GST: Are you trending?

May 2016

by Tim Simpson

Now that GST is one year old, businesses have generated a significant amount of GST data. This can be as simple as the data that you have submitted to Royal Malaysian Customs Department (“RMCD”) on your GST return each month or each quarter for the last 12 months. However, the nature of GST as a transactional tax means that each individual transaction is a data point that you can perform trend analysis on.

So what is trending?

Trending simply means analysing at the data you have generated and looking for patterns. These patterns can be used by the business to identify and investigate results which are not in line with expectations of business trading and can help you identify potential errors in your GST returns.

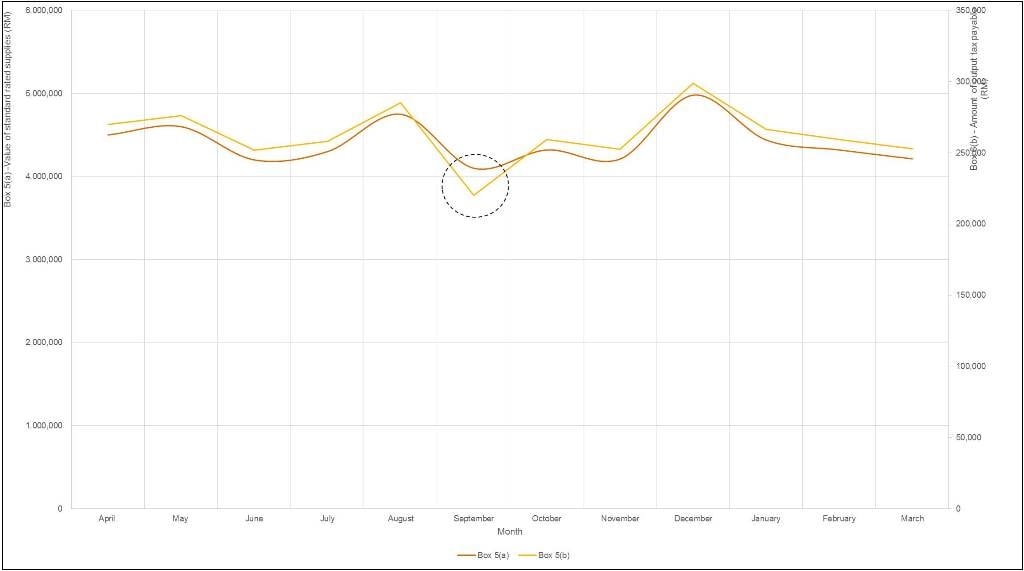

For example, a simple trend would be to compare the value of your output tax with the total value of your taxable supplies. If the trends are not the same, it would imply that output tax is not being computed as 6% of your taxable supplies. Therefore, there is an error either in your GST return preparation process, or worse, your data collection process. Consider the case below:

The red line denotes the value of standard rated supplies, while the yellow line denotes the output tax payable. There is a clear outlier in the month of September where the trend for input tax paid drops below the trend for taxable supplies. This is a red flag for a RMCD audit officer, and should be for you as a business. If you have a trend like this, you should immediately conduct further investigations to determine if the values in your GST return are correct, and if not, why not?

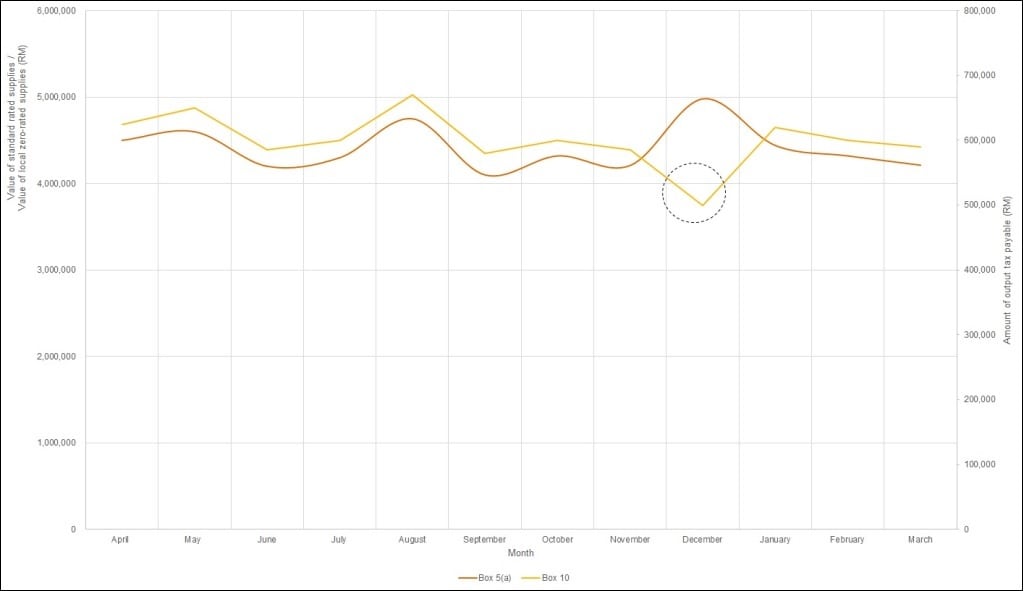

The nature of your business will have a significant impact on the trends you look at. For example, if you run a hypermarket, you know that, a certain portion of your supplies will be local zero rated supplies. You would expect that your customers’ behaviour would be reasonably consistent in terms of the goods and services they buy. Therefore the trend of standard rated and local zero rated supplies would be similar:

In this example, there is a dip in zero rated supplies that corresponds with a peak in standard rated supplies. This takes place in the month of December. Does this mean that your customers have procured additional ‘luxury’ goods for Christmas while simultaneously reducing their acquisitions of zero rated ‘essentials’? Or is there an issue with the reporting of standard rated and local zero rated supplies this month?

When RMCD performs its analysis, it will have an advantage. Your GST registration number will identify you as belonging to a particular industry or sector. RMCD will be able to compare the trends of all hypermarkets and see if your variance is reasonable. If this is not the case, then you may receive some requests for validation based on the data for the month of December, or RMCD may arrange to visit you to conduct a field audit.

If RMCD have the advantage, why should I trend?

Firstly, if you review your own trends, it will give you an idea of where to look for errors. Identifying an anomaly in a particular month would be a starting point for you to look further. For example, in the case above, you may seek to review your local zero rated and taxable supplies reports and ensure that the correct data has filtered through to your GST return. If yes, then you may wish to review the detailed listing for unexpected large value or large volume transactions. Finally, you could select sample invoices from the anomalous areas to see if the underlying GST treatment is correct.

This is likely to be similar to the process RMCD will undertake in their own audits. Trending by business in advance of submitting the return can help mitigate the threat of potential audits by detecting errors before the information is disclosed to RMCD. Incorporating a trend analysis as a standard part of the return preparation process will undoubtedly help businesses in their drive to be GST compliant.

RMCD only has the advantage where an industry comparison applies. Other than this, the business will always be able to trend better because it has access to source data. With your GST return data, RMCD can only trend the information disclosed on a return basis. Not only can you trend more frequently, weekly or daily should you wish, you can trend more data points.

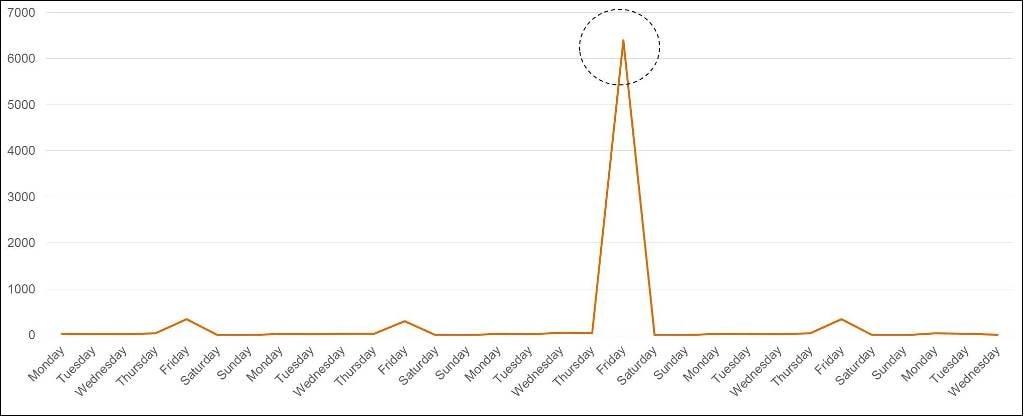

For example, the nature of your business may mean that you tend to incur more entertainment expenditure on a Friday. Trending your blocked input tax credit on a monthly basis you would expect to see something like this:

The expected peaks arise on a Friday, however there is a significant anomaly towards week 3 of the month. Given the size of the peak, it could be assumed that there has been a significant error in GST treatment on this day. Or could it be that a passenger motor vehicle was purchased on which input tax credit was blocked?

What a business should be looking for is unusual trends, for example, a business with seasonal sales sees continual growth in output tax throughout the year or as concentration of expenses in one part of the year. Other red flags would be amounts clearly outside of the normal range and unlikely events. Unlikely events could be as simple as unlikely peaks in data, for example, a large volume of zero rated export supplies for a business that does not export. Alternatively, the evidence may not necessarily be visible at return level, for example, a relatively low trend in deemed supplies when the business gives away a significant volume of goods for marketing purposes.

So the key to trending is not only knowing what to trend, but also understanding the potential causes of peaks and troughs in your trends and knowing the GST issues behind them. The GST return preparation process should involve at a minimum:

- Comparing the trend in value of supplies with the trend in output tax;

- Comparing the trend in value of acquisitions with the trend of input tax;

- Reviewing the trend in GST paid over several tax periods; and

- Reviewing the trend in input tax claimed over several tax periods.

This takes GST knowledge and most of all experience. If you are interested in learning more about trending and how it can help your business, please contact a member of the PwC GST team. We would also be happy to arrange for you a demonstration of our proprietary Comply First Time Software which will enable you to extract the source data and view your trends in a variety of different ways.

Tim Simpson is a Managing Consultant, Indirect Tax Advisory Group at PwC Malaysia.