{{item.title}}

{{item.text}}

{{item.text}}

October 2020

By Pauline Lum, Tax Director and Jeannie Shee, Tax Managing Consultant, PwC Malaysia

Market demands, the push for transparency and connectivity, coupled with time and regulatory pressures have driven many companies to reassess and transform their business and operating models to remain relevant. On top of that, the ongoing COVID-19 pandemic has accelerated the need for companies to evaluate their purpose and the value they provide to their customers, while assessing the business drivers and support they require to deliver on their commitments.

Cash flow management has become a key focus area as a result of the uncertainties of the current landscape. Tax functions have had to pivot to support the business with real time insights on factors that could impact cash flow, whilst ensuring risk and compliance is being managed. These insights could help optimise effective and cash tax rates to support planning of repatriation for cash needs and identification of cash zero day.

Some key challenges that Malaysian companies face in managing Tax risk and compliance include:

Lack of visibility on the “end-to-end process” and appropriate controls to manage tax risks

Impact on accuracy and completeness (indirectly impacting management’s confidence levels) in performing tasks due to lack of structured instructions in place in a remote work environment

Access to and availability of data for tax reporting

Continued engagement and upskilling of the tax team to support business requirements

Continued monitoring of legislative changes during the movement restriction periods e.g. Movement Control Order (MCO) and the subsequent variations of the MCO to manage risk and compliance whilst continuing to bring value to the business

Companies having to “do more with less” have adopted “lean” operating models. These models are driven by more output-based key performance indicators (KPIs) that centre around a reduction in full-time equivalent (FTE) hours, reduced variances between actual and budgeted costing, and value delivered to support strategic business decisions, amongst others. We anticipate that more Tax functions will start assessing their operating models to consider how they can transform to remain resilient and relevant amidst the uncertainties of the future.

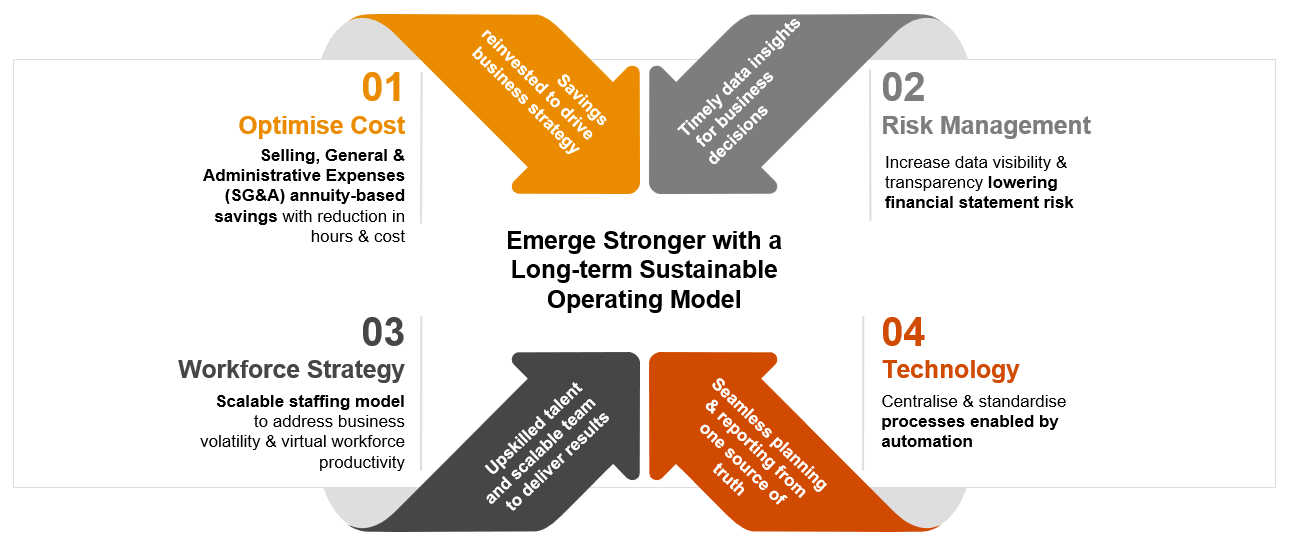

Strategic investments in your Tax functions today will help you emerge stronger against the next disruption. Alignment of the changes you’re going through as a business to internal functions, which include Tax (illustrated below) and moving in tandem with enterprise-wide initiatives will manage operational cost and efficiencies, whilst minimising “transformation fatigue”.

Understandably, the expectation to deliver more value at a similar or lower cost and in real time is a challenge that many internal functions are facing. Each company’s culture and ecosystem differs, but what’s required is a thorough evaluation of the business’s operational needs and what an effective support system needs to look like to support these new demands. For Tax functions, specifically, you would be looking to strike a balance between managing risk effectively and driving operational efficiencies. Here are some questions to ask when making your evaluation:

What tools are available to help with workflow management, document storage, computation engines, legal reporting, amongst others?

Do I have the right data available in real time?

Are the right resources available?

How do we manage risk and compliance?

These considerations coupled with business requirements should help you determine what changes are required to meet the growing needs of the business in this volatile landscape. We’ll be sharing various tax operating models that you may find relevant for your current needs in our next blog, the second in this series.

Our ‘Driving agile tax functions’ blog series will help provide insights on how to transform and meet the new requirements of Tax functions.

Technology in tax: Disrupter or enabler?

Driving agile Tax functions: Pulling the components together

Get in touch if you would like to delve deeper into any of the aspects covered in this blog.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}