Introduction of VAT Grouping in Malta

Pursuant to the 2018 Government Budget Speech, Legal Notice 162 of 2018 has introduced the possibility of VAT grouping in Malta. Indeed, the Legal Notice establishes the Value Added Tax (Registration as a Single Taxable Person) Regulations, 2018, as subsidiary legislation to the Maltese Value Added Tax (VAT) Act, Chapter 406 of the Laws of Malta.

In short, this means that two or more legal persons established in Malta may apply to the Commissioner, to be registered as a single taxable person for the purposes of the VAT Act, subject to the satisfaction of certain specific conditions.

As a result, upon successful registration, transactions taking place between persons who form part of a VAT group are disregarded and fall outside the scope of Maltese VAT legislation.

Two of the primary conditions to be satisfied for a successful registration are that:

- At least one of the applicants is a taxable person who is licensed or recognised in terms of the legislation listed in the Schedule to the Legal Notice. This legislation contemplates (but is not limited to) taxable persons who are licensed in terms of the Banking Act, the Financial Institutions Act, the Insurance Business Act, the Gaming Act and the Lotteries and Other Games Act, amongst others; and

- Each of the applicants is bound to each of the others by financial links, organisational links and economic links. The Legal Notice sets out specific rules in order to establish that financial, organisational and economic links actually exist.

In addition to these two primary conditions, the Legal Notice also establishes other requirements that will need to be satisfied in order to establish a VAT Group.

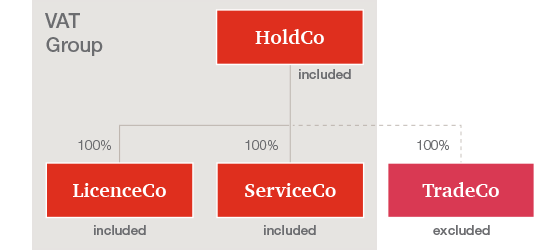

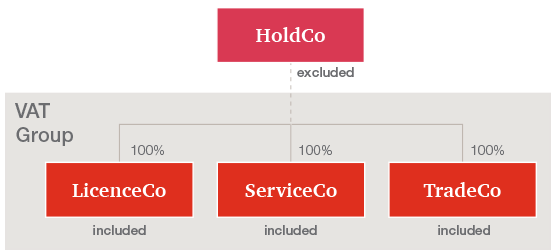

No person may be a member of more than one VAT Group at the same time. Moreover, persons bound to each other by financial links, organisational links and economic links may only form part of the same VAT Group.

Members of the VAT Group are required to appoint from amongst themselves a Group Reporting Entity. This entity shall exercise any and all rights and discharge any and all obligations arising to the VAT Group under VAT legislation. Generally, this means that any importation, intra-community acquisition or supply made by or to a member of the VAT Group will be treated as an operation made by or to the Group Reporting Entity.

That said, each member of a VAT Group shall be jointly and severally liable for the payment of any tax, administrative penalties and interest arising under the Act, which have become due and payable by the Group Reporting Entity.

The Legal Notice establishes specific rules for supplies between establishments of the same entity that are not in the VAT Group. Indeed, supplies of services made by or to an establishment situated outside Malta (if that establishment is a member of a VAT Group in a Member State that operates a system of VAT grouping in terms of which the establishment alone, and not the entire enterprise of which it forms part, is incorporated in a VAT group) shall be treated as supplies made by or to a separate taxable person.

Finally, the Legal Notice sets out the manner and procedure in which the membership in a VAT group may be terminated, e.g. where a member of the VAT group no longer satisfies the requisite conditions to form part of the VAT Group.

What Now?

The primary benefit of VAT Grouping is a material simplification of group compliance requirements, ultimately translating into a reduction in administrative costs (especially in the context of larger groups). That said, its effects and implications may vary depending on the specific fact pattern and circumstances.

PwC Malta has a dedicated VAT team with significant experience working with licensed business. If you would like to discuss VAT Grouping further, please reach out to any of your usual PwC contacts or one of the below contacts.

Contact us