{{item.title}}

{{item.text}}

{{item.text}}

The last couple of months has introduced a ‘new normal’ to the world, one where, in Malaysia, movement restriction measures in response to COVID-19 have kept us working, buying and banking from home. Although we are currently resuming our daily lives gradually under the Recovery Movement Control Order (RMCO), we have realised the importance and urgency of being connected digitally and virtually. As fewer people visit bank branches and more Malaysians are banking online, digital accessibility and connectivity in financial services takes centre stage.

What’s more, today's customers are accustomed to personalisation through social media and rapid fulfillment through e-commerce. When it comes to banking from their devices, customers expect the same experience. They want interactive, instantaneous and intuitive ways to bank from their devices wherever and whenever. To keep customers interacting and banking with them, banks need to move from being transactional to being integrated into customers' lives.

According to a recent Mastercard survey, 40% of Malaysians use e-wallet services (GrabPay, Touch ‘N’ Go E-Wallet or Boost) compared to the Philippines (36%), Thailand (27%) and Singapore (26%). This shows that Malaysians are ready to adopt a different way of banking and transacting. They’re also looking for an enhanced customer experience. Our recent Virtual Banking: Malaysian Customers Take Charge Survey shows that Malaysian customers want more features integrated with their banking platforms such as an FX wallet (72%), travel bookings (59%) and healthcare consultation (63%). They also want more empowerment with access to personalised tools to take control of their financial planning.

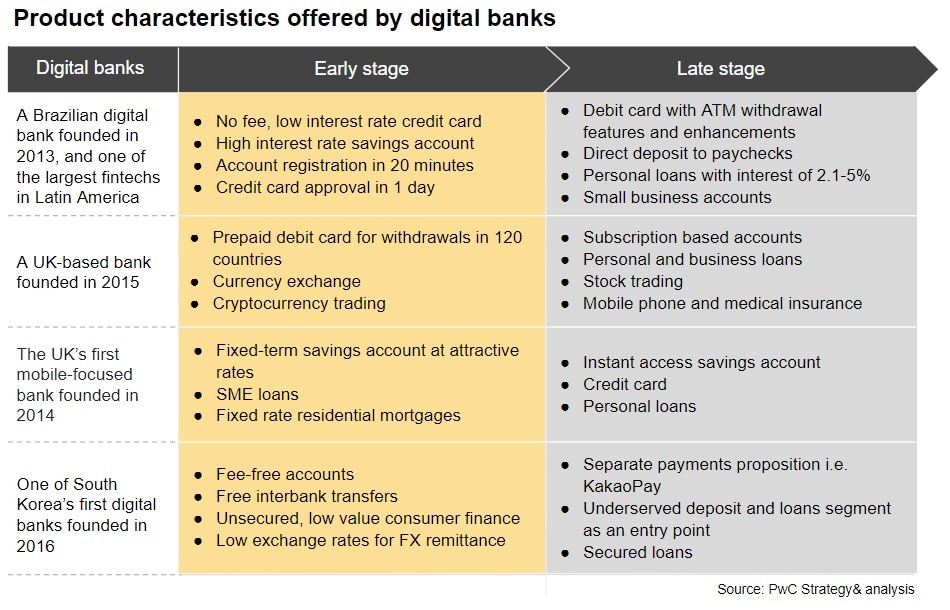

Banks, as such, need to ask themselves how they will reshape their business models and achieve hyper-personalisation, where real-time data helps deliver more relevant products or services specific to each user. We’ve seen challenger banks in countries including South Korea, the UK and Brazil rise up to meet this challenge. Their digital banking platforms are far more interactive, they are quicker to bring customers on board and the ecosystem provided is extensive. The diagram below shows the value demonstrated by digital banks to their customers.

Let’s look at a case study of the South Korean digital bank mentioned above. It began as an offshoot of a very popular messaging platform when it started operations as a mobile-only bank in July 2017. It quickly attracted an impressive 300,000 accounts within the first 24 hours and exceeded 10 million customers after only 2 weeks of service.

With focus on a seamless customer experience, the bank reduced the e-KYC process from 20-30 minutes to only 7 minutes, reduced the commission rate for remittance due to a digital-only approach and allowed users to transfer money using the existing messaging app. The integration of the messaging platform with the digital bank has allowed banking to be seen as more of a lifestyle partner than a provider of traditional, transactional services.

Taking the learnings from this success story, Malaysian banks can consider this as a case in point to start their own journey to build a more integrated and innovative platform for their customers.

How do we create value for customers with digital banking?

What is the winning proposition that will work in the Malaysian context?

What capabilities are needed to build the value proposition? How can we build/partner with other parties (like technology companies) to acquire the necessary capabilities?

“In the midst of chaos, there is also opportunity” said Sun Tzu. The pandemic has highlighted the importance of a platform-based economy and being agile in understanding ever-changing customer behaviour.

The time is rife for banks to put customers at the heart of what they offer by integrating banking needs and services with our customers’ lifestyle, and delivering experiences that continue to delight them. Digital banking presents opportunities for players, both incumbent and challengers to succeed.

Read more on the 4 key steps applicants should complete before licence application starts in 2021.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}