PwC has collaborated with DataEQ to analyse the customer sentiment towards seven leading banks within KSA to gain a greater understanding of the consumer perceptions and experiences shaping the industry's reputation and risk profile. This year’s index tracked over 5 million posts on X (formerly known as Twitter). These posts were then processed using DataEQ’s proprietary method which uses a unique combination of Crowd and AI technology.

Overall, the industry shows signs of improvement, with an 11.3 percentage point increase in Net Sentiment compared to 2022. This uptick can be largely attributed to a 9.1 percentage point increase in reputational Net Sentiment that arose from media reports on positive financial results for several banks, engagement with CSI initiatives, as well as benefits and loyalty programs. However, banks are still grappling with lingering challenges and feeling the negative impact of consumer criticisms, mainly aimed at slow service and lengthy processing times.

This index taps into an often-overlooked source of truth – unsolicited social media feedback – providing a quantifiable measure of the industry's performance in areas such as pricing, products, customer service, and risk-related conversation. This raw, unfiltered data illuminates real consumer pain points and the areas where banks are excelling. By analysing key drivers of consumer satisfaction and frustration, the study aims to assess how well Saudi banks are meeting customer expectations in terms of service and experience. With these insights, stakeholders will be better equipped for swift action and the development of long-term strategic plans that will likely see their public sentiment, and profits, soaring to even greater heights.

Key Findings

Share of Voice (SoV) does not reflect the size of retail banking balance sheets – suggesting the need for SoV laggards to engage more proactively with its customer base.

The banking industry almost reached positive Net Sentiment due to corporate social investment (CSI) initiatives, flourishing financial performances, and improved customer experience (CX).

Digital channels dominated volumes and Net Sentiment. However, human interactions at branches still solicited praise and positivity.

Despite CX improvements, customer service and turnaround time remained prominent pain points.

Consumers remained price-sensitive towards home loans and credit cards and have shown a greater interest in saving and investing.

Digital downtime impacted the industry and eroded customer confidence in banks.

Digital security remained a major concern amid account irregularities and reports of fraudulent transactions.

Digital channels outperformed traditional ones. Despite both generating high levels of negativity, digital channels performed significantly better (27.3 percentage points) than traditional channels in Net Sentiment.

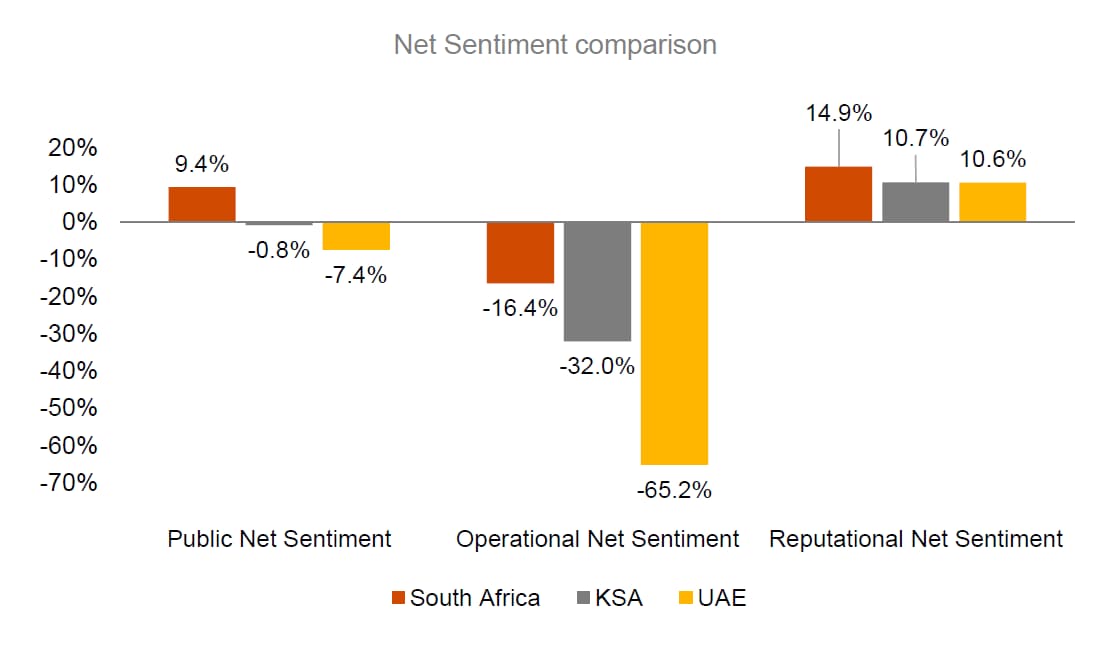

KSA banking ranks second in Net Sentiment versus other markets measured by DataEQ

KSA secured a second second-place ranking when evaluated against other markets measured by DataEQ. For the 2023 review period, Saudi banking outperformed the UAE and the UK, but fell short of South Africa in overall, operational, and reputational Net Sentiment categories.

ServiceService-related discussions were a common source of negativity across the board, while all regions scored positively for reputational Net Sentiment thanks to the favorable reception of brand-driven content, promoted services, and CSI initiatives.

Explore our insights and analysis in our full 'KSA Banking Sentiment Index 2023' report

Contact us

Jean Abou Assi

Partner, Financial Services Consulting Leader, PwC Middle East

Tel: +971 4 304 3100