Are we entitled to credit for GST on importation of goods?

September 2016

by Hanim Mohd Hizan

18 months into the implementation of GST, most (if not all) of GST registered businesses are already coming to terms with the scope of GST and the input tax credit mechanism. Section 9 of the GST Act 2014 sets out the scope of Malaysian GST – the tax is applicable on all supplies of goods and services made in Malaysia. Whilst imported goods are not supplies made in Malaysia, the Law specifically prescribed for any importation of goods into Malaysia to be subject to import GST.

Similar to GST incurred on purchases of goods made in Malaysia, GST registered businesses are entitled to claim import GST as their input tax credit if the prescribed conditions are met. The entitlements to credit are governed under Sections 38 and 39 of the GST Act, and the prescribed conditions are set out under Regulations 38 and 39 of the GST Regulations 2014 (“the Regulations”).

GST document for input tax claims on imported goods

Regulation 38 prescribes for the documents to be held to substantiate input tax credit incurred by GST registered businesses.

For goods imported into Malaysia, Regulation 38(1)(d) provides that for claim of input tax, "if the claim is in respect of an importation of goods, the prescribed form under the Customs Act 1967 stating the claimant as the importer, consignee or owner and the amount of tax charged or paid on the goods". These documents are often referred to as Customs Declaration Forms and for GST registered businesses who regularly import goods into Malaysia, you will be familiar with the K1 forms.

Based on the above, GST registered businesses are entitled to claim the input tax if their names are on the Customs form. The same position is set out in the Customs Guide on Input Tax Credit (as at 29 December 2015), under paragraph 34 for Documents Needed in Claiming Input Tax “34. In respect of importation of goods, the importer must hold a valid Customs importation document Customs No. 1…”

What can we deduce from the above is GST registered businesses are entitled to the input tax credit on importation of goods if they hold valid import documents in their names.

What is the issue?

A number of our clients have faced issues in relation to the input tax claims when their imported goods are handled by freight forwarders. Customs have denied the input tax claims incurred by the freight forwarders, although their names appear on the Customs declaration forms as the importer on records.

Customs are denying these input tax on the basis that the freight forwarders are not the owner of the goods.

Is there a basis to disallow the input tax?

The GST Act does not define “ownership of the goods” and further, our GST Regulations are silent on whether the entitlement of input tax credit would be dependent on the ownership of the goods.

Prior to GST era, for Customs purposes, Section 2 of the Customs Act 1967 provides that "importer includes and applies to any owner or other person for the time being possessed of or beneficially interested in any goods at and from the time of importation thereof until such goods are duly removed from customs control".

"Owner in respect of goods" is further defined in Section 2 of the Customs Act 1967 as "includes any person...being or holding himself out to be the owner, importer, exporter, consignee, agent or person in possession of, or beneficially interested in, or having any control of, or power of disposition over, the goods".

Based on the above, "importer" is defined widely under the Customs Act and does not restrict the importer to be only the legal owner of the goods. In other words, in the absence of precise definition for “owner of the goods” for GST purposes, the freight forwarder is the person in possession of the goods for the purposes of customs clearance. On this basis, they should be allowed the input tax credit if their name is on the K1 form.

And … the impact?

First and foremost, the decision taken by Customs is one that is not provided for under the GST Act nor it is supported by the Customs Act.

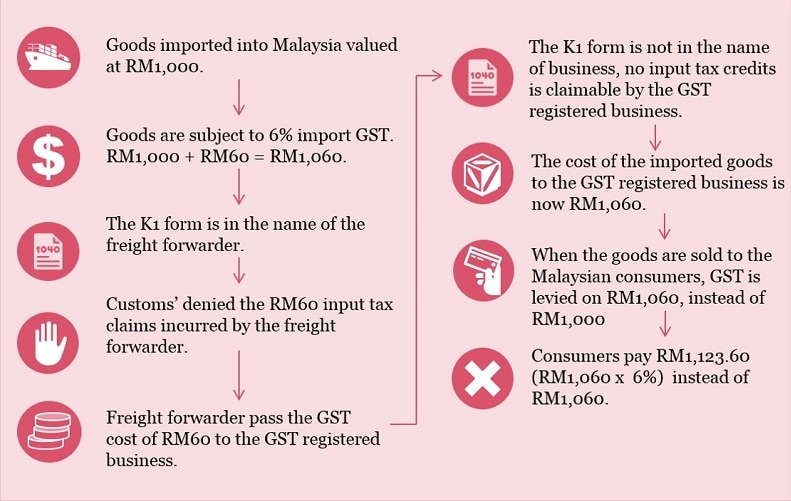

The bigger impact on what has happened is that, disallowing the input tax claims incurred by the freight forwarders would mean that the GST is embedded in the value of the imported goods. The cost of this GST will be passed on from the freight forwarders to the GST registered businesses. When the goods are sold to the Malaysian consumers, GST will be levied on the value of goods, which already include the value of the import GST.

Charging GST on the same goods twice cannot be right!

So what’s next?

If you are experiencing or have experienced this situation, where your input tax claims have been denied on the basis that you are not the “owner of the goods”, our view is that there is no provision in either the GST Act of the Customs Act to deny the entitlement of credit to you, provided that the Customs Declaration Form is issued in your name and other conditions under Regulations 38 and 39 are fulfilled.

If the Customs have intended for the Law to be applied as to only “owner of the goods” are entitled to the input tax claims, then the Law as well as the Customs Guide should explicitly express the same – but this is not the case and the stance taken is one that is not supported by Law.

This matter has been taken up with Customs and they appear to be reluctant in applying the definition of “owner of goods” under Customs Act for input tax claiming purposes.

Until there is a clear indication on the basis applied by Customs for denying the input tax claims, we would advise GST registered businesses who have similar arrangements to ensure that your name is stated as the importer on records, and not the name of your freight forwarders, in all Customs Declaration Forms.

This is to ensure there is no unnecessary GST leakage for the business and goods are not subject to GST … twice.

Feel free to call us for a chat on the above!

Hanim Mohd Hizan is a Senior Consultant, Indirect Tax Advisory Group at PwC Malaysia.