As a general rule, a taxable person established in Malta should be eligible to claim a deduction for any Maltese VAT incurred on business-related purchases/costs (i.e. input tax) provided that such input tax is attributable to:

1. taxable supplies;

2. exempt with credit (zero-rated) supplies;

3. supplies which:

take place outside Malta which would, if made in Malta, be treated under the provisions of the Maltese VAT Act ("VATA") as taxable supplies or as exempt with credit supplies; or

- supplies which are taxed outside Malta and which, if made in Malta, would have been treated as exempt without credit supplies;

4. certain exempt without credit supplies (including the provision of insurance and the provision of credit) which are provided to customers established outside the EU.

Contrary to this, input tax directly incurred in connection with supplies which do not give the right to input tax recovery, may not be allowed as a deduction.

This is to the extent that several other criteria are satisfied, including that the person is in possession of a valid VAT invoice and registered under Article 10 of the VATA.

A taxable person who incurs input tax on expenses that are connected to both:

supplies which give the right to credit for input tax; and

supplies which do not give the right to input tax;

may not recover in full the VAT incurred on purchases and overheads. Indeed, the portion of input tax that can be recovered is calculated following the partial attribution mechanism as set out in the VATA.

The VATA also includes provisions regarding purchases/expenses on which any input tax is considered to be blocked for VAT purposes. In this regard, VAT incurred on inter alia motor vehicles (and related expenses), hospitality and/or entertainment cannot be recovered in the respective VAT return. That said, this is subject to certain exceptions such as if the taxable person in question is buying the otherwise blocked supplies for the purposes of resale.

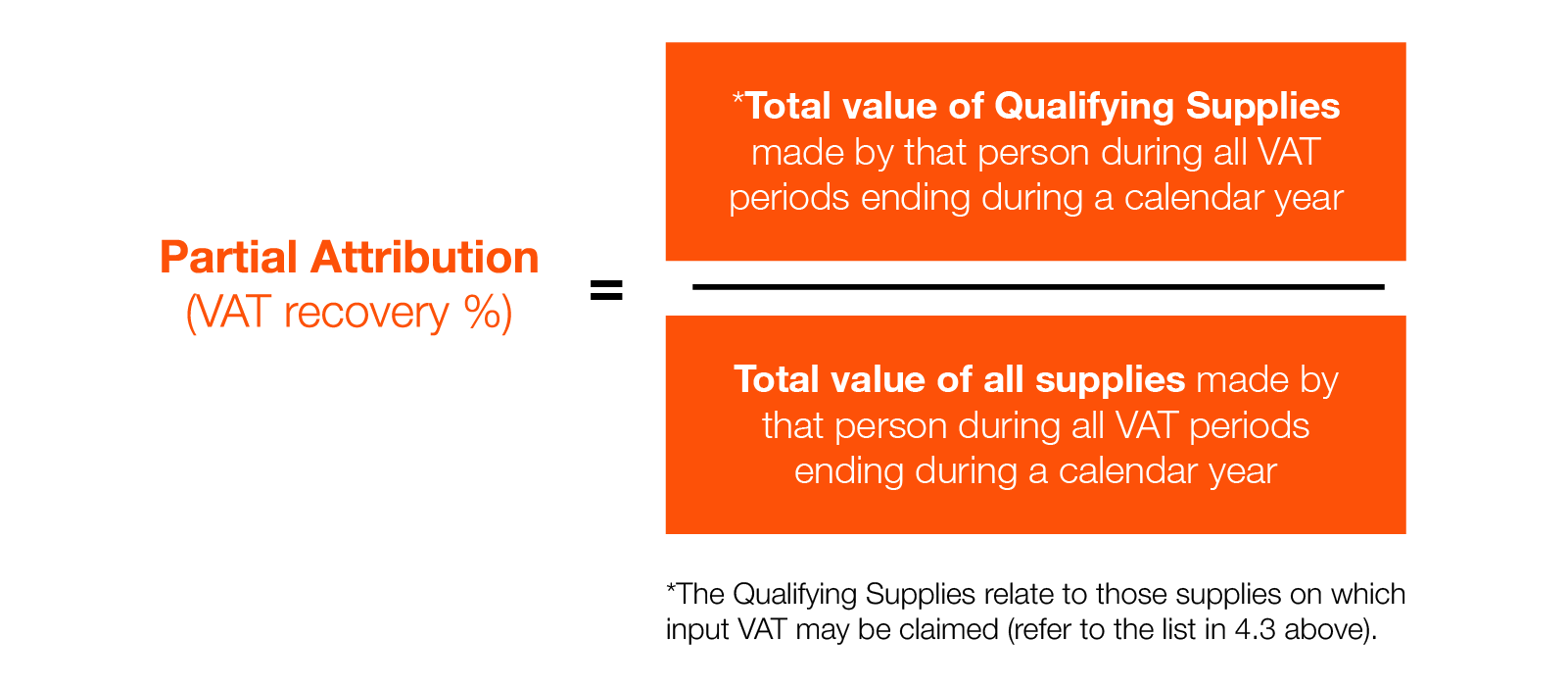

Partial Attribution - Input VAT recovery

The general method to calculate the partial attribution formula is as follows:

The result obtained by the above calculation is referred to as “the definitive ratio” for that year and is also used provisionally to recover VAT for the following year - until that year’s definitive ratio can be calculated.

In summary, the input tax credit for the general overheads of that person for each tax period ending during a calendar year shall be calculated provisionally by multiplying the value of the input tax of that person for that tax period by the definitive ratio for the previous year (calculated as above and which is, therefore, the provisional ratio for the period ending during the current calendar year).

The total input tax credit of the person for all the tax periods ending during a calendar year shall be calculated definitively by multiplying the total input tax for those periods by the definitive ratio for that year.

The difference between the total input tax for the tax periods ending during a year calculated provisionally and the definitive calculation for that year shall represent either an amount of tax due by the person or a deduction allowable to the person, as the case may be, which tax or deduction shall be accounted for in the tax return for the first tax period that ends in the year following that for which the provisional calculation was made.

The adjustment, against or in favour of the taxpayer as the case may be, is then included in Boxes 40 or 41 of the applicable VAT return.

Additional rules apply in respect of the claiming of input tax incurred on capital goods.

How can we help?

Get VAT right, and uncover potential opportunities

Reclaiming input VAT is a core part of how the EU VAT system works, and it’s a right that’s well established in EU VAT Directive and supported by several decisions of the Court of Justice of the EU. But when not all your business activities qualify for input VAT recovery, the calculations can get complex. And mistakes can lead to penalties, interest, or missed opportunities.

A VAT health check can give you clarity. It helps ensure your input tax calculations are accurate, and may reveal opportunities to recover VAT you didn’t know you could claim.

Contact us