{{item.title}}

{{item.text}}

{{item.text}}

Paying Taxes, now in its 14th edition, continues to be a unique study from PwC and the World Bank Group, which investigates and compares tax regimes across 190 economies worldwide using a young, growing domestic case study company. The economies are ranked according to the relative ease of paying taxes based on:

Also considered is a post-filing index, which is the time to obtain a sales tax refund, correct a corporate income tax return and deal with corresponding audits.

This year’s publication dives deeper into the impact of digital technologies on the ease of paying taxes. The report discusses different technologies that are currently available for tax compliance, how these are being implemented and the ways in which they can reduce the administrative burden of filing and paying taxes. It also explains some of the most prominent new tax policy issues that businesses currently face. At the global level, the most prominent tax policy issue is how to tax the digital economy — the Organisation for Economic Co-operation and Development recently released its proposals on this policy issue relating to allocating profit arising from digital activity. It is important that governments and tax authorities understand the implications of any agreements that may emerge globally on how to tax the digital economy. The study also shows that governments should continue to invest in modernizing their tax administration systems.

Canada continues to rank 1st among the G7 countries for ease of paying taxes — it ranks 19th out of the 190 economies in the study. This year’s report shows that Canada remains an excellent place for small and medium-sized businesses (SMBs) to operate. Canada’s tax climate and incentives support entrepreneurial ventures to help them succeed — with small business tax rates declining federally and in several provincial jurisdictions, and all governments trying to reduce or eliminate “red tape” for SMBs.

Despite Canada’s ranking, for Canada to remain competitive globally and continue to be an attractive place for large domestic and multinational firms to do business, the federal government will need to conduct a long overdue comprehensive review of Canada’s tax system. The review could look for ways to ensure the tax regime keeps Canada’s economy competitive while reducing complexity and remaining adaptable to changing economic pressures. US tax reform has raised questions on whether Canada can remain competitive, and the uncertainty of whether the United States-Mexico-Canada Agreement (USMCA) will be implemented creates unpredictability for Canadian organizations doing business south of the border. Although the Canadian government responded to US tax reform by allowing an immediate 100% tax depreciation of eligible manufacturing and processing equipment, and specified clean energy equipment, it remains to be seen if this is sufficient.

In North America, the average number of payments, at 8.2, remains the lowest of any region, due to all three countries — Canada, Mexico and the United States — having online filing and payment systems.

North America’s Total Tax and Contribution Rate (i.e. the cost of all taxes borne by a company as a % of commercial profits) decreased in 2018, primarily because US tax reform reduced US corporate income tax rates.

The average time to comply for North America remained unchanged in 2018, at 182 hours, with corporate income tax accounting for 78 of those hours.

PwC and the World Bank Group present the study results and answer the audience’s questions on the findings.

Explore current and historical tax data from all 15 years of the study to find the results for your economy.

You can compare individual economies, geographic regions and economic regions for any year since 2004 and save your results.

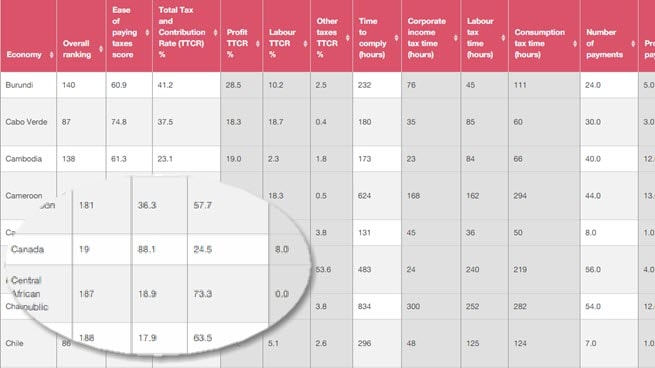

See this year’s ease of paying taxes ranking and the results for our four indicators for 190 economies.

{{item.text}}

{{item.text}}