Inspiring trust through insight

Rethinking the value of corporate reporting in a disruptive world

KUALA LUMPUR, 8 September 2015 - Malaysian companies have started to put some structure into their corporate reporting, however most businesses still treat reporting as a compliance exercise. There are significant opportunities for Corporate Malaysia to enhance transparency and improve stakeholder relationships through their reporting amidst an uncertain market environment, but companies are not capitalising on it.

Three key themes emerged from PwC Malaysia’s recent benchmarking analysis of Bursa Malaysia’s Top 5o companies’ annual reports against the International Integrated Reporting Council (IIRC)’s Integrated Reporting Framework. Themed ‘Inspiring trust through insight’, the benchmarking exercise was a follow-up to a pilot study last year, which surveyed Bursa Malaysia’s Top 30 companies. The results are telling:

- Siloed reporting is evident – Even the best performing companies in the analysis fail to adequately demonstrate how the key elements from the Framework link to each other in the annual report, which is the main premise of Integrated Reporting

- Historical reporting remains the focus –A small number of companies have started to disclose key global trends affecting their business and how this translates into strategic opportunities for them. However, most companies still shy away from providing insight into their future outlook

- ‘Copy and paste’ content is the norm – Many companies simply rolled forward content from the previous year. This was particularly evident for governance reporting - many companies reproduced unchanged board charters and Terms of Reference (from the previous year) instead of providing actual insight into the board’s/committee’s actual activities

“As the marketplace becomes increasingly volatile, investors are clearly demanding more relevant, reliable and outcomes-driven information in annual reports to help them make more informed decisions,” said Dato’ Mohammad Faiz Azmi, executive chairman of PwC Malaysia.

“The integrated report can be a very compelling stakeholder engagement tool especially in the extraordinary times we are operating in. It allows companies to define their own corporate story, by focusing on the true value drivers of their business, instead of allowing the market to define the story for them. Reporting on how the company’s activities comply with Shariah principles for example, can provide investors with a more holistic view of the company’s performance in relation to Islamic finance principles. Disclosing the company's Environmental, Social and Governance (ESG) activities, which can be a useful barometer of the company's management, is also beneficial in creating long term shareholder value.

“These measures can provide significant opportunities for companies to sustain the trust that is so fragile and fleeting in our emerging market,” he continued.

The mindset behind Integrated Reporting is “integrated thinking” – a process which requires a deeper understanding of all the building blocks of the value creation process, including how the outcome of the stakeholder dialogue links to strategy and risk, and how it connects to value drivers and performance and ultimately to impact.

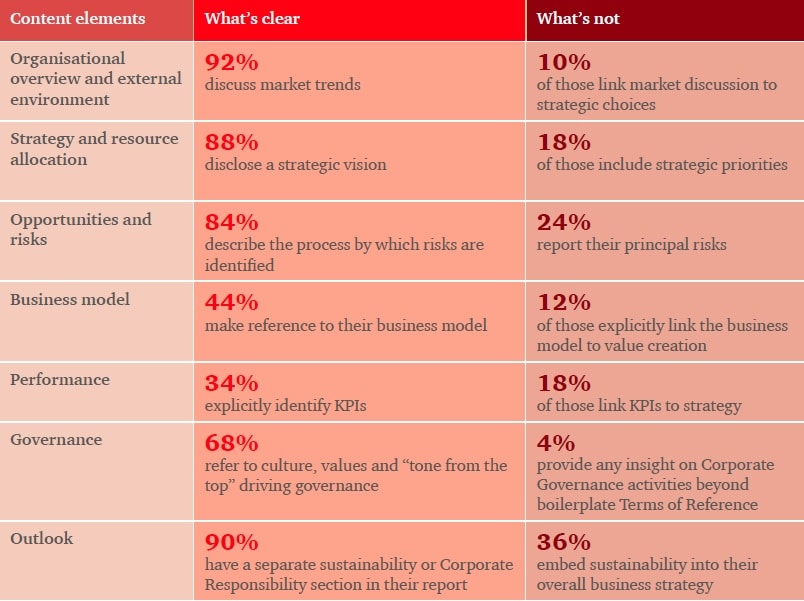

The Integrated Reporting Framework recommends that reports include the following key content elements: Organisational overview and external environment, Strategy and resource allocation, Opportunities and risks, Business model, Performance, Governance, and Outlook.

Key findings from PwC’s benchmarking analysis:

“Clear linkage between reported information is critical in supporting investor analysis. This is an area that is particularly wanting in the local reporting landscape, and an issue that needs to be addressed especially at a time where public trust is low,” said Pauline Ho, PwC Malaysia assurance leader.

“At the speed at which our landscape is evolving, we need more insights rather than just information in the annual report. We need to be cognisant that Integrated Reporting is a journey which needs to be both holistic and authentic, beyond mere aesthetic enhancements of the annual report as a quick fix to improve its usefulness to the reader.

“PwC recommends a roadmap which sets out 5 stages to introduce and embed Integrated Reporting with the view to help companies achieve greater connectivity across the business. One of the ways to embed a culture of integrated thinking within an organisation is by putting in place a meaningful storyline that can be used consistently across all communication platforms,” she continued.

The five stages for implementing Integrated Reporting are:

- Look at the outside world and engage with your stakeholders

- Determine your stakeholder value proposition and refresh your strategy

- Align your internal processes to your strategy

- Develop your integrated dashboard to monitor stakeholder value with a set of relevant management information

- This tool needs to demonstrate how the company’s strategy makes an impact and creates value for its key stakeholders.

- Integrate your reporting (by bringing your previous activity and outputs together) for a better investor dialogue

This roadmap is designed to achieve greater alignment of internal and external reporting to promote more streamlined communications in companies.

ENDS

Notes

- PwC Malaysia analysed the annual reports of Bursa Malaysia’s Top 50 companies in April and May 2015

- A detailed assessment of 110 questions was performed based on the content elements for an integrated report based on the International Integrated Reporting Council (IIRC)’s Integrated Reporting Framework i.e. the level of disclosure of the content elements from the Framework: Organisational overview and external environment, Strategy and resource allocation, Opportunities and risks, Business model, Performance, Governance, and Outlook

- Companies were spread across a range of industries including financial services, telecommunication, Oil and Gas, energy, property and healthcare

- The full report with samples of best practices from companies like Astro Malaysia Holdings Berhad, Sime Darby Berhad, Digi.Com Berhad and Nestle (Malaysia) Berhad can be accessed on our website (www.pwc.com/my/ir2015)

- Watch a video on why companies should invest in Integrated Reporting and find out how PwC can help here (www.pwc.com/my/ir)

About the International Integrated Reporting Framework

The Framework was issued in December 2013 and provides companies with a starting point for driving integrated thinking and reporting. It focuses on getting companies to describe their value creation in the short, medium and long term, allowing them to assess where they stand today, and what improvements they need to make going forward.

Our PwC experts have been working with the IIRC in a number of ways including supporting the technical development of the Framework through its working group and partnering with the IIRC on practical implementation initiatives for business through its Pilot Programme.

About PwC

PwC helps organisations and individuals create the value they’re looking for. We’re a network of firms in 157 countries with more than 195,000 people who are committed to delivering quality in assurance, tax and advisory services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

©2015 PricewaterhouseCoopers. All rights reserved.