All VAT payers are obliged to submit a control statement if they have made a local taxable supply or have claimed an excess VAT deduction.

VAT Control Statement

Automate the preparation of your control statement with VAT Spectrum – don't waste time preparing VAT reports!

Our solution

We offer you a unique, tailor-made solution in a simple web environment – this means you don’t have to learn how to use or get any licenses for additional programs. Automate the preparation of your control statement with VAT Spectrum – don't waste time preparing VAT reports!

- Full service

- VAT Spectrum

- Outsourcing

- Individual

Full service

The full service includes our VAT Spectrum tool along with full support and integration into your systems, including consultations with our IT and tax consulting specialists. Everything is geared to your total satisfaction.

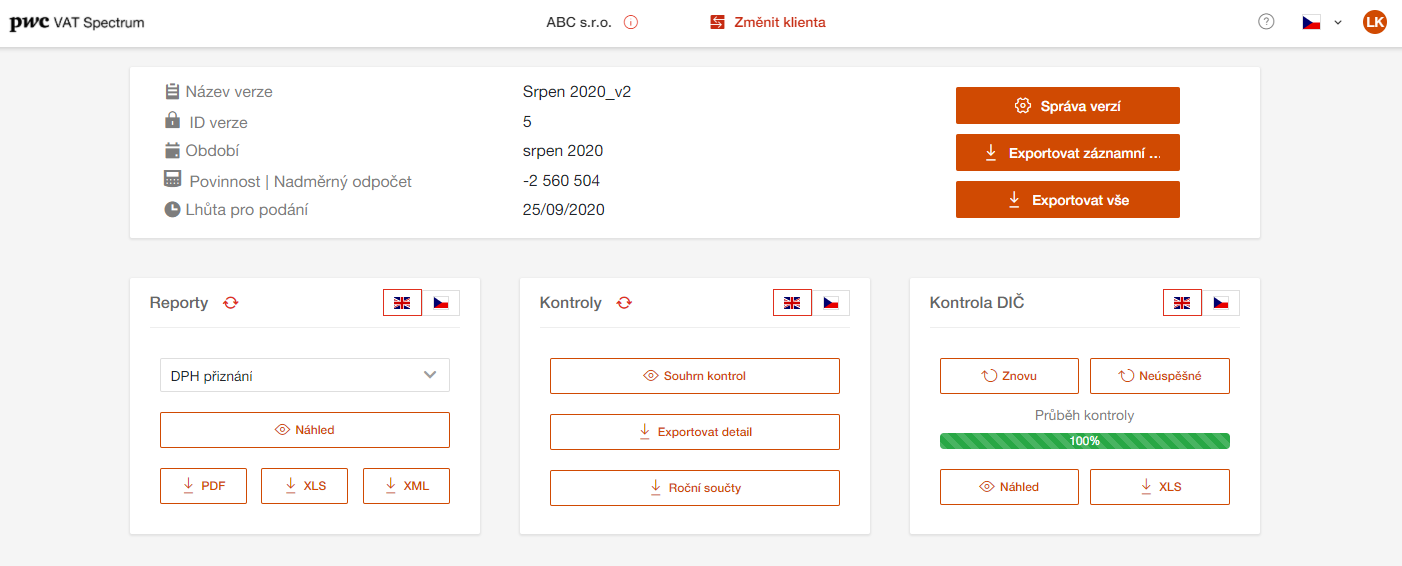

VAT Spectrum

VAT Spectrum is a web-based tool for preparing VAT Returns, control statements and EC Sales Lists. The solution, which enables the preparation of all VAT returns, will help to detect errors in reporting and check the validity of your customers’ and suppliers’ VAT IDs.

Outsourcing

For outsourcing, the entire VAT control reporting process will be carried out directly by PwC's tax consultants based on the documents you provide.

Individual

An individual offer is intended for those whose business has special requirements associated with the VAT control statement. Our VAT Spectrum tool can be adapted to all your company’s specifications.

Who is obligated to submit a VAT control statement?

From January 2016, all VAT payers are obliged to submit a control statement if they have made a local taxable supply or have claimed excess VAT deduction.

What does it mean?

In addition to the necessary work that has to be performed before a control statement is first submitted, this new obligation will of course increase the administrative burden related to the preparation of these reports.

How can we help you?

We’re ready to help you not only with the preparatory steps, but also with the automation of preparing your VAT reports, including control statements. This will reduce the burden that could arise each month when creating the control statement.

Our solution includes:

Setup and staff training, maximization of transparency and control and

other customization options on request.

Contacts

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.