GCC economies are undergoing fundamental transformations in order to reduce their historical reliance on revenues from fossil fuels, build their non-oil GDP and create employment opportunities for their young, educated and growing populations.

Industrials and logistics have been identified as two core pillars to diversification agendas and key drivers of Foreign Direct Investments (FDI) into GCC economies. This is due to the region’s central location between three continents, sea access to marine’s busiest routes, cheap feedstock and utilities, and the financial ability to invest in enabling infrastructure and technologies.

In Saudi Arabia, the National Industrial Development and Logistics Program (NIDLP) was established with plans to transform the Kingdom into a leading industrial powerhouse and a global logistics hub by focusing on 4 key sectors; industry, mining, energy and logistics. Abu Dhabi 2030 vision entails developing a comprehensive and resilient infrastructure, while Kuwait’s national Development Plan 2035 aims to develop and modernize national infrastructure to improve quality of life for all citizens across the country. Qatar, through its National Vision 2030, is aiming for a more diversified economy by expanding industries and services and investing in world-class infrastructure.

Special Economic Zones (SEZs), used in this context as an umbrella term for free trade or export zones, have regained importance as key enablers to these national transformation programs, offering potential investors the ability to enter local and regional markets and the access to infrastructure, facilities and ancillary services.

Incidents like the COVID-19 pandemic with a sudden drop in oil price can serve as a catalyst for long- term sustainable economic reform. Governments will continue to scrutinize public spending plans more thoroughly for their economic returns and value-add to the security of critical local supply chain elements. The attraction of industrial sectors like pharmaceuticals or high-tech will be measured also for its strategic relevance in building required capabilities in addition to the prevalent metrics for economic impact.

Likewise, producers will have to align their manufacturing footprint strategies, often relying on a fail-safe global supply chain, towards a more regional hub model to maintain agility and continued proximity to core markets.

SEZs with a bespoke regulatory and incentive scheme constitute in this context an attractive proposition in the increasingly competitive contest for FDI. They enable governments a fast track approach to test and introduce regulatory reform and facilitate ease of doing business within zones that would otherwise require a much longer and potentially arduous reform journey across the “main economy”. They also signal the country’s seriousness to being open to business and attracting FDI.

SEZs help stimulate economic development, create jobs, boost and diversify exports, and expedite the industrialization process of an economy at costs which are perceived to be low by most governments. Such costs include, cost of land, foregone revenues through the cost of incentives, and any upfront infrastructure investments to stimulate interest in the SEZ. The project funding can be staged and sourced through private sector partnership (PSP) models as the tenant interest and the investment security for the partners grow over time.

In this context, this paper recaps the evolution of SEZs in the region, specifically looking at propositions to date in efforts to stimulate economic development. Furthermore, this paper provides an outlook on a set of strategic imperatives for the success of SEZs moving forward.

Evolution of Special Economic Zones

SEZs in their modern format have been around since the 1950s. However, their proliferation was mainly in the turn of the century with the push for globalization post the cold war. In 1997, there were 845 zones globally in 93 markets, which ballooned to 5,400 zones in 147 markets in 2018.

Such zones have been present in the GCC region since the 1990s with mixed success. They arenow, however, getting renewed mandates and, in many cases, undergoing complete revamps of theirpositioning and value propositions. This is overdue, considering the GCC’s competitive advantage withan estimated 40,000 hectare of land ready to be developed across major SEZs over the next years.Considering the total assigned areas for existing and planned SEZs in the GCC, this number can easilysurpass the 100,000 hectare mark by 2040 – a size larger than the Kingdom of Bahrain.

Figure 1: Historical trend in SEZs Globally (# countries and SEZs)

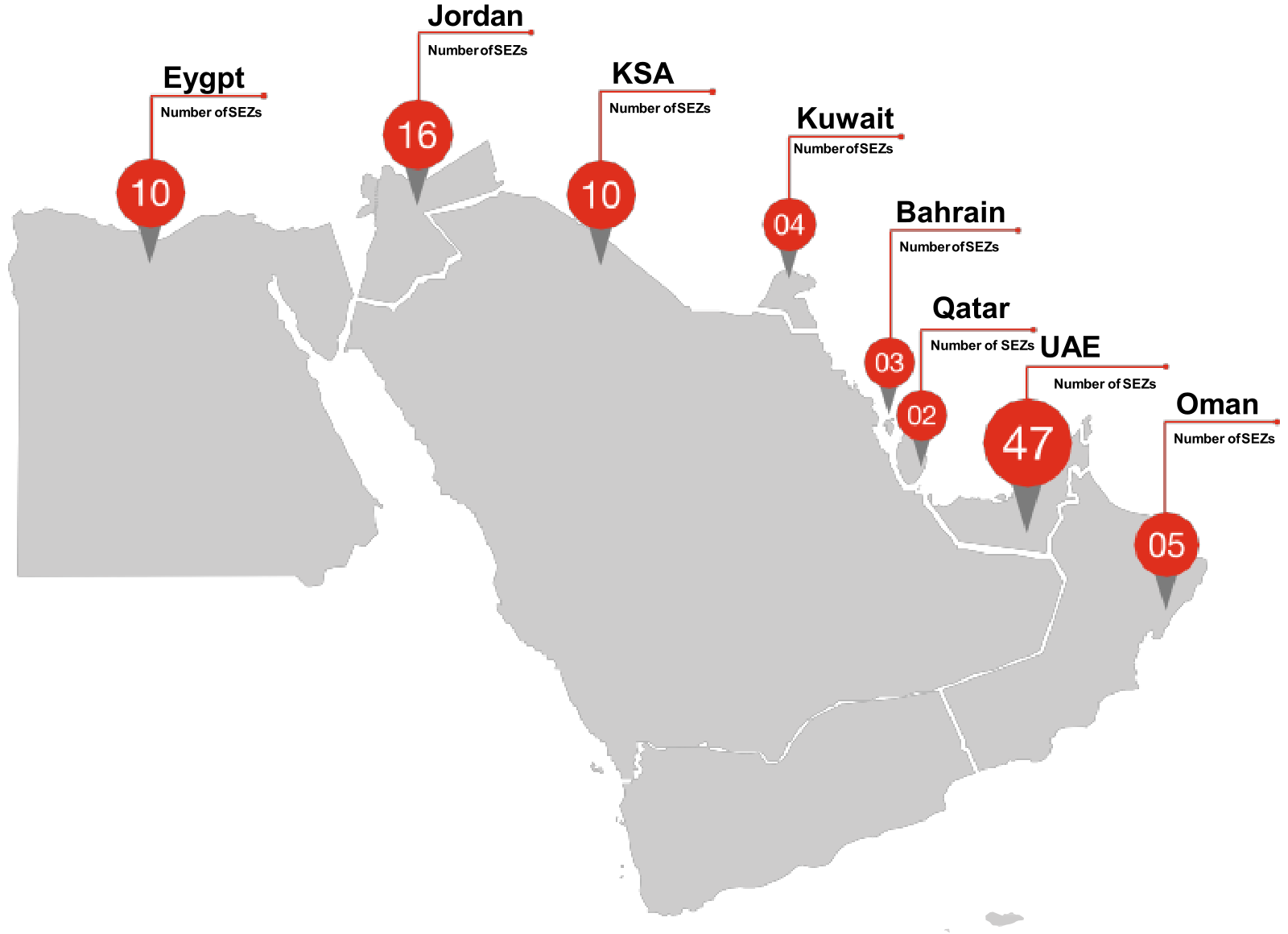

Figure 2: SEZs/ Free zones by Country

However, even with these levers, success is not guaranteed, competition globally and in the region is increasing, and these levers have become minimal requirements. According to a survey by the UNCTAD Investment Promotion Agency, only 35% of free zones are fully or sufficiently utilized with the rest being somewhat heavily underutilized. In the region, we estimate that only about 25% of the available SEZ land in the GCC is developed and only two SEZs (i.e. Jafza and Hamriyah - both in UAE) have developed more than 75% of their total reserved area.

Moving forward, it is essential to shift focus and re-align efforts from a competition to an investor lens. Zones tend to drive their proposition, specifically incentives, in relation to what their direct competition is offering to attract or retain tenants. This can even reach the extent that service and price structures are replicated without a deeper understanding of their own value proposition that is being used to target investors and industrial sectors. The reality is that investors build a business case and assess expected outcomes, rather than each element unilaterally. An SEZ’s objective should be to develop strong insights on customer perceptions of their proposition and the elements that they truly value. For many, insights from existing tenants are eye-opening and can significantly contribute to shaping zone’s future strategies.

Case Study

One exercise that PwC conducted for one of its clients, was to determine the Cost-to-Serve (CTS) from the tenant’s perspective. For a more tangible and relevant analysis, PwC first identified target industries, followed by the development of multiple primary scenarios (e.g. import of raw material from a far eastern country for production and re-export and/or local and regional distribution).

Next, the value chain was broken down for each scenario into its smallest components to cover all logistics and value chain costs like terminal handling costs and ocean leg costs, in addition to industrial park costs like utilities and labor costs. CTS for each identified scenario was then calculated through primary and secondary research, including interviewing existing and potential tenants, followed by:

The elements were then prioritized based on their potential impact on the overall CTS, and an action plan was derived highlighting initiatives that are within the zone’s control, and those that require wider alignment with external stakeholders.

A customer centric led approach, provided a unique proposition, resulting in tangible and prioritized initiatives that deliver measurable impact to potential investors. Furthermore, it allowed the zone to be effective in engaging and aligning with stakeholders, specifically on trade offs versus long term gains.

Strategic imperatives for success

While no two strategies are alike, we see a common set of imperatives that GCC Free Zone decision makers should consider in shaping their strategies:

- Clear and stable regulatory and operating environment

- Specifically coherent scale

- Investor or Customer centric view

- Positive Spillover

- Entire ecosystem

- Sustainability becoming a driving factor for decision making

- Embracing the 4th industrial revolution

Clear and stable regulatory and operating environment

Investors favor a clear and stable regulatory and operating environment over one that is continuously shifting, even if more favorably. Investors need a certain level of confidence in their business cases and cash flow projections. Hence, regulatory framework and good governance become key enablers for success.

- For example, in one of our studies we interviewed existing and potential investors within two competing industrial zones in the Middle East to better understand their perceptions on the competitive offerings of the zones and specifically why Zone B is perceived more favorable than Zone A. One of the key issues that came out is the lack of stability over utility and land prices. While Zone A offered cheaper average prices on utilities and land than Zone B, Zone B prices have been stable over the past 5 years while Zone A prices have been fluctuating every year. For investors, this creates uncertainty in their long-term business plans and cash flow projections – a risk investors are keen to mitigate.

Specifically coherent scale

Scale, more specifically coherent scale, is a key enabler in re-enforcing the zone’s competitive positioning and differentiations. Many SEZs tend to pursue short term gains in efforts to appear attractive to investors locally and globally. However, it is critical to ensure that this does not come at the expense of the SEZ’s long-term positioning and target industries/customer segments. Ultimately, zones that focus on similar factors of production can create more efficiencies and synergies, and hence be more competitive.

- An example of successful synergy is displayed in the Hainan Special Economic Zone (HSEZ), where the abundance of agricultural resources and knowledge within the island province helped establish HSEZ as the second largest contributor of natural rubber in China. This was done by successfully creating a collaborative and conductive environment that interlinks and integrates key ingredients of the natural rubber ecosystem. More specifically, HSEZ’s efforts in creating a vibrant and collaborative natural rubber ecosystem were deemed successful by implementing the Triple Helix System (THS) and the “six-domain” concept. Natural rubber is a renewable industrial agricultural commodity, whose demand is majorly driven by automobile users, for tires and spare parts. The strategy designed around developing the agricultural products ecosystem and improving its synergy delivered an impactful socio-economic change, reflected in the GDP per capita jump of Hainan province to USD 7,179 in 2017 from USD 1,909 in 2007.

Investor or Customer centric view

Maintain an Investor or Customer centric view on cost to serve (CTS). Thus, when considering SEZ’s competitive differentiation, it needs to be viewed holistically from the investor’s lens rather than specific elements.

- For example, lowering utilities prices will not have a material impact on the total CTS for a logistics player as opposed to a manufacturer. Utility costs can contribute an average of 69% of a metal manufacturer’s CTS (excluding raw material costs), while an average of 25% of a cold storage player CTS. In this case, providing lower utility prices may improve the SEZ’s position against others in attracting metal manufacturers, as it would significantly improve their own competitiveness. However, cold storage players, as lower utilities consumers, will be more interested in lower incurred logistics costs which is on average 52% of their total CTS.

- In another example, at first glance, a promising business case for an industrial investment was severely jeopardized by the remoteness of the nearest utility access point. The connection of the provided site to the utilities network would have increased the total capital investment cost by ~10%, which made the overall case unattractive.

Therefore, SEZs should consider end-to-end operating costs of each of the different industries according to their long-term strategy, in order to position themselves amongst the most attractive SEZs.

Positive Spillover

Foster a Positive Spillover from the SEZ to its neighboring region in the form of supply chain and job creation opportunities. Each multinational investing in an SEZ constitutes for local players, particularly the ones downstream the supply chain, a new market opportunity. To be acknowledged as a reliable supplier, however, the local firm is typically forced to lift its quality, efficiency and adopt new technologies to become eventually part of not only the local but the global supply chain of the investor.

- The GCC countries are e.g. already witnessing this effect primarily through the Local Content Programs of the National Oil Companies (NOC). The prospect of large contracts encouraged international players to invest into local production and develop an internationally sustainable local supply chain to boost their competitive advantage.

- Investors are typically also more productive and apply better management techniques than local firms. They contribute to the knowledge and technology transfers to national economies by upgrading the local talent they employ. The Shenzhen SEZ in China, for example, benefitted from this approach and grew from a formerly small fishing village to an important manufacturing base by driving a stringent high technology agenda for the SEZ paired with continuous vocational training for its workers and the establishment of mega science and industrial park projects.

To optimize these indirect effects and rely less on - often subsidized - local content programs, SEZ policymakers need to establish “soft” policies promoting these spillovers rather than “hard” regulations that could detract FDI. These policies need to enable local firms to easily export into the SEZ and promote the knowledge transfer and collaboration between the vocational training institutes and the multinationals in the SEZ including the transition of employees between the SEZ and its hinterland.

Entire ecosystem

It takes the entire ecosystem to come together for SEZs to succeed. Zones mimic many aspects of an economy only at a smaller scale. So, success requires the collaboration and streamlining of all agencies across trade or manufacturing value chains to produce a compelling proposition. Such players include customs and tax authorities, municipalities, ports authorities, labor authorities, security services, health services, education services, and many others.

- As part of Dubai’s strategy to become a multimodal hub, one innovative initiative is the Virtual Freight and Logistics Corridor (VFCL) that was launched in 2015. This single platform connects airports, ports, and SEZs via a “virtual corridor”, ensuring smooth freight transfers between custom bonded areas of Dubai without imposing any financial burden on the consignees. In other words, this smart solution facilitates a hassle-free custom clearance transfer of cargo without the requirement of submitting any bank guarantee or any financial back-up. Not only did said VFCL enable a streamlined process for the sea-air cargo transshipment, but it has also ensured a speedy process for transferring the cargo from the ports or airports to “detached” free zones.

Having said that, in addition to the economic impact of VFCLs, such initiative and collaboration between different stakeholders positively affects two main factors for tenants in SEZs; cost and time.

Sustainability becoming a driving factor for decision making

Sustainability is increasingly becoming a driving factor for decision making as investors tackle more environmentally conscious consumers and more strict environmental laws. Such pressures transcend geographic boundaries for the typical global investor and hence becomes a key element to consider in preventing any reputational damages.

- Many SEZs are now incorporating the UN Sustainable Development Goals frameworks (SDG) into their operating models. Such zones would focus on attracting investments in SGD-relevant activities while emphasizing the highest-level of Environmental, Social and Governmental (ESG) standards and compliance.

- For example, South Korea has showcased extensive efforts in implementing Industrial Symbiosis (IS), where through a collaborative network, a company can utilize another company’s waste as raw materials. This was done through the initiation of a 15-year National Eco‐Industrial Park Development Program, over three main phases, aimed at transforming aged industrial complexes into six Eco‐Industrial Parks (EIPs). Through key scaling strategies post pilot, South Korea’s EIPs has seen its number of projects and participating players increase from 52 to 159 and from 90 to 596 respectively, from Phase 1 to Phase 2 (10 years). Moreover, this led to direct environmental benefits in Phase 1 proven by the reduction amounts of by-products, oil equivalent of energy, wastewater and CO2 equivalent of GHG emissions produced by EIPs. Lastly, Phase 2 saw reduction numbers rise by almost 4 times than that in Phase 1, further emphasizing the success of the projects undertaken in South Korea’s EIPs.

Embracing the 4th industrial revolution

Embracing the 4th industrial revolution. While for many cheap labor is a key differentiator, in the long term global value chains are becoming more digitized and adoption of next generation technologies such as additive manufacturing, robotics and AI will become the mainstream.

- China has been regarded as a trend setter for developing High-Tech Development Zones (HTDZs), starting back in the late 1990s. As of 2017, there were 156 HTDZs in China contributing $1.42 trillion (~12%) to the national economy. These zones have been successful in attracting investments through various incentives including access to quality infrastructure, corporate income tax exemptions for the first two years on tariffs for high-tech equipment. As a result, HTDZs have an R&D expenditure to total production ratio three times larger than the average in the main economy.

- Russia built 6 techno-innovative SEZs which are now considered among the most successful SEZs in the country. The success was reflected by the number of residents in the zones (374) and the jobs created (14,000 jobs). In addition, Russia established a high-tech business area in 2010, the Skolkovo Innovation Centre, which hosts firms in advanced microelectronics, nanotechnology and other science-based areas. The Centre aims to become a leader in sustainable development by sourcing at least half of the energy consumed by the zone from renewable sources and by constructing energy-neutral buildings, recycling water and minimizing pollution by transport.

The above may be relevant in its entirety or partially to many of the zone’s authorities in the region.

Conclusion

Events like COVID-19 or economic crises point to the need for a more sustainable and diverse economy in the GCC. Policy makers will need to balance the short-term view on FDI attraction and GDP/ job creation with a long-term reform for economic development that increases self-sustainability from an economic, financial and supply chain aspect. New operating and partnership models for SEZs are needed to create new sources of cash and capabilities to lower public spending and professionalize service delivery.

Ultimately, SEZs cannot replace a well-functioning economy and in most cases, SEZs only succeed when the wider economy is geared for transformation and growth. SEZs should be seen as a policy instrument to create a breeding ground for wider economic growth and act as a catalyst for a country’s economic development.

Sources

1. Assessing Synergies, Linkages and the Role of Hainan Special Economic Zone in Development of Natural Rubber Ecosystem (Azam Pasha 2020).

2. CIIP Special Economic Zones - An Operational Review of Their Impacts (The World Bank Group 2017).

3. Place-based Development: Evidence from Special Economic Zones in India, Boston University. (Hyun & Ravi 2018).

4. World Investment Report (UNCATD 2019)

5. http://dpworld.ae/content/files/2019/03/DPW-Std-Presentation-June-2019.pdf

6. https://taxsummaries.pwc.com/azerbaijan/corporate/tax-credits-and-incentives

7. https://firb.gov.au/about-firb/news

8. PwC Analysis

Contact us