{{item.title}}

{{item.text}}

{{item.text}}

14/08/22

In our first blog on the Tax Corporate Governance Framework, we discussed the various tax reporting requirements that companies have to comply with. In the second blog, we took a closer look at the core Tax Corporate Governance Framework (TCGF)/Tax Control Framework (TCF) principles. Based on the Malaysian Inland Revenue Board’s (IRB) latest guidelines published on 27 July 2022, we share how you can get started to meet the TCGF and other reporting criteria by outlining our approach in this blog.

According to the IRB's revised Frequently Asked Questions (FAQ) and Guidelines on the TCGF, the TCG Programme is now being implemented in two phases as a pilot project, with the first phase (for selected organisations) commencing in June 2022 and ending in June 2024. The programme will be open to all other organisations during the second phase. They have advised interested organisations to adapt and execute the framework as soon as possible in order to be prepared to meet the prerequisites.

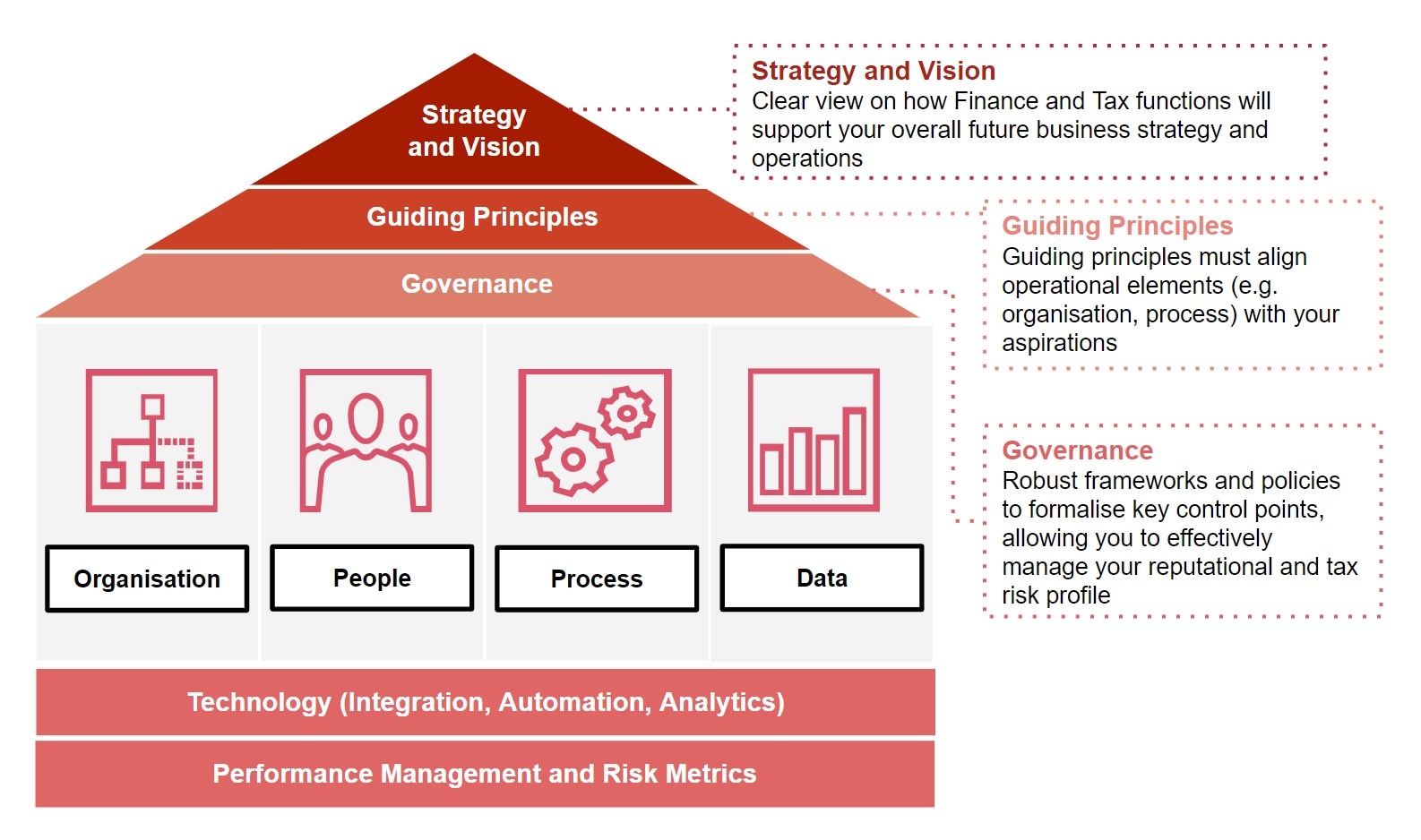

IRB’s Guidelines have clearly laid out that a good TCGF should comprise both strategic (Strategy and Vision, Guiding Principles and Governance) and operational levels (Organisation People, Process, Data, Technology and Performance Management). We’ve previously used the analogy of renovating or building a house as part of building a roadmap to level up your tax function. Imagine these building blocks from IRB’s Guidelines as fundamental components of a house, represented below:

Just as you would when renovating or building your house, you may want to define your overall vision and strategy for your tax function. Always remember to consider all stakeholders’ needs and reporting requirements. When you have a clearer vision on what your house should look like and the function it needs to fulfil, then assess the current state of your structure and establish what needs to be replaced or enhanced. According to IRB’s FAQ, organisations are required to publish their tax strategy and policy, whether this is on the company's website, annual report or any medium that is publicly accessible, as part of the prerequisite for participating in the TCG programme. This requirement is similar to the UK’s requirement for large companies to publish their tax strategy.

To help you navigate your challenges and achieve your objectives, what’s needed is a well-balanced approach that considers the factors that make up a strong foundation for a house from an operational perspective – Organisation, People, Process and Data. The following illustration shows some indicative fit-for-purpose TCF features in line with the four key building blocks to unlock efficiencies in the management of your tax affairs and reporting:

TCF building blocks |

Indicative fit-for-purpose TCF features |

|---|---|

Organisation |

|

People |

|

Process |

|

Data |

|

We discussed earlier that some global and multinational companies may have already adopted several measures in other countries to meet their transparency requirements, but they are not sure how this translates to the IRB’s TCGF programme.

The measures adopted in other countries, if these are done by a holding company/parent company, are usually top down i.e. through the organisation’s Strategy and Vision, Guiding Principles and Governance. In IRB’s FAQ, they have shared that if both the global tax governance strategy of the company and the Malaysian company’s tax governance align with key principles as laid out in TCGF, the Malaysian company can apply to participate in the TCG programme.

To further assess the effectiveness of TCF from a Malaysian perspective, companies operating in Malaysia may want to consider rebuilding these four building blocks from a local perspective to manage domestic tax risks. For example, we have seen many companies prioritising withholding tax risks due to its higher financial impact (as tax deduction is not allowed in the event that withholding taxes are not paid upfront). The IRB guidelines also points out that it is the responsibility of the company to monitor the TCF, and the IRB may conduct real time testing to ensure the effectiveness of the company’s TCF.

To enhance your tax function’s agility in meeting the ever-changing demands of the business, it is essential to leverage the enablers i.e. Performance Management Metrics and Technology, to continue monitoring and automating processes. Some companies have a dashboard in place to monitor their Total Tax Contributions, which are the total tax borne and total tax collected. Companies will assess the abnormality in the amount of tax borne and tax collected in order to prioritise their tax risk areas based on the type of tax. As an example, companies with large property investment transactions may have to closely monitor their property taxes based on ownership, sales or transfer and occupation of the properties. Whereas companies in the shared services industry have to closely monitor their people taxes (taxes on employment borne and collected i.e. income tax and social security payments).

To help companies decide if they should participate in the TCGF programme, they can consider performing a self assessment on their current overall TCGF. It can be beneficial to consider what are the best practices in your industry when rebuilding the blocks for your tax functions. We have developed the Tax Management Maturity Model (T3M) to facilitate the current state review of tax management in any organisation along with the identification of a detailed ambition state with a roadmap to achieve transformation. Our T3M further categorises the level of maturity of tax function into five levels - initial, informal, standardised, managed and optimised. Many companies that we have assessed lie between Levels 2 to 3, summarised below:

We’ve also discussed how important it is for tax functions to level up in order to remain relevant. These are the key steps we take to assist our clients:

Introduce |

Work with management to identify key stakeholders in the organisation to attend a collaborative workshop or interviews to populate the online tax maturity model. Provide an introductory pack to each stakeholder to enable preparation for the workshop or interview combined with desktop review. |

Report and recommend |

Provide a report summarising the output of the model. We will evaluate the organisation’s feedback and ambition levels, summarising themes and providing targeted recommendations to enable you to further develop your Tax Control Framework and move to the target operating model you desire. This is based on our PwC global network’s experience of implementing effective and efficient tax management solutions in other organisations and will include consideration of the latest in tax technology. We can also, where appropriate, discuss how you compare with peers. |

Collaborate |

Hold a collaborative workshop or range of interviews combined with desktop review to populate the model and assess the current state of the tax operating model and Tax Control Framework. At the same time we consider the detailed desired future state of tax management in each area we discuss. We also collate evidence of supporting statements made which can be uploaded to the model and used as an audit trail. |

Post T3M assistance |

Where suitable we can assist you with achieving the optimum Tax Control Framework and tax operating model. This may include a more detailed assessment in areas of weakness, opportunity or relevance. We can also facilitate the use of T3M on an ongoing basis to monitor and test your Tax Control Framework periodically and ensure that the desired state of your Tax Control Framework has been achieved and the standards of control you've set yourself are met. |

For companies to remain relevant in this space, they should start assessing their baseline, determine their future, and plan a roadmap to get there. Remember that Rome was not built in a day, and the same is true for your TCGF and TCF.

Similar to building a house, it is critical to analyse your existing structure, and develop a timeframe with small, actionable steps to build a strong foundation to elevate your tax function to the next level. Here are some questions to think about while planning your next steps:

What are your Board of Directors’ roles and responsibilities in tax governance?

Do you have measures in place to monitor and test the effectiveness of your tax policies and procedures?

Do you have a dashboard to monitor your Total Tax Contributions?

Our ‘Tax Corporate Governance Framework’ blog series will help provide insights on:

Blog #1: Tax Corporate Governance Framework - Are you ready for greater transparency?

Blog #2:Tax Corporate Governance Framework - Does one size fit all?

Blog #3: Tax Corporate Governance Framework - How can you get started?

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}