Gain insights into your future balance sheet

Dynamic Portfolio Simulator

The Dynamic portfolio simulator allows the future development of a bank’s portfolio to be simulated under predefined assumptions. The simulation is performed on the level of individual exposures. The time resolution is typically defined by monthly snapshots over a period of multiple years. The simulation allows the bank’s strategy, formulated in a close connection with external drivers, to be projected into their balance sheet.

Dynamic portfolio simulator can be used for:

Stress testing

Allows inclusion of long-term projections of ESG factors.

Challenging economic capital models

Scenario-based analysis with arbitrary portfolio breakdowns.

Business model assessment

Comparison of different business strategies and their impacts.

Validation and testing of credit loss models

Robustness of the models with respect to future structural changes in the portfolio.

Our approach

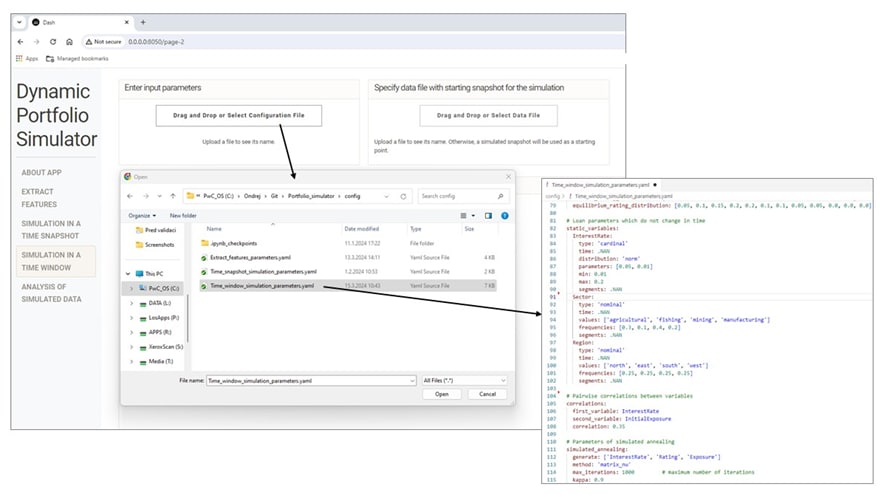

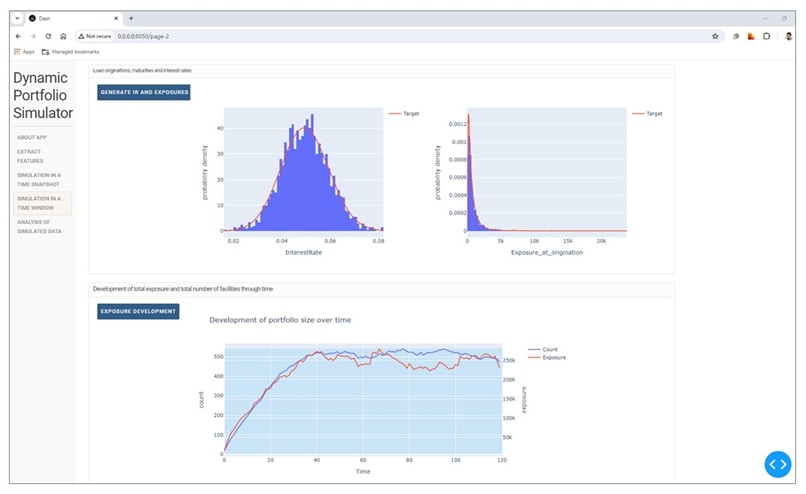

Evolution of the portfolio is driven by target statistical distributions of the exposure and client characteristics which can exhibit pairwise correlations as well as correlations with external factors.

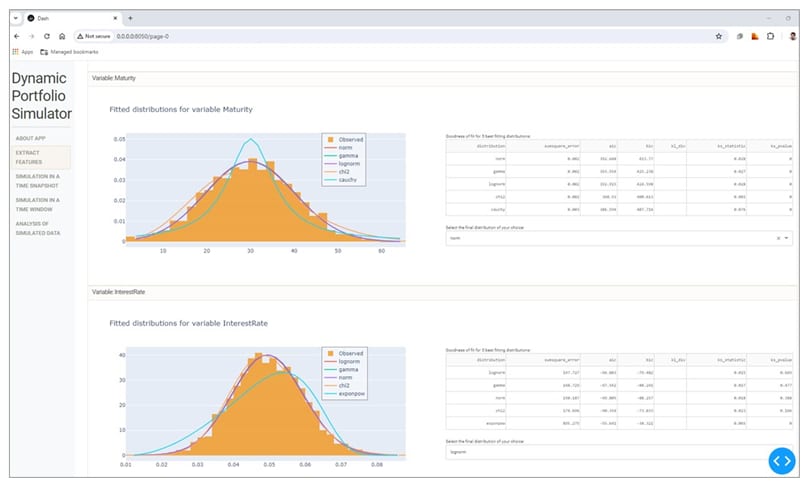

A feature extraction module allows statistical distributions of available factors and their correlation structure to be extracted from historical data and arbitrarily altered to build the future scenarios. The statistical distributions can also be specified in such a way that they evolve through time either in a continuous way, or in a way which mimics the occurrence of shocks.

Multipurpose

Portfolio simulator is a versatile simulation tool applicable for multiple purposes such as stress testing, business model assessment, or challenging economic capital models.

Scalable

The tool allows from small to very large portfolios with millions of individual facilities to be generated.

Granular

A synthetic portfolio is generated over a predefined time interval on the level of individual exposures.

Complex

An optimisation algorithm called simulated annealing is employed to fit all constraints simultaneously, including correlations among the characteristics.

Simulation workflow

Contacts

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.