We use technology-enabled solutions to optimise your VAT compliance.

VAT compliance services

We are flexible and able to offer you a tailored model of VAT compliance services in which

- You can select the solutions you wish to receive from us to meet your requirements; and

- You can utilise your own VAT data in whatever form.

We will work alongside you as tax specialists to identify, assess and prioritise your needs as regards VAT compliance activities.

Automated VAT Compliance Solution ensures all steps in the VAT compliance process are completed and saves your time for other important work.

Why our Automated VAT Compliance Solution?

- Fast and transparent

- Quick deployment

- Process documentation

- The solution can be implemented as a software as a service or fully outsourced.

Automated VAT compliance solutions

Our solution

We use technology-enabled solutions that use historical data, aggregation and enrichment of your VAT related data via the use of Extract, Transform and Load, and Data Analytics tools to optimise your VAT compliance.

Automated review of reported transactions

Solution for identification of transactions

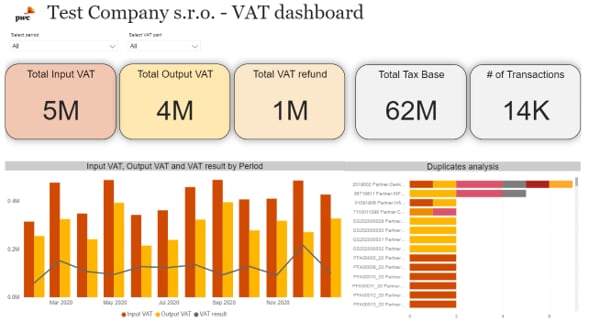

VAT dashboard combined with the use of Extract, Transform and Load, and Data Analytics tools and your historical data to optimise your VAT compliance.

Features and advantages

- Visualisation of VAT data,

- Identification of new transactions, new business partners,

- Changes to VAT treatment according to business partner,

- Highlighting anomalies / non-standard VAT assessment of transactions,

- Saving time for your employees as regards preparing and checking VAT returns; and

- Focus on most critical transactions in review.

Focused review of VAT treatment

- Review of new transactions or business partners identified under VAT compliance automation tools

- Consulting of VAT treatment of the outliers and / transactions where different VAT treatment was applied over the VAT periods

- Review of VAT treatment of the transaction identified by the company’s tax department

Our approach

Taking into account your current staff and technical resources, you may need to cover full scope or only selected VAT compliance processes. We will work alongside you as tax specialists to identify, assess and prioritise your needs as regards VAT compliance activities.

* Applicable to tailored development of solution only.

Required input

The ratio of manual and automated processing as regards your inputs usually depends on the number of transactions subject to monthly VAT compliance.

Our outputs

We transform input data into:

- Slovak VAT records in Excel format;

- xml file of Slovak statutory form of VAT return,

Control Statement and EC Sales list ready for e-filing; - E-filing confirmation;

- Payment instructions;

- VAT numbers validation to Slovak Finance administration database;

and EU VIES database; - Identification of unregistered bank accounts.

VAT compliance obligations and requirements

- VAT compliance reports preparation and review

- E-filing with the tax authorities

- Filing Intra-EU declarations with the Statistical Office

- Notification of all bank accounts

- VAT control of bank accounts

- Changes to company information

VAT compliance reports preparation and review

Depending on your company’s activities, transactions and turnover, it may be required to file VAT reports. Detailed VAT records should be kept including information essential for correct calculation of VAT.

Our solutions

- Preparation of all regular, corrective and amended VAT compliance reports

- Preparation of VAT reports in various forms (i.e. .xml, .pdf, .xlsx, .xls), so the company can submit them to the tax authority

- Keeping VAT records

- Automated VAT review solutio

E-filing with the tax authorities

All communication by VAT payers with the tax authorities is undertaken electronically, using electronic signature.

Our solutions

- Preparation and filing of e-filing authorization application

- E-filing of monthly VAT filings

- Regular checking of the ebox, forwarding of relevant documents in the Slovak language with a short translation of the document into English and steps which should be undertaken

Filing Intra-EU declarations with the Statistical Office

To file Intra-EU declarations, separate registration with the Slovak Statistical Office is required.

Our solutions

- Preparation and filing of the registration application

- Preparation and filing of Intrastat reports

Notification of all bank accounts

All VAT payers are required to notify the Tax Office of all the bank accounts they use for business purposes (activities subject to VAT in Slovakia), regardless of whether the account is held in Slovakia or abroad (including cash-pool bank accounts).

Our solutions

Submission of notification of bank accounts used in respect of transactions subject to Slovak VAT to the Slovak tax office

VAT control of bank accounts

The tax office is entitled to demand from a company payment of VAT which was not paid by its supplier to the state budget if the company has paid the invoiced amount to a supplier’s bank account that is not listed in the register of bank accounts on the Financial Administration’s portal.

Our solutions

One-time or repeated check of bank accounts, allowing a company to identify bank accounts that suppliers have not reported to the tax administrator to reduce the risk a company will be required to pay VAT on behalf of a supplier

Changes to company information

All VAT payers are obliged to inform the tax authorities about changes in the data provided during VAT registration ((e.g. change of the business name, address, etc.)

Our solutions

Preparation and submission of an official notification of changes in Slovak to the Slovak Tax Office.

Contact us