The Danske Bank case - in a nutshell

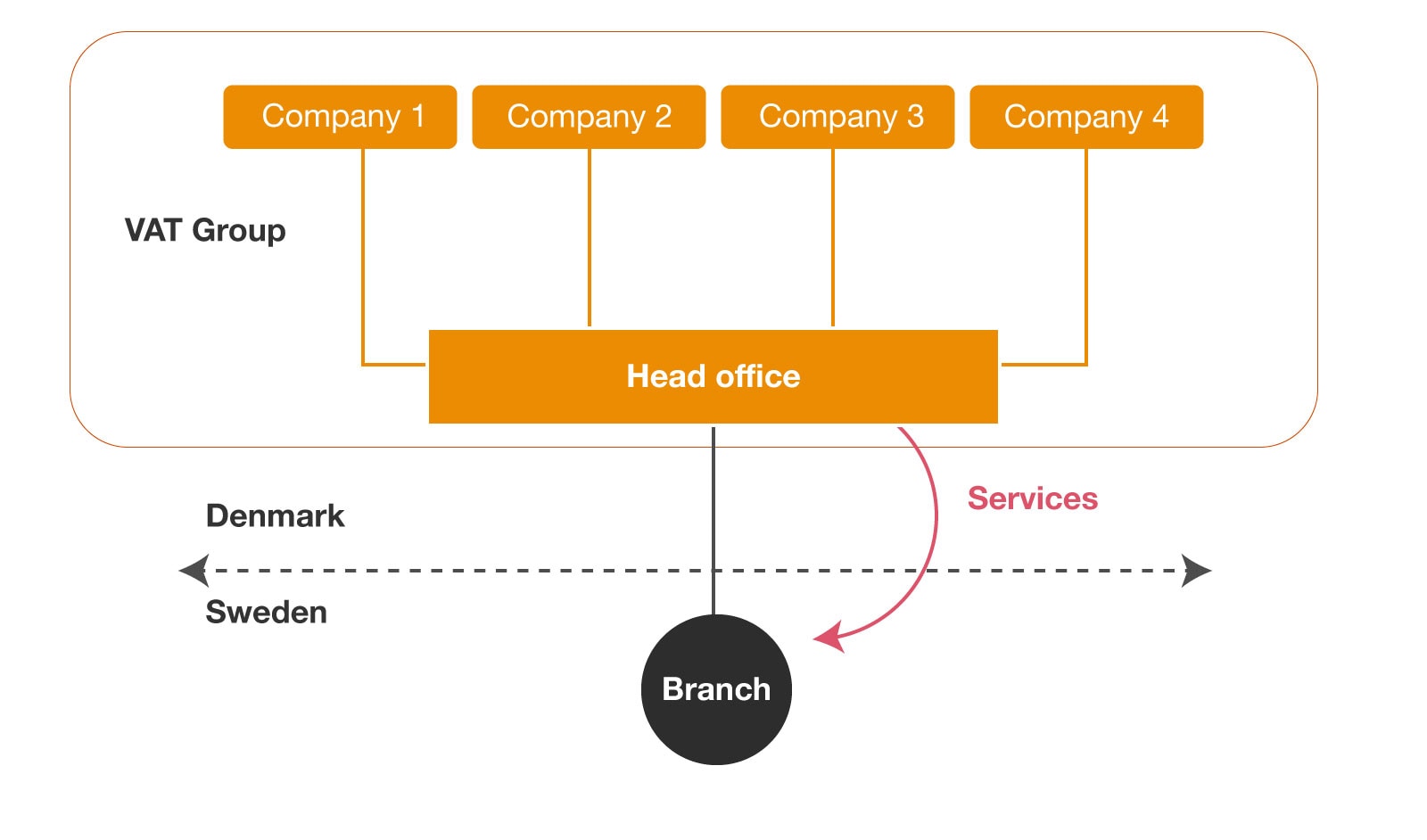

During March 2021, the Court of Justice of the European Union (“CJEU”) published the eagerly awaited "Danske Bank" ruling (Case C-812/19) which dealt with the question as to whether or not a Swedish branch of a principal establishment that is established in a different EU Member State (Denmark in this case) should be considered to be an independent taxable person in situations where the principal establishment forms part of a VAT group in that other EU Member State.

Given the particular facts of the case, it is relevant to note that this case should not have any impact on VAT Groups formed between members that are exclusively established in one EU Member State.

The VAT treatment of services supplied between a principal establishment and its branch established in a different EU Member State was previously contemplated in the FCE Bank case (Case C-210/04). Given the specific fact pattern of that case, the CJEU held that the branch was not independent from its head office and this on the basis that it was not to be considered a legal entity distinct from the company of which it forms part. Thus, there was no legal relationship between the principal establishment and its branch (since they formed a single taxable person) and the services between the principal establishment and its branches should fall outside the scope of VAT.

On the other hand, by virtue of its ruling in the Danske Bank case, and mirroring its previous decision in the Skandia case (Case C-7/13), the CJEU found that the Swedish branch and the Danish VAT group of which the principal establishment forms part should be regarded as two separate taxable persons. This essentially means that services provided by the principal establishment that forms part of the Danish VAT group to the Swedish branch should not be disregarded as non-taxable internal flows - and may therefore be subject to VAT.

In deciding this case, the CJEU also took into consideration the territorial boundaries applicable to the Danish VAT group imposed by Danish law as a critical factor on which the decision was based.

Such territorial boundaries imply that only establishments in the territory of a VAT Group may form part of that VAT Group. In the context of the Danske Bank case, this effectively meant that the Swedish branch of the Danish principal establishment forming part of a Danish VAT group could not be considered to form part of the VAT Group since, in terms of Danish VAT law, only establishments situated in Denmark could form part of the VAT Group.

The Maltese VAT Perspective

Maltese VAT grouping regulations do not contain the same extent of territorial limitations that both Sweden and Denmark have. In fact, the Maltese VAT grouping regulations allow, in certain situations, for non-Maltese establishments (or principle establishments) of a member of a Maltese VAT Group to also be considered to form part of the Maltese VAT Group for Maltese VAT purposes. Furthermore, the said regulations already take into consideration the Skadia decision that was mirrored in the Danske Bank case. On this basis, we do not anticipate any changes to the Maltese VAT grouping regulations as a result of this particular case.

However, we would nonetheless suggest that multinational enterprises which have establishments in and outside of Malta that form part of a Maltese VAT Group to assess whether the interpretation of the Danske Bank case impacts the VAT treatment of supplies provided between the members of their VAT Group.

Contact us