The system supports self-service configuration of additional rules to cater for business specific needs.

CESOP End-to-end reporting made simple

Automate compliance. Reduce risk. Gain control.

Our CESOP reporting solution is designed to help Payment Service Providers (PSPs) navigate the EU reporting directive with confidence. Built by regulatory, business and tech experts, the solution automates the full reporting process, minimising manual work and ensuring accuracy every step of the way.

Intelligent Payment Analyser

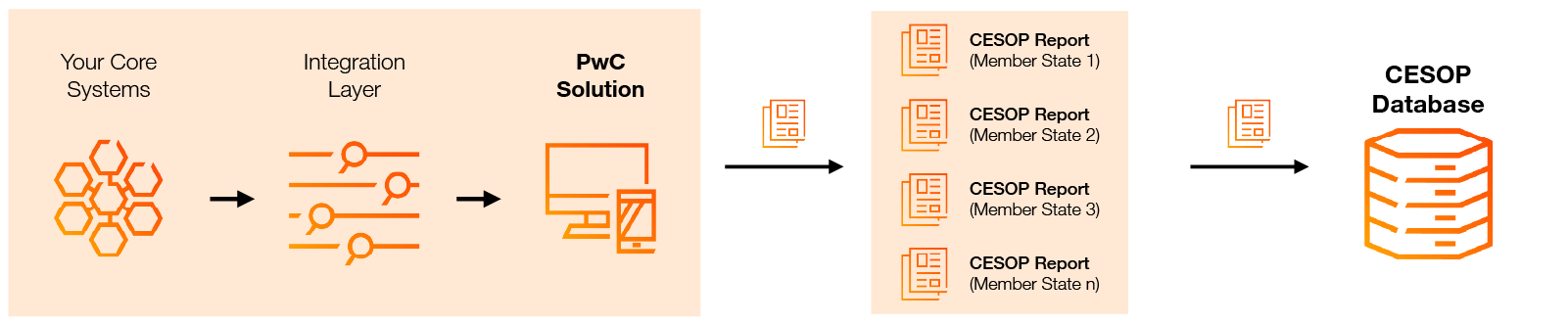

Our Integrated Solution

Our solution brings together the right expertise and the right technology to manage CESOP reporting requirements, seamlessly and at scale. The solution tackles all the reporting requirements relating to the CESOP legislation in an automated manner; so you can reduce the compliance burden on your teams. Once upstream data is mapped into our data model, the system performs validations, applies business logic to identify reportable transactions, and generates jurisdiction-specific XML files ready for submission.

Deployed within your environment

Our solution is designed to integrate directly into your systems. Data is ingested, filtered and processed automatically. Once reportable transactions are identified, the system produces CESOP-compliant XML files ready for upload, giving you peace of mind with minimal disruption.

Our solution outputs data in full alignment with CESOP’s requirements. Built-in validations ensure the accuracy and integrity of submissions before XML files are forwarded to the relevant authorities in each Member State.

Direct your questions to our Subject Matter Experts

Key Features

We’ve built our solution to meet the practical challenges CESOP creates for PSPs, with two core modules at its heart:

1. Intelligent Rule Engine:

A scalable and intelligent solution that analyses large volumes of payment data and identifies reportable cross-border transactions as defined within the Directive applicable to certain PSPs requiring to report such data to be stored in the CESOP database. The solution leverages on a sophisticated and flexible rule engine to aggregate payment data across your various products and determine in which Member State(s) you may have a reporting obligation. Our team has translated the business logic within the rules engine to enable the solution to accurately identify the cross-border payments in line with the various scenarios identified within CESOP guidelines.

2. Multi-Jurisdiction Report Generator:

Our solution simplifies the process of generating the required reporting by generating the required XML files that are fully compliant with the XSD required by the CESOP legislation, as well as any specific requirements that may have been issued by local authorities in the respective Member States. Our team of experts are constantly monitoring the requirements emanating from each Member State to ensure that these are embedded within the reporting layer of Our Solution. Furthermore, in-built data validations will ensure data integrity prior to it being forwarded to the respective authorities.

The solution is developed in a modular manner to provide organisations with more options that cater to the needs. For example, an organisation may only need a reporting add-on to transform data from existing systems into an XML file that is aligned with the published XSD guidelines.

Some of the Key Benefits of using our solution:

What is CESOP?

- The new Directive and CESOP

- Immediate Action Required

- Who falls within the scope of these reporting requirements?

The new Directive and CESOP

- The Directive became effective 1 January 2024, requires PSPs to collect and report data on cross-border payment transactions.

- This reporting obligation was introduced as part of an EU-wide regime to detect and combat VAT fraud arising from cross-border e-commerce transactions.

The data collected is stored in the Central Electronic System of Payment information (CESOP) database, providing visibility to each Member State’s authorities.

Immediate Action Required

The Directive came into effect on 1 January 2024, and in‑scope Payment Service Providers (PSPs) are now required to collect and report data on cross‑border payments on a quarterly basis. The underlying data‑capture obligations are highly technical and often require PSPs to identify, filter, and analyse significant volumes of transactional information, which may also need to be reported across multiple EU jurisdictions.

These requirements place substantial demands on both reporting and IT functions, which must ensure that all relevant data is accurately collected, validated, and submitted within the required timelines. EU Member States apply different penalties for late, incomplete, or incorrect reporting, increasing the need for robust, compliant processes.

Given the ongoing reporting obligations and the complexity of the underlying rules, it is essential for in‑scope PSPs to implement effective solutions that enable the efficient capture, management, and submission of all required data to the authorities.

Who falls within the scope of these reporting requirements?

The new rules apply to Payment Service Providers (PSPs). This refers to any of the categories of payment service providers listed in points (a) to (d) of Article 1(1) of Directive (EU) 2015/2366 (the Payment Services Directive - PSD2) and include any person or entity benefiting from an exemption under Article 32 of that Directive. The provisions also apply to PSPs incorporated in EEA countries and which have passported their licence in terms of PSD2.

Reporting entities include:

- Credit institutions

- E-money institutions

- Post office giro institutions

- Payment institutions

Your journey to CESOP compliance

Getting CESOP-ready takes time, planning and the right partners. The earlier you start, the more confidently you can meet the directive’s requirements.

Here’s how we support your journey:

Impact Assessment

We help you understand how CESOP affects your business, so you can plan your compliance strategy effectively. The earlier this starts, the more time you’ll have to adjust systems and processes.

Data Assessment

We work with your teams to evaluate if your systems capture the right data points for CESOP reports and identify any quality issues that may limit your reporting capabilities.

Integrated Solution

Our automated CESOP reporting solution handles end-to-end processing. Reducing your compliance burden and supporting consistent, secure reporting across all relevant jurisdictions. It is highly scalable and able to analyse large volumes of data, generating the required XML reports.

Ready to move forward?

Let’s simplify CESOP compliance, together. Get in touch to learn how PwC can support you with technology, expertise and a proven path to readiness.

Contact us