{{item.title}}

{{item.text}}

{{item.text}}

20/06/23

On 22 May 2023, the Malaysian Inland Revenue Board (IRB) formally announced that they are targeting 4,000 businesses for the first stage of the new electronic invoicing (e-invoice) system. This is a mandatory enforcement for businesses that reach a sales threshold of RM100m per year. Implementation is slated to commence in June 2024. While we await the IRB's guidelines, we share our understanding of what will potentially be required for Malaysia’s e-invoicing platform and the implementation plans based on our interactions with IRB. We will also share some points to consider in your preparation for your e-invoicing journey.

Many countries have introduced e-invoicing to digitalise their tax administrations and enhance the effectiveness of their overall compliance risk management. Based on the timeline below, we can see e-invoicing started in 1965 with the first e-invoice issued through the electronic data interchange (EDI).

As part of the Value Added Tax (VAT) in the Digital Age (ViDA) initiative, the European Commission has proposed a series of measures, where they further categorise VAT listing, Standard Audit File for Tax (SAF-T) reporting, real-time reporting and e-invoicing as part of digital reporting requirements to modernise the European Union (EU)'s VAT through digitalisation.

Therefore, from the graph below, we see many countries, especially from the EU, have begun their e-invoicing journey to monitor tax administration from an indirect tax perspective. In Malaysia, IRB’s current implementation will focus on a direct tax perspective. However, looking at the global trends and developments on digital reporting requirements, this may extend to cover other areas of taxes, e.g. indirect taxes and transfer pricing, or to further extend real-time reporting or SAF-T reporting like what we are seeing in EU countries.

As part of many organisations’ digital agenda, some have initiated the e-invoicing process by issuing invoices to their buyers in PDF or Microsoft Word formats, or images in JPG, TIFF or HTML formats. To avoid confusion and streamline the type of formats that can be used for e-invoicing, IRB defines the e-invoice as a file created in the format specified by the new regulations that can be automatically processed by the relevant accounting system, e.g. XML, UBL, IDOC or EDIFACT.

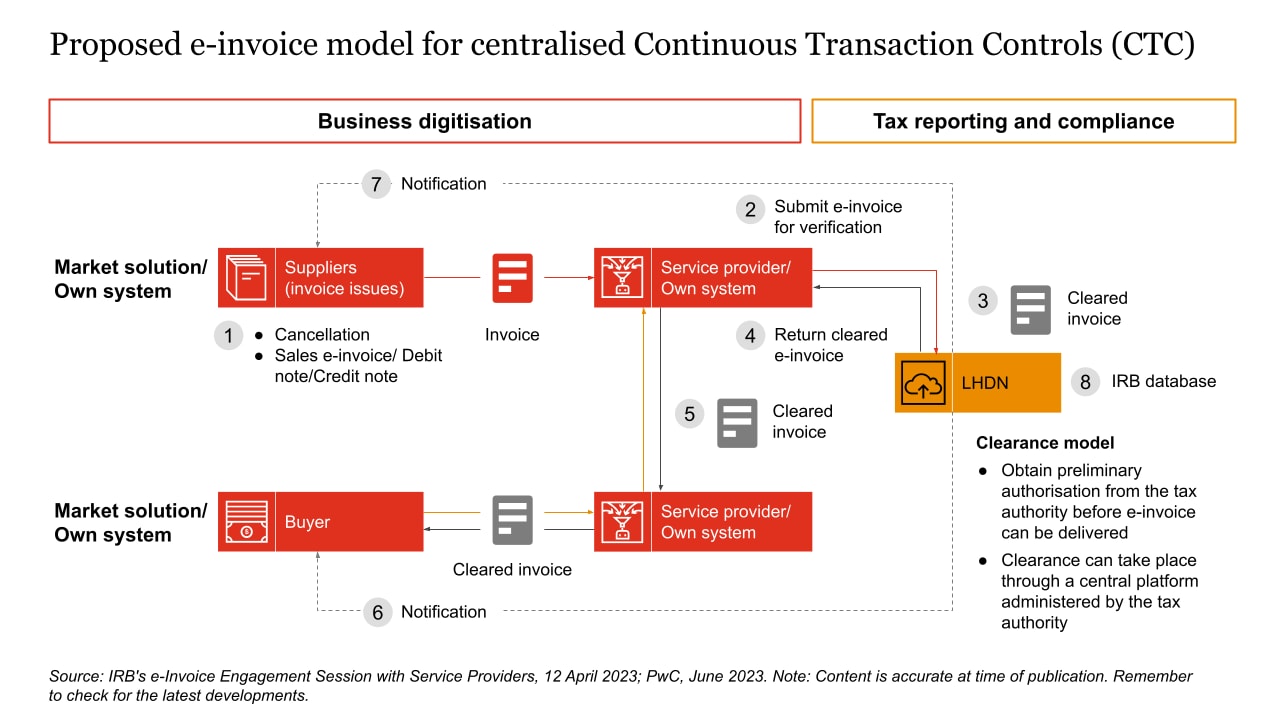

The file created will then be submitted to IRB’s central platform for real-time verification via the proposed Continuous Transaction Controls (CTC) Clearance model. The diagram below illustrates the process flow involving suppliers and buyers that have an e-invoice system in place:

Based on Steps 4-5 in the CTC model, as an output of the e-invoicing verification process, there will be an URL link (containing a QR code) provided to suppliers. The supplier then has to print the QR code on the invoice (some accounting systems already have this capability built-in) before they send it to the buyer. The IRB foresees that the verification process will be seamless and done in real-time. For small and medium businesses which don’t have an e-invoice system in place, IRB will provide free solutions which are web-based and require manual input of data into the system. This may be time consuming depending on the volume of your invoices.

IRB has shared a draft list of e-invoice data/item requirements based on five categories, some of which are optional, as shown below:

The final list will be shared when the guidelines are released by IRB in July 2023.

Although the first stage of implementation begins in June 2024 and is mandatory for business with a sales threshold of RM100m per year, the IRB welcomes organisations who are ready to undertake the programme to volunteer themselves for the pilot project. The first stage of implementation will focus on business to business (B2B) and domestic transactions, which include intercompany invoices. Prior to the implementation, there will be a sandbox for organisations in the pilot phase to perform testing. For companies looking at implementation for June 2024, the sandbox will likely be available from January 2024 onwards.

A few updates can be expected in the next few months based on our interactions with IRB:

IRB is in the process of developing their e-invoicing platform, therefore the e-invoicing process flow can only be visualised at a very high level. However, we can help you with a high-level impact assessment with recommendations on potential solutions, that may include direct integration or integration through a third party solution, where the integration will likely be using an Application Programming Interface (API). This will help you to start your budget planning and conversations with your IT team

Roadshows and sessions on IT requirements will be conducted by IRB to promote understanding on general and system requirements

Based on how other countries are carrying out e-invoicing, we note there are some exemptions that may be available for some types of companies (e.g. holding companies) or industries (e.g. India - banking and insurance industries). Therefore, IRB will engage specific industries for feedback

The pilot/testing phase involving a select group of companies and volunteers will take place in the first quarter of 2024

IRB will release their e-invoicing guidelines in July 2023, and the updated legislation for those mandates are expected to follow suit.

e-Invoicing will become mandatory for all businesses regardless of sales threshold from January 2027. Regardless of whether your organisation has received an invitation to participate in e-invoicing, or would like to volunteer for it, there are some considerations to take into account to help expedite your process in getting yourself ready:

Looking at the IRB’s e-invoicing implementation timeline, which category does your organisation fall under?

Have you started your conversations with key stakeholders (e.g. Finance, IT etc.) who will be impacted by this e-invoicing implementation?

Are you familiar with your Accounts Receivable/Order to Cash/Intercompany billing processes?

What ERP/accounting software does your organisation currently use?

Have any of your affiliates adopted e-invoicing in other countries? What were the solutions they looked at i.e. direct integration or integration through a third party solution?

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

.jpeg)