Macroeconomic developments

Regional engagement and LNG investment will support the recovery

Our last Economy Watch in July 2020 came out just after an intense phase of lockdown. We forecasted a strong Q3 rebound, which was actualised. But since then, the global pandemic has lasted for longer than many analysts had expected. Vulnerable sectors of Qatar’s economy, such as tourism, have not been immune to the crisis, although the impact has been less pronounced than in many states, including in the region. Qatar has also benefited from three significant recent drivers.

Three positive drivers

Firstly, energy prices have recovered much faster than expected. A year ago, many forecasters were assuming prices around $50 a barrel for 2021. Instead they rallied to an average of $61 in Q1 and $69 in Q2, rising above $75 in late June 2021 for the first time since 2018. LNG spot prices have performed even better, surpassing $12 in Asia in late June, the highest since 2014, excluding a brief spike in January when they increased to record levels.

Secondly, the main contracts for implementing the North Field East LNG expansion were awarded in February 2021. Although Qatar was already committed to this project, there had been several delays and the award means that investment activity will pick up, providing a timely economic boost.

The final driver is the decision by Qatar’s neighbours to restore relations at the AlUla summit in Saudi Arabia in January 2021. This has significantly de-risked the economy and is reviving bilateral commercial opportunities, including aviation and the 2022 World Cup.

Rapid vaccination roll-out

The pandemic has lasted longer than most expected and included a second wave of cases in Spring 2021, mirroring trends across the GCC, requiring Qatar to temporarily reinstitute some social distancing measures. However, the speed of its vaccine rollout has also been among the top 10 countries globally; although infection and death rates peaked in mid-April, by end-June they were at the lowest since the start of the pandemic. It is always possible that new variants could emerge that are partially resistant to antibodies from existing vaccinations, and, like some of its GCC neighbours,

Qatar has structural vulnerabilities to pandemics given its role as a global aviation hub and its large expat population. However, the country has now developed strong technology-driven mechanisms for response including testing, tracing and quarantine, which will help mitigate these risks.

Hard hit sectors

As it did everywhere, the pandemic has hit certain sectors very hard. The two sectors most adversely affected were transport (-27% y/y) and hospitality (-18% y/y), previously the two fastest-growing sectors in 2019. Other major sectors that had been in decline in 2019, including wholesale & retail trade, manufacturing, and construction, weakened further during 2020, with smaller declines in other sectors.

A notable exception was financial services which achieved 6.3% growth, double the rate in 2019, as the banking sector, supported by central bank’s liquidity, provided financing to help companies survive the lockdowns and invest in the reopening phase.

Qatar’s real GDP growth by sector (%)

Source: Planning & Statistics Authority

Leading indicators point to a recovery

Daily mobility data generated by Google has become a new indicator studied by economists during the pandemic. This showed a return to pre-pandemic levels of travel to workplaces and retail spaces in Qatar by late 2020. This weakened again in Spring 2021, as social distancing measures were temporarily reinstated, but was approaching normal levels once again by late June 2021.

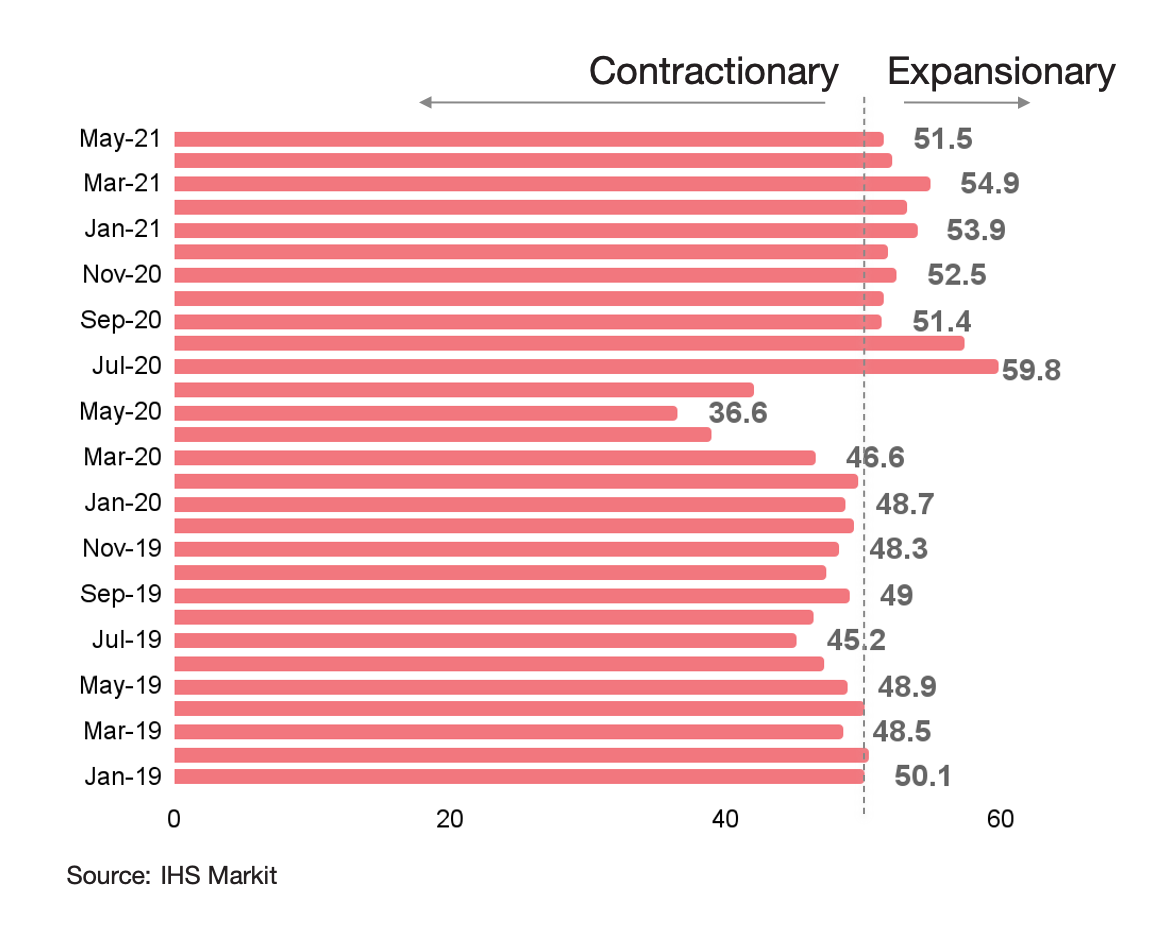

A more standard measure of economic activity is the purchasing managers index (PMI), produced from a monthly survey of major companies. The PMI provides a reasonable leading indicator for trends in private sector non-oil GDP. Qatar averaged 54 during Q1, on a scale in which a reading over 50 indicates economic expansion. This suggests that Q1 GDP will show a strong reading (as has already been seen in Saudi Arabia, which had a similar PMI to Qatar during Q1). The renewed lockdown in April 2021 was likely the cause for the decline in the PMI to 51.5 in May 2021, although this still pointed to expansion.

Qatar’s PMI

Qatar has seen a steady decline in population over the last year, recording a -4.3% y/y decrease in May 2021. This likely relates to expat workers and dependents who have returned to home countries during the crisis. Population will likely rebound as the pandemic eases and in response to the employment demands of the World Cup and the North Field expansion. Real estate prices have also declined, hitting a seven-year low in February 2021, before rebounding slightly in March 2021. The population decline is likely a factor in this, and so the trend may soon reverse when population recovers.

Government finances are also improving as a result of higher energy prices. Qatar recorded a fiscal deficit of 2.1% of GDP in 2020. In Q1 2021, this turned into a small surplus of 0.2% of GDP and major forecasters such as the IMF and credit rating agencies anticipate surpluses going forward. The IMF’s May 2021 Regional Economic Outlook forecasts that Qatar’s fiscal breakeven oil price will fall to just $40 in 2022, indicating that a large surplus is likely if prices remain close to current levels.

Low-carbon LNG expansion will meet growing global demand

Energy prices have recovered to pre-COVID-19 levels and may show continued strength for several years. This is because there has been a sharp drop in capital expenditure by oil and gas companies which may result in supply constraints, depending on how strongly demand recovers and how rapidly the OPEC+ output cuts are tapered. Speaking at the Qatar Economic Forum on 22 June 2021, the CEOs of ExxonMobil, Shell and Total Energies, along with Qatar’s Minister of State for Energy Affairs, H.E. Saad al-Kaabi, warned that underinvestment could cause oil prices to spike towards $100. Of particular relevance for Qatar is the fact that a raft of major LNG projects have been postponed or cancelled as a result of the lower capex budgets and worries about long term prices, reducing competition for the new capacity that will be generated from its own North Field expansion.

At the same time, there has been a growing emphasis in global commitments to tackle climate change and address ESG (environmental, social and governance) concerns, such as China pledging to reach net-zero emissions in 2060. Sustainability advocates are finding traction in leveraging the willingness of governments to take decisive action against COVID-19 as a precedent for stronger action on climate change, including the Biden Administration’s pledge to “Build Back Better”. This shift in focus benefits Qatar because of the importance of gas as a lower-carbon transition fuel. Energy sector outlooks produced over the last year, such as the BP Energy Outlook 2050, have tended to lower their demand forecasts for oil but increase them for LNG. In fact, LNG demand may be positively correlated with ESG progress as gas replaces coal as the source of baseline electricity, particularly in Asia, as it has half the carbon intensity of combustion per unit of energy as well as none of the other pollutants that harm air quality.

Furthermore, Qatar’s gas production process is among the lowest carbon-intensity globally and will further decline as a result of Qatar Petroleum (QP) sustainability strategy, announced in January, that includes cutting methane leaks, using solar power for operations and boosting carbon capture and storage. As part of these efforts, Qatar was one of the five founding members in April 2021 of the Net Zero Producers’ Forum, alongside the US and Saudi Arabia. This commitment to reducing the intensity of production will further add to Qatar’s competitive edge against other LNG producers. In a world-first in September 2020, QP signed a LNG contract with Singapore that includes wellhead-to- delivery reporting of greenhouse emissions. This was a first step towards a future in which carbon taxes or other mechanisms could advantage lower-intensity producers like Qatar.

The combination of an improving demand outlook for LNG with delays to new supply because of the weakened balance sheets of private hydrocarbon companies, makes it an ideal moment for Qatar to press ahead with expansion. In February 2021, QP awarded the main contract to build the four new LNG terminals for the North Field East expansion. The new supply will come onstream in stages during 2025-7 and QP intends to soon commission another two trains. QP may be considering further expansion in the future, which makes sense given that North Field’s reserves are sufficient for around three centuries of production at current levels, whereas the global economy is expected to have fully decarbonised by the end of this century.

Financing the project, expected to cost around $43bn for all six trains, will benefit from the low interest rate environment, enabling QP to finance much of the capex through low-cost bonds as well as equity contributions from joint-venture partners. Equity bids were received from six oil majors in May 2021, and discussions are also underway for customers, including in China, to take smaller stakes.

The six new trains will boost Qatar’s LNG output by nearly two-thirds and also lift its production of valuable by-products including condensates, natural gas liquids, ethane and helium. This will enable ongoing government expenditure to boost the economy as well as QIA’s reserves. Work on the project will pick up rapidly over the next few years, providing a significant boost to the post-COVID-19 recovery, particularly for the construction sector and for companies supplying goods and services to the project.

There are renewed opportunities in the GCC

Although Qatar’s economy was resilient during the years of regional tensions, the restoration of full travel and trade ties with the Quartet (KSA, UAE, Bahrain and Egypt) has a range of economic advantages.

The most immediate benefit is to Qatar Airways, which has been able to both relaunch lucrative routes to Quartet cities and use their airspace, equating to significant savings in fuel costs and flight times across many routes. The pandemic remains the limiting factor, but Qatar Airways is expected to emerge in a strong position as the aviation sector recovers. It managed to maintain its international routes, which was facilitated by the fact that its fleet contains a larger proportion of medium- sized planes, making it more flexible at a time when the largest planes like A380s are too expensive to fly at limited capacity. It also won goodwill internationally by keeping routes open, including to help people repatriate during the crisis.

The tourism sector will also benefit, as visitors come not only by air but also by land from Saudi Arabia. Traditionally, Saudi visitors have comprised about half of all tourists to Qatar and an even larger share of tourism revenue. So far, the pandemic means only a handful of Saudis have visited since the border reopened, notably during the Eid holiday, but there is significant scope for this to increase rapidly in the second half of the year.

There are also opportunities to resume exports to the Quartet and source imports from these countries. This enhances Qatar’s appeal for foreign investors, as a regional hub for services and manufacturing. For financial markets, the reconciliation reduces political risk concerns and should make it easier for companies in Qatar to borrow at favourable rates. Qatari banks and companies are also now able to do business in the Quartet once again, which may lead to new cross-border investments in the coming year.

The World Cup nears

The return of regional tourists will be particularly important for the World Cup next year, and there are reports of heavy hotel bookings during the tournament by Emiratis and Saudis, whose teams stand a good chance of being in the tournament, having topped their groups in the second Asian qualification round in June 2021.

Even aside from these countries, there are indications that interest from fans globally will be even greater than had been expected as the World Cup is likely to be the first major in-person global sporting event after the pandemic.

Meanwhile, preparations for hosting the tournament have not been affected by the pandemic. Four of the eight stadiums have been completed, three more are due to be inaugurated this year and the final one, Lusail, in early 2022. The transport infrastructure, including the metro and road expansions, is largely complete, as are many of the facilities for players and fans. Still there is plenty left to do in the final year and a half, which will serve as another driver for the economy.

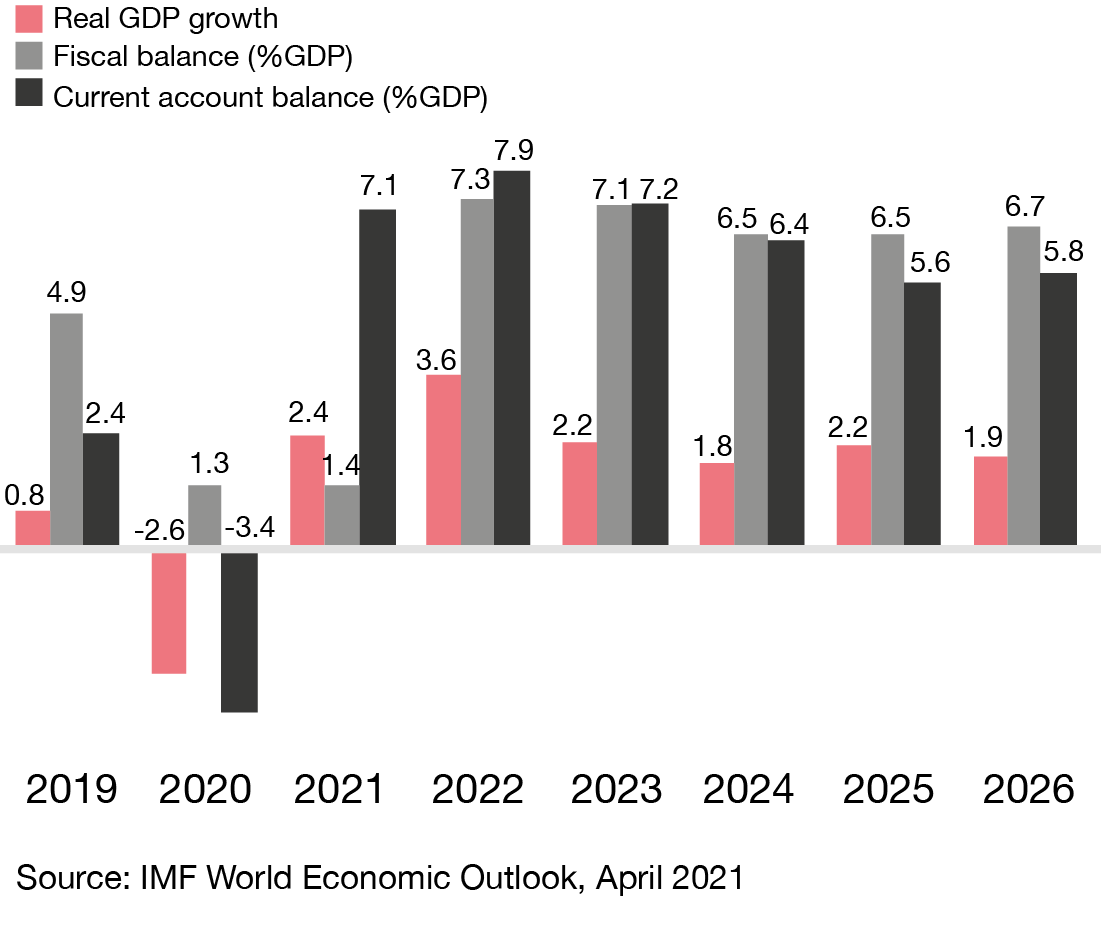

IMF forecasts for Qatar

Source: IMF World Economic Outlook, April 2021

A bright outlook

The IMF’s most recent forecasts in April 2021 show GDP rebounding by 2.4% in 2021. The actual recovery is likely to be higher because the Fund had underestimated the contraction in 2020 (putting it at -2.6%, whereas preliminary data put it at -3.7%). Either way, output is likely to be back to pre-pandemic levels by early 2022. The combination of the recovery and the World Cup will drive stronger growth that year, forecasted at 3.6% by the IMF; and then expansion will continue at a steady pace for the next five years, receiving a major boost in 2026-7 from the new LNG production.

The IMF forecasts, which are based on oil averaging a modest $55 in 2021-26, see strong fiscal surpluses even before the North Field expansion comes on stream, averaging 5.9% of GDP.

Contact us