Global growth stabilised at 2.8% in 2024, expected to decline to 2.6 % and 2.5% over the next two years on the back of slower growth in US and China.

According to the latest projections from the PwC Network, global economic growth is expected to ease slightly to 2.6% in both 2025 and 2.5% in 2026, down from 2.8% in 2024. This moderation is largely due to ongoing geopolitical tensions and rising protectionist policies. The US economy is forecast to expand by just over 2%, while China’s growth is set to slow to around 4.6%. The eurozone is projected to experience subdued growth, with GDP rising by 0.9% in 2025 and edging up to 1.4% in 2026 as Germany begins to recover. In contrast, India is expected to maintain strong momentum, with growth exceeding 6%. Against this backdrop, Malta’s 6% growth in 2024 and its projected 4% growth over the next two years stand out as comparatively strong.

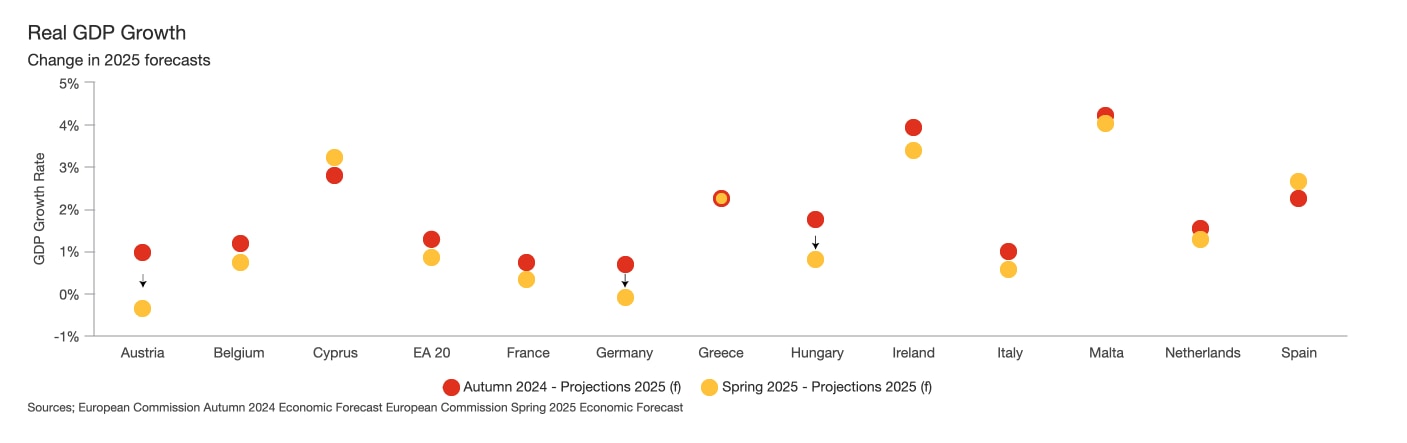

Update to projections following the Introduction of the US Tariffs as at 5 April.

The EC is predicting a slowdown in economic growth in FY25 due to the impact of the tariffs, with the euro area GDP forecast to grow at 0.9% in 2025 compared to 1.3% at the start of the year.

| Change in GDP growth projections | Austria | Belgium | Cyprus | EA 20 | France | Germany | Greece | Hungary | Ireland | Italy | Malta | Netherlands | Spain |

| Autumn 2024 - Projections 2025 (f) | 1.0% | 1.2% | 2.8% | 1.3% | 0.8% | 0.7% | 2.3% | 1.8% | 4.0% | 1.0% | 4.3% | 1.6% | 2.3% |

| Spring 2025 - Projections 2025 (f) | -0.3% | 0.8% | 3.0% | 0.9% | 0.6% | 0.0% | 2.3% | 0.8% | 3.4% | 0.7% | 4.1% | 1.3% | 2.6% |

| Change | -1.3% | -0.4% | 0.2% | -0.4% | -0.2% | -0.7% | 0.0% | -1.0% | -0.6% | -0.3% | -0.2% | -0.3% | 0.3% |

The European Commission’s Spring 2025 forecast marked a clear shift in tone, revising GDP growth projections downward across the EU in response to new US trade tariffs. Austria saw the steepest cut from 1.0% to -0.3% while the euro area’s outlook dropped from 1.3% to 0.9%, highlighting regional vulnerability to global trade tensions.

Germany’s downgrade of 0.7 points underscored its export dependence. Malta’s revision was modest, from 4.3% to 4.1%, reflecting relative resilience due to its service-based economy. Spain, meanwhile, saw a slight upgrade, supported by strong domestic demand and investment momentum. Overall, the revisions signal a more cautious EU outlook shaped by shifting trade dynamics.

In Q1 2025, Malta’s year-on-year growth slowed to 3.0%, similar to the 3.1% growth rate observed in 2024 Q4 and continuing a downward trend from the comparatively higher rates achieved in previous quarters in 2023 and 2024. In contrast, the euro area showed signs of recovery, with growth rising to 1.5%, its strongest pace in over a year. While Malta still outpaces the EU average, the gap is narrowing as domestic momentum softens and the eurozone gradually rebounds.

When focusing specifically on 2025Q1 performance, trends mirror the broader annual expenditure patterns. The restaurants and hotels sector continued to lead with strong growth, while personal care and social protection registered a notable year-on-year decline.

In Q1 2025, Malta’s strongest consumption growth remained in restaurants and hotels, which posted a 17% year-on-year increase, only slightly below the 18% recorded in Q1 2024. Education and communication also gained momentum, accelerating to 13% and 11% respectively. Housing and energy also picked up, while food and beverage remained stable.

However, several categories showed signs of weakening. Personal care & social protection moved from stagnant growth to a 6% decline, whilst the Transport sector which saw 14% growth in q1 2024 registered a modest 4% growth. These shifts suggest that while spending in essential and experience-driven categories remains resilient, broader household consumption is beginning to soften.

From a GVA perspective, the positive growth observed in the Maltese economy is largely driven by externally oriented sectors such as financial services, while domestically focused sectors like construction and manufacturing show signs of weakening. Wholesale and retail trade also contributed positively, reflecting mainly the positive performance of hotels and restaurants which are included in this sector.

Compared to the same quarter last year, Malta’s Q1 2025 GVA data reveals a shift in momentum across sectors. Financial and insurance services saw the strongest year-on-year gain, jumping from 1.5% to 10.6%, while wholesale and retail also strengthened to 8.5%. ICT returned to growth, and the public sector remained stable.

However, professional services and real estate slowed sharply, and both construction and manufacturing slipped into contraction. Arts, entertainment, and recreation (including gaming) remained in negative territory for the second consecutive year, pointing to persistent challenges in that segment.

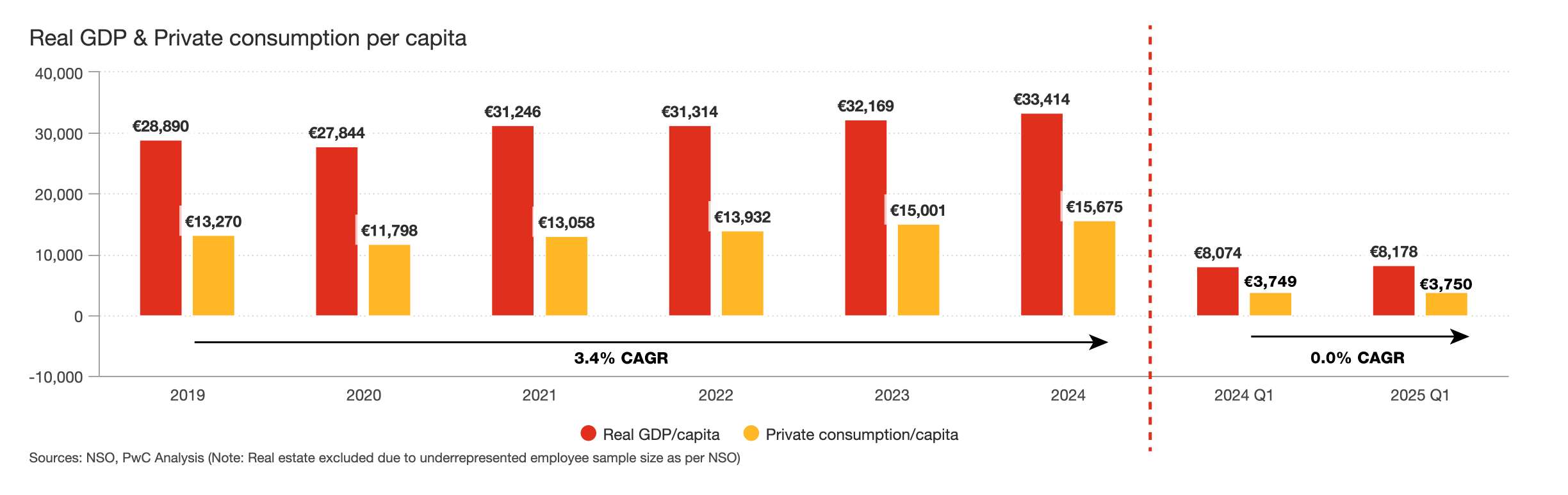

Meanwhile, growth in consumption per person remained flat in Q1 2025, compared to a CAGR of 3.4% over the 2019-2024 period.

Real private consumption per capita in Malta showed no growth in Q1 2025, remaining virtually flat at €3,750 compared to €3,749 in Q1 2024. This stagnation marks a clear pause in the upward momentum seen between 2019 and 2024, when consumption rose steadily at a CAGR of 3.4%. The lack of movement signals early signs of a slowdown in household spending and raises concerns about consumer confidence heading into the rest of the year.

Local economic sentiment in Malta observed a downward trend throughout 2024. Following a brief rebound in October and November, sentiment continued on its downward trend during the first half of 2025.

The Economic Sentiment Indicator (ESI) continued to decline in 2025, following a temporary increase from the two-year low observed in September 2024. Despite a notable rebound in November above the 100 long-term average, the downward trajectory resumed into 2025, reflecting persistent concerns over economic uncertainty and a more pessimistic outlook for early 2025. The Employment Expectation Indicator (EEI) stabilized above the 100 average at the beginning of 2025, yet overall remained on a downward trend.

Conclusion

Malta’s economic performance in Q1 2025 suggests a moderation in momentum. Real private consumption per capita during this quarter was flat year-on-year, signaling a pause in household spending growth after several years of gradual increases. Sectoral data reveals a mixed picture: externally oriented sectors such as financial services continued to expand, while domestically focused industries like construction and manufacturing contracted. Wholesale and retail trade also contributed positively, reflecting the continued outperformance in hotels and restaurants. Meanwhile, the Economic Sentiment Indicator continued its downward trend into the first half of 2025, reinforcing concerns about weakening consumer and business confidence. These developments suggest that while Malta remains relatively resilient, sustaining growth in future will require improvements in performance of the more productive sectors of the economy.

Contact us