Assess the corporate tax position of a group of entities

ETR+ tool

The ETR+ (the acronym ETR stands for Effective Tax Rate) is a PowerBI web-based platform to assess and display in a user-friendly fashion the corporate income tax (CIT) position of multinational group of entities.

Key benefits of ETR+ tool

Assess the overall CIT position and optionally compare it with your industry peer group or selected competitors.

Analyze relative contribution of the CIT amount per entity & jurisdiction to refine your area of focus.

Determine the ETR of the group and of each entity & jurisdiction and compare it with the nominal country tax rate.

The ETR+ is based on 3 readily available and predefined dashboards. Based on client data uploaded (via PwC cloud) into the ETR+ platform, these dashboards display the data and patterns in a user-friendly way thanks to the PowerBI processing.

- Basic functions

- How does it work?

- Tailored solution – ratios & extensions on demand

- Language

Basic functions

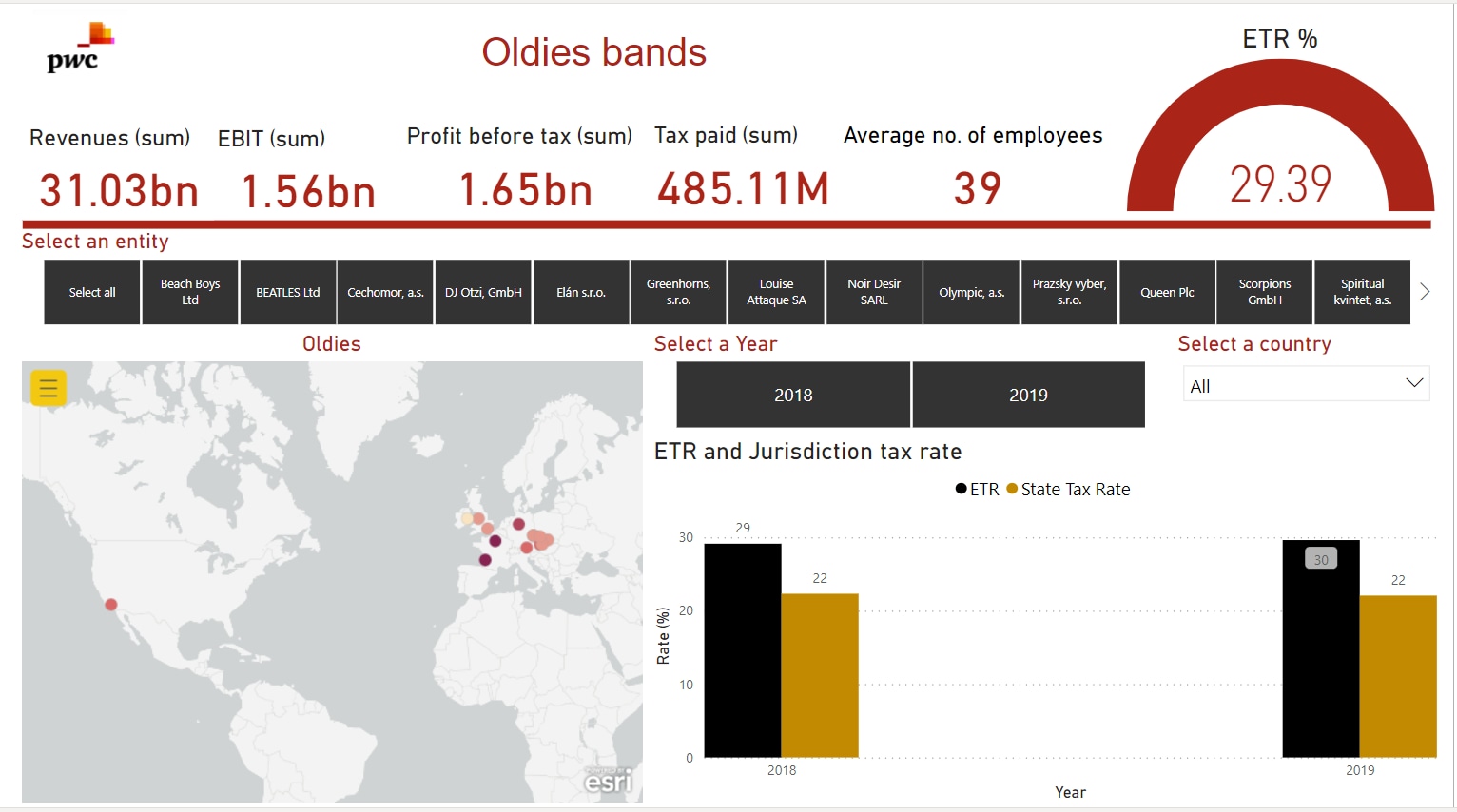

Overall group dashboard containing:

- Overall ETR compared to industry peer group and/or competitors

- Sum of revenues, EBIT, PBT and Tax paid

- Single vs. multiple year display

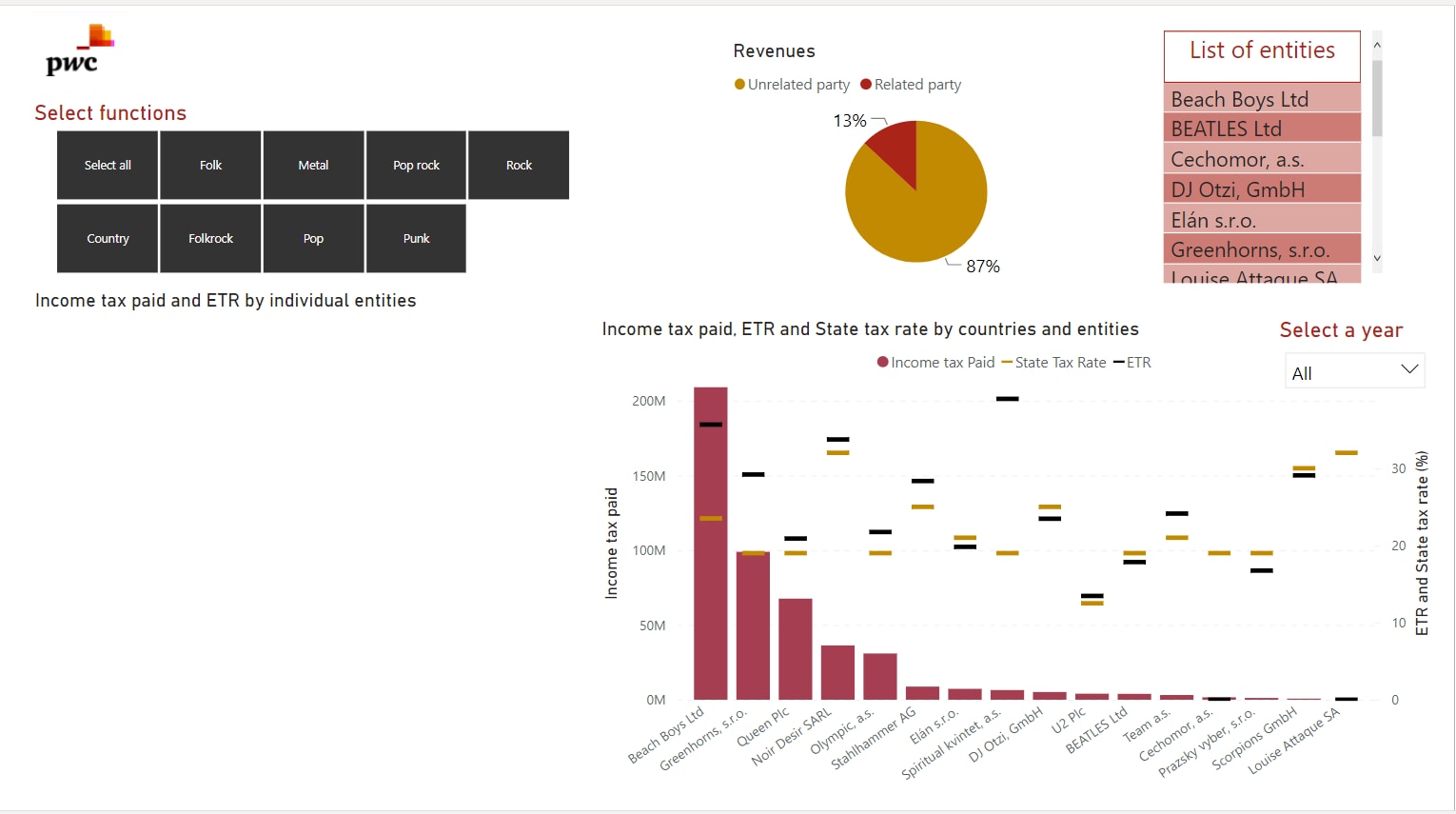

Functional & country slicer dashboard providing:

- ETR per entity (country) compared to the domicile country CIT rate

- Bar chart of jurisdictions drilled to legal entity (as per cumulated CIT liability)

- Slicer to display entities per functional profile / characterization

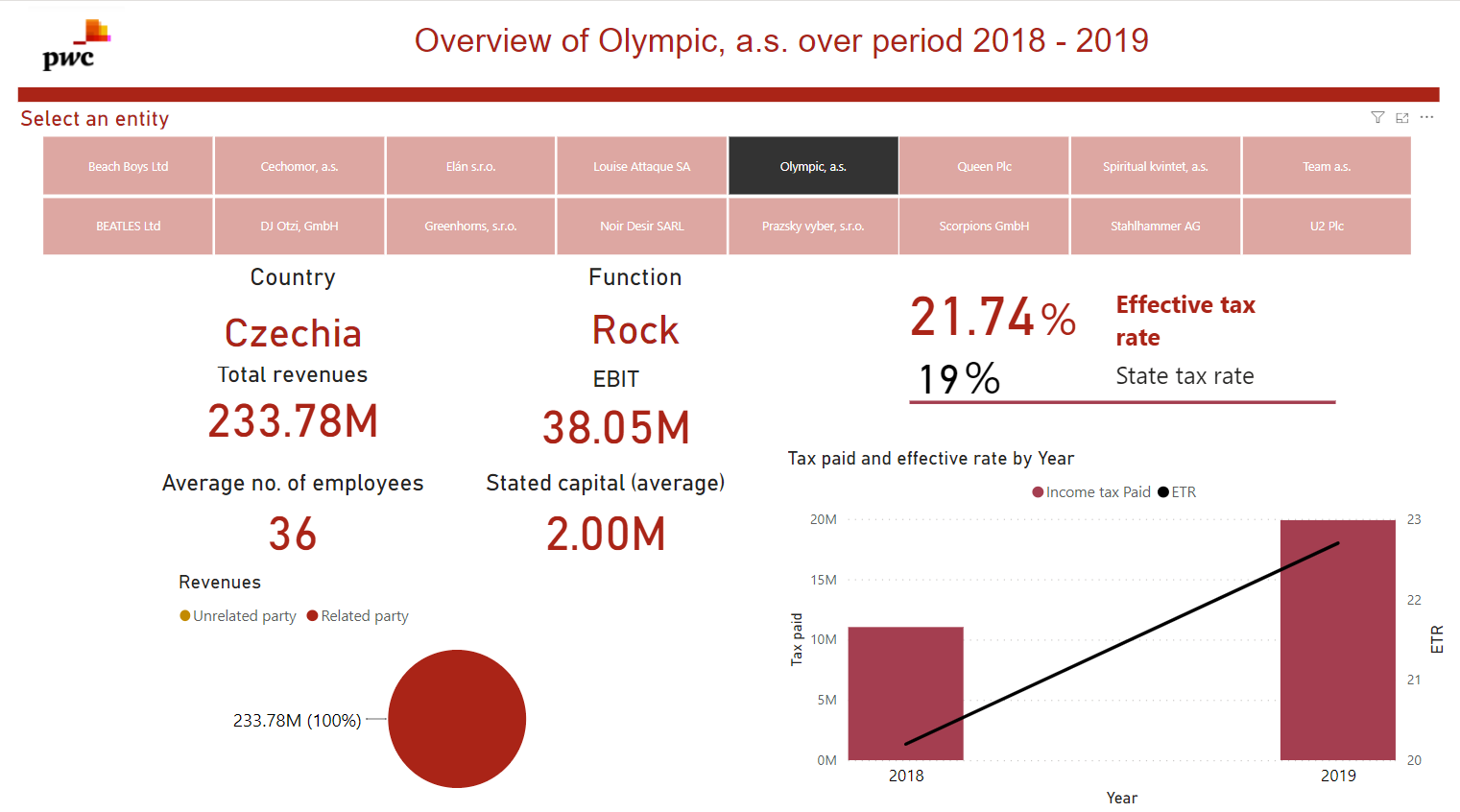

Legal entity “scorecard” dashboard displaying:

- ETR dynamics in selected years

- Time-series of CIT paid in selected years

- Breakdown of revenues: related vs. 3rd party

How does it work?

- ETR+ is a web-based tool (with the embedded PowerBI application), easily accessible via web browser

- No need to install any SW nor implement any IT solution

- One-off setup and subsequent quarterly to annual updates (or on monthly basis if required)

- Initial setup to tailor the ETR+ platform to suit your data display & analytics needs

Tailored solution – ratios & extensions on demand

The ETR+ platform can be further tailored to display additional indicators such as:

- Ratio of the tax non-deductible items to total cost;

- Thin-cap ratio;

- Carry-forward tax losses and their expiration.

Language

ETR+ can provide dashboards in both Czech or English language.

ETR+ Tool Environment

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.