Simple off-the-shelf solution for (Current) Expected Credit Loss calculation and analysis

IFRiSk 9 / CECL Calculator

IFRiSk 9 / CECL Calculator – instant access to flexible (Current) Expected Credit Loss calculation

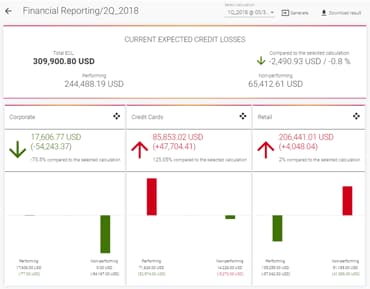

The PwC IFRiSk 9 / CECL Calculator has been developed to support financial institutions with the (Current) Expected Credit Loss calculation. A powerful engine together with a simple interface enables users to quickly evaluate and compare expected loss under different scenarios.

IFRiSk 9 / CECL Calculator enables

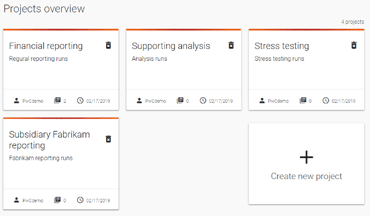

- small and medium sized financial institutions to perform ECL / CECL calculations for regular reporting purposes;

- business users to perform ad hoc ECL / CECL analyses and stress-testing exercises;

- internal or external audits to challenge and verify the results produced by a solution already in place.

Our approach

IFRiSk 9 / CECL Calculator operates as a calculation engine that loads in the required parameters for all ECL / CECL components, i.e., PD, LGD, EAD, macro-economic forecasts and a portfolio snapshot at the reporting date and computes the resulting expected losses for each account.

Quick deployment

PwC provides Calculator as a service accessible on the PwC-managed cloud. Or it can be deployed in your environment.

Scenario analysis

Fast calculation engine also makes Calculator a great tool for various scenario analyses and quick impact calculations.

Easy access

Application is easily accessible via a web browser without the need for any installations by end-users.

Flexible calculation

Thanks to general inputs, Calculator can handle most of the common ECL / CECL methodologies as it is.

Calculation workflow

Fast calculation

IFRiSk 9 / CECL Calculator harnesses the power of a complex system of ETLs and advanced calculations. Results of the computations are obtained in a straightforward manner and an intuitive process has been designed to make the IFRiSk 9 / CECL Calculator easy to use and understand.

Contact us:

CZ_IFRiSk9_Calculator@pwc.com, CZ_CECL_Calculator@pwc.com

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.