E-Invoicing implementation (real time invoicing)

06/04/22

Indirect Tax Alert, April 2022, Issue 1

E-Invoicing implementation (real time invoicing)

In 2021, the Ministry of Finance has introduced a law on sending structured data from invoices to the Financial Directorate and started a comment process with the professional public. The law should be finalized and approved during 2022 and would be effective from 2023. The implementation period of e-invoicing for entrepreneurs will be at least 12 months from the effective date and during this period entrepreneurs should familiarize themselves with the process and decide on a technical solution for the sending of invoice data. The obligation to use e-invoicing is planned from 1 January 2024.

A free online application – Virtual Invoice – will be available to entrepreneurs and will be provided by the state free of charge. Users will be small entrepreneurs and the application is intended to simplify the business environment and reduce administrative burdens. The application will be able to issue an invoice on a mobile device and send the invoice data to the e-invoice system.

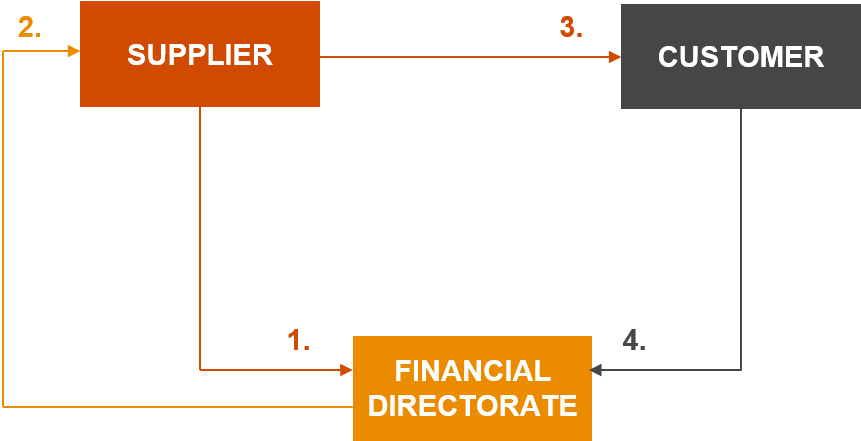

The process of sending invoice data to the e-invoice system and sending the invoice to the customer will be as follows:

- Invoice data should be sent to the Financial Directorate during the invoice issuing. The invoice can be issued using the accounting software or the free online application – Virtual Invoice.

- After the successful verification of invoice data, the Financial Directorate will send a QR code which must be stated on the invoice. This process should take only a few milliseconds.

- The supplier can then send the invoice to the customer.

- The customer will be obliged to mark invoices if he intends to claim input VAT deduction or CIT expense from the respective invoice. This should be performed using accounting software, or the free online application – Virtual Invoice.

For suppliers with a high number of issued invoices, a special regime will be available. The special regime is permission from the Financial Directorate for entrepreneurs to assign their own QR code to issued invoices generated using their own invoice software.

In the event of a successful and functional implementation, the Control Statement may be cancelled within a few months of the launch. Another benefit for entrepreneurs will be pre-filled tax returns based on the sent invoice data.