Think you know all about reverse charge?

July 2016

by Jonathan Doraisamy

Did the change in law on imported services make GST reporting easier for you?

When a Malaysian business procures a service from a local supplier, GST is chargeable and the local supplier must account for output GST on the taxable service rendered. However, if the exact same service is acquired from an overseas supplier, the recipient must account for output GST on the service consumed locally. This is known as the “reverse charge”, where the liability to account for output GST shifts from the supplier to the recipient. Examples of such imported services include the acquisition of intangible rights, intellectual property, software licences and consultancy services from an overseas supplier.

Now imagine the following:

- You are a GST registered business which makes wholly taxable supplies in Malaysia with a monthly taxable period

- You have just renewed your software license with your United States based supplier (“Supplier X”)

- You receive an invoice from Supplier X on 10 April 2016, while the invoice is dated 31 March 2016

- You paid Supplier X on 2 May 2016

The old rule

Up until 31 December 2015, you were required to account for output GST (i.e. reverse charge) on the imported services procured when payment was made to the overseas supplier. At the same time you were allowed to recover the GST as an input tax credit in the same GST return provided those services are used to make taxable supplies. A document showing that you made payment for the services is required to justify the claim. Consequently, the liability and the entitlement cancels each other out.

At that time, Royal Malaysian Customs (“Customs”) recognised the administrative burden faced by Malaysian businesses to track and account for output GST on the date of payment.

Hence, Customs allowed (via Panel Decision 1 /2014) Malaysian businesses to account for output GST based on the date of the invoice, if it was issued earlier than the date the business made payment.

While the concession purports to give businesses the flexibility in reporting their output tax on imported services, there was an obvious gap in the concession. Time to claim input tax credit remained status quo. Therefore, the taxpayer was only allowed a claim of credit when he or she held a document showing payment for the imported services.

A cash flow issue would have arisen if payment made for imported services and date of the invoice is not within the same taxable period. In other words, you cannot claim input tax to offset the GST accounted for on the date the invoice was issued until you hold a document evidencing the payment to the overseas supplier.

The new rule

However with effect from 1 January 2016, amendments to the rules were made stipulating the:

- Time of supply for imported services

The output tax must be accounted for at the earlier of the date when payment is made or date when any invoice is issued by the overseas supplier; and

- Claim for input tax in respect of imported services

Subject to the time of supply for imported services, claim for input tax credit may be made in the taxable period in which the claimant holds:- A document evidencing the payment to the overseas supplier; or

- An invoice issued by the overseas supplier.

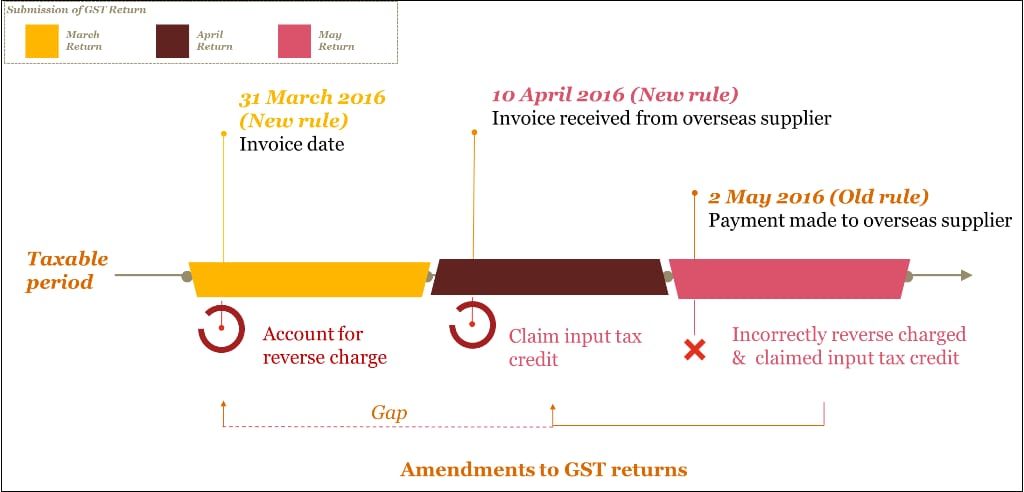

Going back to the example, if you have reverse charged on the date of invoice (i.e. 31 March 2016), strict reading of the amended rules would indicate that you would only be entitled to claim input tax in the taxable period in which you hold the invoice from the overseas supplier (i.e. 10 April 2016). This would result in you having to account for output tax in the March taxable period, while the claim of input tax credit can only be done in the April taxable period.

The gap between accounting for output tax and claiming of input tax for imported services is significant when an invoice is received in a taxable period that is later than the period in which the reverse charge is due for (i.e. date of invoice).

Application of the amended rules is illustrated below:

Does this problem resonate with you? If it does, you may want to review your business processes and controls to ensure that each imported services transaction is reported in the appropriate taxable period.

This would include establishing whether your assigned tax codes can cater to the new requirements.

If the delay in receiving an invoice is an issue, perhaps a discussion with your overseas supplier to align the timing of the issuance of invoice is required. Remember that any understatement of output tax or overstatement of input tax will result in an incorrect GST return.

Conclusion

The Malaysian GST continues to evolve and with the increase in cross border transactions, complex GST rules such as the one above will increase the risk of non-compliance for Malaysian businesses. We have shared our views with senior Customs officers, highlighting administrative issues such as this and we look forward to updating you in our future issues of GST Pulse.

Should you require any assistance or wish to know more about the imported services and how it affects your business, do feel free to contact us.

Jonathan Doraisamy is a Senior Associate Consultant, Indirect Tax Advisory Group at PwC Malaysia.