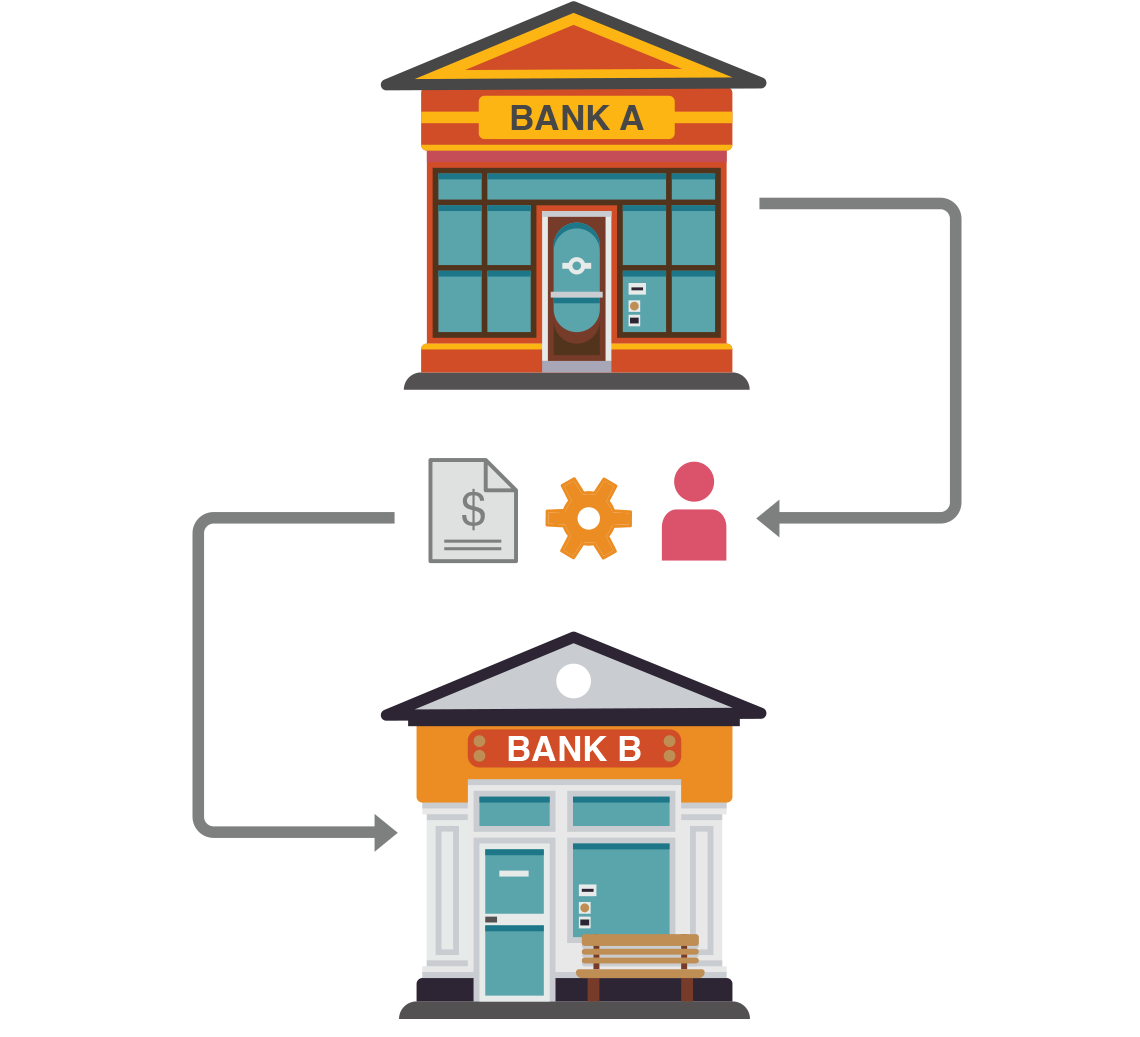

What does open banking look like for customers?

Here are some examples of the types of services open banking could make possible:

Open data

In this scenario, a customer has authorized a third-party provider to read the transactions in her chequing accounts as well as investments held at other banks and asset management providers. Based on that information, the third party can aggregate the information, through its online platform, and is able to give the customer financial advice.

Open process

In this scenario, the customer has authorized a third-party payments management platform to initiate payments on her behalf. The platform takes funds from the customer’s bank account to pay her various bills on the date they’re due.

Open products

In this scenario, the customer has gone to Bank B to switch her account from Bank A. Through open banking, the customer can initiate the switch without being physically present at Bank A. Her account at Bank A will be closed and the funds in it, along with all electronic funds transfer information, will be transferred to Bank B.

The power of partnerships: Open banking and the opportunities for FinTechs

Open banking is a significant opportunity for FinTechs. Access to customer data will let them create innovative offerings, such as aggregation platforms that facilitate financial planning and advice and services that help customers compare product features, like fees and interest rates, across financial institutions. FinTechs will be able to expand their reach if they create services that target a specific customer irritant or need.

But to truly extend their reach, FinTechs should think about the expanded opportunities open banking offers for working with the banks themselves. In some cases, banks will turn to strategic acquisitions of FinTechs to add to their own services. And in other cases, banks will give access to their platforms to FinTechs vetted as trustworthy and valuable partners in order to complement their services and offer a better customer experience.

But before they get to that point, an important step for the banks will be to determine which partnership models work best for them, when they must control parts of the customer journey and when they should delegate commoditized elements of it to other parties.

The complexities of regulating open banking in Canada

Introducing open banking will be a major job for Canada’s financial regulators. Among the issues to work out will be to decide which players can participate in open banking, including who can use bank APIs to access and make use of customer data. Other issues to think about include rules around customer consent and the various privacy matters at play.

We believe open banking in Canada will begin in a limited and gradual fashion, with uses restricted to certain cases and open-data requirements applied to the country’s biggest banks to start. Uses would likely expand over time, particularly as Canada’s banking industry and regulators learn from the experiences in other countries.

Adding to the challenges of regulating open banking is Canada’s complex system of financial services regulation. While banks fall under federal rules, for example, credit unions are subject to provincial regulation. A number of regulators, such as the Office of the Superintendent of Financial Institutions (OSFI), the Canada Mortgage and Housing Corp. (CMHC), the Office of the Privacy Commissioner of Canada and Payments Canada, will have significant roles to play.

The Canadian Bankers’ Association has already weighed in on some of the regulatory issues that would be at play in an open banking framework. The CBA has called for a more robust Canadian digital identity system, which would be helpful for preventing fraud in an open-banking environment. In a 2018 white paper, it cited solving the digital identification issue as a precursor to open banking in Canada.

“We like a federated model for digital ID,” says Neil Parmenter, President and CEO of the CBA. “What, in essence, that means is that it allows the provincial government, the federal government and industry to all participate.”

“We like a federated model for digital ID. What, in essence, that means is that it allows the provincial government, the federal government and industry to all participate.”

A credit union's perspective on open banking

The Canadian financial services industry is carefully watching the progress of open banking discussions in Canada. Recently, Jeff Wong, Chief Digital, Information and Technology Officer at Coast Capital Savings, sat down with Jessica Macht, PwC Canada's Financial Services Leader in Western Canada, to talk about what open banking means for credit unions. Wong agrees open banking is coming and sees it as an opportunity to serve customers. like credit union members, even better, particularly around their finances and spending habits. While he acknowledges the technical and infrastructure challenges open banking would create, Wong believes the ongoing discussions about the issue make it a good time for financial institutions to focus even more on delivering the best experiences to their customers or—in the case of credit unions like his—their members.

Contact us

Partner, Banking & Capital Markets Assurance Leader, Financial Risk Management Leader, PwC Canada