The evolving role of finance

As finance functions serve the ever-increasing demands placed on their resources, an appropriate balance of insight, compliance and control and efficiency is required.

High performing functions must continually look to refine this balance, either through targeted change or a more holistic review of the Finance Operating Model.

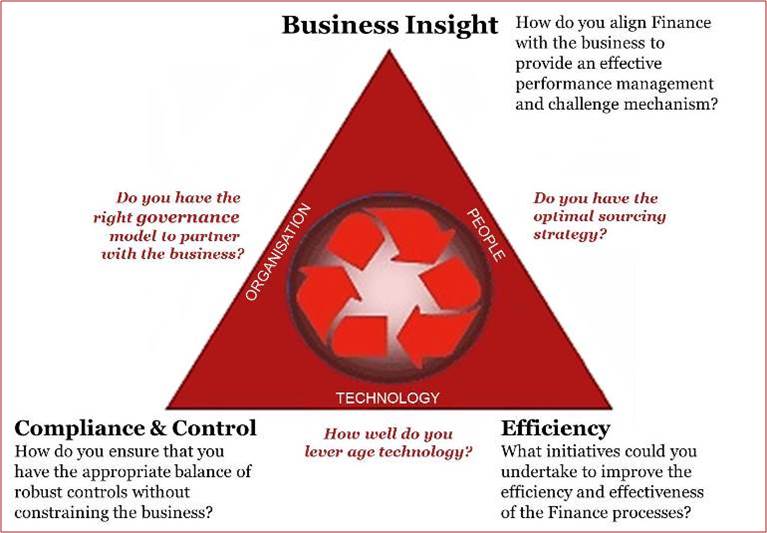

The PwC Finance Framework (also known as the "Finance Triangle") shows the relationship and balance between the three competing objectives of Finance:

- Business insight - relevant, accurate and timely KPIs to support business managers in decision making

- Efficiency - elimination, standardisation and automation to free up resources for value added activities

- Compliance and control - sustainable, flexible embedded controls to meet current and future regulations

The PwC Finance Framework

How do you balance the competing demands of insight, efficiency and control?

The Finance Framework provides a simple visual representation of Finance that can be used throughout a Finance Transformation project in a number of different ways.

It is particularly useful during the Strategy and Assess Stage, as it can be used during discussions with key stakeholders to assess the current role of the Finance Function and envision the target state.

Business insight

Insight is at the heart of the vision of the future finance function. It can take the form of corporate performance management (CPM), business analytics, corporate information logistics and straightforward management information. This gives:

- better business decision-making

- simplified flows of data, information, analysis and insight

Efficiency

Efficiency in Finance means performing Finance's tasks in a timely and cost effective manner typically via simplified and standardised processes that leverage technology and the consolidation or elimination of non-core activities through shared services or outsourcing. This:

- generates cost savings releasing resources for value add activities

- makes Finance more robust and scalable to support future business growth

Compliance and control

The accountability of CFOs means control and compliance has been at the top of the agenda in recent years. The future Finance function needs sustainable, efficient and focused risk management which meets today's requirements as well as being flexible for future changes in regulations. This gives:

- greater transparency and accountability

- greater control and oversight of the business

How does a high performing finance function balance all three objectives - control, efficiency and insight?

The answer is likely to change depending on the organisation and drivers but the message from the CEO is clear: how can we release time and people from transactional work to perform value adding activities whilst maintaining an optimised control environment?

Characteristics of high performing finance functions include:

Business insight

In a high-performing Finance function, business insight means:

- time is focused on planning and decision making, not transactional processing and data manipulation

- scorecards and balance metrics are linked with enterprise-level strategic goals and objectives

- performance measures are directly tied to the business strategies

- best-of-breed is used in reporting, planning and analytics

- data and reporting standards are standardised and necessary governance policies and procedures are implemented

- an efficient strategic planning process is used in which Finance is actively engaged

- there is a streamlined and simplified legal entity structure

Compliance and control

In a high-performing Finance function, compliance and control means:

- controls are integrated into business operations - not seen as an overhead

- a culture of ethics, compliance and governance exists throughout the organisation

- risk management is baked into each level of the organisation and effective risk management is measured and rewarded

- controls are supported and enabled by an effective and robust technology framework

- individual staff and divisions own their controls

- controls are not seen as a problem for Internal Audit

Efficiency

In a high-performing Finance function, efficiency means:

- an efficient finance cost structure is maintained at less than 1% of revenue

- there are large spans of controls

- there is a move to common global process models - standardisation is ruthlessly enforced

- business services are used for consolidation of activities across business units and regions

- there is a shifting of activities to low-cost countries to leverage labour arbitrage benefits

- industrialisation is achieved through automation

- a culture of continuous improvement is embedded e.g., use of Six-sigma or Lean methodology

- service management and culture are taken seriously - high use of KPIs and performance management frameworks

Contact us