Space exploration epitomises the human race’s continued pursuit to push all boundaries and to make the impossible possible. Since the first mission into space in 1957, to man stepping foot on the moon in 1969, this sector has witnessed incredible growth and innovation. Huge strides have been made in areas ranging from satellite launchers, space stations, material sciences, scientific experiments, exploration missions, and other advanced-technologies.

Recently, there has been a renewed emphasis in this field from the:

Public Sector

The Public Sector is rethinking the model for mission delivery, customer centricity, mining and resources, and exploration.

Private Sector

The Private Sector is exploring commercialisation and privatisation to capture the opportunity in alignment with Public Sector objectives.

From HRH Sultan bin Salman’s journey into space with NASA’s space shuttle Discovery in 1985, the Middle East has been making great strides. And we are seeing a significant rejuvenation of strategic ambitions in the space sector across the region, such as Saudi Arabia’s evolving mandate and the UAE’s historic Emirates Mars Mission in 2021 and deployment of the Hope probe.

The global space sector is predicted to exceed $1 trillion USD by 2030, reflecting a growth of 186% from 2020’s market size. The growth in the Middle East will be driven by concerted investment between the public sector, global original equipment manufacturers (OEMs) and local industry. Specifically, the areas of satellite launch, earth observations, space tourism, satellite communication, space mining, space research & development, space exploration, space debris, and manufacturing will be the key drivers of growth in terms of subsectors - with satellites alone projected to constitute 50% of the growth of the global space sector.

In the Middle East, there is ample opportunity to strengthen the foundations of the emerging Middle East space sector and build capabilities and infrastructure to thrive in the future. To do so, we need to bridge the gap between the ambitions of government and emerging private sector players on the one hand, and world class capabilities in manufacturing, science and aeronautics on the other - all while involving regional talent and supporting localization agendas.

Driving strategic national impact

The global space sector is expected to reach a $1 trillion market size in the next decade. This growth offers a range of opportunities for Middle Eastern governments to advance across six strategic areas - all of which are key to the development and transformation of our region.

The key sub-sectors

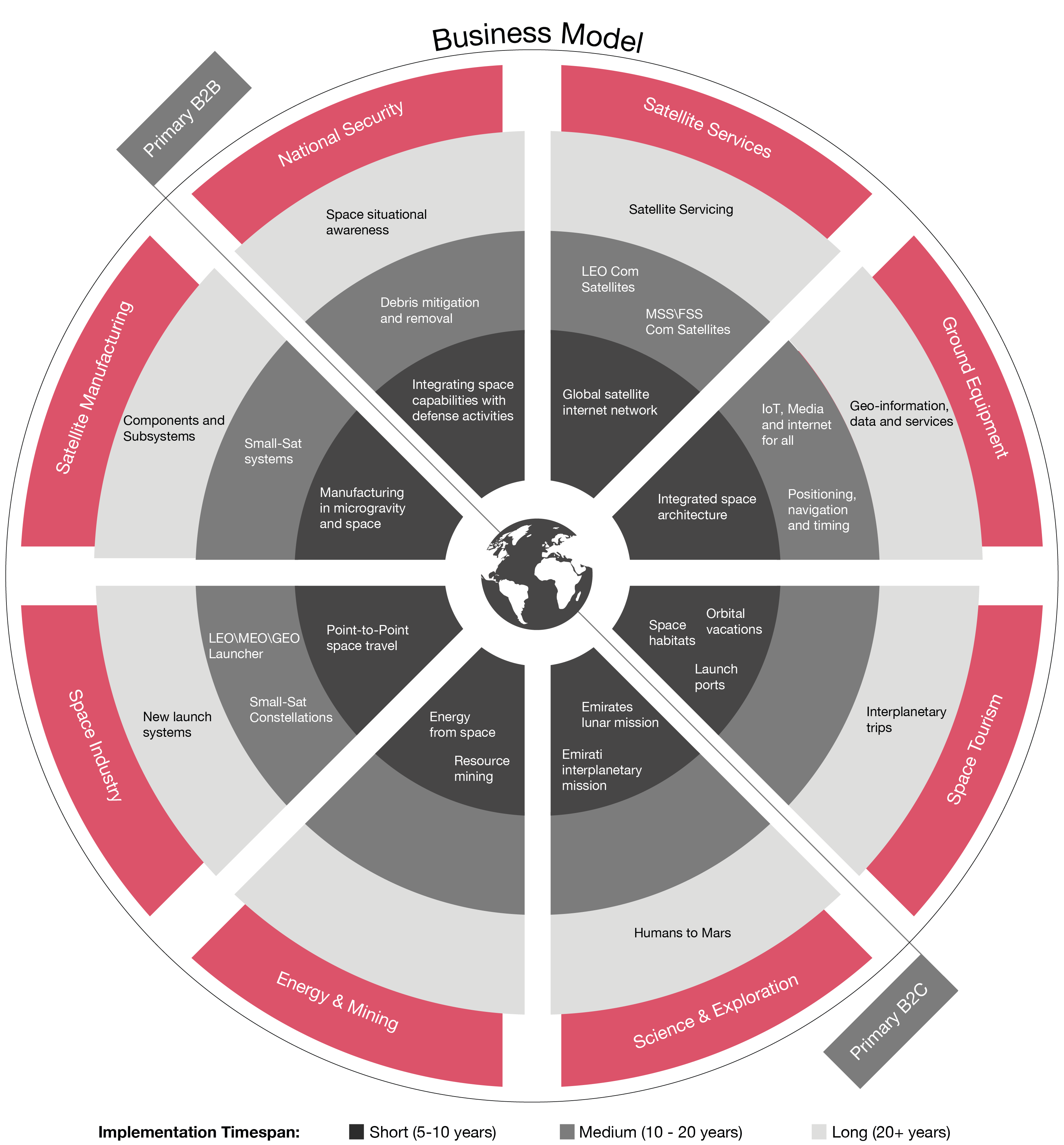

With a projected growth rate of 186% by 2030, the thriving space sector can be broken down into nine main sub-sectors, each offering it’s own case for investment and development.

On the horizon

A new space race led by the world’s emerging economies and wealthiest individuals is now underway. Across our region, a number of countries are taking the lead in focusing on growing and enhancing their capabilities in space to capitalise on the opportunities that the sector offers, through leveraging the benefits of superior technologies, private sector finance, and a global profusion of scientific and engineering talent.

Country overview

- United Arab Emirates

- Saudi Arabia

- Egypt

- Jordan

- Oman

- Kuwait

- Qatar

- Bahrain

United Arab Emirates

Space Tourism

- The UAE National Space Strategy highlights the importance of developing new activities in the space sector including space tourism. Since 2010 the UAE has invested in Virgin Galactic with hopes that the investment will support future space tourism infrastructure and activities.

- In 2021 the UAE entered into a space tourism partnership with Blue Origin. An outcome of the partnership is the potential construction of a spaceport in the UAE, where space tourism flights can be launched from in the near future.

Space Exploration

- A strategic objective in the National Space Strategy is to increase interest in space sciences and exploration.

- In 2024 the UAE is planning on sending a compact lunar rover to study the moon and in 2028 is planning on conducting an interplanetary mission which involves an expedition to the orbit of Venus, followed by an exploration of the asteroid belt beyond Mars. The UAE Space Agency signed the Artemis Accords in 2020, which align with the UAE’s long-term programs to explore outer space and collaborate internationally on better understanding the solar system.

Space Resources

- Launching inspiring space scientific and exploration missions is a key strategic goal of the UAE National Space Strategy. To achieve this strategic goal, one of the initiatives set is to attract sector investment, in particular in the field of space resources utilisation. By achieving this initiative, the UAE will be better placed to discover, extract, and utilise resources from space.

Saudi Arabia

Space Strategy

- Saudi Arabia plans to finalise its Space Strategy by the end of 2022. As part of its Vision 2030 reform agenda, the Kingdom’s long-term plan is to diversify its economy away from oil and embrace a wide array of next-generation industries. This strategy frames the Kingdom’s initiatives and strategic direction and is the basis for evaluating opportunities in the sector.

- Saudi Arabia's national space strategy is envisaged to have more than 50 initiatives clustered around themes such as satellites, space science and emerging space.

Satellite Services

- King Abdulaziz City for Science and Technology (KACST), established a “Center of Excellence for Space and Earth” in cooperation with Stanford University, with aims to collaboratively provide global-impact research results and advanced technology developments.

Ground Equipment

- KSA is focusing on establishing a comprehensive and integrated space architecture, allowing the Kingdom’s modern military systems and operations to be greatly strengthened across all domains.

Space Tourism

- Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, invested around $1 bn in Virgin Galactic space travel ventures. This partnership with Virgin Group reflects the strides the Kingdom is making towards space tourism.

Egypt

Satellite Services

- The Egyptian Space Agency will be launching two Egyptian designed satellites, EgSAcube-3 satellite and EgSAcube-4 satellite by the end of 2022.

Satellite Hub

- Egypt started to build Space City that will consist of 23 buildings dedicated to promoting research, education, and development in the field of space, in addition to enhancing Egypt’s satellite-manufacturing and designing capabilities. The plan is set to be complete in 2026.

Jordan

Space Strategy

- In 2020, Jordan developed a proposal to establish a Space Regulatory Commission to regulate all of its space and astronomy related activities.

Oman

Space Research & Development

- The Oman Ministry of Transport is currently developing a National Space Program for the country. The Program aims to support the development of Oman’s capabilities and expertise in the space sector.

Launching Capabilities

- With Oman’s location close to the equator, it offers a strategic location to launch satellites and rockets into space.

Satellite Services

- Oman is planning to launch its first satellite, Omani CubeSat, by the end of 2022. The Satellite will be launched in partnership with Virgin Orbit with plans to conduct scientific research and capture space imagery.

- The Oman Space Communications and Technology (SCT), is working on the future Omani satellite project, with aims to begin service in 2024. SCT is focused on utilising the latest technologies developed in building the satellites along with partnering with largest global satellite manufactures.

Kuwait

Rocket Design & Development

- Kuwait plans to launch the Kuwait Space Rocket (KSR), the first GCC suborbital liquid bipropellant rocket. Plans include the design and manufacture of the rocket in country by 2023.

Space Exploration

- The ‘Experiment on the Moon’ project led by Orbital Space, the first private space enterprise in the Middle East, is set to launch in 2024. The project aims to be the first private Moon mission from the Arab region and the second lunar mission after the UAE.

Qatar

Satellite Services

- Having launched Es’hail-1 in 2013 and Es’hail-2 in 2018, Qatar aims to expand it satellite services and continue to develop and launch satellites over the coming years.

Space Research & Development

- The Qatar Aeronautical and Space Agency is aimed at strengthening and evolving four core competencies: Space science, Human–system collaboration, Computation, Space vehicle design.

Bahrain

Satellite Services

- The National Space Science agency is planning to build and launch remote sensing satellites.

Ground Equipment

- The National Space Science Agency is set to begin the construction of a ground station for operating and tracking owned satellites.

The future may be closer than you think

The space sector presents an ever-evolving ecosystem where opportunity and ambition constantly push the boundaries of what is possible. Cross-industry and multinational collaboration is a must in a sector which expands beyond the traditional borders of engineering, technology and space.

During the course of 60 years, the space sector has witnessed impactful achievements in science and technology; leading to exponential growth and modernisation of the world we live in today. Recently there has been a significant push by private sector players to enter the industry:

- SpaceX - An aerospace manufacturer and the first private company to send spacecraft to the international space station. SpaceX is also developing Starlink, a satellite internet system to provide commercial internet service around the globe.

- Virgin Galactic - The world’s first commercial spaceline, focused on developing commercial space craft with aims to provide suborbital space flights to tourists.

- Blue Origin - A privately funded aerospace manufacturer and sub-orbital spaceflight services company. Blue Origin is committed to developing partially and fully reusable launch vehicles that serve the needs of all civil, commercial and defense customer

- ArianeGroup - A joint venture between Airbus and Safran consists of three core arms: aerospace, defence and security. ArianeGroup is currently developing its next-generation two-stage Ariane 6 launch vehicle on behalf of the European Space Agency.

Quick Wins

With many nations now establishing national space strategies and agencies, our region is on its way to becoming a significant player in the space sector. As the Middle East looks to the future of this industry and the promising economic opportunities it offers, the focus is shifting from feasibility studies to implementation and capability building to start benefiting as soon as possible. In the short term, opportunities in science and exploration, space resources, and space tourism present a lucrative economic entry point. Taking the lead, both Saudi Arabia and the UAE have launched national space strategies, with bold ambitions in the fields of space exploration, technology and application. Showcased in the visions are strategic goals and initiatives to achieve local sector growth. This includes capitalising on investments to develop space tourism infrastructure, and forging strategic partnerships with leaders in the private sector to become more competitive players in the field of space exploration and resource extraction.

Long-term opportunities

Activities in the space sector are expanding globally, with more countries and private firms investing than ever before. Poised with exponential growth, key factors to consider include rapid advances in technology, declining launch costs and the rising public sector interest in the field. By focusing on the long-term advantages that the sector promises, opportunities include satellite broadband and servicing, high speed product delivery though point-to-point space travel, active debris removal capabilities, to one day establishing a colony on Mars.

On the regional level, investment in the sector will lead to the localization of this industry, while building infrastructure will stimulate the local economies on a multi-sector basis and provide education, training, and future of work opportunities for citizens as we look ahead and into the space-age.

Future Considerations

While the decreasing costs of satellite development and space exploration increases the volume of regional players of all sizes, there are yet to be effective governance tools regulating the sector. There is a clear gap in policy development, with effective regulation missing in key areas such as satellite launches, space traffic control, and activation of enforcement principles. The absence of governing regulations that enable equal opportunities for growth leads to increasing inequality amongst regional and global participants, and will start to play an ever more critical role moving forwards. Given the rapid transformation happening across our region and especially in this sector, it is important for effective governance, trust and transparency to keep up as we pave the way into a more equitable, competitive and ambitious future.