{{item.title}}

{{item.text}}

{{item.text}}

June 2020

By Yennie Tan, Partner and Deals Strategy Leader, PwC Malaysia

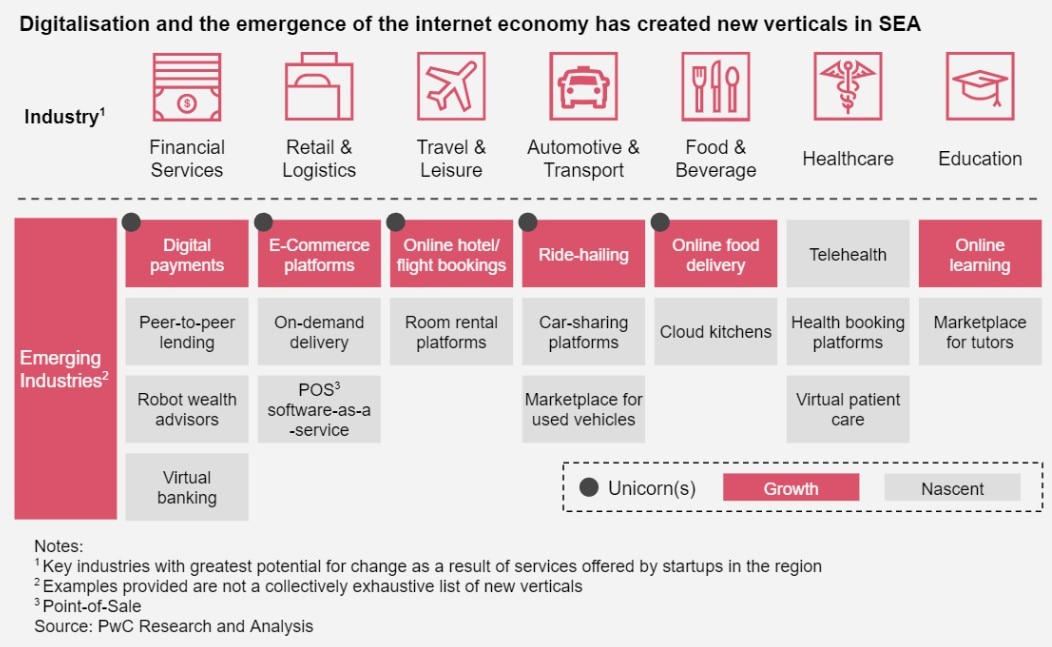

South East Asia has become an attractive market for startups powered by a growing digital economy. These startups have introduced disruptive innovations that have revolutionised industries and created new business models and delivery channels.

Not all Tech startups are created equally, however there are certain characteristics common to successful Tech startups:

Proprietary technology that addresses key customer pain points

Strong understanding and focus on customer needs, leveraging big data and predictive analytics

Scale and diversity across industry verticals or service offerings

Strategic partnerships and alliances

However, these characteristics don’t necessarily translate into long-term profitability. Recent headlines around failing Unicorns have prompted investors to take a closer look at their tech startup investments. A startup's pathway to profitability should be a key consideration when evaluating investment potential.

What should startups be able to demonstrate?

Compelling value proposition

Established sources of recurring revenues, supported by strong customer retention

Ability to achieve positive unit economics

Optimised business operations using technology

The valuation of a Unicorn is neither a science nor an art, but rather a craft. While there are many considerations when valuing a tech startup, investors always consider the following:

Uniqueness and appeal of the platform and its ability to disrupt

Attractiveness of the industry and sector outlook

Viability of product or service value proposition

Sustainability of competitive advantage and growth prospects

Depth of management talent when evaluating the investment’s future potential

For more insights, read our thought leadership publication “Have Unicorns reached their tipping point?”

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}